|

Rebounds from Past Bear Markets

|

|

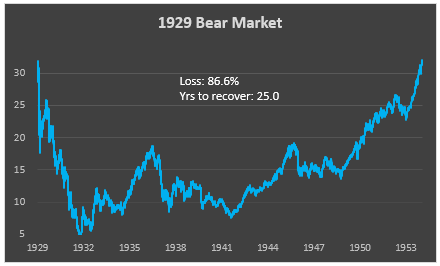

1929 ... 25 years to rebound

This was an 86.6% drop ... and it is entirely possible that it might not have ever recovered if there had not been a World War!

|

|

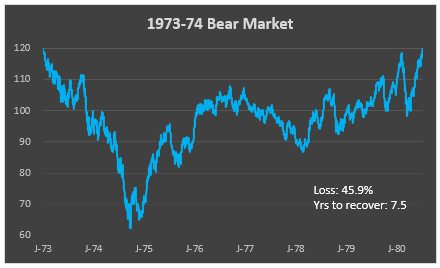

1973-1974 ... 7.5 years to rebound

This was a 45.9% loss which took 7.5 years to recover. In some ways, however, the oil shock which caused the drop was never resolved.

|

|

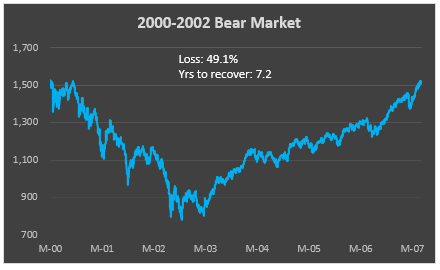

2000-2002 ... 7.1 years to rebound

This was a 46.1% loss which also took around 7 years to recover. This was the burst of the 'dot.com' bubble. The economic damage was mainly financial.

|

|

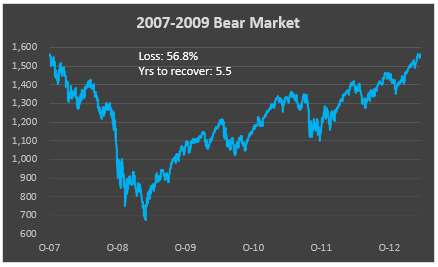

2007-2009 ... 5.1 years to rebound

This was a 56.8% loss which took around 5.1 years to recover. This was the 'Great Recession'. There was massive social damage in addition to economic damage.

|

|

.

|

|

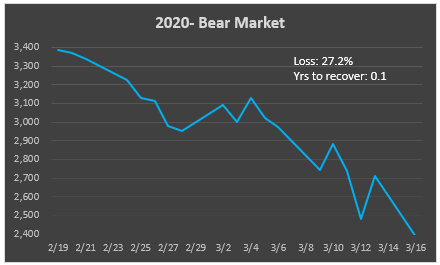

The Coronavirus Crash

|

|

The decline in the stock market during the early part of 2020 has been the largest point drop in the history of US exchanges. There is no data yet that gives any indication of what rebound, if any, there will be when the coronavirus crisis recedes.

|

The massive drop on stock markets from mid-February to mid-March 2020 has surprised many in the financial community, but it probably reflects the systemic overvaluation of financial markets that has been building since the 1980s. At its roots the reason for this overvaluation is the out-dated accounting convention that externalities need not be taken into account when the (financial) performance of a corporate organization is computed, When social impact and environmental impact associated with corporate activity are taken into consideration, the true value of companies have been substantially below stock market valuations.

The economic shock arising in the wake of the coronavirus pandemic might well be the catalyst for an overdue rethink of how corporate valuation is addressed. This has the potential to be the most meaningful change in socio-enviro-economic behavior since the end of WWII

|