OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

US ECONOMY

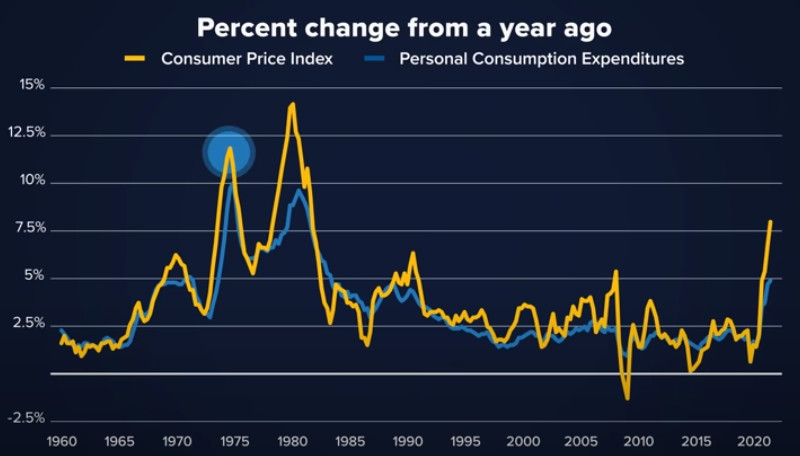

INFLATION CNBC ... Is this stagflation? Original article: https://www.youtube.com/watch?v=eNLC9sYDuV4 Burgess COMMENTARY I posted the following in the comments to this video The current inflation is very different from the inflation of the 1970s ... which became the stagflation of the early 1980s. The OPEC oil shock of 1973 increased the price of a barrel of crude oil from $3.50 a barrel to $13.00 and then by the end of the decade to around $30.00. This created 'cost-push' inflation that wiped out the profit margins for most major industries especially in the energy inefficient USA. The modern US economy is hugely profitable compared to 1980 with profitability increasing for many major sectors (like banks, energy, tech companies and others) even during the pandemic. Investors and big business oligopolies are laughing. The more the media talks up inflation the more they can increase their prices and their profits !!!!!!!!!!!!!!!!!!!I was in shock when I first viewed this CNBC video. It took me back to the days when I was a young student studying economics at Cambridge where Keynesian thinking was alive and well. My tutor, Andy Roy, was a hard taskmaster in some ways, but excellent and not tolerant at all of analysis that ignored facts and merely parroted pre-determined conclusions. I was co-CEO of a manufacturing company in 1973 when the OPEC oil shock took place. The price of crude oil went from $3.50 a barrel to $13.00 a barrel for every buyer in the world. This was a cartel that worked. The Organization of Petroleum Exporting Countries got control of the global market, and they were making their prices stick. Back then the USA was a big importer of oil and a big user of oil, and of course, there is an energy component in everything in an advanced economy like the United States. Some years later I realized that one of the reasons why OPEC, with the leadership of Sheik Zaki Yamani had been successful in controlling ... that is raising ... prices was that there were many other actors that also wanted energy prices to rise. These included the political and oil industry leadership in Britain and the Netherlands where investments had been made in North Sea Oil which would have been uneconomic at pre-OPEC world prices. Also, every oil drilling company in the world which were struggling to be profitable at pre-OPEC prices and would never have been able to innovate and provide the abundance of oil that is available for delivery into the modern global economy. Peter Burgess | ||

|

Will Stagflation Return To The U.S.?

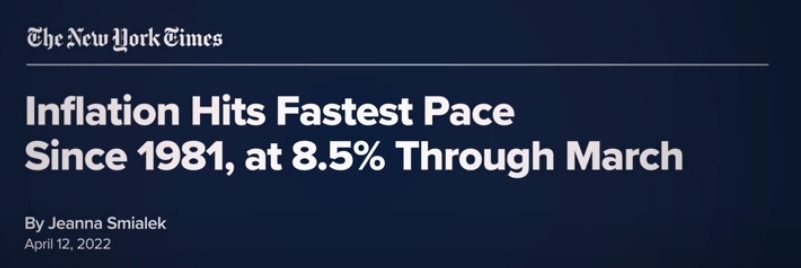

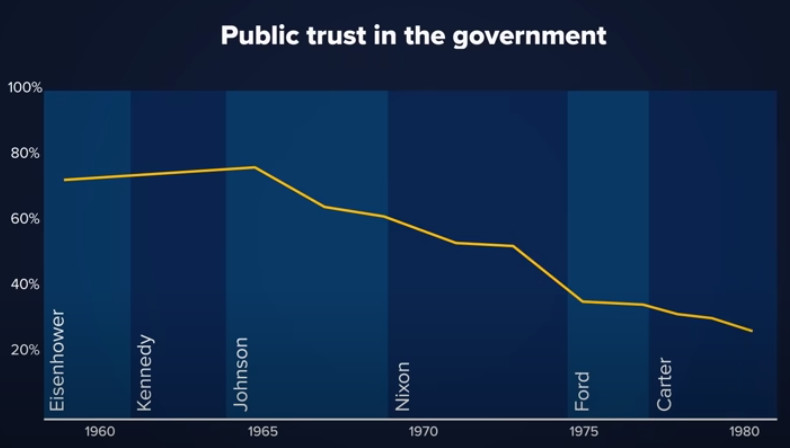

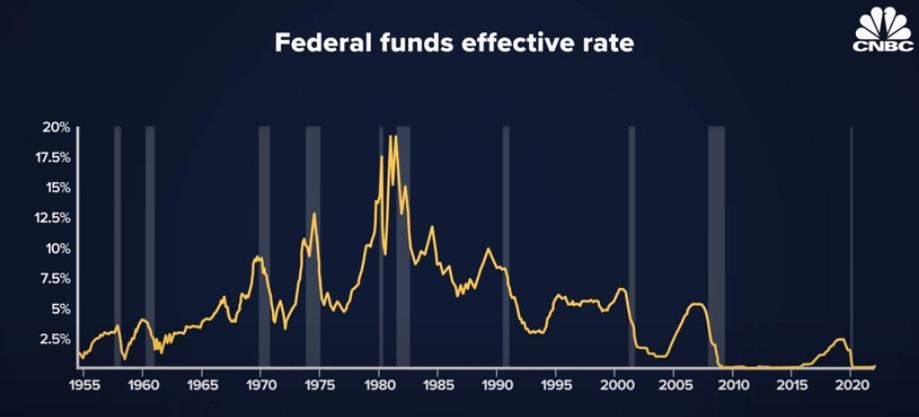

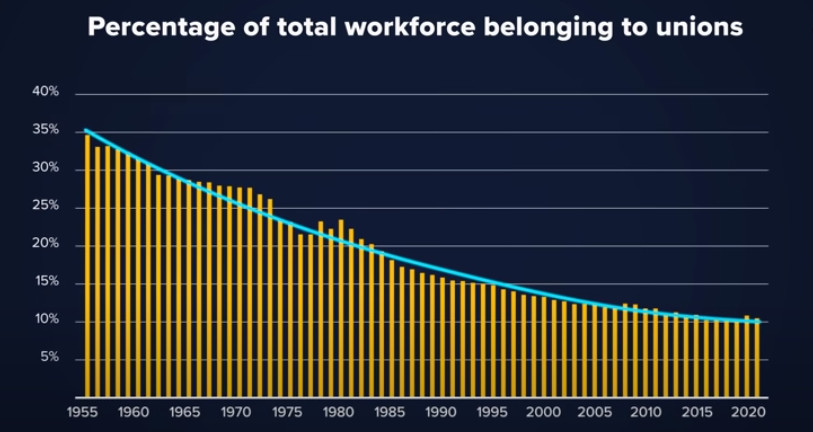

613,883 views May 2, 2022 CNBC ... 2.69M subscribers Central bankers are tightening the U.S. economy as inflation takes hold in historic fashion. Meanwhile, the unexpected shock of war in Ukraine is slowing global growth. Experts say the moment recalls the 'Great Inflation' of the 1970s and 80s. This period is remembered for stagflation, which describes the dual-threat of stagnant growth and persistent inflation. Today's Federal Reserve leaders hope to avoid such a dramatic turn of events. But their plan could backfire, as many root causes of inflation are outside of the bank's control. The Federal Reserve is hiking interest rates in an effort to defuse an explosive year of price inflation. But global forces could neutralize the effects of that tightening of monetary policy, and keep inflation high. Some observers believe the U.S. government may have misread the looming threat of inflation. During the pandemic, Uncle Sam dispersed historic sums of cash to blunt widespread economic damage. Analysts say this stimulus produced strong household savings. A boom in demand for durable goods followed. This surge in demand came as global supply chains stalled out, and a persistent bout of inflation followed. In March 2022, prices across all categories rose to historic levels, 8.5% year over year. And investors believe the price hikes aren’t over yet, according to a New York Federal Reserve survey. “The only way to break the back of inflation that’s running out of control is for very tight monetary policy, ” says Richard Fisher, former President of the Federal Reserve Bank of Dallas. “It slows things down because everything becomes expensive.” Today’s inflation isn’t spiraling in the way it did in the recent past, however. From 1965 to 1982, inflation soared, at times reaching double-digit rates. In 1979, the central bank, under Chair Paul Volcker, kicked off a tightening cycle that resulted in interest rates of nearly 20%. Strong monetary policies killed inflation, but also led companies to offshore labor costs. As a result, American workers saw their labor income stagnate relative to productivity for four decades. This period in U.S. economic history is remembered for stagflation, which describes the duel threat of stagnant growth and persistent inflation. Today’s Federal Reserve leaders hope to avoid such a dramatic turn of events. But their plan could backfire, as many of the root causes of inflation are outside of the bank’s control.

Connect with CNBC News Online

| The text being discussed is available at | and |