|

|

PROGRESS / PERFORMANCE

ECONOMIC INEQUALITY

Prevailing management metrics make this outcome all but inevitable.

|

|

Measure State and you Measure Progress

|

|

|

|

|

IMPACT ON SOCIAL CAPITAL

|

In OECD countries, quality of life has flatlined or worse for several decades.

The average improved, but all the benefit was at the top, leaving nothing for everyone else

|

|

GDP up ... Profits up ... But NOT wages

|

|

As GDP has gone up (red line), labor (green line) has gone up not quite as much, but profits (blue line) have gone up by a substantial amount. What this shows is that all the benefits from 'productivity' have been given to profits and nothing given to labor.

|

|

Before Reagan / After Reagan

|

|

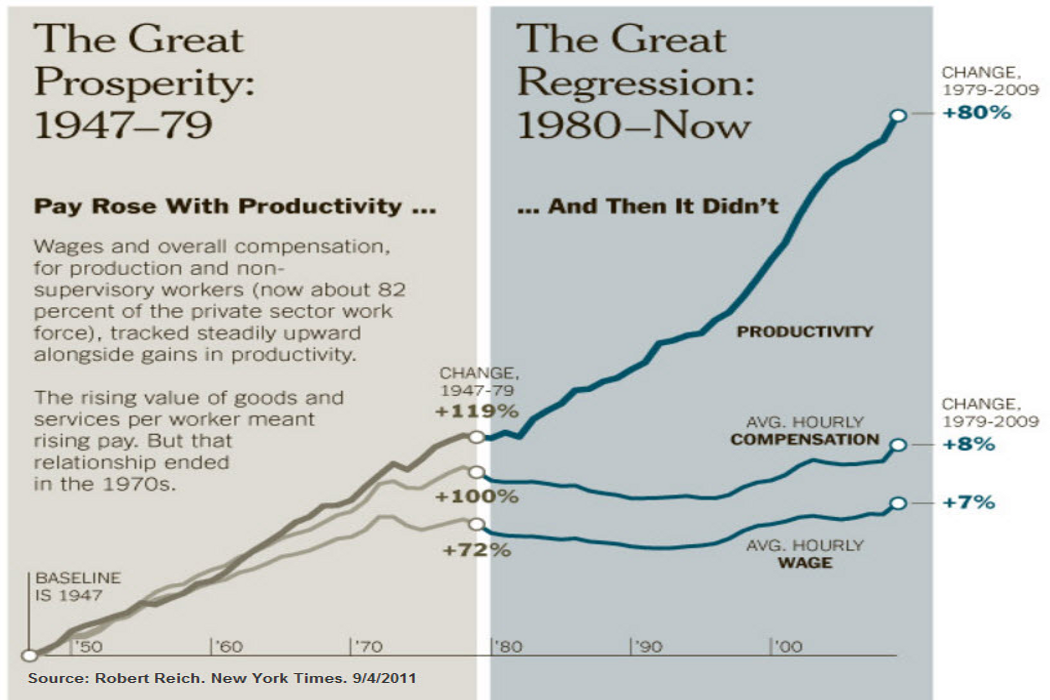

This graphic prepared by Professor Robert Reich shows some key economic indicators pre-Reagan and then after Reagan.

For about 30 years post WWII during the 'Great Prosperity' the US economy enabled most Americans to improve their quality of life, but after 1980 when that ended the share of prosperity was much bigger for owners than it was for workers.

|

|

Union membership down ... Inequality up

|

|

Union Membership reached an all-time high by the end of WWII. The proportion of union members remained high after the war, and then declined during the 1960s and 1970s. The decline gained momentum under President Reagan in the 1980s, and this decline has continued up to this time (2019).

Collective bargaining was an important tool for getting a fair balance between labor and management in wage negotiations. Profits were increasing with improved productivity, and collective bargaining meant that the benefit of increased productivity was shared in a reasonably equitable manner.

This being weakened over time as more US States adopted 'Right to Work' laws that made unionization difficult. Companies started to migrate from the unionized North to the less unionized South where wages were lower.

The trend was aggravated significantly with the oil shock of 1973 when the OPEC cartel established a crude oil price of $13.50 a barrel, up from $3.50 a barrel. While major international oil companies could have continued to sell at pre-OPEC prices, they chose to increase prices dramatically, no matter that they had been profitable under the pre-OPEC market conditions. While this was good for the oil companies, it was catastrophic for most of US industry that was labor efficient but chronically energy inefficient. This inefficiency did not matter much when US energy was very cheap, but under the OPEC market conditions, this was no longer the case. In the 1970s post 1973 the US industrial sector was facing a crisis with costs dramatically increased. They increased prices in an attempt to sustain profitability, and the result was record levels of inflation. This was entirely cost push inflation. Not surprisingly, attempts to control inflation using monetary policy were a complete failure.

Inequality accelerated after President Reagan fired striking Air Controllers and American companies moved more and more of their product sourcing to a variety of low wage countries around the world, and to a great extent, to China.

|

|

|

Decline of US Household Wealth

|

|

GDP up ... but not GPI

Gross Domestic Product -v- Genuine Progress Indicator

|

|

GDP has grown and grown and grown ... enabled by financialization and a singular focus on economic performance but not taking into consideration externalities, including those that are very important to quality of life and a sustainable environment. When these are taken into account as they are with GPI (Genuine Progress Indicator), then the improvement disappears.

|

|

Household Debt / Student Loans in the USA

|

|

Student loan debt is the only segment of household debt that has been expanding since the financial crisis of 2008. This graphic from 2010 shows the growth of student debt compared to other components of household debt. Around $100 billion has been added to student debt each year.

|

|

Government Spends Too Much and Taxes Too Little

|

|

The financial management of Government is driven far too much by politics and not enough by economic reality and an optimum use of funds.

|

|

US Consumer Debt Outstanding

|

This graphic shows the state of household finance is worse now (in May 2019) than it was in the runup to the financial crisis of 2008.

This graphic also shows the catastrophic damage done to household balance sheets since the 1970s. In the 1970s the world economy was stressed by the OPEC oil shock of 1973 which made the US especially uncompetitive because of its previous reliance on very cheap energy. Reagan era policies set the stage for much tougher limits on labor and collective bargaining as well as financial deregulation which facilitated the creation of more and more consumer credit. The growth of consumer credit made it possible for consumer demand to remain strong even while wages were weak. Reagan era banking deregulation unleashed the greed of bankers which resulted in the Savings and Loan Crisis and other abuses.

|

|

|

|