OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

ECONOMICS

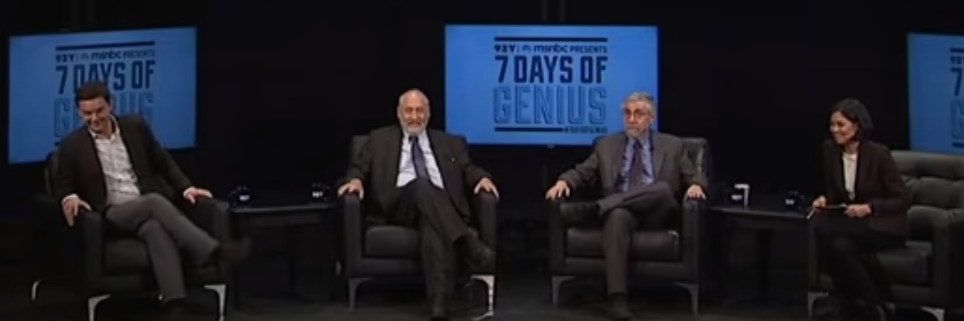

PIKETTY, KRUGMAN AND STIGLITZ Thomas Piketty, Paul Krugman and Joseph Stiglitz: The Genius of Economics Original article: https://www.youtube.com/watch?v=Si4iyyJDa7c Peter Burgess COMMENTARY I studied economics in an academic setting at Cambridge in my early 20s about 60 years ago and was fascinated by the subject. Much of the focus of the program at the time was to embrace the more dynamic Keynsian analysis rather than the old classical more static framework associated with Marshall. Previously I had studied engineering (known at Cambridge back then as Mechanical Sciences) and moving to economics was something of a shock. In engineering the measurements are very tangible, but in economics they are very fuzzy and subject to all sorts of gaming. I was very comfortable with the idea that economics was 'the dismal scienve'. For all its flaws, however, my involvement was economics was that it was then and still is the best framework for analysis of the totality of cause and effect in individual quality of life and national performance ... in spite all its flaws. After university I joined an engineering company in Sheffield that was a major manufacturer of the heavy machinery used in the iron and steel industry ... rolling mills, blast furnaces and the like ... as a management trainee. I was shocked by the almost complete lack of meaningful management metrics and the use of 'rule of thumb' that went back decades. When I was working with this company it had a huge 'order book' because the world was rebuilding after WWII and industrializing as fast as they could and steel mills were a big part of this. It became clear to me that while the company was very active it was not very profitable, and worse, an increasing part of their order book was going to be unprofitable. How top management did not understand that they were accelerating to business oblivion, I do not know, but it was clear to me that the way the company priced their products completely ignored the massive changes in control engineering that were now being built into the products. Selling heavy castings at a 'per ton' price is one thing, but selling sophisticated control gear on a 'per ton' basis is insane ... but this was what the company was doing. As a young 'trainee' my views were ignored by most of those that mattered with the exception of the CFO (Chief Financial Officer) who understood my concerns and recommended that I should consider becoming trained as an accountant ... a Chartered Accountant. I took this advice and moved from management training in engineering in Sheffield to training as an Articled Clerk at an accounting firm in London. Very soon, I realized that what I had been learning about engineering at Cambrige and economics at Cambridge and business management in Sheffield was not very well integrated into the core concepts of financial accountancy and financial reporting by corporate organizations. There were some links between the work of financial accountants and 'cost and works' accountants but they were quite weak in the 1960s and it can be argued have become even weaker over time as 'financialization' and 'financial engineering' came to dominate management decisions in the corporate world and finance. My subsequent career was a mixture of success and failure ... but I have had the opportunity do a lot of interesting work and to continue experiential learning all my life in a wide variety of situations. Fast forward ... I am fascinated by discussions like the one here between Piketty, Krugman and Stiglitz. I am not particularly impressed by the impact that the academic community has had on the 'progress and performance' of the socio-enviro-economic system that surrounds us and enables everything. I know I have not had anything like the impact on these matters that I would have liked, but as I get older many of the important issues that need to be addressed as a matter of some urgency are becoming more clear ... this is what TrueValueMetrics is all about. Peter Burgess | ||

|

Thomas Piketty, Paul Krugman and Joseph Stiglitz: The Genius of Economics

Mar 6, 2015 (Accessed August 2022) 92NY Plus 49.3K subscribers ... 405,571 views Piketty, arguably the world’s leading expert on income and wealth inequality, does more than document the growing concentration of income in the hands of a small economic elite. He also makes a powerful case that we’re on the way back to ‘patrimonial capitalism,’ in which the commanding heights of the economy are dominated not just by wealth, but also by inherited wealth, in which birth matters more than effort and talent,” wrote Paul Krugman in The New York Times. Krugman and his fellow Nobel laureate Joseph Stiglitz (author of The Great Divide) join Piketty to discuss the genius of economics.

| The text being discussed is available at | and |