|

A Different Take on Socially Responsible Investing (SRI)

What is Socially Responsible Investing? This is the big question asset managers are facing as they try to integrate social responsibility into their management practices.

Like beauty, SRI is in the eye of the beholder. The “market” defines SRI as the confluence of three factors: Environment (E), Social (S) and G (Governance). But market participants, depending on their perspective, see the relative importance of these factors differently.

For many, the Environment holds sway. But for others, it is the social component with an emphasis on workforce diversity. Hard-nosed investors look at the performance benefits that seem to come from isolating good governance practices as the key consideration.

Source: Bloomberg, as of 7/31/2017

Parsing the data becomes highly subjective which explains why implementing “best practices” is so important. There are over four hundred key data points that define best practices. These data points include simple questions of policy: Does the company have a formal policy for promoting diversity? Does the company have a formal plan for reducing CO2 emissions?

Then there are the metrics that validate policy. For example, what are the company’s actual CO2 emissions and what is the trend line for these emissions in the recent past?

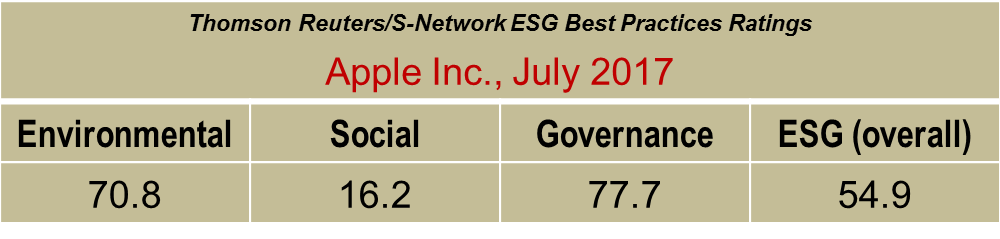

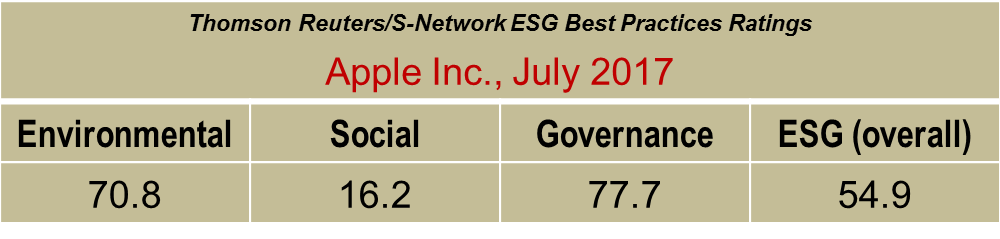

Aggregating all of this data establishes a company profile that drives deep into a company’s interaction with the economic milieu, including the social efficacy of its supply chain. For example, Apple, one of the world’s largest companies, gets high marks for its environmental and governance practices, but loses ground when it comes to its social positioning. This is mostly because the companies involved in their supply chain don’t employ well-regarded business practices.

Source: S-Network, as of 7/31/2017

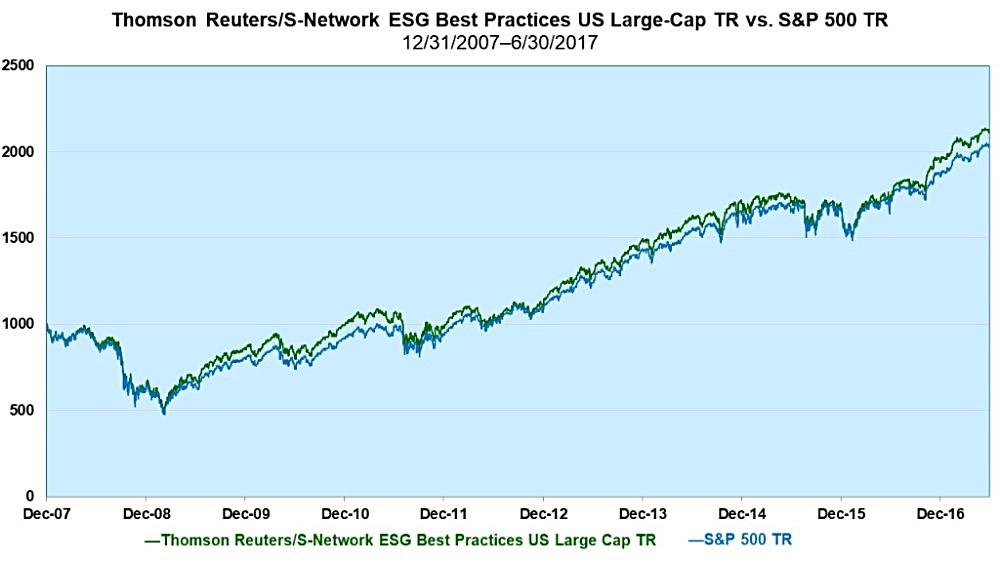

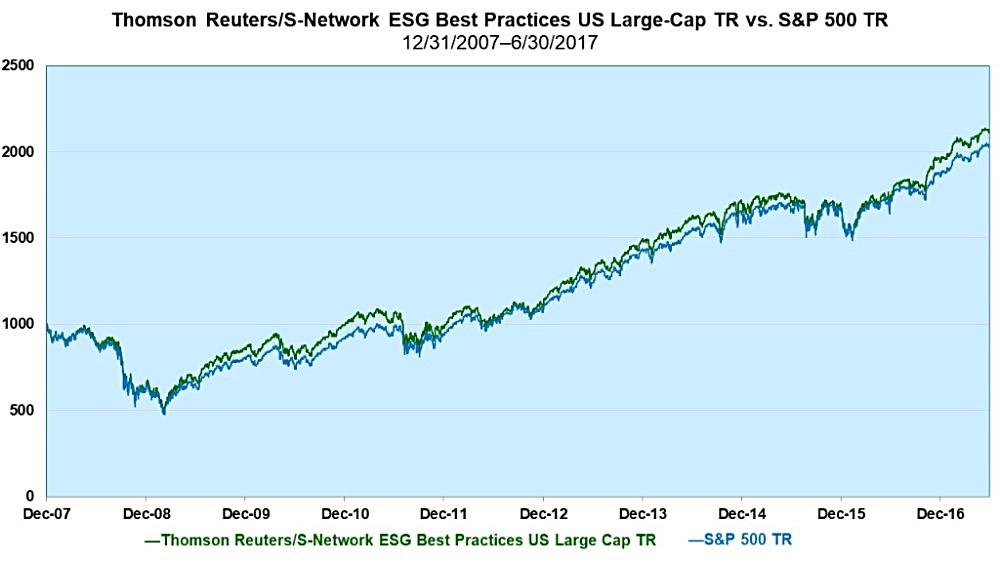

These data points constitute a new frontier in investing, because they facilitate a more rigorous level of analysis. In fact, defining whether or not a company adheres to established ESG best practices is the essential first step in constructing a socially responsible portfolio. Once a best practices universe is defined, the highly personalized definition of Socially Responsible Investing can be applied through the exclusion of companies based on their business practices. Some examples include participation in the energy, nuclear, armaments, and tobacco or alcohol industries.

However you define the relevance of environmental, social and governance practices, it all starts with applying best practices.

For more information please contact:

Gregg Sgambati

Director of ESG Solutions

gsgambati@snetworkinc.com

Thomson Reuters/S-Network ESG Best Practices Ratings are quantitatively derived based on over 200 separate criteria, scaled by industry and region.

Thomson Reuters/S-Network ESG Best Practices Indices & Ratings offer a turnkey tool set for meeting established social, environmental and corporate governance investment goals.

Thomson Reuters/S-Network ESG Best Practices Ratings & Indices

A joint initiative between S-Network Global Indexes and Thomson Reuters

The Thomson Reuters/S-Network ESG Best Practices Indices are a suite of indices designed to provide a benchmark of companies exhibiting best corporate social responsibility practices as measured by their superior ratings in the Thomson Reuters/S-Network ESG Best Practices Ratings schema. The ratings rank the constituent companies on Environmental, Social and Governance performance and are powered by “dynamic” ratings derived from the Thomson Reuters ESG database. The indices represent a comprehensive benchmarking system for CSR investors. A universe of over 5,000 companies worldwide are rated in over 225 key indicators of ESG performance. The Thomson Reuters/S-Network ESG Best Practices Indices include:

TR/SN ESG Best Practices Ratings & Indices

S-Network Global Indexes, Inc. is a publisher and developer of proprietary and custom indexes. Founded in 1997, S-Network publishes over 200 indexes, which serve as the underlying portfolios for financial products with over USD 7 billion in assets under management. S-Network indexes, which are supported by a state-of-the-art technology platform, are known for their transparency and efficiency. More...

US Large-Cap ESG Best Practices Index TRESGUS

US Large-Cap Environmental Best Practices Index TRENVUS

US Large-Cap Governance Best Practices Index TRCGVUS

US Large-Cap Social Best Practices Index TRSCUS

Developed Markets (ex-US) ESG Best Practices Index TRESGDX

Developed Markets (ex-US) Environmental Best Practices Index TRENVDX

Developed Markets (ex-US) Governance Best Practices Index TRCGVDX

Developed Markets (ex-US) Social Best Practices Index TRSCDX

Europe ESG Best Practices Index TRESGEU

Europe Environmental Best Practices Index TRENVEU

Europe Governance Best Practices Index TRCGVEU

Europe Social Best Practices Index TRSCEU

Emerging Markets ESG Best Practices Index TRESGEX

Emerging Markets Environmental Best Practices Index TRENVEX

Emerging Markets Governance Best Practices Index TRCGVEX

Emerging Markets Social Best Practices Index TRSCEX

|