MONEY / LIQUIDITY

HOW MONEY WORKS

|

|

How MONEY works

|

|

Modern MONEY is a mess

Economic theory has it that money is an economic measure, a store of value and a medium of exchange. The US dollar has does none of these things well. See how the purchasing power of the US dollar has declined during the 20th century!

|

|

HOW MONEY IS CREATED.

This is a very important mechanism, and very little understood by most people as they go about their daily lives. In 2008, at the height of the banking crisis, the Centrtal Banks around the world did exactly this, and have continued to do it. The result is that Central Banks have created many trillions of new money that has enabled the world's banking system to survive and to thrive. Meanwhile, the major structural issues of the 'real' economy ... the 'main street' economy have not been addressed in a meaningful way.

|

|

CENTRAL BANK LENDING: 2006 - 2015

Central Bank lending has increased from around $5 trillion to almost $18 trillion from 2005 to 2015. Where has this money come from and what has it been used for? The sharp increase in Central Bank lending in 2008 related to the near collapse of the global banking ecosystem, but an ongoing policy of easy and essentially free money for banks encouraged continuing money creation that has never happened before.

The US (green) has had the biggest percentage growth in the 10 years. The Chinese (maroon) has becoming the biggest banking system. The ECB (orange) has been relatively prudent, as has the Japanese Central Bank (Grey).

What happens when this $13 trillion of 'emergency money' is removed from the global economy? This has never been done before, and thoughtful people are very concerned about what might happen.

|

|

MONEY SUPPLY GROWTH: 1970-2008

Most of the population works with M0 (money in circulation) and M1 (M0 + demand deposits) which have grown substantially. The financial institutions work with M3 which has grown even more in the period since 1970.

|

|

UK BANK LENDING by SECTOR: 1997-2011

In the UK, the main business of the banks seems to be to be lending to other parts of the banking business. Presumably this is because of the profit potential of the banking system while doing rather little of substance for the real economy!

|

|

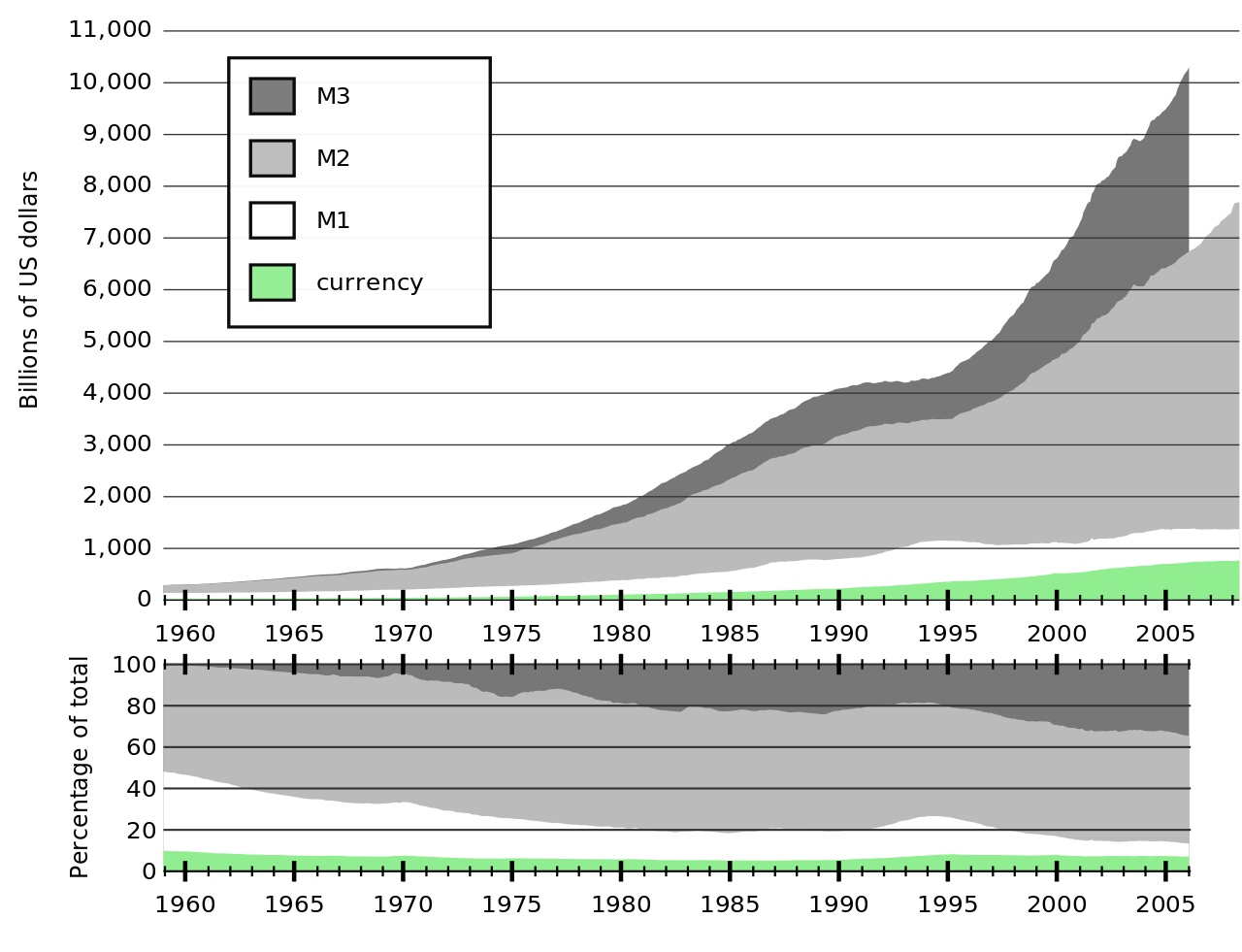

COMPONENTS OF THE US MONEY SUPPLY: 1959 - 2007

M3 (which is the part of the money supply that is managed by banks, financial institutions and big companies) has been getting bigger and bigger during this time while M1 (which is the part of the money supply used by ordinary people and small business) has been getting relatively smaller. The relative size of M2 and M0 have been more or less constant. This is another manifestation of the inequality in the economy where owners within financial economy have become more and more wealthy, while ordinary people have remained more or less where they were at best, and in many cases significantly worse off.

|

|

INTANGIBLE COMPONENT OF STOCK MARKET WEALTH: 1973 - 2005

This is where most modern wealth has come from ... it has little relationship with the tangible real world that feeds people and provides essential services. There has been modest growth in the tangible balance sheet of companies since the 1980s, but substantial growth in the companies' intangibles and explosive growth in the stock market premium derived from computation of the net present value of future profits.

|

|

PRODUCTIVITY and PEOPLES' PAY

For the past 40+ years since the early 1980s, there has been massive improvement in business productivity. For the previous four decades workers shared in productivity gains. Starting around 1980 all of the benefits of productivity improvment has been for the account of owners rather than workers. Nothing has been done by either business or political leaders to change this unhealthy outcome, which is increasingly eroding social stability.

|

|

CORPORATE LIQUIDITY

The amount of cash reported on the Balance Sheets of corporate organizations has increased to record levels at around $1.8 trillion in 2012, up from around $200 billion in 1980

This is a very important idea, and very little understood by most people as they go about their daily lives.

In 2008, at the height of the banking crisis, the Central Banks around the world did exactly this, and have continued to do it. The result is that Central Banks have created many trillions of new money that has enabled the world's banking system to survive and to thrive.

Meanwhile, the major structural issues of the 'real' economy .... the 'main street' economy have not been addressed in a meaningful way.

|

|

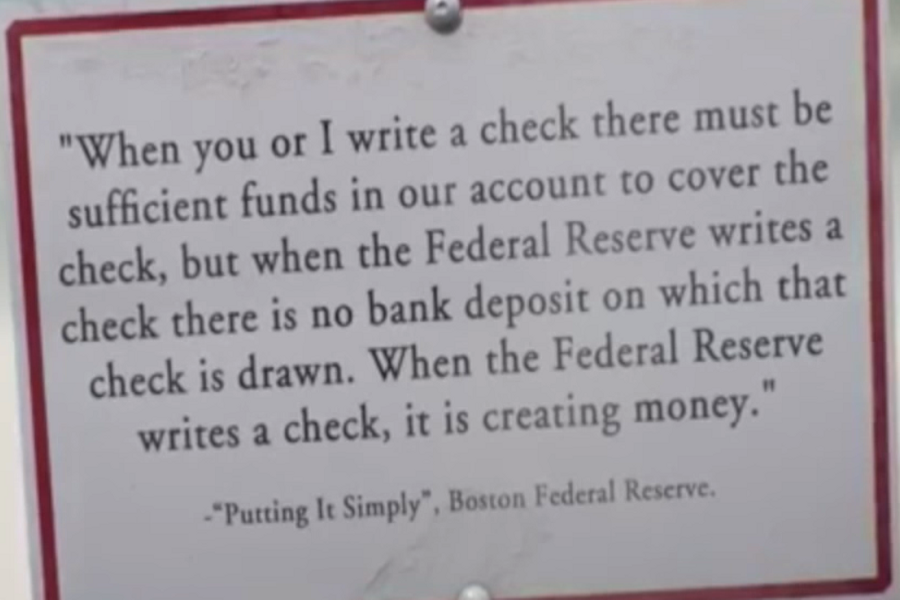

The quote from the Federal Reserve makes no sense ... it is a fiction

|

|

On the other hand this quote from Keynes has validity. Inflation and the loss of purchasing power is a very subtle way of rewarding owners of real assets and defrauding those that work for their livelihood.

|

What does this mean? What is the way forward?

When the banking crisis occurred in 2008, the bankers, political leaders and the business community enabled the issuance of several trillion dollars of 'money' to be created in order to give liquidity to the banking sector and enable it to survive. The exact amount of this liquidity injection is not obvious, but estimates are in the range of between $7 trillion and $20 trillion ... a very substantial amount.

Many will argue that there is a bigger crisis in Society as a whole than the rather modest crisis of the banking industry and financial sector. Surely, there should be a plan to enable the issuance of an amount of liquidity for this problem just as was done for the financial problem.

And the same goes for the Natural Capital crisis where degradation of the system has existential risks for the survival of mankind. Surely, we can plan to enable the availability of liquidity in order for the natural capital system to be repaired and returned to good health.

|

How might this be done?

|

TPB commmentary:

This is very thought provoking ... but is essentially wrong, not so much because of the detail of how 'money' is created, but because it ignores the mechanisms within natural capital and social capital by which wealth and prosperity are created.

Wealth and prosperity are created because the PROCESSES of the ECONOMY are able to 'harvest' the VALUE ADD of the PROCESSES of NATURAL WORLD and also the VALUE ADD of the ACTIVITIES of PEOPLE.

The financial processes being described in this video explain very well how the value created by human effort and natural systems is extracted by the banking and financial system to renrich this segment of the system at the expense of everyone else.

|

Just 41 minutes after the second plane hit the World Trade Center, the world’s most powerful bankers held a secret meeting.

At the head of table was Alan Greenspan, the Chairman of the Federal Reserve. He assured all in attendance that he would prevent a financial crisis by using emergency powers granted to him by the government.

Flash forward to today. Bestseller author Mike Maloney, has spotted recent activity at the Fed that signals another economic 9/11 is coming. But it will be much worse.

You’ll be shocked at what’s going on behind closed doors. For the full story, watch Mike’s newest video right here.

It’s the highly anticipated first episode of the new season of the Hidden Secrets of Money. And it’s completely free.

------------------------------------------------------------------------------

HIDDEN SECRETS OF MONEY - MIKE MALONEY S1 • E6

Top 4 Reasons For Deflation BEFORE Hyperinflation - Hidden Secrets Of Money Episode 6 (Mike Maloney)

667,298 views

GoldSilver (w/ Mike Maloney)

Published on Nov 17, 2015

Watch the Bonus Feature here: http://goldsilver.com/hsom/ep6/ Conclusive proof a market crash bigger than 1929 is coming. There are 4 unmistakable signals a financial crisis of epic proportions is headed straight toward us. And to walk you through each of them, bestselling author Mike Maloney has released a shocking new video. It’s the first episode of the all-new season of the Hidden Secrets of Money. And it contains vital information for avoiding a stock market collapse.

Of course, just like the first season which has over 20 million views and counting, these episodes are free. It’s all part of our mission to educate as many people as possible about how money really works. And expose the dangerous game the Fed and government is playing with our financial system.

For more information about investing in Gold & Silver or Mike Maloney, visit the Why Gold & Silver channel and subscribe: http://goo.gl/emXEB

Join GoldSilver.com & Mike Maloney on other social networks:

|

More TPB commmentary:

The embedded older video is no longer accessible ... but this 2015 video is somewhat similar.

There are some important ideas and it is is very thought provoking. Some of the trends are very disconcerting ... but the analysis continues to ignore the important mechanisms within natural capital and social capital by which wealth and prosperity are created.

|

Financial Inclusion ... Accion-CFI-Uniting-Tech-and-Touch-Kenya-2017

36 page paper prepared by Alexis Beggs Olsen in November 2017

While Kenyans are comfortable conducting transactions digitally, other key aspects of the financial service customer journey are not adequately handled by digital means alone

'http://truevaluemetrics.org/DBpdfs/Finance/Accion-CFI-Uniting-Tech-and-Touch-Kenya-2017.pdf'

| Open PDF ...

Accion-CFI-Uniting-Tech-and-Touch-Kenya-2017.pdf

|

Levy-Bard-College-Money-Power-and-Monetary-Regimes

Pavlina R. Tcherneva Levy Economics Institute of Bard College 26 pages

Money, in this paper, is defined as a power relationship of a specific kind, a stratified social debt relationship, measured in a unit of account determined by some authority. A brief historical examination reveals its evolving nature in the process of social provisioning. Money not only predates markets and real exchange as understood in mainstream economics but also emerges as

a social mechanism of distribution, usually by some authority of power (be it an ancient religious authority, a king, a colonial power, a modern nation state, or a monetary union). Money, it can be said, is a “creature of the state” that has played a key role in the transfer of real resources between parties and the distribution of economic surplus.

'http://truevaluemetrics.org/DBpdfs/Money/Levy-Bard-College-Money-Power-and-Monetary-Regimes.pdf'

| Open PDF ...

Levy-Bard-College-Money-Power-and-Monetary-Regimes

|

|