|

|

CLIMATE CRISIS

GHG Emission Management Systems

A Primer for CPAs on Greenhouse Gas Emissions Management Systems

|

A Primer for CPAs on Greenhouse Gas Emissions Management Systems

|

AUGUST 2018

A Primer for CPAs on Greenhouse Gas Emissions Management Systems ... AUGUST 2018

DISCLAIMER

This paper was prepared by the Chartered Professional Accountants of Canada (CPA Canada) as non-authoritative guidance.

CPA Canada and the authors do not accept any responsibility or liability that might occur directly or indirectly as a consequence of the use, application or reliance on this material.

© 2018 Chartered Professional Accountants of Canada

All rights reserved. This publication is protected by copyright and written permission is required to reproduce, store in a retrieval system or transmit in any form or by any means (electronic, mechanical, photocopying, recording, or otherwise). For information regarding permission, please contact permissions@cpacanada.ca

iii

Table of Contents

Executive Summary 1

Section 1: Overview of Climate Change Mitigation 3

Intended Audience and Scope 3

What Is Climate Change? 4

Government Responses 4

Section 2: The Need for GHG Emissions Management 11

Different Types of Greenhouse Gases 11

GHG Emissions Management Systems 12

Overview of GHG Reporting Frameworks 13

Key Components of a GHG Emissions Management System 14

Section 3: Roles for CPAs 17

Roles for CPAs in Leadership Positions 19

Roles for CPAs at All Levels 20

Conclusion 23

Appendix A — Where to Find More Information 25

1 Executive Summary

This paper addresses the need to reduce and manage greenhouse gas (GHG) emissions. Achieving global targets envisioned in the Paris Agreement will require a cultural shift and the harnessing of markets, innovation and technology.

This publication identifies various government responses to address global climate change ranging from international agreements to national and provincial action plans. These action plans require many companies to submit GHG emissions reports on an annual basis. In Canada, GHG emissions reporting is complex because the requirements differ across jurisdictions. Therefore, it is important to understand the regulatory reporting requirements in the jurisdictions where companies have operations.

In particular, the federal government and various provincial governments have put a price on carbon. This has strategic operational and financial implications for entities.

Not only are regulatory reporting requirements in Canada complex, so too is the measuring of GHGs. There are seven types of GHGs generally included in regulatory reporting requirements. Some GHGs are more potent and short-lived in the atmosphere, while others are less potent but remain in the atmosphere for a longer period.

A GHG emissions management system consists of a set of processes and tools designed and developed by organizations and tailored to their need to understand, quantify, monitor, report and verify GHG emissions. Two of the most commonly used frameworks for GHG emissions reporting are ISO 14064 and the GHG Protocol.

2 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

Chartered Professional Accountants (CPAs) have a crucial role to play in supporting their organization’s GHG emissions management activities. This publication presents:

- an overview of climate change developments and mitigation efforts in Canada and globally

- existing federal and provincial carbon pricing and GHG emissions reporting requirements

- key components of a GHG emissions management system

- questions for companies to address when establishing such a system for their organization

- What are the relevant regulatory requirements for GHG emissions reporting?

- Is participation in a GHG emissions reporting program mandatory or voluntary?

- Which GHG emissions reporting framework is applicable?

- Is third-party verification required for GHG emissions reports?

- What types of GHG emission are relevant for my industry and/or business?

- What is the appropriate scope and boundaries for GHG emissions reporting?

- Will the organization set targets for GHG emissions reductions?

- What is the organization’s strategy for managing GHG emissions?

- What is the role of leadership in GHG emissions management?

- Is external disclosure to capital providers necessary?

Additional resources are provided in Appendix A.

We believe that increased attention will be placed on emissions management and reporting as various regulators and stakeholders push for change. We encourage management to closely monitor developments and also contact us with any feedback or insights that could help us in the development of future publications on this topic.

Sarah Keyes, CPA, CA Principal Research, Guidance and Support CPA Canada

277 Wellington Street West Toronto ON M5V 3H2 Email: skeyes@cpacanada.ca

Davinder Valeri, CPA, CA

Director

Research, Guidance and Support

CPA Canada

277 Wellington Street West

Toronto ON M5V 3H2

Email: dvaleri@cpacanada.ca

SECTION 1 Overview of Climate Change Mitigation

Intended Audience and Scope

This publication is intended to be used by:

- CPAs working in industry (operational, management accounting and reporting roles)

- CPAs and business professionals in leadership roles

- boards of directors

This paper addresses the issue of managing the reduction of GHG emissions (also known as climate change mitigation). While adapting to the impacts of climate change is a significant and costly business issue, the focus of this paper is on the need to reduce and manage GHG emissions in order to avoid costlier impacts in the future and the associated roles for CPAs.

Overview of Climate Change Adaptation

Severe weather events such as floods, wildfires, heat waves, droughts, and hurricanes have become more common in recent years. As a result, we are already experiencing the costs associated with climate change.

A June 2017 report published by the International Institute for Sustainable Development (IISD) states that “the cost of climate change-related heat waves in Canada is estimated to have been $1.6 billion in 2015.” According to the Insurance Bureau of Canada, “ severe weather due to climate change is already costing Canadians billions of dollars annually.” The year 2016 saw a record $4.9 billion of insured losses.1

According to the U.S. National Oceanic and Atmospheric Administration (NOAA), 2017 was the costliest U.S. disaster year on record, with total damages of $306 billion. There were over 16 events exceeding $1 billion in damages; the majority of the damage came from hurricanes.2

It is important to note that, because impacts vary regionally, businesses and governments need to tailor their responses to each unique circumstance.

(www.cpacanada.ca/climatechange)

1 www.ibc.ca/nb/resources/media-centre/media-releases/severe-weather-natural-disasters-cause-record-year-for-insurable-damage-in-canada

2 www.washingtonpost.com/amphtml/news/energy-environment/wp/2018/01/08/hurricanes-wildfires-made-2017-the-most-costly-u-s-disaster-year-on-record/?noredirect=on

4 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

What Is Climate Change?

Environment and Climate Change Canada defines climate change as “a long-term

shift in weather conditions. It is measured by changes in a variety of climate

indicators (e.g., temperature, precipitation, wind) including both changes in

average and extreme conditions. Climate change can be the result of natural

processes and/or human activity.”3

“Ninety-seven per cent of climate scientists agree that climate-warming trends

over the past century are very likely due to human activities and most of the

leading scientific organizations worldwide have issued public statements

endorsing this position.”4 Scientific evidence has also shown that the period

from 2015-2017 was the hottest three years on record in terms of the earth’s

temperature.5 NASA reported that 2017 was the warmest year on record without

an El Nino.6

Government Responses

United Nations Framework Convention on Climate Change (UNFCCC)

The UNFCCC was adopted in 1992, came into force in 1994, and underpins the international climate negotiations and global agreements.7 There are 197 Parties (countries) to the UNFCCC. The UNFCCC’s objective is to “stabilize greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system.”8

Since the UNFCCC was established, a number of climate-change agreements have been developed, including the Kyoto Protocol and the Copenhagen Accord.

The latest agreement and the one currently in force is the Paris Agreement.

3 www.canada.ca/en/environment-climate-change/services/climate-change/facts.html

4 https://climate.nasa.gov/scientific-consensus

5 www.nytimes.com/2017/01/18/science/earth-highest-temperature-record.html & www.theguardian.com/environment/2017/nov/06/2017-set-to-be-one-of-top-three-hottest-years-on-record

6 www.accuweather.com/en/weather-news/nasa-reported-2017-was-the-warmest-year-on-record-without-an-el-nino/70003912

7 http://unfccc.int/parties_and_observers/items/2704.php

8 https://unfccc.int/resource/docs/convkp/conveng.pdf

SECTION 1 | Overview of Climate Change Mitigation 5

Paris Agreement

On December 12, 2015, 197 Parties to the UNFCCC, including Canada, adopted the Paris Agreement at the 21st Conference of the Parties (COP21).9 The Paris Agreement established a consensus to limit the growth of GHG emissions globally to less than 2° Celsius above pre-industrial levels by 2050 and towards 1.5° Celsius in the latter half of the century.10

The Paris Agreement is the culmination of years of work by governments, businesses and civil society on a sub-national, national and international basis. The difference between the Paris Agreement and previous UNFCCC Accords is that the Paris targets were negotiated based upon Intended Nationally Determined Contributions (INDCs) developed by individual countries and submitted prior to the Paris negotiations. INDCs were developed with input from stakeholders including business and industry, cities, provinces and states and other stakeholders. The Paris Agreement entered into force November 4, 2016, and at the time of this publication, 174 of 197 Parties had ratified the Paris Agreement, including Canada.11

“This monumental agreement by the world’s governments in Paris marks a critical turning point for the global economy. The deal is an unequivocal signal to investors to shift trillions of dollars of capital to low-carbon solutions and to companies, in their turn, to invest in developing and scaling up clean technologies. Those that do will surely be the winners in the now inevitable transition to a low-carbon economy.” ... Paul Simpson — CEO, Carbon Disclosure Project

Since the entry into force of the Paris Agreement, some challenges have arisen which could impact its potential for success, notably:

- the stated intention of the U.S. to withdraw from the Paris Agreement (However, the withdrawal of the U.S. at the national level, has led to significantly increased activity at the city, state and regional levels as well as from the private sector.)

- there is a gap between the current commitments by governments and the stated goal of limiting average global warming to 2° Celsius

9 http://unfccc.int/paris_agreement/items/9444.php

10 http://bigpicture.unfccc.int

11 http://unfccc.int/paris_agreement/items/9485.php

Page 6 A Primer for CPAs on Greenhouse Gas Emissions Management Systems Implementing the Paris Agreement in Canada

Canada has signed on to the Paris Agreement commitment levels for 2050 and

beyond. In 2017, Canada’s Environmental Commissioner noted, however, that

there is a significant gap between the government of Canada’s stated targets

and its planned programs and actual progress.12

Figure 1 shows both historical and projected GHG emissions in Canada. Figure 1 also shows that Canada’s GHG emissions trajectory is estimated not to peak in 2020; it is necessary to peak by this date, however, in order to meet the Paris Agreement aspirations.

FIGURE 1: CANADA’S DOMESTIC EMISSIONS PROJECTIONS IN 2020 AND 2030

(Mt CO₂ eq)13

2005 2010 2015 2020 2025 2030

500

550

600

650

700

750

800

850

720

Canadian target = 523 Mt

731

747

790

742

697

Greenhouse gas emissions in megatonnes (Mt)

High emissions scenario Low emissions scenario

12 www.oag-bvg.gc.ca/internet/English/parl_cesd_201710_00_e_42488.html

13 www.canada.ca/en/environment-climate-change/services/climate-change/publications/2016-greenhouse

-gas-emissions-case.html

SECTION 1 | Overview of Climate Change Mitigation 7

Pan-Canadian Framework on Clean Growth and Climate Change

Canada’s strategic action plan to achieve the targets committed to under the Paris Agreement is set out in the Pan-Canadian Framework on Clean Growth and Climate Change (Framework).14

The Framework features four pillars:

- carbon pricing

- complementary actions to further reduce emissions

- adaptation measures

- actions to accelerate innovation, support clean technology and create jobs15

Broad-based carbon pricing is the foundation of the Framework.

By the end of 2018, all jurisdictions (including those that have not yet signed onto the Framework16) must have carbon pricing. According to the Framework, jurisdictions must have instituted one of the following systems:

- an explicit price-based system (i.e., carbon tax) where the explicit price must be at least:

- —— $20 per tonne in 2019

- —— $30 per tonne in 2020

- —— $40 per tonne in 2021

- —— $50 per tonne in 2022

- a cap-and-trade system whereby 2030 emissions must be reduced to at least 30% below 2005 levels and with declining “annual caps to at least 2022 that correspond, at a minimum, to the projected emission reductions resulting from the carbon price that year in price-based systems.”17

The federal government has indicated that by early 2022 it will review the comparative effectiveness of the carbon pricing systems.

14 www.canada.ca/content/dam/themes/environment/documents/weather1/20170125-en.pdf

15 Ibid.

16 At the time of writing, only Saskatchewan has not signed on to the Framework.

17 www.canada.ca/en/services/environment/weather/climatechange/pan-canadian-framework.html

8 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

Provincial Responses

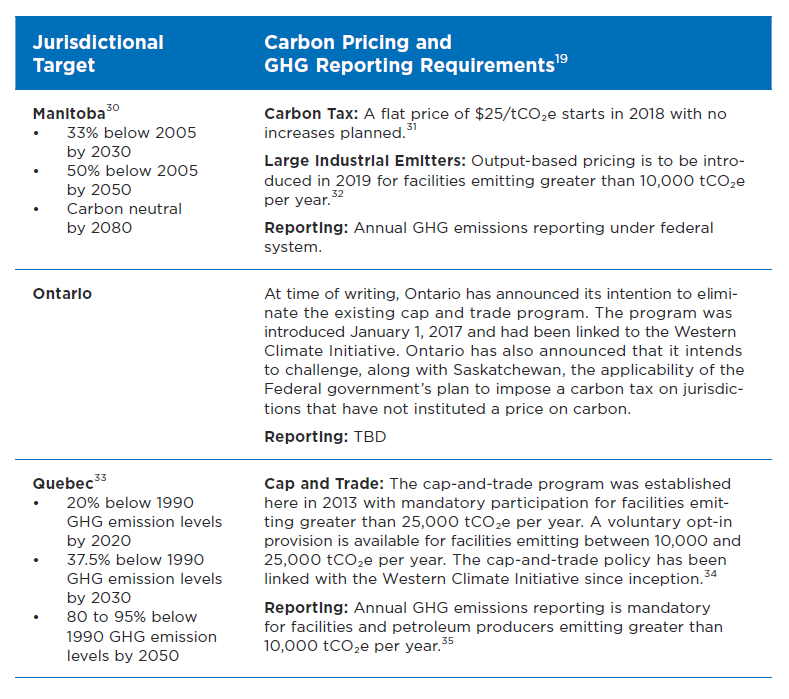

Table 1 summarizes the current carbon pricing elements in existing federal and provincial programs in Canada.18

TABLE 1: EXISTING FEDERAL AND PROVINCIAL CARBON PRICING AND GHG EMISSIONS REPORTING REQUIREMENTS

Jurisdictional Target

Carbon Pricing and GHG Reporting Requirements 19

Federal

- 30% below 2005 GHG emission levels by 203020

- 80% below 2005 GHG emission levels by 2050 21

Carbon Tax: The federal backstop applies in provinces that do not establish a carbon price (tax or cap and trade) by the end of 2018. The carbon tax will be $20/tCO2e in 2019, increasing by $10 per year to $50/tCO₂e by 2022.22

Reporting: Annual GHG emissions reporting is mandatory for facilities emitting greater than 10,000 tCO₂e per year.23 British Columbia24

• 33% below 2007 GHG emission levels by 2020

• 80% below 2007 GHG emission levels by 2050

Carbon Tax: The carbon tax was established in 2008 and is currently set at $30/tCO₂e;25 starting April 1, 2018, it increases by $5/tCO₂e per year to $50/tCO₂e in 2021.26

Reporting: Annual GHG emissions reporting is mandatory for facilities emitting greater than 10,000 tCO₂e per year and facilities that have emitted more than 10,000 tCO₂e in any of the previous three years.27

Alberta28

- Cap on annual emissions from oil sands: 100 Mt per year

- Methane Emissions: 45% reduction by 2025

Carbon Tax: The carbon tax started at $20/tCO₂e in 2017 and increased to $30/tCO₂e in 2018.

Large Industrial Emitters: These entities are subject to the Carbon Competitiveness Incentives (CCI) program as of January 1, 2018.

Reporting: Annual GHG emissions reporting is mandatory for facilities emitting greater than 10,000 tCO₂e per year.29

18 At the time of writing, Ontario announced its intention to eliminate the existing cap-and-trade system, withdraw from the Western Climate Initiative (WCI) and challenge the federal government’s jurisdiction to impose a national carbon price. However, Ontario still remains a member of the Framework at the time of writing.

19 Compliance requirements for third-party verification of GHG emissions reports vary by jurisdiction. For additional information, refer to the relevant government legislation.

20 www4.unfccc.int/submissions/INDC/Published%20Documents/Canada/1/INDC%20-%20Canada%20-%20English.pdf

21 https://unfccc.int/files/focus/long-term_strategies/application/pdf/canadas_mid-century_long-term_strategy.pdf

22 Ibid.

23 www.canada.ca/en/environment-climate-change/services/climate-change/greenhouse-gas-emissions/facility-reporting.html

24 www2.gov.bc.ca/gov/content/environment/climate-change/planning-and-action/legislation

25 www2.gov.bc.ca/gov/content/environment/climate-change/planning-and-action/carbon-tax

26 www2.gov.bc.ca/gov/content/taxes/tax-changes/budget-changes

27 www2.gov.bc.ca/gov/content/environment/climate-change/industry/reporting

28 www.alberta.ca/climate-leadership-plan.aspx

29 http://aep.alberta.ca/climate-change/guidelines-legislation/specified-gas-reporting-regulation/default.aspx

SECTION 1 | Overview of Climate Change Mitigation 9

Jurisdictional Target

Carbon Pricing and GHG Reporting Requirements19

Manitoba30

- 33% below 2005 by 2030

- 50% below 2005 by 2050

- Carbon neutral by 2080

Carbon Tax: A flat price of $25/tCO₂e starts in 2018 with no increases planned.31

Large Industrial Emitters: Output-based pricing is to be introduced in 2019 for facilities emitting greater than 10,000 tCO₂e per year.32

Reporting: Annual GHG emissions reporting under federal system.

Ontario

At time of writing, Ontario has announced its intention to eliminate the existing cap and trade program. The program was introduced January 1, 2017 and had been linked to the Western Climate Initiative. Ontario has also announced that it intends to challenge, along with Saskatchewan, the applicability of the Federal government’s plan to impose a carbon tax on jurisdictions that have not instituted a price on carbon.

Reporting: TBD

Quebec33

- 20% below 1990 GHG emission levels by 2020

- 37.5% below 1990 GHG emission levels by 2030

- 80 to 95% below 1990 GHG emission levels by 2050

Cap and Trade: The cap-and-trade program was established here in 2013 with mandatory participation for facilities emitting greater than 25,000 tCO₂e per year. A voluntary opt-in provision is available for facilities emitting between 10,000 and 25,000 tCO₂e per year. The cap-and-trade policy has been linked with the Western Climate Initiative since inception.34

Reporting: Annual GHG emissions reporting is mandatory for facilities and petroleum producers emitting greater than 10,000 tCO₂e per year.35

30 www.gov.mb.ca/sd/annual-reports/sdif/mb-climate-change-green-economy-action-plan.pdf

31 www.gov.mb.ca/asset_library/en/climatechange/climategreenplandiscussionpaper.pdf

32 Ibid.

33 www.mddelcc.gouv.qc.ca/changementsclimatiques/engagement-quebec-en.asp

34 www.mddelcc.gouv.qc.ca/changements/carbone/documents-spede/in-brief.pdf

35 www.mddelcc.gouv.qc.ca/air/declar_contaminants/index-en.htm

10 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

Private Sector Role

National and international policy and regulation alone will not achieve the goals

of the Paris Agreement. Actions by the private sector and other non-state entities

will be needed to bridge the gap; this can only be achieved by harnessing

markets, innovation and technology. Achieving the 2° Celsius target itself and

moving towards 1.5° Celsius will require a cultural shift in the world economy

and the way business operates.

It is estimated that from 2020 onward at least $200 billion of public and

$800 billion of private resources in climate action each year is necessary.36

Much of this spending will come from businesses seeking to achieve competitive

advantage in this new economic landscape.

36 www.mission2020.global

11

SECTION 2

The Need for GHG Emissions Management

Part of an entity’s competitive advantage may be connected to its ability to manage GHG emissions. In order to reduce GHG emissions, it is important for companies to establish appropriate measurement and record-keeping systems and processes.

Different Types of Greenhouse Gases

There are several types of GHG emissions that contribute to climate change; seven of these are included in the Paris Agreement (see Table 2). The national GHG inventories will be used for each country’s reporting against targets established in the Paris Agreement.

Some GHGs are more potent and short-lived in the atmosphere; others are less potent but remain in the atmosphere for a longer period. To simplify emissions reporting by organizations and governments internationally, reporting protocols require that the global warming potential (GWP) of each GHG be expressed in tonnes of carbon dioxide equivalents (tCO₂e). Determining the total tCO₂e emissions of a reporting entity then becomes a simple matter of multiplying the tonnes of each gas emitted in a given year by its GWP value. For example, the impact of reducing one tonne of carbon dioxide would be measured as a reduction of 1 tCO₂e, whereas the reduction of one tonne of methane would be measured as 25 tCO₂e.

12 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

TABLE 2: GHG EMISSIONS INCLUDED IN PARIS AGREEMENT37

GHG

Emission

Global

Warming

Potential

(GWP)

Illustrative

Examples

of Sources

Carbon Dioxide — CO₂ 1 fossil fuel combustion (e.g., emissions from

electricity production from coal or gas)

Methane — CH₄ 25 landfill and animal waste decomposition,

natural gas, oil and coal production

Nitrous Oxides — N₂O 298 fertilizers (e.g., used in agriculture), nitric

acid production from manufacturing, etc.,

biomass combustion

Hydrofluorocarbons — HFCs 124 – 14,800 by-products of industrial processes

(e.g., chemical production)

Perfluorocarbons — PFCs 7,390 – 12,200 manufacture of semi-conductors,

refrigeration equipment, aluminum

Sulfur hexafluoride — SF₆ 22,800 high voltage circuit breakers, switchgear

Nitrogen trifluoride — NF3 17,200 manufacture of semiconductors and LCD

panels, certain types of solar panels and

chemical lasers

GHG Emissions Management Systems

A GHG Emissions Management System consists of a set of processes and tools

designed and developed by organizations and tailored to their need to understand,

quantify, monitor, report and verify GHG emissions. This section explores

key components of GHG Emissions Management Systems and provides key

information for CPAs and businesses seeking to reduce GHG emissions.

37 www.epa.gov/ghgemissions/overview-greenhouse-gases

SECTION 2 | The Need for GHG Emissions Management 13

Overview of GHG Reporting Frameworks

The table below provides a summary of the two most commonly used frameworks for GHG emissions reporting: ISO 14064 and the GHG Protocol. For additional information, refer to Appendix A.

TABLE 3: GHG EMISSIONS MANAGEMENT STANDARDS AND PROTOCOLS

Standard / Protocol

Description and Use Cases

ISO 14064

The International Standards Organizations (ISO) Greenhouse Gas Standard 14064 (ISO 14064: Parts 1, 2 and 3) is globally recognized and widely accepted and used across the private and public sectors for measuring, reporting and managing GHG emissions. It was developed and initially released in 2006 as a globally applicable standard. There are three parts to ISO 14064:

•

Part 1: Specification with guidance at the organizational level for quantification and reporting of greenhouse gas emissions and removals: requirements for the design, development, management, reporting and verification of an organization’s GHG inventory.38

•

Part 2: Specification with guidance at the project level for quantification, monitoring and reporting of greenhouse gas emission reductions or removal enhancements: requirements for planning a GHG project, identifying and selecting GHG sources, sinks and reservoirs, developing a baseline scenario, monitoring, quantifying, documenting and reporting GHG project performance.39

•

Part 3: Specification with guidance for the validation and verification of GHG assertions: requirements for verifying an organization’s GHG inventory (under ISO 14064-1) and GHG project quantification (under ISO 14064-2).40

GHG Protocol

The World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD) jointly developed the GHG Protocol in 2001. The GHG Protocol establishes comprehensive global standardized frameworks to measure and manage GHG emissions from private and public sector operations, value chains and mitigation actions.41

The GHG Protocol has developed seven separate GHG Standards, including:42

•

Corporate Accounting and Reporting Standard

•

GHG Protocol for Cities

•

Mitigation Goal Standard

•

Corporate Value Chain (Scope 3) Standard

•

Policy and Action Standard

•

Product Standard

•

GHG Project Protocol

38 www.iso.org/standard/38381.html

39 www.iso.org/standard/38382.html

40 www.iso.org/standard/38700.html

41 www.ghgprotocol.org/about-us

42 www.ghgprotocol.org/standards

14 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

Key Components of a GHG Emissions Management System

The development and implementation of a robust GHG Emissions Management

System is a key part of managing climate-related risks and opportunities and

integrating them into business decision-making and reporting processes. It is

important to note that while GHG Emissions Management Systems are typically

tailored to the industry, process and/or supply chain relevant for organizations,

there are standard components that should be considered by all companies

implementing such a system.

The following questions provide guidance for evaluating an organization’s

unique requirements for a suitable GHG Emissions Management System:

1. What are the relevant regulatory requirements for GHG emissions reporting?

In order to determine reporting obligations, a jurisdictional scan of existing

and planned GHG emissions reporting regulation is a prudent first

step. It is worthwhile noting that GHG emissions reporting regulations

vary significantly within Canada; each province and territory may have its

own approach. Companies should understand the policies in all jurisdictions

where they have operating facilities, not only the jurisdiction where

head office is located.

2. Is participation in a GHG emissions reporting program mandatory or voluntary?

Most GHG emissions regulations specify a GHG emissions threshold for

mandatory participation. A summary of the relevant thresholds can be

found in Table 1. Understanding whether your facilities are required to

submit annual reports to different levels of government is an essential step

early in the process. In order to make this assessment, the organization may

need to complete a GHG emissions inventory to determine whether facilities

currently exceed, or are expected to exceed, regulatory thresholds.

3. What GHG emissions reporting framework is applicable?

In many cases, the GHG emissions regulation will specify the requirements

for reporting. The framework utilized to produce GHG emissions reports

will dictate the systems, processes and controls in place to ensure reliable,

accurate and timely data. Refer to Table 3 for information on two of the

most widely used GHG emissions standards and protocols.

4. Is third-party verification required for GHG emissions reports?

Many, but not all, regulations require organizations to have their GHG emissions

reports verified annually by an independent third party. In evaluating

the applicable requirements, it is important to understand the frequency

and level of assurance required for GHG emissions reports. In addition, it is important to understand whether the lead verifier is required to be certified (e.g., ISO 14064-3) or whether the verification body as a whole must be certified under the regulation (e.g., ISO 14065). This will impact the selection of a third-party verifier.

SECTION 2 | The Need for GHG Emissions Management 15

5. What types of GHG emissions are relevant for my industry and/or business?

As noted in Table 2, GHG emissions reporting entails measuring and managing the seven relevant greenhouse gases. Some gases are more important to specific industries than others. Industry associations (e.g., Mining Association of Canada’s Energy and GHG Emissions Management Reference Guide), UNFCCC, and multilateral agencies (e.g., International Energy Agency, World Resources Institute, and World Business Council for Sustainable Development) all provide technical guidance and additional information as appropriate. Refer to Appendix A for resources.

6. What is the appropriate scope and boundaries for GHG emissions reporting?

GHG emissions reports can include Scope 1, 2 or 3 emissions. According to the GHG Protocol definitions, Scope 1 emissions are defined as direct GHG emissions from operations (e.g., emissions associated with operating facilities); Scope 2 emissions are defined as indirect GHG emissions from energy usage (e.g., emissions associated with electricity use); and, Scope 3 emissions are defined as other indirect GHG emissions from business activities (e.g., emissions associated with employee travel). Depending upon the objectives and regulatory requirements for GHG emissions reporting, organizations will need to consider what facilities, processes and business activities will be scoped into the GHG Emissions Management System.

7. Will the organization set targets for GHG emissions reductions?

A critical starting point is completion of a baseline GHG emissions inventory in order to evaluate the current GHG emissions profile of the organization and its facilities. The baseline will be used to measure progress toward goals over time. From there, a company must determine whether it will set targets for reducing GHG emissions in the context of business strategy, regulatory compliance and reporting requirements. In setting targets for GHG emission reductions, many organizations including Nike, Walmart and HP are utilizing science-based targets that align with the 2° Celsius threshold defined in the Paris Agreement (refer to Appendix A for resources).

16 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

8. What is the organization’s strategy for managing GHG emissions?

In managing GHG emissions, the organization needs to define its strategy

for mitigating risks and capitalizing on opportunities. An essential part of

the strategy includes setting objectives for GHG emissions management in

line with existing business strategy and risk management processes. The

organization should create an action plan that includes key performance

indicators, milestones, monitoring and regular progress reviews in order

to meet stated objectives. In addition, roles and responsibilities across the

organization must be clearly defined and aligned with specific actions

outlined in the plan. Systems, processes and internal controls should be

designed and implemented to ensure the accuracy, consistency, comparability

and reliability of GHG emissions data collected for reporting

purposes.

9. What is the role of leadership in GHG emissions management?

The importance of leadership by executive management and oversight

by the board of directors cannot be understated. The “tone at the top”

articulates the importance of integrating GHG emissions management with

existing risk management, strategy and operations. In this context, GHG

emissions reports may be used for internal or external audiences.

10. Is external disclosure to capital providers necessary?

As demonstrated throughout this paper, companies may be required

to report GHG emissions to various levels of government. Beyond that,

an entity should evaluate whether there is a need or benefit to reporting

GHG emissions and/or related information to other external stakeholders.

For example, many companies may choose to respond voluntarily to investor

requests for further GHG emissions information via CDP surveys.43 In

addition, if assessed as financially material, listed companies must include

GHG emissions information in financial filings.44 While this paper does not address the issue of financial reporting related to GHG emissions, some useful resources are provided in Appendix A.

43 CDP (formerly the Carbon Disclosure Project) is an international not-for-profit organization providing a global system for companies and cities to measure, manage and share environmental information.

44 In Canada, listed companies must disclose material information, including material climate change information, in their securities regulatory filings. Further guidance can be found in CSA 51-333: Environmental Reporting Guidance: www.osc.gov.on.ca/documents/en/Securities-Category5/csa_20101027_51-333_environmental-reporting.pdf.

17

SECTION 3

Roles for CPAs

An organization’s GHG emissions profile can have implications for business strategy, risk management, financial and operational performance, and long-term value creation. In responding to GHG emissions and the associated organizational risks, CPAs have an opportunity to play a critical role by acting as a hub within the organization, bringing together multi-disciplinary teams to take collaborative action.

Similar to any complex organizational challenge, GHG emissions management programs require diverse skills. Consistent with the approach taken in other multifaceted areas, such as insurance liabilities and infrastructure investment, CPAs will need to engage with engineers, sustainability professionals, climate scientists and others to respond effectively to these unique risks and opportunities.

The table below outlines appropriate roles for CPAs in GHG emissions management activities. These roles illustrate some of the ways CPAs can support their organizations as they mitigate GHG emissions.

18 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

TABLE 4: ROLES FOR CPAs IN CLIMATE-CHANGE MITIGATION

Climate-Change Mitigation Stage

Roles for

CPAs

Motivate

Action

Plan

Action

Implement

Action

Assess

Performance

Respond to

Market and

Stakeholders

CPAs in

Leadership

Positions

Examples:

• Ensure board is educated about GHG emissions management.

• Comment on policy alternatives.

• Integrate GHG emissions mitigation considerations into organizational strategy,

risk management and decision-making.

• Set GHG emissions reduction targets and develop organization-wide action plans.

• Establish accountability structures for mitigation goals and targets.

• Embed GHG mitigation into business functions and processes, including compensation.

Roles for

CPAs at all

levels

Examples:

• Identify GHG

mitigation

risks and

opportunities.

• Develop business

case for

GHG mitigation

actions based

on regulatory

environment

and stakeholder

input.

Examples:

• Support

development

of GHG

emissions

reduction

targets and

action plans.

• Estimate

costs and

benefits of

GHG mitigation

activities.

• Evaluate

impact of

carbon pricing

on capital

expenditure

decisions.

Examples:

• Participate

in carbon

markets trading

and

appropriate

accounting for

transactions.45

• Track ROI on

GHG emission

reduction

investments

and compare

to plan.

Examples:

• Establish key

performance

indicators

(KPIs) for

mitigation

targets.

• Establish

systems and

internal controls

over GHG

emissions data

and KPIs.

• Measure

impacts of

GHG emissions

on assets,

liabilities,

revenue and

expenses.

• Perform

internal audit

of GHG emissions

data,

systems and

reports.

Examples:

• Contribute to

external GHG

emissions

reporting

(government,

financial and

voluntary).

• Contribute to

internal GHG

emissions

reporting.

• Engage

third-party

assurance

providers for

GHG emissions

data, systems

and reports.

45 For additional guidance on accounting for cap-and-trade transactions, refer to Appendix A.

SECTION 3 | Roles for CPAs 19

“Accountants in business play a critical role in supporting their organizations in responding to climate change and its impacts. First and foremost, they can help make the case for climate action by framing climate change opportunities and risks in a business context. Connecting this Goal to business objectives and long-term business resilience is important in gaining wide-spread support and ensuring business sustainability.

The objective performance data and insights accountants in business can provide should include material climate change issues and help establish and monitor appropriate targets and goals for emissions management and abatement. Their reporting and communication skills can be applied to developing enhanced forms of reporting, such as environmental profit and loss statements and integrated and sustainability reporting, which provide insights to investors, employees, and other stakeholders on an organization’s climate change performance.”46

International Federation of Accountants (IFAC): 2030 Agenda for Sustainable Development — A Snapshot of the Accountancy Profession’s Contribution

Roles for CPAs in Leadership Positions

CPAs in leadership positions have roles that span all stages of climate change mitigation. Working collaboratively with other members of the management team and other subject matter experts, chief financial officers (CFOs) can build climate-change goals into overall business strategy, risk management and operational decision-making. CFOs often have an expansive view of the entire organization. They can lead an integrated response to mitigation issues by supporting the establishment of company-wide GHG emission-reduction targets.

This includes the development of mitigation action plans with key performance indicators to assess performance against goals. CPAs in leadership roles can also embed mitigation considerations into existing business processes, such as enterprise risk management systems, financial and operational reporting systems, asset management, supply chain management, and procurement policies, to name a few.

“CPAs in leadership positions, such as the CFO, have an opportunity to set the tone for the organization when it comes to investing in climate change mitigation and adaptation actions. As accountants, we are uniquely positioned to lead the business case for GHG emissions management activities. We bring the skills and rigor required to ensure that investments to reduce GHG emissions align with overall risk management and strategy.”

Robert Siddall — FCPA, FCA, Chief Financial Officer of Metrolinx

46 www.cpacanada.ca/en/business-and-accounting-resources/financial-and-non-financial-reporting/

sustainability-environmental-and-social-reporting/publications/the-2030-agenda-for-sustainable

-development

20 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

Roles for CPAs at All Levels

The roles for CPAs across all stages of mitigation demonstrate that the enabling

and technical CPA competencies can be applied in a new subject matter area.

Accountants already have the skills and expertise to add value to their organization’s

climate-change mitigation efforts.

Motivate Action

As a starting point, most organizations will seek to understand their GHG

emissions inventory, also known as a carbon footprint, and evaluate whether

government reporting is required and whether reductions are necessary for

compliance purposes and/or advisable in the context of their business model

and strategy. CPAs can help to identify mitigation risks and opportunities and

build the business case for reducing GHG emissions by developing quantitative

and qualitative analyses to support decision-making. CPAs in leadership

roles can identify and analyze business drivers for GHG emissions management,

such as a changing regulatory environment and evolving stakeholder

expectations.

Plan Action

In evaluating responses to identified risks and opportunities, CPAs can support

their organizations in estimating the costs and benefits of mitigation options

and prioritizing activities to achieve high-impact emissions reductions. CPAs

can also support the development of GHG emission reduction targets by using

scenario modelling to forecast financial and operational outcomes of alternate

mitigation actions.

Implement Action

CPAs may be engaged in carbon markets as part of trading and compliance

activities related to cap-and-trade systems. This could include accounting for

assets, liabilities, revenue and expenses associated with cap-and-trade transactions.

For additional information on this topic, refer to a recent CPA Canada

publication titled Accounting for Cap and Trade Systems in Appendix A.

Assess Performance

Measurement is an essential tool for evaluating progress toward GHG emissionreduction

targets and reporting externally to the market and stakeholders.

CPAs working in business are well positioned to help their organizations with

performance measurement and management of mitigation efforts. Accountants

can play a critical role by establishing key performance indicators for

SECTION 3 | Roles for CPAs 21

mitigation action plans used for internal decision-making and external communications. CPAs can support the design and implementation of systems and internal controls for collecting and validating GHG emissions data.

Respond to Market and Stakeholders

CPAs in reporting roles may be involved with mandatory and voluntary reporting on GHG emissions. Mandatory reporting includes GHG emissions reporting to federal, provincial and territorial governments. If the organization is publicly listed, CPAs may also be involved with mandatory reporting on material climate change information in regulatory filings. Voluntary reporting includes responding to surveys, such as the CDP and developing standalone sustainability reports intended for a broader audience beyond investors.

23

Conclusion

For Canadian companies to meet regulatory requirements and succeed in the transition to a low-carbon economy, it is important to measure, manage and report on GHG emissions. An effective GHG Emissions Management System is imperative. CPAs play an important role in motivating, planning and implementing action, assessing performance and reporting to stakeholders.

25

Appendix A — Where to Find More Information

This appendix provides useful resources in relation to the issue of GHG emissions management and reporting.

CPA Canada Publications

• Accounting for Cap and Trade Systems: www.cpacanada.ca/en/

business-and-accounting-resources/financial-and-non-financial

-reporting/international-financial-reporting-standards-ifrs/publications/accounting-for-cap-and-trade-transactions

• Study of Climate-Related Disclosures by Canadian Public Companies:

www.cpacanada.ca/en/business-and-accounting-resources/financial-and

-non-financial-reporting/sustainability-environmental-and-social

-reporting/publications/climate-related-disclosure-study

• Climate Change Briefing: Questions Directors Should Ask: www.cpacanada.ca/

climatechangebriefing

GHG Emissions Management and Reporting Resources

• ISO 14064-1: www.iso.org/standard/38381.html

• ISO 14064-2: www.iso.org/standard/38382.html

• ISO 14064-3: www.iso.org/standard/38700.html

• ISO 14065: www.iso.org/standard/60168.html

26 A Primer for CPAs on Greenhouse Gas Emissions Management Systems

• Greenhouse Gas Protocol: www.ghgprotocol.org

• Mining Association of Canada — Towards Sustainable Mining — Energy

Use and GHG Protocol:

http://mining.ca/towards-sustainable-mining/protocols-frameworks/energy-and-ghg-emissions-management

• Science-Based Targets Initiative:

http://sciencebasedtargets.org/companies-taking-action

Financial Reporting Resources

• CSA 51-333: www.osc.gov.on.ca/documents/en/Securities-Category5/csa_20101027_51-333_environmental-reporting.pdf

• CSA Climate Change Disclosure Review: www.securities-administrators.ca/

aboutcsa.aspx?id=1567

• COSO and the World Business Council for Sustainable Development

(WBCSD) Report on Enterprise Risk Management — Applying

Enterprise Risk Management to Environmental, Social and Governance-

related Risks (Draft February 2018): www.wbcsd.org/

Projects/Non-financial-Measurement-and-Valuation/Resources/

Applying-enterprise-risk-management

Voluntary Disclosure Initiatives

• Task Force on Climate-related Financial Disclosures (TCFD): www.fsb-tcfd.org

• Sustainability Accounting Standards Board (SASB): www.sasb.org

• Carbon Disclosure Project (CDP): www.cdp.net

• Climate Disclosure Standards Board (CDSB): www.cdsb.net

277 WELLINGTON STREET WEST

TORONTO, ON CANADA M5V 3H2

T. 416 977.3222 F. 416 977.8585

WWW.CPACANADA.CA

|

|

|

|

|