Date: 2025-04-03 Page is: DBtxt003.php L0700-TVM-s-FLOW-PROCESS-CHANGEinSTATE

|

TRUE VALUE METRICS

FLOW / PROCESS / CHANGE in STATE |

| HOME | BRIEFS | L020-IS-ISSUES-ALPHA | L020-IS-ISSUES-CHRONO | Last txt00024408 | Next txt00024410 |

|

PROGRESS is the increase in VALUE (of the STATE) from beginning to end of the period | ||

|

|

|

| Simply measure the change in the VALUE of everything | ||

The genius of accountancy is the concept of double entry, which in turn gives rise to the essential continuity between the balance sheet accounts and the profit and loss accounts. Putting it another way, double entry accounting is about measuring both state and flow in the same framework.

A balance sheet shows state at a specific moment in time. The balance sheet has been a core piece of financial accounting and reporting for a very long time … it is a big reason why accounting is such a powerful system of economic performance metrics. The balance sheet is a financial representation of the “state” of the reporting entity … it reports on the condition of the entity, whether an organization, a nation or a community.

If you do not know where you are, it is difficult to know where you are going!

Not only money, but also value

The money balance sheet

The state of an organization is based largely on information reported in the balance sheet. A for-profit entity had assets, liabilities and the owner's equity … that is the investors' equity. Other entities have money balance sheets that reflect the assets and liabilities of the entity based on the money flows and the balances. In the main, the balances are merely a reflection of the aggregate cumulative money transactions.

The value balance sheet

The value balance sheet is a core piece of the TVM framework of metrics. Instead of the balance sheet being only about money in TVM the balance sheet is about the value of the entity … the present value of what the entity has done and will do for value in society.

In the TVM framework, it is not only the organization that is the focus of analysis, but people and place or community as well. The value of economic activity is the improvement and maintenance of quality of life for people. Community is a place where people live, and a place has truly long term if not perpetual existence. Place is also a good proxy for planet, because what happens to the resources and environment in a place translates to impact on the planet.

Example of Okehampton in EnglandThe balance sheet of a community is the main analytical and reporting focus. The balance sheets of organizations, projects and other economic activities are subsidiary to the community … and are aggregated or consolidated into the community balance sheet.

Facts about my own little home town of Okehampton in Devon, England are recorded in the Domesday Book compiled by William the Conqueror shortly after his invasion of England in 1066. The town did not grow much in almost 900 years!

Any entity that might use standard money accounting can just as well use the TVM methodology. The system works for all organizations whether or not they are for profit or not-for-profit, whether they are in the private sector or in the public sector, and whether or not they are large or small.

Balance sheet has assets and liabilities

A business balance sheet … a money accounting balance sheet … has assets and liabilities, all of which relate to money transactions of one sort or another. There are money accounting rules about how the assets and liabilities are recorded and included in the financial reporting.

A TVM value balance sheet has asset data representing good things in the community, and liabilities which are bad things in the community. The value balance sheet has much in common with a money accounting business balance sheet. The money accounting balance sheet has assets and liabilities about all the money elements of the community … and these are part of the value balance sheet. In addition the value balance sheet has data about elements that relate to quality of life and the latent potential of the reporting entity.

Assets

The resources of the community are an important part of the foundation for progress of the community. Though the community may not have a lot of money, there may be many other material resources, as well as the human resource that can be the driver of sustainable progress.

There are 7 main asset elements with both money and value dimensions:

- Labor ... people, human resources;

- Capital ... money, financial resources;

- Physical capacity ... infrastructure, production capacity, organization;

- Intellectual capacity … science and technology, know-how, enabling environment;

- Organizational capacity; and

- Governance and the enabling environment.

Liabilities

Constraints and “lack of” are treated as liabilities in the value balance sheet. While money liabilities have the same form in both money and value balance sheets, the value of activities and issues that constrain progress and performance of the community are the treated as value liabilities. The 7 liability elements mirror the value assets thus:

- The lack of land ... natural resources;

- The lack of labor ... people, human resources;

- The lack of capital ... money, financial resources;

- The lack of physical capacity ... infrastructure, production capacity, organization;

- The lack of intellectual capacity … science and technology, know-how, enabling environment;

- The lack of organizational capacity; and

- The lack of governance and the enabling environment.

Constraints are liabilities in the value balance sheet. Constraints may be either an active limit on what progress may be achieved, or something passive like the lack of something that is critical. Examples of active constraints may be the enabling environment, the framework of law and insecurity. Examples of passive constraints may be lack of water, lack of money, lack of infrastructure, and so forth.

Elements of the Balance Sheet

Land … Natural resources

As assets

Land and natural resources have been important drivers of wealth creation … and in large part the history of wealth is also the history of natural resource exploitation. Natural resources in a community should be considered as important assets of the community. There are a host of issues associated with natural resources and their use for the benefit of the community. Many of these are constraints that impact the community and the opportunity of the community to make socio-economic progress.

- Land is an important natural resource and frequently constrained as to use for the benefit of the community by ownership issues.

- Forest and trees are important

- Rivers and water are important

- Minerals and energy resources are important

- Wind and tide may have value

Liability is a lack of these things

A community is constrained when it does not have enough land and natural resources. A community may adapt … but it may not.

Labor … People / human resources

As assets

In money accounting, people are not part of the balance sheet, though their performance makes a huge difference in profit performance. In the TVM framework people are reported as the asset they are.

There has to be care in the handling of data about people which may be constrained by legal issues of one kind or another. Many facts about people may not be shared in the public space because of law and regulation.

People are very important. Especially in the community … without people there is no community. It is people that are the beneficiaries of quality of life and opportunity. People are also the source of labor, creative ideas and intangibles like friendship. People are family … and people are community! People are the most important resource in any place … way more important than money.

What value is a person? What value is education until it is part of a person's capacity. So also what is the value of good healthcare unless it is part of a person's capacity. And what value is a person unless there is opportunity to do something of value with the person's capacity! There are multiple attributes that go into building the value of people in society. The value of a person can be quantified based on the various attributes of the people and the community.

Sustainable socio-economic progress depends on people … human capacity and the human resource more than any other resource. In the end, the human resource is the one that will facilitate or constrain progress and performance. The key, therefore is to enable people to be the energy that drives socio-economic activity and the production of goods and services. In a modern society, it is people who get benefit, but it is also people who work to produce the benefit. A program that has people focus and has a dynamic that is people centric can be sustainable.

People define the needs … and people are the most important resource. When this is the thinking behind the way the planning is done, development becomes an investment with a return and not merely an expenditure. Modern economics recognizes the dual role of people … as people with needs … and as people that produce to satisfy needs. In other words, people are more than merely a factor of production, they are also the driver of demand.

Liability is a lack of these things

The lack of labor ... people, human resources is a constraint. The lack of labor is a liability … the lack of capacity in the population is a liability. If people are a valuable resource, the lack of people is a constraint and a liability. The constraints associated with the population are a function of matters like the history of nutrition and health, the history of education and the history of the community.

Capital … money and financial resources

As assets

Money resources are important. Money is needed to serve as a medium of exchange, and to some extent a store of value. But the biggest reason for money resources is to pay salaries and to pay bills and to be part of the broad money economy. Without money an organization has to close down or go into a dormant state. Good ideas disappear when there is not money to sustain a framework for the ideas to develop and perhaps flourish. Almost everything that is needed, whether goods or services must be paid for with money … or money equivalent.

Credit is a money equivalent, up to a point. The assumption is that money will be available in the future … and if this proves to be wrong, then the “credit” disappears.

Liability is a lack of these things

The lack of capital ... money, financial resources … and the lack of credit is a constraint and recorded as a liability

Physical capacity … buildings, infrastructure, etc.

As assets

There are two levels of value associated with buildings (1) the satisfaction of the basic need for shelter; and (2) the buildings needed to support quality of life and the productivity of society.

The basic need for shelter is very important in the present circumstance of Haiti. With as many as 250,000 housing units destroyed in the earthquake there is a very large need for basic shelter.

Many of the major commercial and governmental buildings have to be rebuilt

- Roads and bridges determine the efficiency of transport.

- Internet and telephone infrastructure determines the efficiency of communications

- Various types of equipment determine productivity in the activities of the society

- Working capital is part of this. Business activity needs working capital … inventory and the ability to finance trade transactions.

The lack of physical capacity ... infrastructure, production capacity, organization … is a liability.

Knowhow … intellectual capacity

As assets

Science and technology … know-how

Know-how is a key enabler of progress. In fact it is the growth of knowledge over the past 200 years that has made it possible for global society to progress so rapidly. The growth in knowledge has been far more rapid than the growth in the application of knowledge. Worse, the application of knowledge has been for both bad and good.

Enabling environment: Governance, Rule of law

Liability is a lack of these things

The lack of intellectual capacity … science and technology, know-how, and an enabling environment are liabilities

Organizational capacity

As assets

Organizational capacity contributes to economic productivity. Organizational capacity has value … it is very important in making it possible for the economic activity of the community to be productive. Productive economic activity is surplus producing and helps a community progress.

An individual is very limited in what he or she can do alone … but when individuals work as a team all sorts of amazing things can get done. Organization is needed so that things can get done … and organizations are a way for organization to take place. It is organizations that do things, create jobs and make it possible for there to be progress.

Organization is needed to have productive activities. Most activities may be initiatives of the private sector … private organizations, and using private capital. In a functioning economy most activities are paid for by the beneficiaries of the activities.

Being organized is an asset. The challenge is to be organized so that there is a structure within which (1) there can be financing; (2) there can be wage employment; and, (3) there can be socio-economic value adding.

There are many legal forms that are possible … depending on the prevailing legal framework and the way the community wants to be organized or structured. From an accountant's perspective the key elements are: (1) the funding of working capital so that wages can be paid; (2) the balance sheet value improvement that results from the work done and the payment of wages; and, (3) the monetization of the value improvement so that the funds mobilized may be repaid or recirculated.

Liability is a lack of these things

Liability is the lack of organization … organizational capacity

Governance and the enabling environment

As assets

Governance is a matter that may facilitate the progress of a community or constrain it ... governance may therefore be an asset or a liability. Governance is an asset when it provides an enabling environment for progress ... otherwise it is a liability.

Money liabilities are amounts owed by the entity to others ... a fairly simple concept.

The concept of liability in value terms is more nuanced. Essentially a liability is a lack of an important asset needed to satisfy community needs.

Liability is a lack of these things

There are two ways in which constraints are manifested: (1) by specific things that stop activities or limit productivity; and, (2) by the lack of things that are needed to have productive activities in the community. Crime is a specific thing that stops activities and limits productivity. Lack of land, for example, constrains agricultural activity.

In TVM value accounting there is value in having the capacity to satisfy needs ... that is Tier 1 needs. Conversely there is a value liability when such capacity does not exist. The same analytical logic applies to all the types of capacity.

The lack of governance and enabling environment

Off Balance Sheet Items

The money accounting rules

The money accounting rules have been changed over time so that many important financial matters are routinely excluded from balance sheet reporting. This is a dangerous state of affairs brought about by “law based” money accountancy that allows wrong principled reporting to take place. It is very convenient for business organizations to be able to legally lie about the financial condition of the organization.

Unfunded pension liabilities are one of several major issues that are reported in a convenient way rather than in a complete and correct way. There are others.

Contingent liabilities

But the concept is less clear when there is conditionality about what is to be paid and where the calculations are complex. Liabilities that might be very large when a set of conditions apply, but may not exist at all if other conditions apply create a huge risk for anyone relying on financial analysis of the entity.

I was part of an investment group that almost acquired a shipbuilder in Florida. There was a good business plan and the future of the acquired organization looked good ... but there was one problem. The shipbuilder built mainly fishing trawlers, and there was the potential for a lawsuit related to one of the company's trawlers sinking in a storm in the Atlantic with loss of life. While all the normal insurance protections were in place ... there was a small possibility that there might be a counter-claim about a deficiency in design, or something along those lines. Even though several hundred vessels of this or similar design were in use ... this contingent liability was sufficient to stop this transaction from closing.

Risk

Change is a risk … and a poor community is likely to be risk averse for good reason. The matter of risk must be taken into consideration and risk managed appropriately.

It should be noted that “risk” is an issue that is almost totally ignored by the wealthy who one might say “self insure” and do not get hurt very much when things go wrong … while the poor have to endure even more hardship when risks hit society, and they are caught up in the damage that ensues.

Winning the Game! What Game?

More and more … of what?

So much of modern progress has merely been doing more and more of what, arguable, the world neither wants or needs. A huge effort has been expended in trying to create wants and needs … for not good reason.

The world has achieved an amazing capacity to produce … something never achieved before at any time in human history, but the metrics about socio-economics are pushing for production of all the wrong things … for things that produce profit and rarely if at all those things that would satisfy needs … be valuable, without being profitable.

The prevailing metrics are wrong most of the time, something that is terribly dangerous for the future of humankind andf the planet.

Maximizing quality of life

In the money metrics construct winning is more and more of money and material goods … with quality of life assumed to improve with more and more of these things.

Keeping Score

In sports, scorekeepers keep score and the score tells which team it is that wins. Society is similar … with the present money metrics system of scoring, winning is about more and more money. In a value based society winning will be maximizing quality of life … the values that make life worth living.

TVM thinks of progress as winning the game … and maximizing quality of life. This is not a money construct but a value construct and way more complete as a system of metrics than mere money and money accounting that has changed rather little since it was devised in its modern form some 400 years ago. In TVM, progress … maximizing the quality of life … has a central role, just as profit has a central role in the business entity and the money metrics of capital markets.

PROGRESS is Balance Sheet Change

Corporate business accounting has well defined ways of computing profit for business. This definition of profit by Lord Benson over 60 years ago is very simple!

In the 1950s, Henry Benson … a senior managing partner at Cooper Brothers in the UK was asked while testifying in a British High Court to define profit. After a short moment of reflection he replied “My Lord, a profit is the difference between two balance sheets”This definition is one of the most elegant definitions about anything anywhere. It is such a contrast to the way profit gets defined in law and regulation … and the FASB standards and IASB standards, where different rules can be applied in a variety of different circumstances, and in the end, there is no certainty about anything.

Henry Benson subsequently became Sir Henry Benson and later on Lord Benson. Cooper Brothers combined with Lybrand, Ross Bros and Montgomery of the United States to form the international firm of Coopers and Lybrand which in turn became a part of PriceWaterhouseCoopers PLC

How change in state shows progress

Simple balance sheet … the steady state situation

In this image, the value of the community is the same at the end of a period as it was at the beginning ... ordinary daily activities produce what is consumed ... it is a stable steady state situation.

The steady state situation is unusual. What is normal is either progress or regression. In this next case the value of the community is more at the end of a period than at the beginning of the period ... ordinary daily activities produce more than is consumed.

Progress is incremental value … that is improved quality of life … improved social value that makes quality of life better.

Socio-economic value progress is one of the core metrics for a smart society … yet almost absent from the money related metrics used by the corporate community, capital markets and the broader society at the present time.

TVM has a community focus treating the community as the reporting entity. The rules for consolidating accounts apply as all the subsidiary units doing economic activities in the community are brought into account. TVM includes transactions that reflect value as well as the normal money transactions.

TVM is more accountancy than a statistical construct. The data are as simple as possible ... the transactions as small as possible, as many as possible and as clear as possible. Some of the value of TVM derives from how TVM can do accounting for community progress. In the following graphic ... the value of the community at the beginning of the period is the same as it is at the end of the period ... the community has gone about its business for the period, the time has gone by, but nothing has changed.

Data about the daily activities is not needed in the TVM system in order to be very clear about progress ... whether it is progress or problem. All that is needed is data about the value changes that have taken place from the beginning of the period to the end of the period as shown below.

Progress is about an improving quality of life … it is not merely having more profit or more growth, though these may be part of the assessment. In the TVM methodology the primary measure of progress is the value increment accruing to a society … the net of value consumed in the period and the value created during the period taking into consideration all the activities of the community. The framework for quantifying value transactions have some similarities with those of business accounting.

The three key datapoints in TVM are cost, price and value. Value is the key datapoint in measuring progress or problem. Cost is a function of and derivative of productivity and important in the analysis of activities. Price is important in money accounting and how value creation is allocated to different groups.

While value is important, it is also a complex datapoint because there may be an unlimited number of views of what the unit or measure of value is for any specific element. This has been embraced for some years now by capital markets as they have created more and more complex financial instruments ... maybe not all of them proving to have substance ... but the basic idea also works for TVM value, and in the case of TVM it has been combined also with standards also drawn from traditional corporate accounting. TVM refers to the unit of value as the CVU ... Common Value Unit. More than anything else, however, TVM is designed to be very practical, very simple, very low cost and very valuable.

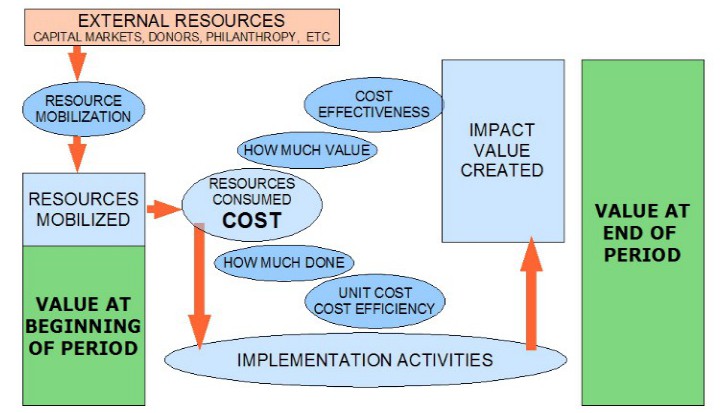

Activity Produces Progress --> Which changes the balance sheet

Resources are consumed

TVM considers activity as an event that consumes resources and creates outputs like goods, services and happiness. Where value creation exceeds value consumption there is value adding, otherwise value destruction.

TVM treats the period value adding aspect of economic activity in the balance sheet in exactly the same way that period profit is treated in a business balance sheet. The profit of business is the net of changes in all the assets and liabilities of the business balance sheet. Similarly the value adding of economic activities changes the value balance sheet.

The balance sheet concept applies at the level of the activity or of the community. The value balance sheet may be used also for organizations and for individuals or families. The most useful for the “management” and oversight of society and socio-economic performance is, however, the balance sheet of the community.

Value is created

When a resource is consumed in some activity, something is done. It is of interest to know what is done, but normally the objective is not to do something but to have something of value be created. Metrics about the amount of activity in relation to the resources used enables the calculation of cost efficiency … but it is the production of value that is more important and enables the calculation of cost effectiveness.

Where value creation exceeds the value consumption there is value adding … otherwise there is value destruction.

Value adding or destruction impacts balance sheet

Value adding or destruction impacts the balance sheet … the balance sheet of the activity and the balance sheet of the community.

A community balance sheet that incorporates elements of quality of life will change when value adding or value destruction activities take place in the community.

It should be noted that “off balance sheet” transactions are as wrong in TVM value accounting as they are in corporate accounting. The value balance sheet for a community is affected by all socio-economic activities that relate to the community.

Profit versus Value

A value balance sheet for a community that is host to large scale minerals extraction will quantify what it is losing in natural resource value compared to what the community is gaining in value such as employment and perhaps assistance with infrastructure, education, health, etc. TVM value chain analysis and value accounting relative to the business organization may indicate that the profit for the organization is substantial while there is offsetting value destruction for the community.

How can this be? And the answer is that business money profit accounting keeps value “off the balance sheet”! It can be argued that not having value metrics is important to the modern corporate community!

Intangible activity has impact

Policy improvement

There are many intangible activities that can change the value balance sheet of a community … and change it significantly and rapidly.

Impact of Policy Improvement

For example, improvement in the policy framework that expands economic opportunity changes the “value” of many of the community value assets associated with people. TVM enables the dynamic of exponential change to be recorded and be a part of the accountability of decision making.

Improvement in the way decisions are made about allocation of resources to value adding activities changes the value balance sheet. TVM makes explicit the relationship between tangible and intangible activities and value change even though these matters are not linear but multiple sets of complex exponential multipliers.

Security … crime

Security changes a lot … the value of security is high based on all the economic opportunity that exists when there is compared to when there is not. People need security in order to go about their daily lives and engage in socio-economic activities. A high crime neighborhood is associated with a poor quality of life!

Job opportunities

The “value” of a person is diminished when there are no job opportunities where a person may used their skills.

Organization

A place may have people and resources but nothing gets done and there is no progress. This is because there is no capacity for organization. Putting in place an framework of organization adds value to the community and enables resources to be used effectively to create the value for progress.

Better and better quality of life

The game is better and better quality of life … and the metrics of performance should have a focus on this. Better and better quality of life is the way this game needs to be scored, and the way the game is played. The “stats” should be all in support of this game. This is about social value as well as about business profit … it is about values in society as well as money and material wealth.

More and more and more is NOT the game!

The dominant performance metrics are all about money and profit and economic growth based on more and more and more economic consumption. The end game for this system of metrics is a planet that no longer works to support humanity … but will appear “profitable” until it is “too late”.

More and more growth is the prevailing metric! This is a dangerous situation … consumption growth and profits are the top metrics and a path that will ultimately … and maybe quite soon end up with global value destruction on an unimaginable scale.

The main metrics for global economic performance are large aggregates and averages about growth and capital market performance. These metrics have some importance in aggregate, but do not inform decision makers adequately. The measures used for global economic performance are interesting, but not very useful. They have connection with correlation … but do little or nothing to help with cause and effect and with making better decisions. TVM aims to change the mindset that economic performance is about more and more but is better when it is about improved quality of life for society.

Paradigm change

Not only a bigger pie … a better pie!

TVM is aiming for some paradigm change. In the TVM view, global economic performance is the aggregation of socio-economic performance in the individual communities. Progress and performance is a result of tangible activities at the community level … done by real people who understand the cause and effect of actions in their locality.

The history of economic performance has a lot to do with technology and productivity … and much less with issues like monetary and fiscal policy. Technology and productivity are the “changemakers” that enable the creation of wealth, while monetary and fiscal policy, and the framework of law merely reposition wealth among various constituencies in society.

The prevailing metrics suggest that the global economy has done very well when viewed from the luxury of society at the top of the socio-economic pyramid … but the performance of the global economy from the perspective of more than 4 billion people who are poor and hungry, the socio-economic performance is pathetic.

There are chronic problems with the socio-economic system and especially decision making and the allocation of resources and the accountability for resource use … and the prevailing system of metrics does little or nothing to help.

The singular incentive of money, power and profit has created a monster that is difficult to tame … but not impossible. Metrics are very powerful … but the metrics need to be about all the important things and not only about the money profit subset of metrics. There also need to be metrics about important social value matters, even though these are more difficult to quantify.

The way the modern socio-economic systems works is not merely inefficient, it is substantively dysfunctional. It does not have the capability to allocate resources to satisfy the real needs of billions of people, but puts resources into “creating” artificial need for people who already have more than enough for their well-being.

How do Heads of State become billionaires?

There is something very wrong with a socio-economic system where Heads of State in countries that are resource rich become money billionaires while the population of their countries remain in a chronic condition of poverty. This reflects decision making metrics that are money profit weighted with little or no attention to social values … or indeed basic moral values!

Money profit and value performance not the same

Money profit and value performance not the same … they are very different. The economic elite and major decision makers have become comfortable with profit measures that ignore all the value destruction in society that enables profit making at its maximum. The profit money accounting metrics are convenient … but fundamentally wrong.

Activity and impact are different as well

Activity and impact are different as well … though many people doing academic studies and carrying out ORDA funded projects report mainly about the activities they have done rather than any impact these impact that may have been realized!

Two main measures ... efficiency and effectiveness

TVM uses the basics of business cost accounting to get metrics about performance efficiency. The simple questions are (1) how much did it cost? and, (2) how much was done?

With the answers about cost and how much done, it is possible to calculate the “unit cost” of the work done. Performance is not just an absolute metrics … it is also about how much is achieved compared to what could have been achieved.

So there is a third question (3) how much should have been done with this amount of cost? This is often done in the corporate environment using “standard costs” which are the expected cost for any specific activity.

Efficiency is a function of the difference between the actual costs and the standard costs.

Alternatively, efficiency is the difference between what was done relative to what should have been done.

Cost accounting measures performance efficiency. In TVM this is complemented with value accounting so that all the elements of socio-economic value flows are taken into consideration.

Cost efficiency is the simple idea of comparing the actual cost with what the cost should have been. This is a powerful way of getting control of operational performance. How much should it have cost to do what was done?

Knowing how much got done is pretty basic. Without knowing how much got done, there can be no oversight, control or accountability ... no inventory control ... no operational analysis ... in other words, without knowing how much got done, the whole process of management falls apart. With cost analysis it is possible to move on to evaluate whether or not the operations are efficient. One way of doing this is to compare what is being achieved with what should be achieved.

What it should have cost is a technical question. The cost that it should be can be calculated based on what needs to be done and the prevailing processes and costs. The cost in one place can be compared to costs in other places. The cost now can be compared to costs in a prior situation.

Cost efficiency is the simple idea that something should have cost X but in fact cost Y. The cost X is the cost that would be expected with a reasonably high level of performance efficiency ... usually calculated by reference to technical specifications, knowledge of the work to be done, and so on. The actual cost Y is what the accounting shows the item actually cost.

A standard cost is simply what something should cost based on technical considerations and the prevailing normal prices. A well done calculation of standard cost includes norms for efficiency and what would be usual in the usual setting. In the international context different standards may be used for different countries, and used for comparative analysis.

The international relief and development community has been doing “relief and development” for upwards of 60 years. A corporate cost accounting mindset would have set the stage for this community to know quite clearly what things should cost ... but rather than being an “open book” with a full set of accessible standard costs, the cost of everything is treated rather like a “state secret” that will put the nation in danger. Underneath this secrecy ... costs are probably too high and performance too low ... and no transparency a must

When there is a variance and costs are significantly higher than they “ought to be” there is almost always a reason. Frequently the reason is that the buyer and the seller ... people usually, but sometimes the institutions ... have some agreement that is not in the best interest of the groups that should be benefiting from the transaction. This is a common problem.

A public TVM database of standard costs will help to identify situations where costs are out of control or have been distorted by inappropriate transactions. A very simple database of costs will enable comparisons to be made ... and judgments made about where costs are out of line. Too low a cost may be an indicator of a problem just as much as too high a cost. Sometimes low cost is achieved by low quality ... and this might well have serious secondary effects.

Low cost (price) drugs may be because a supplier is forgoing high profits ... which is good ... or it might be because the drugs being supplied are sub-standard and maybe dangerous ... which is bad.

Effectiveness

Effectiveness is not the same as efficiency. They are two very different measures that are critical to management and oversight of performance. A society will progress best when the socio-economic activities are both efficient and effective.

Performance is not just an absolute metrics … it is also about how much is achieved compared to what could have been achieved.

What progress for the money? In money accounting terms cost effectiveness is progress relative to the money used.

What value adding for value consumed? In value accounting terms effectiveness is progress or value adding relative to the resources consumed.

Money metrics a proxy for value metrics … in many cases the money metrics are a reasonably good proxy for the value metrics … but not always.

Need to measure impact, not activity. A football game … American football, that is … is won when points are scored, not merely by having the players “in motion”. The amount of “activity” is merely motion, unless the motion results in some sort of impact.

A society progresses when its socio-economic activities are efficient and effective. TVM therefore incorporates cost accounting that measures performance efficiency and value accounting that is the basis of socio-economic productivity. Performance is not just an absolute metrics … it is also about how much is achieved compared to what could have been achieved.

Productivity measures in the main are broad indexes of relationships between for example the revenues of an industry with the payroll of the industry. This measure suggests that productivity is increased when there is more output for less input. But this measure ignores all the value impact associated with, for example, less payroll and therefore higher unemployment and its associated value destruction.

Money and material resources at the community level only benefit the beneficial owners of these resources unless other things are going on as well. The metrics of the community performance must identify not so much the ownership of money and material wealth, but whether or not the community is constrained because these things are not being used for any benefit in the community.

Take the case of a bank in a community that has control over money and material resources in a community.

Banks operate in and have branches located in most communities … not all communities … but many. A bank is a custodian for money wealth, and produces money profit for the owners of the bank and its senior executives and decision makers using this wealth. All of the bank's money transactions are recorded and periodically consolidated and reported on. There is no reporting of what the bank does for the community where is is located … whether the bank serves to diminish the performance of the community and quality of life or not … the only metrics are about the bank's profits!

Wealth Growth NOT a Good Measure

The driving force of modern market economics and capitalism has been the simple idea that the pursuit of wealth is the best incentive for people to be fully engaged in activities that produce progress. There is no question that an economy based on this premise is better than one driven by egalitarian sharing of the product of enterprise … as in socialism or communism … but that does not mean that the capitalist market system works very well and is the best that can be devised.

Without an alternative measure of performance the capitalist market system is going to be “the best there is” … but, based on true value metrics it is abundantly clear that something better is possible.

Building wealth by the exploitation of the poor is as old as history. There is nothing wrong with the creation of wealth … but there is a lot wrong when there is little progress out of poverty because it is the price being paid for the accumulation of wealth and its concentration in the corporate sector and among powerful individuals in the economic elite. Concentration of economic power was seen as detrimental to society in the era of the “robber barons”, and the basic logic of the argument has not changed at all over the years.

| . |

| CORE CONCEPTS of TRUE VALUE ACCOUNTING |

| OPERATIONS / PROFIT AND LOSS ACCOUNT |

|

ACTIVITIES USE RESOURCES AND DELIVER RESULTS

Details of activities are not needed to measure PROGRESS | ||

|

PROGRESS is the increase in VALUE (of the STATE) from beginning to end of the period

Simply measure the change in the VALUE or everything |

|

PROGRESS is the increase in VALUE (of the STATE) from beginning to end of the period | ||

|

|

|

| Simply measure the change in the VALUE of everything | ||

| In this case the activities of the period do not change the state ... state at the end of the period (EOP) is the same as at the beginning of the period (BOP) |

| The Components of the Operating Statement / Profit and Loss Account | |||

|

Conventional GAAP Accounting

The primary PURPOSE of GAAP accounting and financial reporting is to inform investors about the performance of the organization. | True Value Impact Accounting | ||

|

Revenues, Costs and Profit or Loss

A conventional financial statement includes an Operating Statement or Profit and Loss Account. This is a summary of all the money transactions for the period with all the revenue related transactions aggregated and all the cost related transactions aggregated. Transactions that only change the balance sheet accounts are not included in this summary. The revenue number is related to price ... that is the selling price. The cost numbers are related to cost ... that it the purchase price. |

Impact on ALL the CAPITALS

FINANCIAL CAPITAL. HUMAN CAPITAL and CREATED CAPITAL | ||

|

Revenues and Cost of Sales

A core concept is that the revenues in a period must match the costs of the period in order to give an accurate reporting of the profit for the period. |

Impact on FINANCIAL CAPITAL. HUMAN CAPITAL and CREATED CAPITAL

| ||

|

Revenues

Over the years the manner of presenting financial reports has been driven by the need for investors to be better informed about how managers are handling the resources of the company for the benefit of the shareholders. |

Impact on FINANCIAL CAPITAL

| ||

|

Revenues

Revenues are a function of quantity and price. |

Impact on FINANCIAL CAPITAL

| ||

|

Cost of Sales is a function of quantity and cost

Revenues are a function of quantity and price. |

Impact on FINANCIAL CAPITAL

| ||

|

Cost of Sales

Cost of Sales is a function of quantity and cost. As a result of a sale, there is a credit to sales in the amount of the sale and a debit to inventory in the amount of the cost of sales. The computation of unit cost and the debit to inventory may be done using a First In First Out calculation or a Last In First Out calculation. Over time, when costs are fluctuating, the selection of the costing method can change the resultant inventory balance significantly. |

Impact on FINANCIAL CAPITAL

| ||

|

Elements of Cost

... Raw materials ... Component parts ... Energy ... Equipment use ... Labor payroll ... Worker benefits ... Other supplies ... Marketing, advertising etc ... General admin and overhead ... Financial expenses ... Taxation ... Pro-good expenditures |

Impact on FINANCIAL CAPITAL

| ||

| . |

| HOME | BRIEFS | L020-IS-ISSUES-ALPHA | L020-IS-ISSUES-CHRONO | Last txt00024408 | Next txt00024410 |