OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Finance |

|

Burgess COMMENTARY I learned some economics 50 years ago when Keynes was still central to much of the teaching, and I still think about the dynamics of the economy in the same manner I was taught long ago. Now I have the benefit of several decades of experience both in corporate management and in international development. Peter Burgess |

|

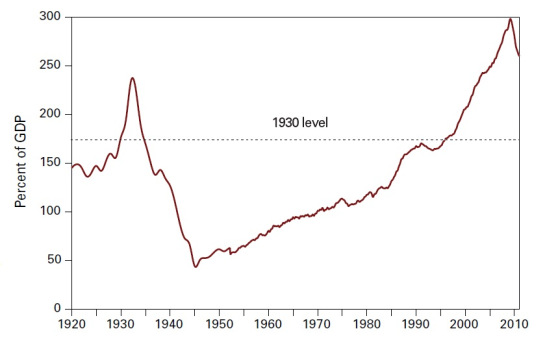

Austerity (for Dummies) The recent article by Antoine Cerisier and Marc Morgan offered a sobering economic and historical perspective on austerity to counter the zealous fervour for such ‘financial bloodletting’ that has dominated public discourse for the past few years. Their debunking of the false analogy between economies and households – a favoured rhetorical set piece of figures like Ben Bernanke, Angela Merkel and George Osborne – is one of the clearest I’ve yet to see. IMAGE “America needs to get its fiscal house in order” In response to the hysteria over the evils of government deficits, however, we could perhaps adopt an even more simplistic critique. We can begin by pointing out that a government deficit is necessarily exactly equal to the private sector’s surplus, or net savings. This means that the opposite is also true; a government surplus drains resources from the private sector (households, firms) and hence forces it into debt. Yet this is exactly what austerians the world over are calling for through increased taxes (on labour) and reduced government spending. The trade-off between the two sectors is pretty obvious when you see it. To start with, all you need is the standard macroeconomic national accounting identity, found in any undergraduate textbook: (S – I) = (G – T) + (X – M) where S = saving, I = investment, G = government spending, T = taxation, X = exports and M = imports. This identity is true by definition. From left to right, the terms represent the private sector, the government sector and the foreign sector, respectively. For simplicity, we will assume either a closed economy or balanced international trade, meaning that we can omit the last term: (S – I) = (G – T) From the above we can see if the government runs a surplus, (G – T) < 0, (S – I) will be less than 0 by an exactly equal amount. If (S – I) < 0, the private sector is investing more than it is saving and, to finance this deficit, will either be forced to go into debt, to cut investment, or both. Of course, cutting investment means that output will be reduced, leading to unemployment and most likely a recession or depression. Taking the debt option only postpones the inevitable, as at some point the debts, which grow exponentially by ‘the magic of compound interest’, will either have to be paid off – meaning reduced investment, increased unemployment and recession/depression – or written off. Suddenly austerity doesn’t seem like such a good idea. Indeed, the folly of such a policy is evidenced by the fact that six of the seven recorded U.S. government budget surpluses were followed by a depression. The sixth of these was recorded, notably, in 1929. The seventh, for which Bill Clinton was lauded, precipitated the enormous increase in private sector indebtedness (households, firms, financial institutions themselves) to the financial sector that led to the recent crash and the Great Recession of 2008-present. While surpluses might be problematic, we can also see, through reference to our accounting identity above, that if both sectors were simply balanced, there could be no means of increasing investment and hence output, because S would equal I. In other words, governments have to run deficits in order for an economy to grow: to finance increased investment in the private sector, leading to increased saving, which leads to an even greater level of investment, and so on. We have thus far assumed the absence of international trade and the possibility of running a current account surplus (exports > imports), which could provide another source of investible resources to facilitate growth. But as one country’s surplus is necessarily another’s deficit (Germany’s export surplus is the deficit of Greece, Spain, etc.), it is impossible for every country to run such a surplus. In general then, government deficits are intrinsic to economic growth. This is where the idea of ‘financial bloodletting’ comes in. For if the problem is over indebtedness, measured by one’s debt-GDP ratio, austerian spending cuts and tax increases that reduce output will only compound the problem, offering much pain and no gain. The only way out of this situation besides default is for the economy to grow its way out of debt through government spending, temporarily increasing public debt but stimulating private sector investment and hence growth. Growing GDP and tax receipts then mean that the debt side of the debt-GDP ratio becomes increasingly insignificant (Adam Smith famously quipped that no government has ever really paid off its debts.) Furthermore, while large public debt is undoubtedly a problem, it is elevated private sector indebtedness that is truly disastrous, invariably leading to reduced consumption and investment, increased unemployment and ultimately depression. As economist Steve Keen points out, the crashes of 1929 and 2008 were both preceded by unprecedented levels of private sector debt relative to GDP. U.S. private debt as a percentage of GDP, 1920-2010. Source: Steve Keen (2011) Debunking Economics

So the big question is: did the austerians skip their first year economics classes, or, calling for private sector indebtedness and reduced investment, are they just anti-capitalist? |

|

By Joshua Mellors

|

| The text being discussed is available at http://socialjusticefirst.com/2012/07/16/austerity-for-dummies/#comment-5731 |