OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Economy |

|

Burgess COMMENTARY 6m Peter Burgess @TrueValueMetric Peter Burgess |

|

It's the entrepreneurs, stupid! The entrepreneurial spirit that guided every great surge of innovation in America's past is as alive as it's ever been.

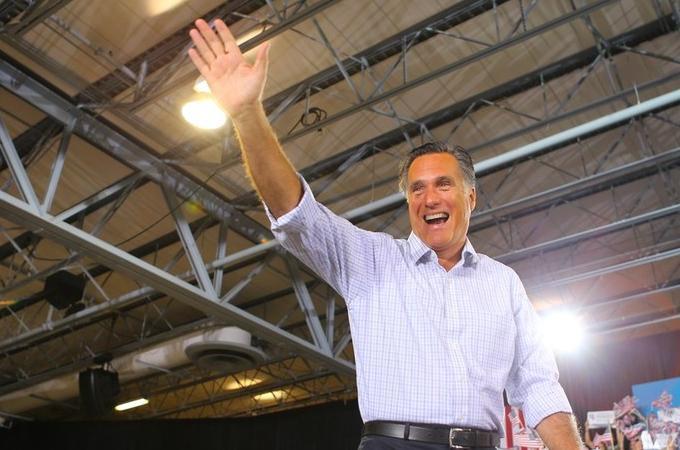

Some things just don't change for Mitt. Writing off 47 per cent of the electorate, much in the same vain as he previously wrote off struggling businesses, focusing on what he can gain, to the cost of society at large. Many have already critiqued his words and their implications, but there is something that concerns me greatly about Romney's recent impersonation of Gordon Gekko. You don't write off people. Separating the haves from the have-nots, even conceptually, is an economic disaster. Ignoring the strains such Randian thoughts place on society, the greatest critique of such thinking should be its effects on innovation. When you start to exclude people, you exclude possibilities. Though there might be a correlation between education and innovation, and a correlation between education and class, you'd be hard pushed to correlate class and innovation. In fact, some of the least innovative places in the US remain Country Clubs, where change is a four-letter word. Mitt's constituents aren't necessarily going to be innovating towards a more robust and vibrant economy. Not that he or they necessarily care. In fact, American Innovation has a history of being birthed by the have-nots. A number of today's biggest innovators began their journey in the midst of 'The Great Depression' of the 1930s, when the have-nots were ubiquitous. These include Disney, Macys Inc., Texas Instruments, Motorola, United Technologies Corp and Revlon, just to name a few. The US saw one of its biggest growth to date shortly after the Great Depression, and it was because of entrepreneurs. They are the people who live, sleep and breathe the old axiom of not seeing things as they are, and asking why, but rather seeing things that never were, and asking why not. Though our laws have changed, our economy has evolved, our monetary system has undergone various, shall we say, 'improvements', there has remained a constant in our ever-evolving societal and economic system as a whole: the impact of the entrepreneur. Put it more simply for all the political puppeteers still wondering how best to tinker with taxes, entitlement reform and overseas spending: It's the entrepreneurs, stupid! US economy plays into Romney's hands

In the history of the American economy, periods of rapid growth can be directly tied to entrepreneurial innovation. Though economic indicators suggest that the economy is still faltering, we should be ignoring the sudden resurgence of 'from-the-ground-up' entrepreneurs who are making waves in the business arena at a pace we have not seen since the early days of the internet era. Innovation and expansion The advent of the personal computer and the internet in the 1990s revolutionised the world economy perhaps more than any other innovation in the world to date. Likewise, the founding and subsequent explosion of PayPal and Google in the midst of the notorious 'Dot-Com Bubble' spawned an entire 'Micro-Economy' that further expanded the reach of entrepreneurs everywhere. Although these two companies together employ less than 100,000 people, Google, PayPal and its parent company, eBay, indirectly enable millions of people to make a living or start a business online through their various services and affiliate programmes that are offered. Furthermore, the entrepreneurial genius of microfinance, which has grown exponentially in recent years, is revolutionising the way in which small businesses can get their foot in the door without the need for large commercial banks. Putting theory into action Now, in just last year alone, we are seeing what is perhaps the successor of microfinance: crowd-sourced funding. Sites like Indiegogo and Kickstarter are increasingly taking the load off the angel investors, microfinance lenders and big banks, by allowing small start-ups to get a boost by enlisting the help of small monetary donors from across the world. This is the symbiotic, entrepreneurial relationship that many economists have been hypothetically dreaming about and proposing for generations, and is an example of entrepreneurship in the digital age at its finest. This model of innovative start-up, investment and then monetisation from advertising or affiliation has resulted in some remarkable success stories in just the past few years alone. The most publicised has been the mega launch of photo sharing site Pinterest and the sale of the popular photo-editing and sharing application Instagram which was purchased by Facebook for an astonishing $1bn just three years after its inception. In other words, these entrepreneurs built a billion-dollar business off a simple idea that put hundreds, if not thousands of people to work. For those people who are looking ahead towards the future trends in the world economy today, there is no recession. That entrepreneurial spirit, which has guided every great surge of innovation in America's past, is as alive as it has ever been. 'Entrepreneurs have shaped American history... and will be determining the future of not just our economy, but also our civilisation as whole for many years to come.' While the political dinosaurs in Washington are busy trying to 'fix' the economy, the entrepreneurs who are really shaping America's future are busy doing what they do best, day in and day out. Entrepreneurs have shaped American history up until this point, they are defining the trends and market prices as we speak, and will be determining the future of not just our economy, but also our civilisation as whole for many years to come. The more entrepreneurial ideas that bloom like Instagram or Pinterest or any of the other exciting start-up companies out there, the more jobs will be created and the more money will be pumped into the economy. The government should be focusing its efforts on nurturing the entrepreneurs out there who need a little extra capital to get going, rather than helping big businesses who have mismanaged their money to pay off their massive debts. Education is also a key factor. The more entrepreneurial programmes that are set up in high schools and colleges for students to begin to think of their own business ideas, the more ideas will be out there for banks and investors to put their money into. Creating a generation of largely self-reliant thinkers and business leaders will also help protect all of us from the dangers of an economic recession in the future and it will create more jobs in cutting-edge industries. According to Forbes, small businesses make up 99.7 per cent of all employer firms and have created 65 per cent of net new jobs for the past 17 years. So with that, we salute you - fellow entrepreneur, and hope the next time someone asks 'Who will save the economy?' you do not point to the closest issue of Forbes Magazine, or to the politician giving a speech on C-Span, but rather to a mirror, as the greatest ideas for America's future are usually the ones that have not yet been invented.

Goutham Bhadri is the CEO of Marketing Samurai, LLC, a New York digital marketing agency. He also helped launch Switch2Health, an angel-backed startup focused on motivating people to be active through the gamification of health. He is a graduate of the London School of Economics, and completed his MBA at Columbia Business School, focusing on Entrepreneurship and Marketing and advises startups via the Entrepreneurial Sounding Board at Columbia Business School's Eugene Lang Entrepreneurship Centre. Follow him on Twitter: @gbhadri The views expressed in this article are the author's own and do not necessarily reflect Al Jazeera's editorial policy. |

|

Goutham Bhadri ... Goutham Bhadri is the CEO of Marketing Samurai, LLC, a New York digital marketing agency. He also helped launch Switch2Health. He is a graduate of the LSE, and completed his MBA at Columbia Business School.

Last Modified: 24 Sep 2012 11:11 |

| The text being discussed is available at http://www.aljazeera.com/indepth/opinion/2012/09/201292481332288223.html |