OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Economy |

|

Burgess COMMENTARY Dear Colleagues Peter Burgess |

|

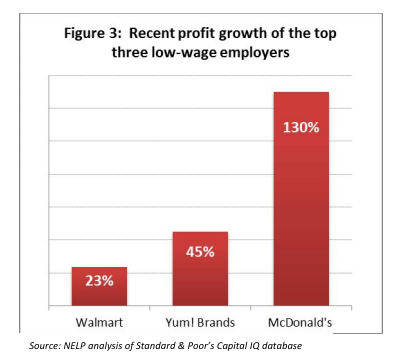

High Profits, Low Wages, and the Growth of Inequality Despite near-record levels of economic inequality, many politicians and pundits still don't think this widening chasm is much of a problem in a country supposedly dedicated to egalitarian ideals. Inequality, the logic goes, is a natural result of different degrees of work and creativity. Some people strive harder and have better ideas, as well as take more risks, and giving them outsized rewards is a good thing, since it encourages others to emulate this behavior and makes us all wealthier in the end. Related to this, low-wage jobs aren't anything to worry about either, since people who put in the effort can climb upward to better jobs and, also, low wages allow business owners to hire more people and generate more growth so that, again, we all win. The only problem with this story, of course, is that it's persistently contradicted by the actual facts about inequality today. In truth, inequality in America tracks more closely with a classic Marxist analysis whereby the owners of capital exploit a surplus of labor to keep wages low and generate high profits for themselves -- depriving workers of a fair share of the value they are creating for companies. Yes, there are smart entreprenuers taking big risks in America, but the more dominant face of the economy is well-established corporations run by professional managers who keep finding new ways to drive labor costs down and profits up. Consider a new study out today by the National Employment Law Project (NELP), which shows that most low-wage workers aren't employed at struggling start-ups or local businesses trying to expand. Instead, says NELP, the majority of such workers are employed by large corporations. And the reason these workers make chump change is not because such corporations are battling to maintain their razor thin profit margins in tough times. Rather, these companies are making plenty of money -- more in many cases then before the recession. According to NELP, of the top 50 low-wage employers in America: 92 percent were profitable last year; 63 percent are earning higher profits now than before the recession; and 73 percent have higher cash holdings now than before the recession.

By and large, these are great times for the nation's top low-wage employers -- which include Wal-Mart, McDonalds, Target, and Wendy's. And great times, too, for the CEOs of these companies, who earn an average of $9.4 million a year. The big losers are the people who are actually creating most of the value of these companies -- i.e., the workers who make the sales, prepare the food, stock the shelves, and so on. Many of these people are paid under $10 an hour, which is not enough to live on -- and certainly not enough to save for retirement on or buy health insurance, which is not offered to most low-wage workers. Even as the shareholders and executives of the top low-wage employers get richer than ever, many of their employees are living in poverty or just above poverty. And make no mistake, the plight of these workers affects all of us, since their shortfalls in income are often made up by government programs like the EITC, food stamps, and SCHIP. It's no exaggeration to say that the business model of America's low-wage employers depends on a generous government safety net, since without that net many of their workers would not be able to survive. So all of us are subsidizing the wealthy owners and executives of Wal-Mart, McDonalds, and Target. Alas, few of us seem to realize this. All of us are hurt, too, by the way that the low-wage model drags down economic growth. If you give a low-wage worker higher wages, they immediately pump that money back into the economy through more spending. But if you give a CEO another few million dollars in compensation, he'll most likely just plow that money into his stock portfolio or other savings vehicles, which doesn't do much for the economy since capital is cheap right now and customers are scarce. If we want an economy with robust consumer demand, workers need to a bigger slice of the pie. Business leaders once understood that elementary fact. Groups like NELP are right to spotlight the gross exploitation of American workers and the grinding hardship this produces in millions of households. But we should never forget about the other high costs of inequality. |

|

David Callahan

July 19, 2012 |

| The text being discussed is available at http://www.policyshop.net/home/2012/7/19/high-profits-low-wages-and-the-growth-of-inequality.html |