OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Money Banking and Financial Services |

|

COMMENTARY I have been a corporate CFO with responsibility for financial reporting, financial control, bank relations and risk management. Risk management was a very important part of our business, and as a company we reduced our 'cost of risk' by a very substantial amount. We did not merely 'lay off' the risk to some unsuspecting insurance company, but we worked on making sure that the actual real risk was reduced. This was engineering and training of staff, and we reduced the risk to such an extent that it was profitable to 'self insure' because our actual risks were well below the cost of the total pool into which we would have been a part in an insurance program. For multiple event catastrophe we had 're-insurance' and that cost little because the risk was extremely low. My point is that risk is about real matters ... not merely chopping risk up into more and more complex combinations, but with the risk in aggregate being exactly the same. Bankers and finance quants do not seem to understand the hard reality of a real world, and until they do, the economy they dominate will fail.

Credit Unions are people oriented ... they have contact with the real world. They do things that people need. They do not make foretunes for their managers, but the managers and staff get to 'sleep nights' and can take pride in their jobs well done.

|

|

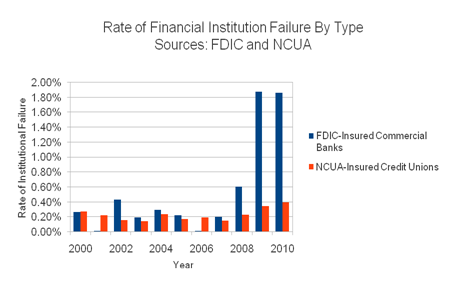

In Pictures: Banks vs. Credit Unions in the Financial Crisis Credit unions are owned by their customers (or, in industry parlance, 'members'). Big banks are owned by their shareholders. A key narrative of the recent Bank Transfer Day was to pit normally sleepy credit unions against the big banking industry. Credit union skeptics are quick to point out the fact that credit unions hardly went unscathed during the 2008 financial crisis, yet CU advocates argue that their institutions fared better than commercial banks. Are their claims backed up by the numbers? To find out, I looked at statistics generated over the past 10 years by their respective regulators, the Federal Deposit Insurance Corporation for banks and the National Credit Union Administration for credit unions. What I found is that in the case of failures, the years before the financial crisis seem to have been a wash, with both types of institutions failing at about the same low rate. When the financial crisis hit, however, the story changed. In 2008, the rate of commercial bank failures was almost triple that of credit unions (0.60% to 0.23%), and that increased to almost five times the credit union rate in 2010 (1.86% to 0.40%). While the sluggish economy seems to have also negatively affected credit unions, they experienced nowhere near the surge of failures seen in the commercial banking sector.

A similar pattern is evident in the case of institutions considered to be problematic by NCUA or FDIC. Though slightly muddied by the fact that the FDIC does not differentiate between commercial banks and savings banks in their statistics, the picture is still pretty clear: While negatively affected by the crisis, credit unions did not experience the sort of radical departure from their baseline rate that banks did.

|

|

By Matt Cropp

November 22, 2011 |

| The text being discussed is available at http://www.fool.com/investing/general/2011/11/22/in-pictures-banks-vs-credit-unions-in-the-financia.aspx |