|

Burgess COMMENTARY

The information contained in these graphs should be a wake up call for analysts and policy leadership but seems to be being completely ignored. I am not so much worried by the conventional idea of cost push or demand pull inflation, but something that is completely different ... specifically a total loss of trust in money followed by collapse of the banking and financial system as we have known it for a lot more than 100 years. The system has been broken for several decades and is in need of a serious rethink. Based on amazing modern technology and a world full of nice people better educated than ever before, there should be a better world than ever before ... but yesterday's ideas about socio-enviro-economic management and determination of policy priorities no longer work. I argue that optimizing for financial performance using money as a measure is insane, while optimizing for progress and performance of PEOPLE and PLANET in the most efficient way will change the way the world works in a really big way.

Peter Burgess ... http://truevaluemetrics.org

Peter Burgess

|

|

Central Bank Balance Sheet Assets Hit Record High!

The balance sheet assets of the world’s six major central banks: the Federal Reserve, European Central Bank (ECB), Bank of Japan (BOJ), Swiss National Bank (SNB), Bank of England (BOE), and People’s Bank of China (PBOC) – have just hit a new all-time record high of USD$16.889 trillion, up 238.66% from USD$4.987 trillion in May 2006. The PBOC has the largest balance sheet with total assets of USD$5.497 trillion, followed by the Fed with $4.495 trillion, the BOJ with $2.834 trillion, the ECB with $2.82 trillion, the BOE with $634 billion, and the SNB with $609 billion.

centralbankassetsusd

The SNB has the largest balance sheet as a percentage of GDP, with it currently up to 88.42% of GDP vs. 19.82% of GDP in May 2006. The BOJ’s balance sheet is equal to 70% of GDP vs. 24.27% of GDP in May 2006. The PBOC’s balance sheet is equal to 52.92% of GDP vs. 56.31% of GDP in May 2006. The Fed’s balance sheet is equal to 25.41% of GDP vs. 6.17% of GDP in May 2006. The ECB’s balance sheet is equal to 24.99% of GDP vs. 12.52% of GDP in May 2006. The BOE’s balance sheet is equal to 22.38% of GDP vs. 6.37% of GDP in May 2006.

centralbankassetsgdp

The total assets of the world’s six major central banks is equal to 35.98% of their combined GDP, a new all-time record high vs. only 14.29% of their combined GDP in May 2006, and well above the nine year median of 26.08%!

totalcentralbankassetsgdp

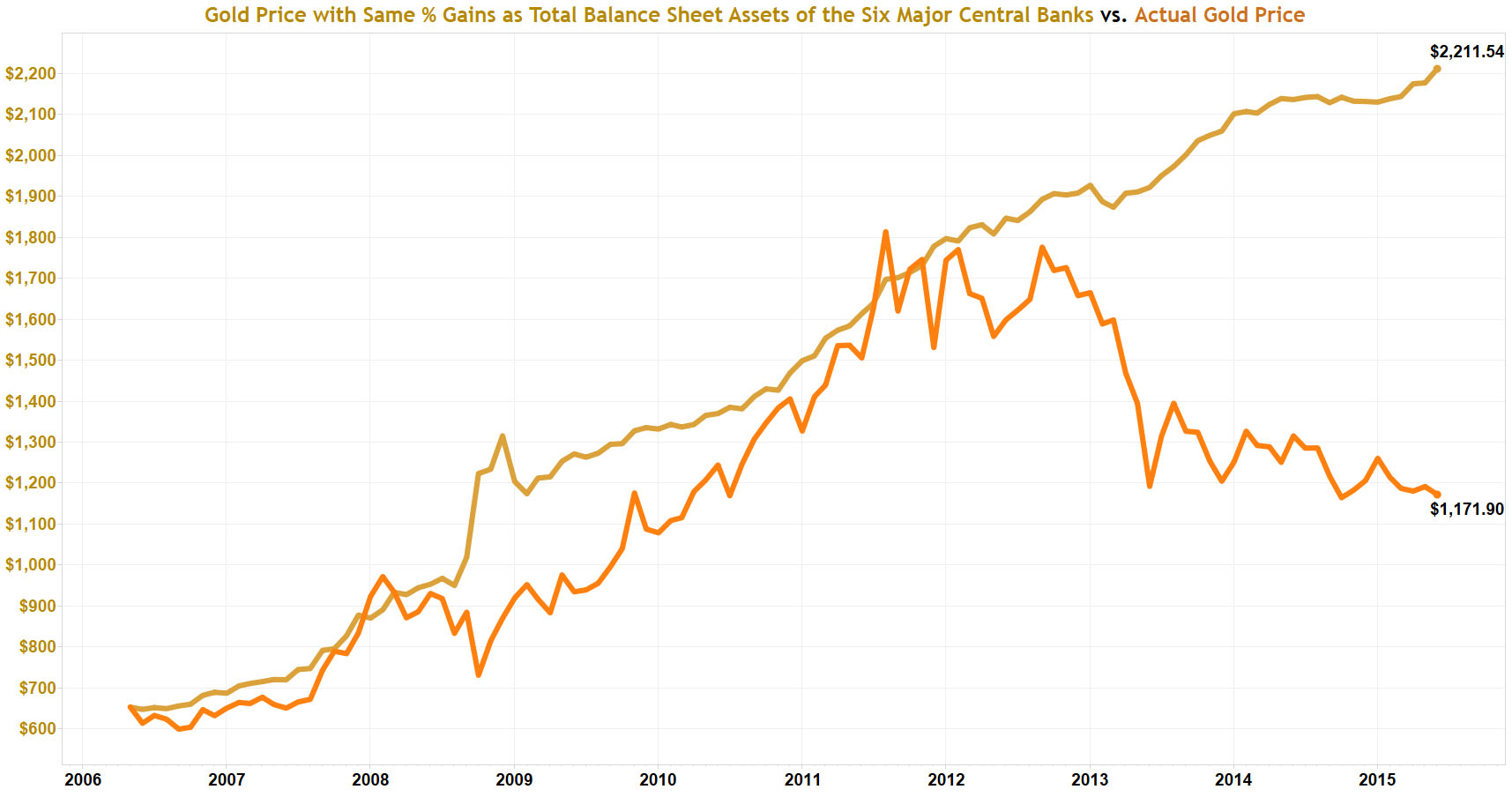

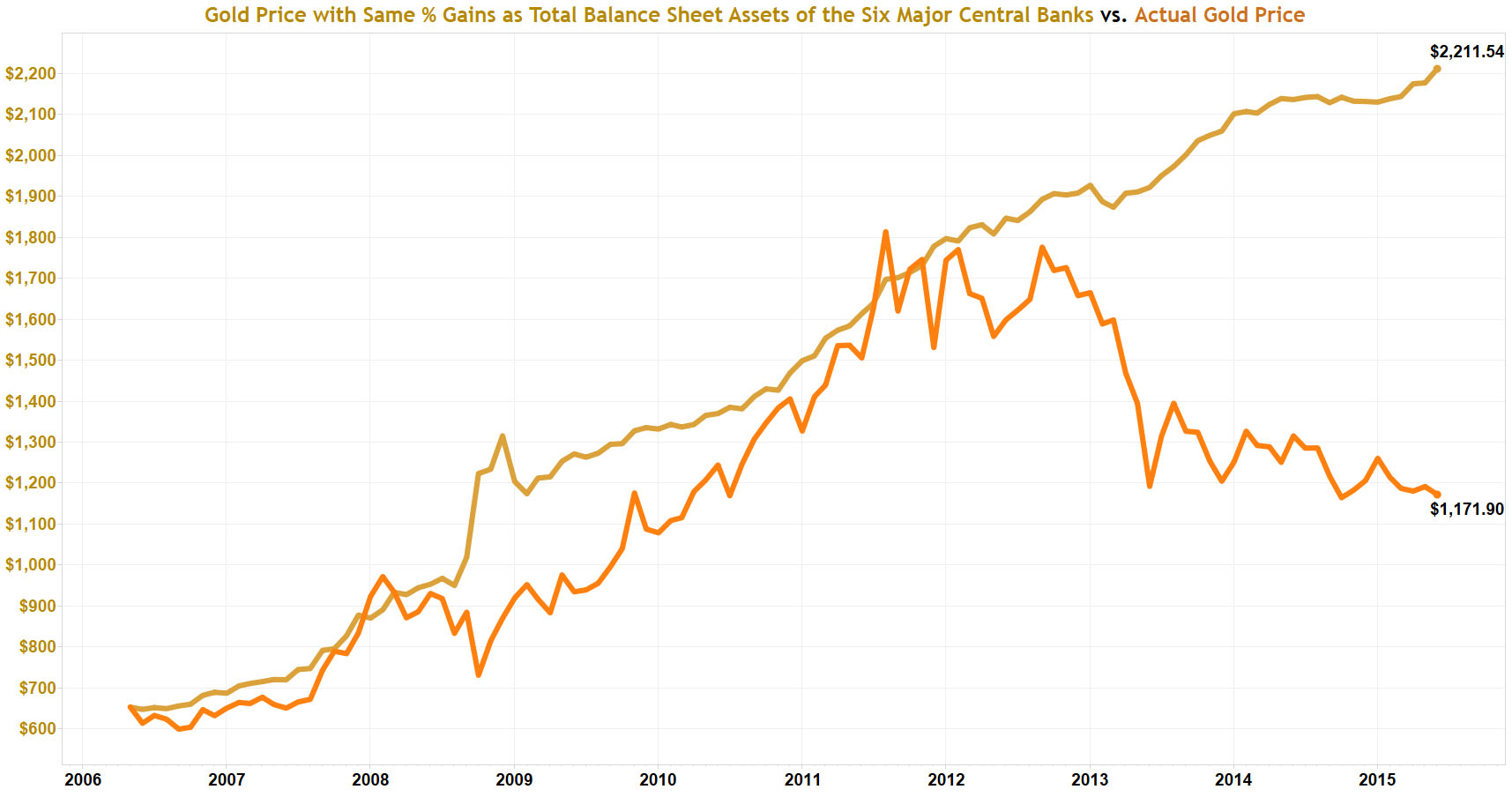

Gold is currently very undervalued and deserves to be trading for $2,211.54 per ounce – based on gold making the same percentage gains as the balance sheet assets of the six largest central banks.

centralbankassetsgold

|