OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

Energy Market |

|

Burgess COMMENTARY |

|

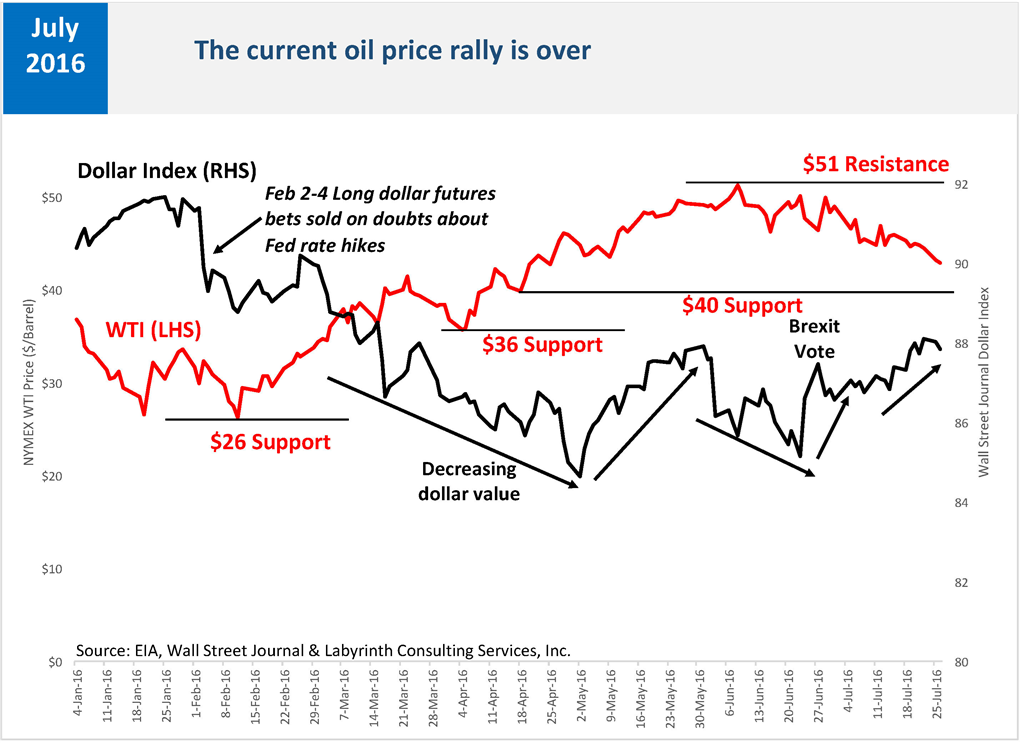

The Price Rally Is Over: Capital Drives the Oil Market to Low Prices The current oil-price rally is over. U.S. rig counts have surged as oil prices sink. Capital is driving the oil markets and it enables bad behavior by producers. That is why oil prices will stay low. The oil-price rally that began in February is over. Prices rose from $26 per barrel to $51 by early June and are now below $42 (Figure 1). If they fall through $40, the next likely support level is at $36 per barrel. Source: EIA, Wall Street Journal and Labyrinth Consulting Services, Inc. The Price Rally Is Over: Capital Drives the Oil Market to Low Prices 1 of 9

The Price Rally Is Over: Capital Drives the Oil Market to Low Prices The current oil-price rally is over. U.S. rig counts have surged as oil prices sink. Capital is driving the oil markets and it enables bad behavior by producers. That is why oil prices will stay low. The oil-price rally that began in February is over. Prices rose from $26 per barrel to $51 by early June and are now below $42 (Figure 1). If they fall through $40, the next likely support level is at $36 per barrel. Source: EIA, Wall Street Journal and Labyrinth Consulting Services, Inc.

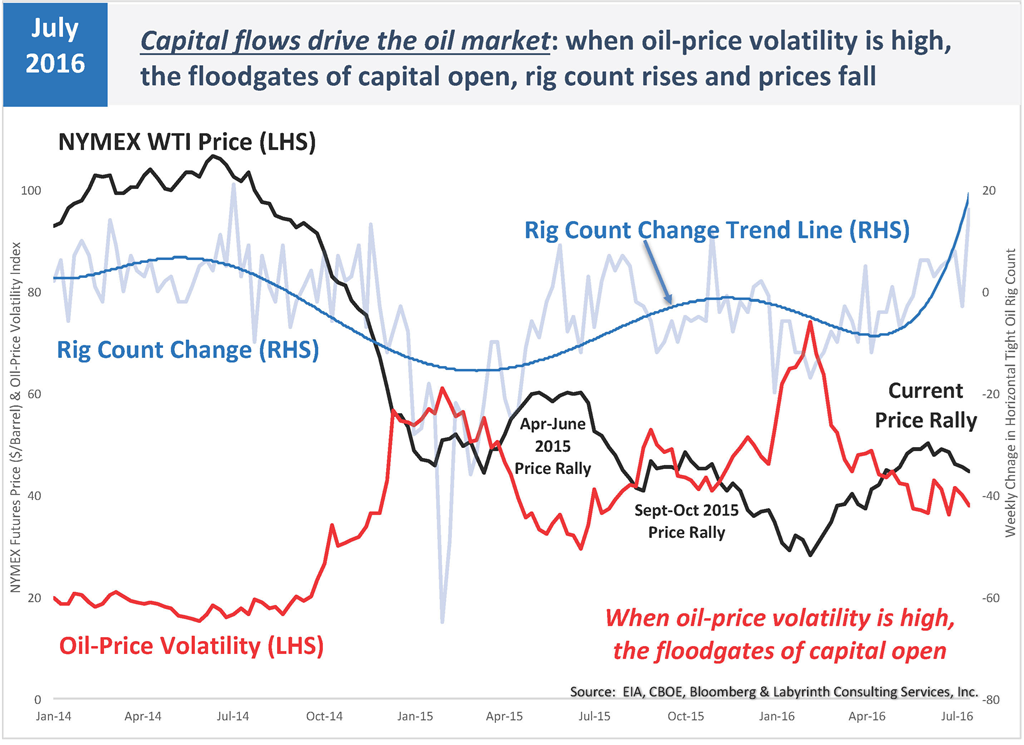

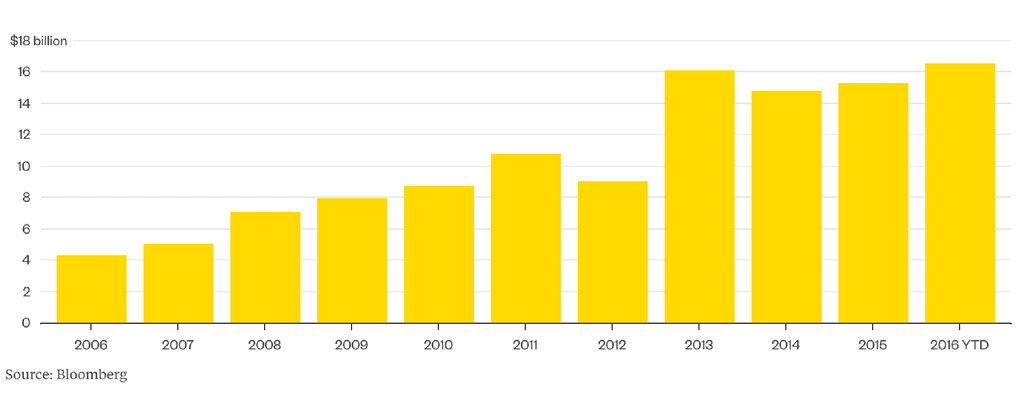

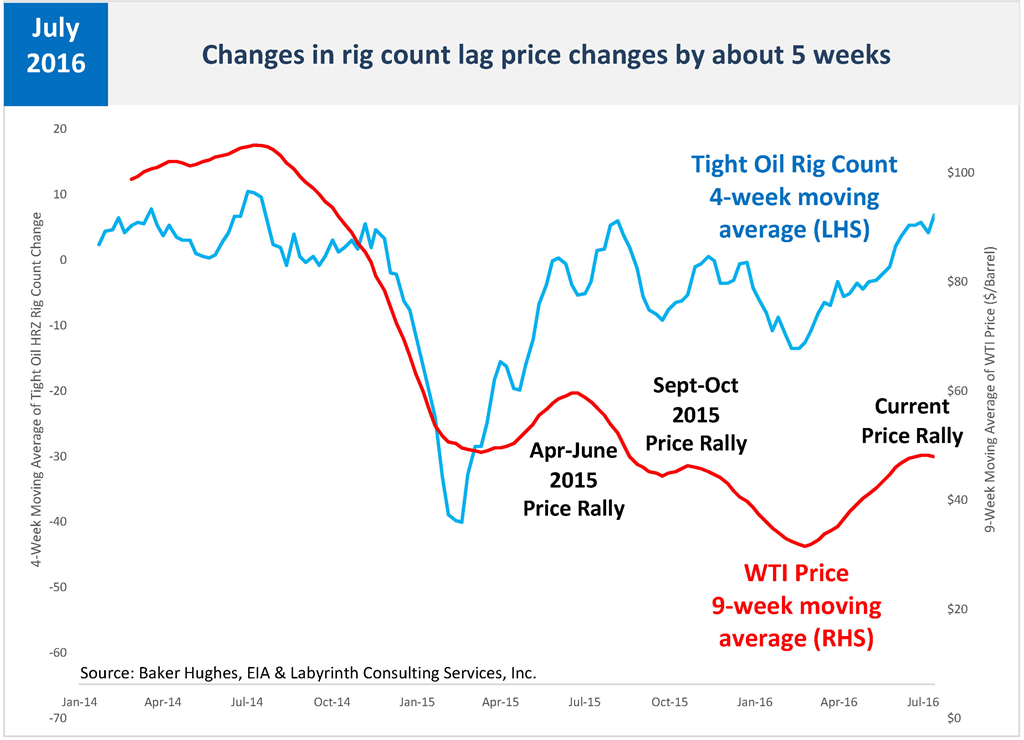

CAPITAL DRIVES THE OIL MARKET AND PRICES Most people think that fundamentals -- supply and demand -- drive the oil market, but capital drives the market and oil prices. More than anything, rig count reflects capital flow. Many believe that price drives rig count but it is really capital flow that drives rig count and production and that affects oil prices. When prices fall and oil-price volatility increases, the floodgates of capital open. Every genius-investor wants to buy low and sell high. Rig count rises with fresh capital, production increases and oil prices fall (Figure 2). The weekly change in tight oil horizontal rig count is the leading indicator of capital expenditures. Price trends roughly follow the inverse path. U.S. E&P companies have sold more stock so far this year than in the whole of the record year of 2013, when oil averaged almost $100 a barrel. Source: Bloomberg.

U.S. E&P companies have sold more stock so far this year than in the whole of the record year of 2013, when oil averaged almost $100 a barrel. Source: Bloomberg. When oil prices were around $100 per barrel in mid-2014, oil-price volatility was low. When prices fell below $90 per barrel in October 2014, oil-price volatility began to increase. When prices bottomed below $46 in January 2015, volatility peaked. Correctly believing that a price floor had been reached, investors poured capital into the markets and oil companies were flush with money to start drilling again. Prices rose to $60 per barrel by May 2015. As drilling proceeded, oil-prices began to fall as market confidence in a price recovery faded. In July 2015, prices began to fall. As they fell to near $40 per barrel by late August, price volatility increased again. Investors saw another price floor and opened their wallets. Prices rose 18% to more than $48 by early October but by then, confidence in a price recovery again faded with increased drilling and global economic concerns about Chinese growth and oil demand. Oil prices fell below $30 in late January 2016 and by mid-February, oil-price volatility reached its highest level since the Financial Collapse in November 2008. Once again, investors saw a price floor and the floodgates of capital opened. Pioneer and Diamondback raised almost $1.5 billion in share offerings in January 2016, probably the darkest time for oil markets since 1998. In the first half of 2016, more capital has flowed to E&P companies than during 2013, the previous record year when oil prices were more than $100 per barrel and the tight oil boom was in full bloom (Figure 3).

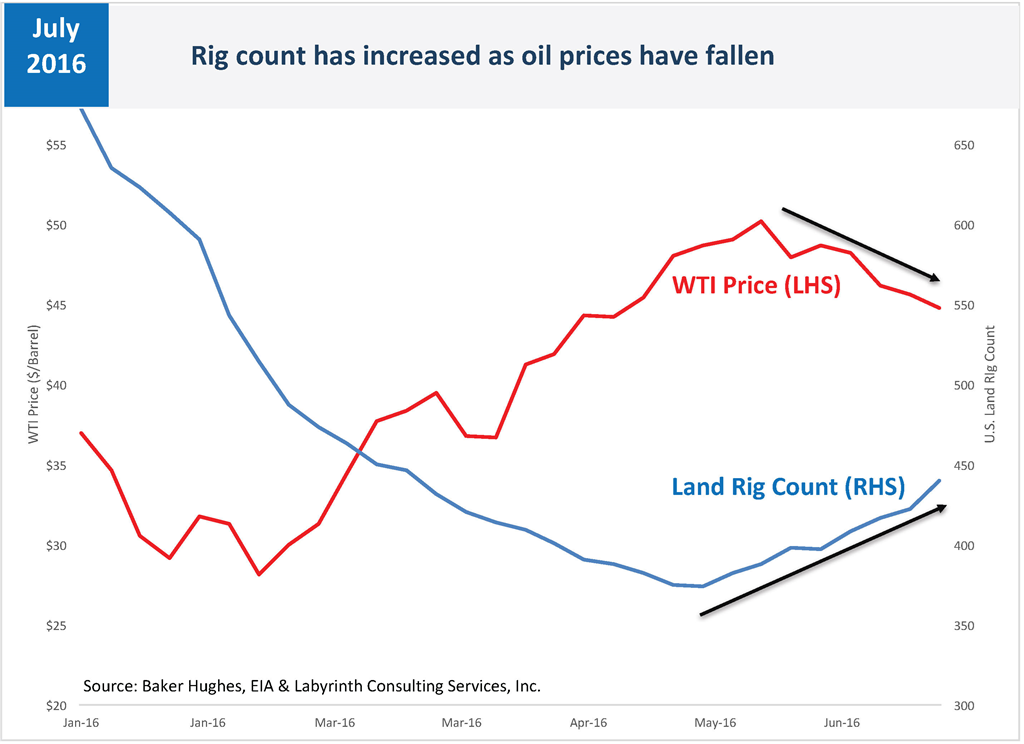

RIG COUNT SURGES AND OIL PRICES FALL During the current price rally, prices increased from $26 in mid-February to more than $51 per barrel by early June. Meanwhile, the rig count change rate has exploded (Figure 2). Predictably, oil prices have fallen below $42 per barrel as hopes for a price recovery fade once again. This repeating process qualifies under the standard definition of insanity namely, continuing to do the same thing that got you in trouble before. 66 land rigs and 47 tight oil horizontal rigs have been added since early June (Figures 4 and 5). Last week, prices were crashing but 18 rigs were added, the biggest increase in almost 2 years.

Those added rigs, however, resulted from decisions and a process that began weeks or even months ago. After a company decides to add a rig, negotiations follow. More time passes between signing a contract and a rig showing up on location. Empirically, there is about a 5-week lag between changes in price trends and a response in rig count (Figure 5).

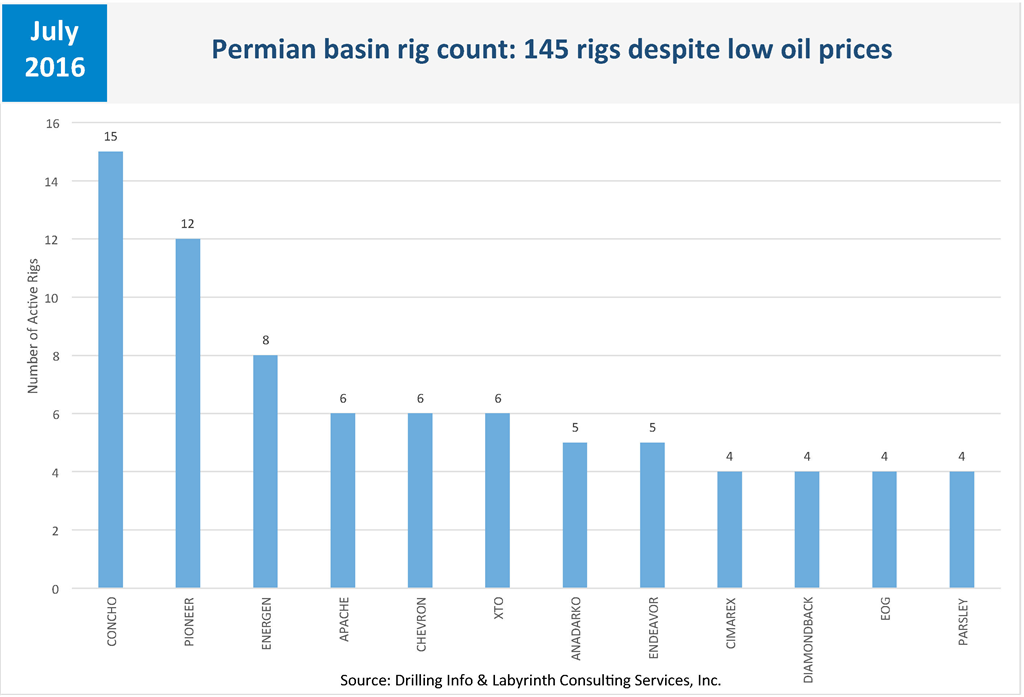

WHO ARE THOSE GUYS? Which companies are adding rigs and do their financial results support more drilling at these oil prices? About 60% of rigs added in the tight oil plays during the last few months are in the Permian basin where there are currently 145 rigs operating (Figure 6). The rest of the new drilling is fairly evenly spread among the Bakken, Eagle Ford, Niobrara, Mississippi Lime and Granite Wash plays.

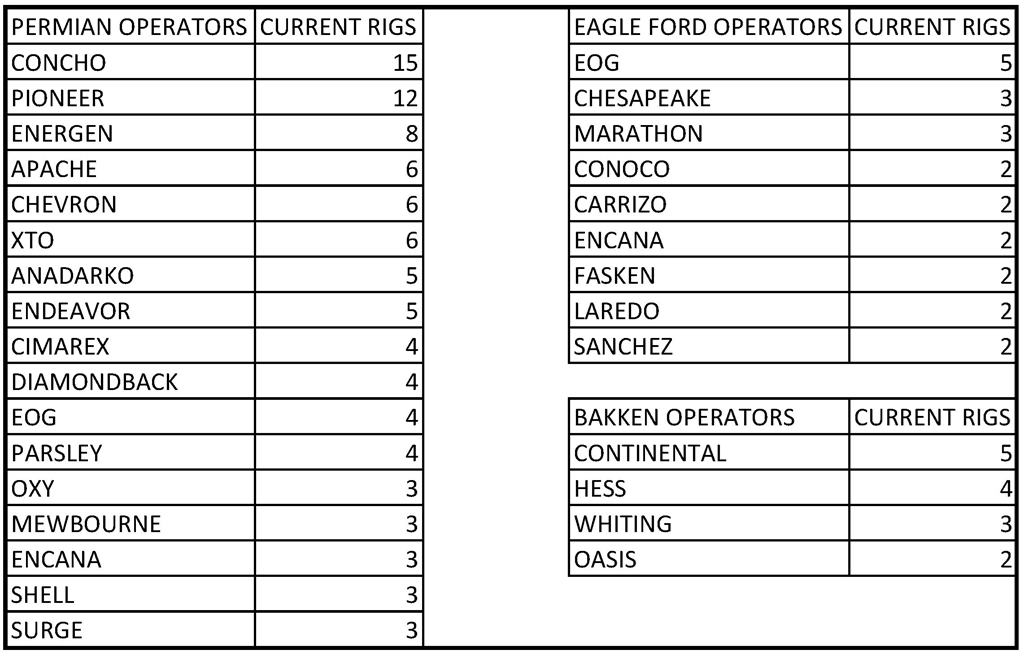

The most active operators in the 3 most-productive plays -- the Permian, Bakken and Eagle Ford -- are shown in the table above.

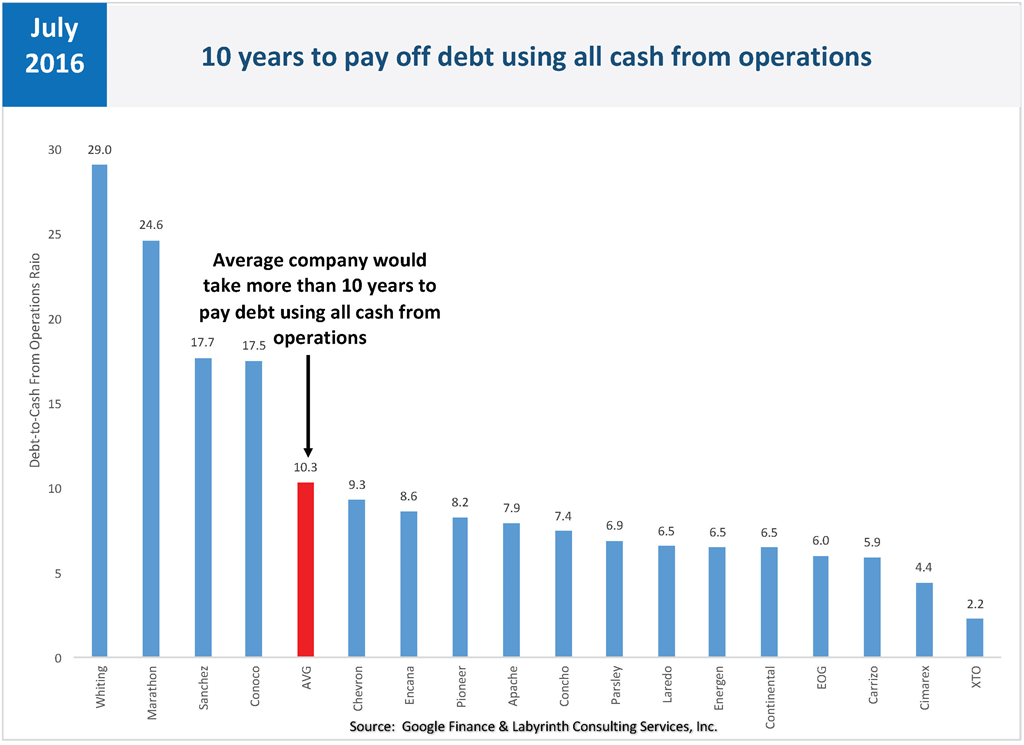

In the Permian basin, Concho Oil & Gas currently operates 15 rigs, Pioneer Natural Resources operates 12 rigs, and Energen operates 8. Apache, Chevron and XTO each operate 6 rigs, and Anadarko and Endeavor each operate 5. Cimarex, Diamondback, EOG and Parsley all operate 4 rigs. The most active operator in the Eagle Ford play is EOG with 5 rigs. EOG is followed by Chesapeake and Marathon each with 3 rigs. In the Bakken, Continental Resources is the leading operator with 5 rigs. Hess operates 4 rigs, Whiting operates 3 and Oasis, 2 rigs. So how are these operators doing financially? Terribly, despite preposterous stories of technology gains, costs approaching zero, and single-well EURs of 1 million barrels of oil equivalent. Figure 7 shows the main rig operators in the Permian, Bakken and Eagle Ford plays. These companies spent an average of 4 times as much as they earned in the first quarter of 2016. And it’s been going on for years. Imagine doing that yourself. Among Permian operators, Parsley spent more than 10 times cash flow and Energen, more than 6. Pioneer and Chevron spent 5 times more than they earned. Anadarko had negative cash from operations meaning that it didn’t even earn enough to pay for well operations.

EOG leads the drilling in the Eagle Ford play and only spends twice what it earns–among the best of a bad lot. Marathon, on the other hand, outspends earnings by more than 6-to-1 and ConocoPhillips is not much better at more than 4-to-1. Like Anadarko, Chesapeake has negative cash from operations and, therefore, does not appear in Figure 4. In the Bakken play, Hess cannot even pay for well operations from its cash flow yet operates 5 rigs. Continental Resources leads Bakken drilling and has a respectable capex-to-cash flow ratio only spending $1.30 for every dollar it earns. Whiting outspends cash flow by almost 6-to-1 and Oasis has negative cash from operations. The debt picture is equally grim. It would take top tight oil rig operators an average of 10 years to pay off debt if all cash earned from oil and gas sales were exclusively for that purpose based on first quarter 2016 financial data–in other words, no drilling, no salaries, no nothing except debt payments (Figure 8). That’s way above standard tolerance for this critical measure of bank risk which is now about 4:1 but before 2012, it was closer to 2:1. In the Permian basin, most operators have a debt-to-cash flow ratio of about 6:1 or 7:1. Chevron and Pioneer are much higher at 9.3:1 and 8.2:1, respectively. It would take Apache 8 years to pay off its debt and 7.4 years for Concho. Cimarex is somewhat lower at 4.4 years and not surprisingly XTO (ExxonMobil) is at 2.2 years. In the Eagle Ford play, EOG has more debt than it could pay off in 6 years and Marathon has a stunning debt-to-cash flow ratio of almost 25! Conoco is not far behind at almost 18-to-one. In the Bakken play, Continental would need 6 years to pay off its debt but Whiting leads all major tight oil players with a debt-to-cash flow ratio of 29-to-1! Meanwhile, these companies tell investors tall tales of fantastic rates of return even at low oil prices that clearly do not pass even a superficial fact check using Google Finance or Yahoo Finance. Why would any rational investor give money to most of these companies? Comments (36) Mike Shellman · 1d ago · Reply · Like · 13 Mr. Berman, I have now had the privilege of reading your most recent article. I recommend everyone read it as well. Thank you. Your opinions, and those of Rune Likvern's, regarding debt, ailing world economies and future demand for hydrocarbons should make the entire oil industry sit up and take notice. This down cycle I do not believe is going to end up like other cycles, in spite of all the best cure for low oil prices is low oil prices rhetoric. Past performance is not indicative of future results; not this time. Yesterday my 2Q 2016 tally for losses from four large, public shale oil companies was 1.5 billion; today I am up over 3 billion and Conoco, one of the top 10 shale oil well manufacturers in the country, comes in at #1 on the hit parade with 1.1 billion dollars of losses. I don't know how anybody can lose over 1 billion dollars in 90 days but hey, I am just a little 'ol country boy stripper well operator and you will excuse me if I never want to learn how, thank you. Next week we're going to get some really big loss numbers from the shale oil industry. Nevertheless, as you point out, all these shale dudes, borrowing more money they will never be able to pay back, are still out there grinding away drilling wells that will never pay out. I am totally stumped at the rationale for all this lunacy. I'd ask you to help explain it to me but I am not sure you could. Thanks again for fighting the fight. Arthur Berman · 14h ago · Reply · Like Thanks Mike. I always enjoy and appreciate your perspective on things! All the best, Art Jerry Carneiro · 3h ago · Reply · Like Mike, Couldn't have agreed more. When working in the west Texas oilfields, its was a sight to see the rabbits that were being chased by coyotes running around looking for a hole to hide, they would find the nearest hole and dive in, and if the coyote gets at their tail, they would dig more and more in panic just to avoid getting gobbled up!. some were smart enough to dig their way out back...but some would be found by our backhoe digging trenches for a flare pit all dead and rotten about 3 or 4 ft under the ground making us wonder how they got there in the first place!.....This debt fueled adventures in shale are are frighteningly beginning to resemble these Rabbit-Coyote stories... I am beginning to understand the writing on the wall, and have been constantly pointing out the signs of these debt storm to my peers , some don't share my view and have the audacity to label me 'Un-optimistic'. I am thankful for Arthur Berman who for has clearly laid out the data behind his analysis (http://oilpro.com/post/25952/oil-prices-lower-forever-hard-times-in-a-failing-global-economy) in simplest terms possible, describing the current state of the Oil industry for all to perceive whats coming and to ponder on possible solutions. Keep up the good work Art, Some of us depend on it to steer our ship in this sea of uncertainty..! Arthur Berman · 2h ago · Reply · Like @JerryCarneiro: Jerry, Thanks for your comments and endorsement. If you haven't read my full post from which the figure on Oilpro is taken, you can find it on my website: http://www.artberman.com/the-price-rally-is-over-capital-drives-the-oil-market-to-low-prices/ I love your anecdote about the dead rabbits in West Texas! I don't wish that fate on the shale players but there are similarities! As I commented below to Rudolf, I see resistance at $52 and support at $38 per barrel, for what it's worth. Those aren't predictions--they are based on empirical data. That doesn't mean that prices will stay in that range, only that is a probabilistic, most-likely range based on past behavior. All the best, Art Arthur Berman · 2d ago · Reply · Like · 9 Ian, Thanks for your comments. I posted the following reply to a question that I got on Forbes about demand: Demand and storage are intimately related. Storage is part of supply so when we have such an excess of storage, it indicates the massive imbalance between supply and demand underscoring that much of the problem with oil price is producer behavior–they lack the discipline to modulate production to meet demand. They lack discipline because they need cash flow to service debt and need to maintain production growth to keep their stock price up. The other point that no one talks about is, Demand at what price? Looking closely at demand/consumption growth and price, it is clear that growth slowed after the big 2010 bump following the Financial Collapse through 2013 as oil price increased. Consumption growth increased in 2014 and 2015 in response to lower oil prices but looks flat for 2016 (compared to 2015) even with much lower prices so far. That all suggests that demand/consumption is very sensitive to oil price and that 2016 isn’t looking very good probably because the global economy is weak. Since population continues to grow, per capita growth looks even worse. My advice, therefore, is not to become too comfortable with demand growth as a way of believing that things are really fine after all. All the best, Art Joe Solari · 21h ago · Reply · Like I concur with Art's view and include a link to supply and inventory data that validates there is now basis for price increases in the supply demand equation http://cuxllc.com/?p=177. Demand is very stable and driven by what can be processed and consumed. Macro consumption is on pace to meet most of the world's projections for growth and there is now big plans for increased refining. What is the Elephant in the Tank is the growing inventories. Even with the production drops inventories have been building and built through the price increases this summer. As this reality sinks in look for prices to challenge last year's lows. At leas that is my opinion. James Drouin · 2d ago · Reply · Like · 5 'The current oil-price rally is over.' Possibly, but the price of oil is always in flux. 'U.S. rig counts have surged as oil prices sink. Capital is driving the oil markets and it enables bad behavior by producers. That is why oil prices will stay low.' No, US rig counts have NOT 'surged' ... they've increased marginally for 3 weeks or so and it's anyone's bet as to whether they will continue to increase. It IS possible that the 'low cost' of capital is driving the 'oil market', whatever that might be, and enabling 'bad behavior', but that is NOT why 'oil prices will stay low'. Oil prices are set by traders on the Nymex exchange, not some of the time, but all of the time. When their greed overcomes their fear (or vice versa dependent on one's point of view), THAT'S when oil prices will climb. Arthur Berman · 2d ago · Reply · Like · 4 James, You don't have the benefit of seeing the whole post: http://www.forbes.com/sites/arthurberman/2016/07/27/the-price-rally-is-over-capital-drives-the-oil-market-to-low-prices/#30430c2f236b. In Figure 2 (http://www.artberman.com/wp-content/uploads/Capital-flows-drive-the-oil-market.jpg), I show weekly rig count change for horizontal tight oil and it has exploded since June. I agree that oil traders have a powerful influence on oil prices and they look closely at rig count, storage and production so I think my observations are both sound and in agreement with yours. All the best, Art Kurt Anderson · 1d ago · Reply · Like · 4 Many indicators point to sustained low oil prices, not the least of which is the strength of the dollar. The elephant in the room is a supply glut. Demand has not surfaced, though no one really expected it to considering low single digit economic growth. Operators jumped the gun and added a few rigs, but I fear we will be in for another long winter. Anadarko's chief thinks we will see $60 oil in 2017, but the data clearly show otherwise. Although all economic curves can be discontinuous, I look for that long term trend for planning purposes. There is plenty to derail the trajectories of current data, but a long position shouldn't be betting on higher oil prices. How long then? Maybe a revisit after the US elections. Ian Austin · 2d ago · Reply · Like · 3 Arthur, Good post. I hope you're wrong (god knows if you're right or not. If I had that gift of foresight I wouldn't be working in the oilfield.....) Do you have any comments or the Demand side of things? I'm noticing that whoever it is that gives these predictions is way off - refining runs have increased, but only seem to have served the purpose of taking a little from crude inventories and put them in gasoline inventories. Frighteningly, this is in the 'peak driving' season. Its scary to think about what can happen to inventory once we get past the en of August Eugene Micewicz · 1d ago · Reply · Like · 2 Gentlemen, as noted above many elements drive the oil price that are variable. However some consistents for the mid term are Iran will increase production unless there is a geopoltical event thatt has a dramatic effect. This is in addition to other middle eastern countries that are cash strapped coming back on line. Their is a good reason why saudi Arabia is focussing on other sources of sustainable income. Is the oil industry in the doghouse ?? NO., effeciency is the key. energy diversity for the companies that have the available capital to diversify and grow. There is no immeadiate solution but one that will be born of evolution and development. Oil will still be needed for the forseeable future.as each company and country pursues its own interests the weaker will leave the market and the stronger will stay. venture - speculative capitalism will disappear and the real oil focussed and dedicated companies will be the ones that will remain. This will result in some stability to the market. ( until the next boom. ) I believe that copanies have learned the lesson about over extension based on fluctuating factors and have become more sober. Charles Minshew · 22h ago · Reply · Like EM, I appreciate your thought--the financial leaders don't learn; they re-finance. Oil will be needed both today & in the future--ONLY those directly affected by low prices (or high prices) learn. Arthur Berman · 15h ago · Reply · Like Eugene, I wish that I shared your belief that companies have learned the lesson of over-extension. That requires a change in the human psyche that goes beyond the reptile brain that rules most human behavior. I don't think we are there yet but would love to see it when it happens! All the best, Art Kirby Mohr · 22h ago · Reply · Like · 1 I wish there was a way to get away from the traders and other middlemen. They produce nothing and make a lot of money screwing other people who do. it's the same with farm prices, metals and lots of other commodities. An odd but telling example: if you go to the Navajo rug auction run by the weavers in New Mexico, prices are about 1/3 of what the tourist stores charge. Can there be some way to let the people sweating in the Permian Basin and freezing on the North Slope and North Sea make the money not the traders in New York? Arthur Berman · 15h ago · Reply · Like · 1 Kirby, Let me know if you figure out how! Art James Drouin · 13h ago · Reply · Like Kirby - If you own your own refinery, you can buy from the NOCs to your heart's content at whatever price y'all can agree on. Of course, as a refiner, unless you own a rather large string of retail stations near your refinery that can absorb the entire output, you've just become a 'middleman'. James Hardey · 16h ago · Reply · Like · 1 I have a slightly different take on the current market conditions. We have somehow been conditioned to accept a 10 yr. Treasury yielding one per cent and $13 trillion in sovereign debt sporting negative yields as normal. By any historical measure this is an insane situation that is predictably producing what would appear to be irrational business decisions. It is indicative of a world economy on life support. One of the biggest stripper producers in my area is now backed by a major insurance company that is pouring money into projects that have virtually no chance of ever producing a positive return. Sound familiar! They have been paying as much as $180,000 for a produceable barrel of oil, most of the wells being more than fifty years old. They make the shale producers look conservative. I think the desperate search for yield by institutions that have historically relied on reasonable and stable bond yields is the cause of the distortions we are witnessing. I can't help but think if we had anything near normal credit markets the last ten years we wouldn't be in this mess. Arthur Berman · 15h ago · Reply · Like James, If you read the post and not just look at the first figure, I think you will see that you don't have an even slightly different take than I do: http://www.artberman.com/the-price-rally-is-over-capital-drives-the-oil-market-to-low-prices/ All the best, Art Mike Pavelka · 23h ago · Reply · Like Company losses include depreciation which isn't a current quarter expenditure but is a tax write off. So not all the losses are out of pocket expenses. The '86 rally was not in oil but in gas and by '89 there was a shortage with Pipeline pressure dropping and Pipeline companies calling producers during the winter with ice and snow on the ground asking them to send people out to unfreeze wells. To get the gas flowing into the system again. Arthur Berman · 15h ago · Reply · Like Mike, True enough, and also depletion and amortization but I get lost in the complexity of accounting. Variable operating costs including overhead and interest expenses, along with capital expenditures and a reserve forecast provide a useful approximation of whether a project is commercial or not in my view. Then, we can add in the other complications that either add or subtract from the conclusion that results. Thanks for your comment, Art Davy Crockett · 22h ago · Reply · Like And 1.2% GDP for Q2 does not help either. Nor does the gasoline build overhang, while the summer driving season slip slides away. Now, about all those oil tankers lined up in Singapore as far as the eye can see..... Douglas Dyer · 20h ago · Reply · Like With an effective test of $40 this week, representing significant support, oil should experience a technical bounce, with $45 as the likely near-term target. If that plays out, oil will reverse, retest $40 and then target the Fibonacci at $34. The entire move since March has been a technical bounce, albeit with some seasonal, summer driving demand providing support. I had expected that move to involve a test of $55 and possibly $60. $52/b was the best it could do. But for a near-term technical bounce, oil will again plumb the depths. Arthur Berman · 15h ago · Reply · Like · 1 Douglas, You seem to be saying that prices may be anywhere between $34 and $60. How could anyone possibly disagree with that? I don't know how Fibonacci sequences apply to oil prices. Mathematics is an extension of the intellect that is fascinating and wonderfully elegant. The oil market--and probably all markets-- are expressions of human behavior. Abstractions of this dynamic system are, of course, useful up to some limit. I rely on data to describe the current state of things knowing that this too is ultimately a form of abstraction. Understanding the present (and the past) incorporates human behavior--and for oil markets, that key subset of producer behavior--into that dynamic system. I find analogues to be the most useful way of describing probable future states but that's just me. Thanks for your interesting comments, Art Joe Schindler · 19h ago · Reply · Like Art: Like you; and as a consultant; I’ve seen my business good when prices are high, and when prices are low. I’ve got enough historic data to show that when we’re in the doldrums; it’s hard for people to make up their minds about moving forward with any kind of project. I’ve just always felt better about billing clients when prices were on the high side. I’ve enjoyed the atmosphere of being around people when projects were successful and profitable. I’ve also never felt good about trying to cover for a group that I know was laid off or as a bankruptcy court receiver. Joe Arthur Berman · 15h ago · Reply · Like Joe, Amen. My experience is that when prices are high, costs are high. People think they are making money but they are not. The only money that is ever really made in the oil business is by those with the foresight to be prepared to drill at the moment prices turn around. Art Leomar Lima · 18h ago · Reply · Like I am with James Drouin nevertheless respecting the others statements. It is all about demand production and lack of control. We don't need complicated graphics macro and micro analysis and hard mathematics to understand that the demand ruled since developing the oil & gas industry discovering new technologies and developing stake holders assets to over limits forgetting the entire world development and economy. Demand follows the world needs and is quite stable with very tiny growth oscillations because the sickness in the world economy and the growth of the humanity. Human beam always works without limits, without plan, we hear frequently let's increase this let's increase that, companies big profits reports showing nice numbers, industries in all areas congratulating themselves for the targets accomplished all without limits without a plan and risk assessment. What's happen now the world don't need oil that much, operators pass over the world limitations in oil & gas production and now need to stop, close the valves and wait, crude oil spoils and loses the chemical characteristics in long time storage consequences: bargain, companies are closing their doors, billions are lost, millions jobless including myself, the future perspective? no way to say good words let's pray to find a effective solution for this situation which is getting worst every day. I really read out all comments here and enjoyed it seems something is already reflecting in people way to think. Big hug to all of you. Thanks! Arthur Berman · 15h ago · Reply · Like Leomar, Supply and demand are flows that are used to explain about what is incorrectly assumed to be an equilibrium system. The fact that the market is never in balance (http://www.artberman.com/returning-to-market-balance-how-high-must-prices-be-to-save-the-oil-industry/) should convince rational observers that oil markets--and probably all markets--represent disequilibrium systems that largely defy prediction. Add central bank credit schemes and resulting capital flows into the picture, and prediction becomes a fool's errand. That does not mean that the disequilibrium cannot be described and understood. That is why comparative inventories--that almost no one pays attention to--are critical. The primary factor in oil market dynamics is producer behavior. Producers routinely undershoot or overshoot market price signals (that indirectly reflect demand among other things). That is the subject of my post whose first figure has generated all of this discussion on Oilpro. It is not even the key figure in that post. That figure is: http://www.artberman.com/wp-content/uploads/Capital-flows-drive-the-oil-market.jpg What you describe as a remedy--using discipline to limit supply--is not part of producer behavior. That is the point of my post. The remedy will not come until the capital/credit goes away. All the best, Art James Hardey · 15h ago · Reply · Like My ancient I-Pad wouldn't download your other post. If I had seen it I would have deferred. Sorry! Jim Capt. David Williams · 13h ago · Reply · Like Art, do you believe that folks like yourself can talk the price of oil up or down? Oil seems to trade in a pattern that reminds me of big rolling waves coming ashore from a distant storm. I also see the same pattern of rolling waves coming from so-called oil price experts. And everyone seems to have their own take on the cause of these rolling waves. In my view, too many expert opinions cause all the volatility. I also believe there is a lot of manipulation in oil and gas markets. Investing in oil and gas today is like rolling dice on a crap table. Arthur Berman · 5h ago · Reply · Like David, No, I don't believe that people like me affect the price of oil. Oil traders are the primary drivers of oil price and I am confident that they could care less about what I say and, frankly, I doubt that they even know. Most of the people who comment on the oil and gas industry have never worked a day of their lives in our business. I am a working petroleum geologist and not an analyst. Because my primary business is making maps, evaluating deals, drilling wells and producing oil and gas, I have a somewhat different perspective than most people who comment on the industry. I don't believe that I have ever made a price prediction except to say from time to time that I think or don't think that fundamentals support the current price. In April 2016, I said that I thought the current price rally would end badly because there was too much oil in storage for prices to recover to the $70-$80 range that many analysts believed would happen: http://www.artberman.com/an-oil-price-recovery-were-not-there-yet/ As it turns out, I was right. That is not predicting price but merely pointing out the obvious namely, that oil prices move for many complex and bizarre reasons. I made much the same observation in May 2015 when oil prices were $60 per barrel: http://www.artberman.com/oil-prices-will-fall-a-lesson-in-gravity/ I was right then also but, again, these are not price predictions. They merely represent my perspective based on 38 years working in this industry. All the best, Art Leomar Lima · 11h ago · Reply · Like Arthur don't make sense producers bahavior plays to lose that much and create a total destruction of the industry, back again in what I have said the limitations are not respected they want more and more and the world don't need that much that's the discipline, the solution is to bargain to flow any analysis here will falls and interest on this will be lost, if my engine burns per day 50 liters of diesel I don't need to buy 100, producers are forgetting to see this the world economy, humanity growth and other social aspects in the society play a key role of course. If the point is producers behavior why the entire world accept that? Why companies are closing as I said billions dollars has been lost, millions jobless and nobody says a word? Where is the international economy authorities? Arthur Berman · 4h ago · Reply · Like Leomar, I don't think that you understand how oil company executives get paid. Their compensation is based on growing production and making deals to produce more oil and gas. They are expected to create enough cash flow to keep debt within the covenant limits required by their creditors. If the price of oil drops as it has, the only way to get the needed cash flow is to produce more oil even if you are losing money on every barrel. As long as executives make more money for themselves, they are happy and, quite honestly, they are doing exactly what their boards of directors expect from them. The fact that this behavior is bad for the companies and bad for oil prices and, therefore, the industry is another matter. As an earth scientist, I can confidently tell you that all species expand until their extinction or the extinction of their competitors. Like all life on earth, humans are takers. We take and use until there is a problem. We only change that behavior because it will kill us not to. Only crisis and trauma cause humans to change their behavior. Oil companies--and, indeed, public companies--have no charter to make money. All they need to do is to get money to do their business. Only shareholders can force tell them to do things differently by abandoning their stock. Apparently, shareholders of tight oil and shale gas companies don't care care about or know about the miserable financial performance of the companies they invest in as long as the share price is fine. Karl Marx said the prime characteristic of capitalism is an 'epidemic of over-production.' Joseph Schumpeter later called this behavior 'creative destruction.' Call it what you will, if you don't understand this, you don't understand producer behavior in the oil and gas business. All the best, Art Rudolf Huber · 10h ago · Reply · Like I know how insane I must have looked when I proposed that we are going to see lower than 25 before May 31st, 2017. http://www.lng.guru/see-less-30-usd-oil-part-2/ Arthur Berman · 3h ago · Reply · Like Rudolf, Your logic was sound when you made those predictions a year ago and it remains sound today. Oil prices did get to $26 per barrel in late January and again, in early February, and could get there again for the same reasons. The market is in a dark mood and almost a year ago, oil prices began their descent from $50 to $26 per barrel. I see resistance at $52 and support at $38 per barrel, for what it's worth. Those aren't predictions--they are based on empirical data. That doesn't mean that prices will stay in that range, only that is a probabilistic, most-likely range based on past behavior. All the best, Art Leomar Lima · 1h ago · Reply · Like Arthur, We are here sharing opinions respecting the others as I said before, if you think trying by force to impose your ideas you are completely wrong, reading all your replies you just don't accept absolutely nothing what people is expressing here more over with negative critics with a poor mentality like 'I will teach you', nobody here 100% sure have nothing absolutely nothing to learn from you. Discussions need to have a good sense of agreement to have progress and achievement here you failed. Sorry to tell that but don't try to be the 'man on top' this mentality as you see cause conflicts and nothing from conflicts and brain storm helps to find solution for the problem. Open a discussion, share your opinions and respect the others without judgement because you and me and the others here will not change this overnight. All the best. Arthur Berman · 28m ago · Reply · Like · 1 Leomar, Sorry that you feel that way. I believe that my comments are respectful. Respectful, however, does not require that I agree with you. I do not claim to know the truth better than any of you but let's remember that you are all commenting on my work and research. My replies are based on that and I think that has some weight beyond mere commentary. All the best, Art |

|

|

| The text being discussed is available at http://oilpro.com/gallery/1122/14529/capital-flows-drive-oil-market-source-eia-cboe-bloomberg-and-laby and |