INTERESTING IDEAS

SUSTAINABLE FINANCE

VERY IMPORTANT, BUT NOT WELL UNDERSTOOD

|

|

|

|

Sustainable Finance: Good Idea Not Working

By Peter Burgess, May 2019 (Draft)

There is a lot more talk about sustainable finance now than in previous years, but what sustainable finance really means remains unclear. Most people ... including myself ... understand sustainable in a way that suits ones own view of the world.

My impression is that many, or perhaps most of the professionals that manage investments think of sustainability merely in terms of profit performance and the related stock valuation in capital markets. A sustainable investment is one that is going to deliver an increasing stock price over time, and time is usually a relatively small number of quarters.

There also seems to be an assumption that the sustainability of a company or an investment is enough to deliver a sustainable world. This assumption is dangerously flawed, and a much deeped understanding of sustainablity is essential along the lines that I will try to describe below.

What Dies Sustainable Mean

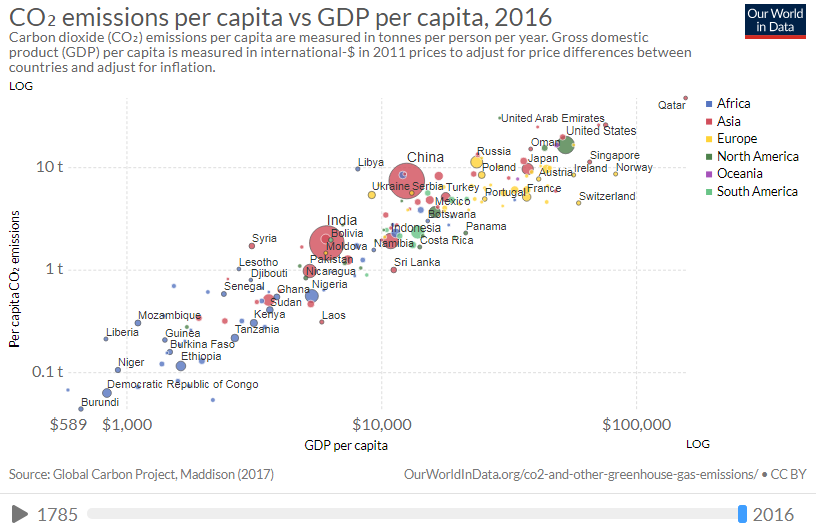

It is perhaps easier to describe unsustainability than sustainability. The modern consumption driven economy associated with rich countries like the United States and Canada are chronically unsustainable. The total population of the world is around 7.5 billion. The population of North America is around 370 million people, or a little under 5%. The consumption patterns associated with the economic prosperity of North America is chronically unsustainable if it is replicated into the rest of the world.

Country GHG emissions (MtCO2e) 2014 Percentage of global total (%) 2014

China 12454.7110 27.51%

United States 6673.4497 14.75%

India 2379.1668 6.43%

Canada 738.3825 1.63%

World 45261.2517 100.00%

This is a list of countries by total greenhouse gas (GHG) annual emissions in 2014. It is based on data for carbon dioxide, methane, nitrous oxide, perfluorocarbon, hydrofluorocarbon, and sulfur hexafluoride emissions compiled by the World Resources Institute.[1] The emissions data shown below do not include land-use change and forestry.

https://en.wikipedia.org/wiki/List_of_countries_by_greenhouse_gas_emissions

1990 1995 2000 2005 2010 2013

Canada 20.22 20.69 22.12 21.94 20.47 20.94

United States 23.23 23.26 23.86 22.92 20.97 19.90

China 2.69 3.39 3.49 5.5 7.43 8.49

India 1.37 1.48 1.59 1.72 2.11 2.28

World 5.62 5.4 5.41 5.85 6.15 6.27

This is a list of countries by total greenhouse gas (GHG) emissions per capita by year. It is based on data for carbon dioxide, methane, nitrous oxide, perfluorocarbon, hydrofluorocarbon, and sulfur hexafluoride emissions compiled by the World Resources Institute, divided by the population estimate by the United Nations (for July 1) of the same year.[1] The emissions data do not include land-use change and forestry.

https://en.wikipedia.org/wiki/List_of_countries_by_greenhouse_gas_emissions_per_capita

Name 2019 Population GDP (IMF) GDP (UN '16) GDP Per Capita

United States 329,093,110 21,410,230 18,624,475 $65,058

China 1,420,062,022 15,543,710 11,218,281 $10,946

India 1,368,737,513 3,155,230 2,259,642 $2,305

Canada 37,279,811 1,908,530 1,529,760 $51,195

http://worldpopulationreview.com/countries/countries-by-gdp/

Role of ESG (Environment, Social and Governance Factors)

Many people interested in 'sustainability' have embraced the conceptual framework associated with ESG (Environment, Social and Governance).

Disclosure Rules

Common Sustainable Finance Taxonomy

Stewardship / Fiduciary

|

|

Sustainable Finance: What It Is and How it Works

By Flavia Micilotta, February 9, 2018

The much-awaited final report of the High-Level Group on Sustainable Finance (HLEG) is finally out. The report contains a series of carefully calibrated recommendations which have been elaborated by the members of the group over the past year. Eurosif, the leading European association for the promotion of Sustainable and Responsible Investment in Europe, has advocated since its inception, and with the support of its membership, for a more sustainable financial system. This report and its recommendations represent a milestone in the chapter of sustainable finance. The report is articulated around eight priority recommendations.

Clarifying Investor Duties to Extend Time Horizons and Bring Greater Focus on ESG Factors

Eurosif’s advocacy work for sustainable finance is long-standing. Back in 2015, as part of Eurosif’s “Sustainable Capital Markets Union Manifesto”, five priority areas were identified as recommendations for the European Commission to weave sustainability through the Capital Markets Union. Already back then, the CMU initiative was applauded as a catalyst for change and two conditions were recognised that needed to be met in this framework, for it to deliver sustainable value for Europe. Those were contributing to reducing the cost of capital for European companies, including SMEs and building an investment environment conducive to a greater long-term capital allocation for productive purposes.

Back then, the notion of integrating sustainability considerations into fiduciary duty was already ingrained in the policy agenda, as the need for clarifying ambiguity around the compatibility of fiduciary duty and ESG investing were identified and a recommendation was proposed on this subject as a key consideration and way forward for European policy-makers. Building up since then, Eurosif strengthened its position around this discourse a year later, when a CMU Action Plan was drafted, asking for a clear definition of fiduciary duty as including ESG issues. The ‘prudent person principle’ in investment, known as ‘fiduciary duty’ in some jurisdictions, is the moral obligation of investors to act in the best interests of beneficiaries. A clear definition of the concept of fiduciary duty was called for, too often interpreted by investors and investment advisors as a duty to maximise short-term financial return.

As climate and wider ESG risks are material to business, acting in the beneficiaries’ best interest means having a long-term approach to business and fully factoring ESG issues in investment decisions. Asset managers and institutional investors, who are naturally interested in maintaining high portfolio returns, should be able to ensure that ESG risks in their portfolios are properly measured and managed. Therefore, policy-makers were urged to develop a clear definition of fiduciary duty with a clear reference to ESG. Eurosif fed its input into the work of the HLEG and the call for action has found new legitimacy in the call for the clarification of investor duties in the relation with fiduciaries by seeking informed consent.

Upgrading Europe’s Disclosure Rules to Make Climate Change Risks and Opportunities Fully Transparent

Transparency in promoting sustainable investment is another topic that has been of strategic relevance for Eurosif. As ESG issues can affect the long-term performance of companies, securities and investment portfolios, it is now widely recognised that climate and wider ESG risks are material to financial performance. Therefore, a basic requirement for long-term sustainable investment in the CMU context, but also a key factor for financial performance of European issuers, is transparency via mandatory ESG disclosure.

It has been shown that mandatory sustainability reporting not only increases transparency but also drives improvement in ESG practices. As better ESG performance is linked to higher economic value, an immediate implication for policy-makers is that mandatory ESG reporting can increase value creation and competitiveness of companies. However, due to a lack of (harmonised) reporting guidelines on ESG, companies have long experience difficulties in determining what ESG issues are of relevance for them and why. This situation creates information asymmetry on the issuer side which affects investors’ ability to use this information in their decision-making processes.

Moreover, it has been shown that the willingness of companies to report on ESG risks has increasingly flatlined. Short-termism and excessive leverage remain significant obstacles to the inclusion of ESG risks in financial decision-making. Due to these reasons, as investors are increasingly looking to reduce climate and wider ESG risks in their portfolios, a long-term investment framework, as well as mandatory ESG disclosure based on clear and harmonised standards, are needed – both on the issuer and on the investor side. On the issuer side, the Non-Financial and Diversity Disclosure Directive represented an important first step, as it requires large companies and groups which fall under its scope to disclose policies, risks and outcomes linked to ESG matters.

However, in order to address the issue of information asymmetry, Eurosif called for the need to complement them with a comprehensive disclosure regime that ensured that disclosed ESG information is comparable and timely and encouraged the Commission to be more prescriptive and specific on Key Performance Indicators (KPI) at a sectoral level. Endorsing the recommendations of the Task Force on Financial Disclosure at a European level represents a substantial and valid step and a concrete framework the investor community has had the time to familiarise itself with, and which builds on the useful example of the French Article 173. The work of the TCFD and its recommendations are a good example of a reporting framework which is concise, practical and to the point, precisely what users were advocating for. Coupling the considerations linked to the TCFD recommendations with the revision of the Non-Financial Reporting Directive (NFRD) makes it easier for the European Commission to devise a disclosure action plan for the years to come. At the same time, the HLEG recognises the need for European policy-makers to foster sustainability reporting requirements as key elements of sustainable finance at an international level.

Introducing a Common Sustainable Finance Taxonomy to Ensure Market Consistency and Clarity, Starting with Climate Change

The need to create a solid and common narrative around sustainability as a robust reference point for all stakeholders was one extremely important element. Naturally, it was soon realised that the lack of definitions on one hand and the infinite number on the other in this space had most certainly hampered the ability of Europe to mobilise capital at scale for sustainable development. A clear set of references at a European level, able to guide investors by allowing them to navigate around the possibilities for sustainable investment, was a clear starting point for many of the proposed recommendations to be unleashed. The time is ripe for bringing all the key stakeholders to the table, utilising their knowledge and resources to define a reference framework for sustainable activities that is applicable to all types of assets and capital allocation.

The recognition of the need for a common frame is deeply intertwined with an equally urgent need, the engagement of European citizens on sustainable finance issues.

Empowering and connecting Europe’s citizens with sustainable finance issues is a key recommendation which is directly targeting those investors who are less knowledgeable with these considerations, but who represent a rich investment pool and therefore great potential. A sustainable financial system should be transparent and accountable to EU citizens. Improving access to information on sustainability performance and promoting financial literacy are essential elements of that effort.

Although the development of new sustainable financial products has continued to rise rather modestly, the retail investor sector has grown exponentially in the past three years. In 2016, Eurosif’s latest landmark biennial SRI Study highlighted that demand from the retail sector had grown by over 500%, a truly impressive result and a clear signal for the industry and for policy-makers. This appetite needed to be addressed by bringing clarity to the sustainable investment industry and providing a level playing field for practitioners who have long been in SRI. The need to tackle a fragmented offer of SRI products which draws from a set of definitions and denominations, never before unanimously accepted by the investors’ community, was pressing.

Again, year after year, the Eurosif Study tracks the flows of responsible investment across European member states, and the last review registered a total of SRI Assets under Management of 11 trillion euros. This impressive figure is made up of all the assets classified today as part of a sustainability offer. Guiding and protecting the retail investor is not just the right thing to do, but it is also essential to the sustainable growth of an industry which has been evolving over the years from niche to norm. Establishing a minimum standard for SRI products to be respected by manufacturers and targeting all funds, represents the keystone of this strategy and one that one can hope will spur further growth for this rich industry. Engraining sustainability in the discussions of investment advisers with their clients and referencing impact and process of products, constitute important dynamics of this retail recommendation.

This last recommendation also ties in with the one focusing on the need to develop official European sustainable finance standards, starting with one on green bonds. Investors are asking for a standard endorsed at a European level. In the last years, green bonds have been and continue to be an incredible investors’ tool to finance green projects to contribute to wider sustainability objectives. The European Commission has been investigating green bonds and their potential in the past years and commissioned studies which identified possible shortcomings, preventing them from achieving their full potential. Public sector measures had already been identified as potential solutions, together with standardisation.

Establishing a European Green Bond Standard will help to build on the transparency needed in the industry and help stakeholders ensure that the proceeds from green bonds are used for genuinely green projects with clear and measurable environmental objectives. Setting up a Committee drawing from technical experts is set to guarantee work towards the adoption of harmonised global standards. Of note, the work in the green bond space is set to stimulate additional European sustainable product standards for other asset classes, such as EU Social Bond Standards.

Establishing a Green Bonds Standard is directly linked to helping fuel capital to infrastructure investments. As green bonds represent a promising tool for channelling long-term capital towards green infrastructure projects, Eurosif has been very supportive over the years of the European Commission’s recognition and pledged to support the development of the green bond market as part of the CMU work. The relevance of promoting infrastructure investments as a valid tool to build a post-carbon and resource-efficient European economy is a crucial lever for promoting long-term growth, jobs, and competitiveness, and as such, it should be a top priority of the CMU initiative. As both the climate challenge and the broader sustainable development challenge can be seen as inherent investment challenges, it is coherent and consequential that the financial system plays its role in financing sustainable development.

Indeed, investments in sustainable long-term infrastructure can and should play a key role in achieving EU decarbonisation and broader environmental and social sustainability goals. Some of the key bottlenecks that have prevented the mobilisation of capital for investment in Europe directed through infrastructure, were around the lack of development capacity and the impossibility of appropriately structuring projects in the appropriate way for investors who remain wary of these investments. Establishing a ‘Sustainable Infrastructure Europe’ (to expand the size and quality of the EU pipeline of sustainable assets) as an entity built on existing institutions to function as a platform between developers and investors would also ensure meeting the obligations of the Paris Agreement. The entity would help secure the strategic advice needed to deliver sustainable infrastructure projects supporting and translating EU policy objectives into national capital-raising plans to deliver the 2030 climate and energy goals under the Energy Union.

Final Thoughts

Building a sustainable framework for finance goes hand in hand with a governance and leadership review. The considerations of the HLEG around the culture of the financial sector and its need to be better aligned with a long-term outlook calls for a Reform of the governance and leadership of companies to build sustainable finance competencies. This effort should involve a specific understanding of sustainability issues from executives and supervisory governing bodies while having financial sector supervisory authorities performing assessments as to whether members of governing bodies are able to anticipate sustainability and other long-term challenges. In that respect, the HLEG called for the updating of the ‘fit and proper’ tests to include sustainability risks as part of the skillset required from members of the governing bodies in financial institutions. Extending the Stewardship Principles for institutional investors to include the development of clear stewardship policies and promoting the long-term value creation and integration of sustainability factors are key examples.

Strengthening the mandate of the European Supervisory Authorities to specifically include sustainability constitutes a step that the European Commission had already picked up, while on September 20th 2017, President Juncker proposed reforms to the ESAs for a more integrated financial supervision of the CMU. This also included the notion that ESAs are going to serve as entities for the active promotion of sustainable finance. This means that they will take into account ESG criteria and risks in all the tasks they perform. Enlarge the role and capabilities of the ESAs to promote sustainable finance as part of their existing mandates. This calls for a clarification of their mandate while extending the horizon of risk monitoring with a clear focus on climate-related risks. This will entail a series of the steps, including the increased expertise on tools for scenario analysis, strengthening the ability to document and monitor the mismatch of time horizons, while ensuring consistency of implementation of the single rulebook.

Helping to craft the HLEG report has been a great pleasure and honour and a meaningful journey. A new one begins now.

|

Sustainable Finance ... Commentary by Flavia Micilotta

Sustainable Finance: What It Is and How it Works

|

Open file 14677

|

|

https://themarketmogul.com/sustainable-finance-eu/

|

Flavia Micilotta

Flavia Micilotta

1st degree connection

Director at Luxembourg Green Exchange

Luxembourg

Luxembourg Stock Exchange

Solvay Business School

500+connections REVIEWED 190506 CONNETED February 21, 2018

Flavia is Director at the Luxembourg Green Exchange, the key stock exchange for listing of green bonds. A member of EFRAG's EU reporting Lab and of the EIOPA Occupational Pension Stakeholder Group, Flavia has supported the work of the European Commission to devise a sustainable finance framework as member of the High-Level Expert Group on Sustainable Finance (HLEG). With 18 years of experience in sustainability, Flavia was previously Executive Director of Eurosif, the pan-European sustainable and responsible investment (SRI) membership organisation whose mission is to promote sustainability through European financial markets. As a sustainability consultant and qualified environmental auditor at EY and Deloitte, she assisted companies embed sustainability in their business models and go beyond the remits of social and environmental compliance. Focused on issues ranging from climate change and adaptation, to supply chain management and responsible investments, Flavia worked with several European banks and asset managers to help them streamline their Responsible Investment approach. A founding member of the UN Global Compact in Belgium, Flavia has developed much of her career working with companies to improve their transparency and accountability through material and forward-looking sustainability reporting.

36 Mutual Connections

You and Flavia both know Daniel Hood, Daniel Brooksbank, and 34 others

|

Flavia Micilotta on Linkedin

https://www.linkedin.com/in/flavia-micilotta-3601211/

|

Open Linkedin profile

|

|

|

|

|