Date: 2024-12-26 Page is: DBtxt003.php txt00003268

Ideas

Chris Cook and a Real Economy

Transition ... Market 2.0 ... Chris Cook makes a presentation (slides) on Barter 3.0 IRTA Convention Ocho Rios 14th September 2012

Burgess COMMENTARY

Peter Burgess

1. Barter 3.0Back to the Future Chris CookIRTA Convention Ocho Rios 14 September 2012

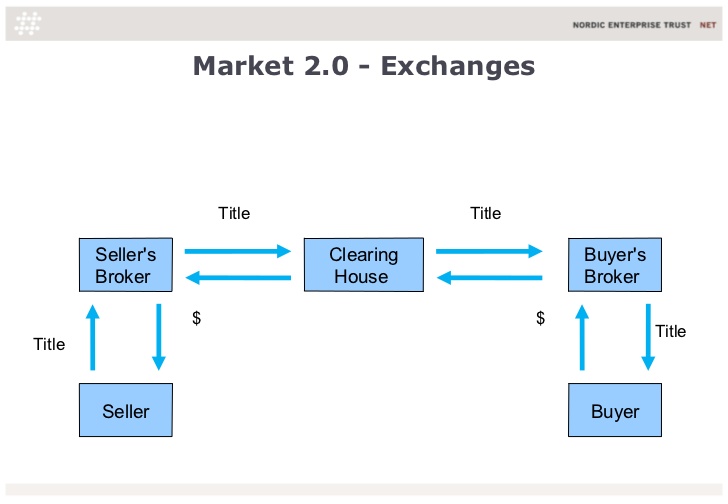

2. Market 2.0 - Exchanges Title Title Sellers Clearing Buyers Broker House Broker $ $ TitleTitle Seller Buyer

3. Financing and Funding FinancingPeople-based creditShort/medium term, medium/high riskFinances circulation of goods & services and creation of new productive assets FundingAsset-based creditMedium/long term, medium/low riskFunds completed productive assets

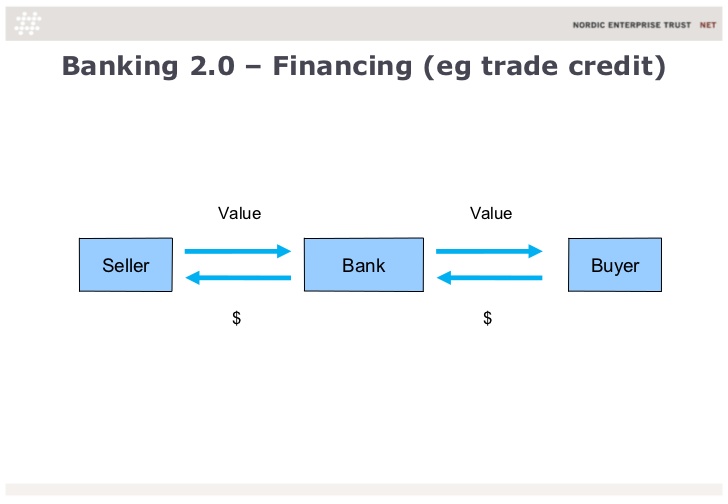

4. Banking 2.0 – Financing (eg trade credit) Value Value Seller Bank Buyer $ $

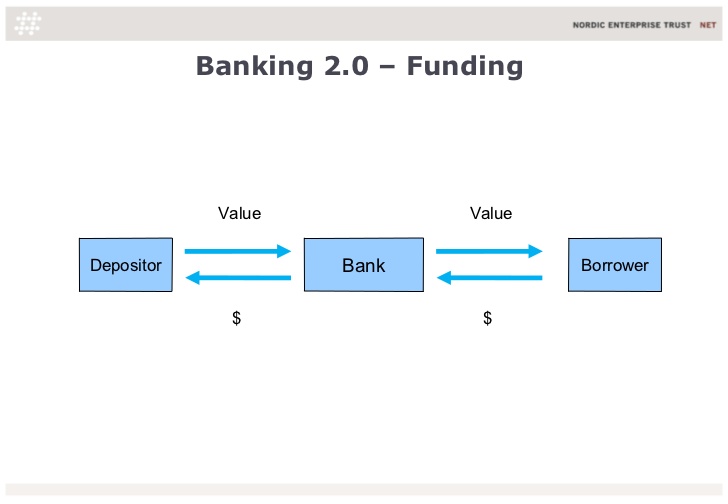

5. Banking 2.0 – Funding Value ValueDepositor Bank Borrower $ $

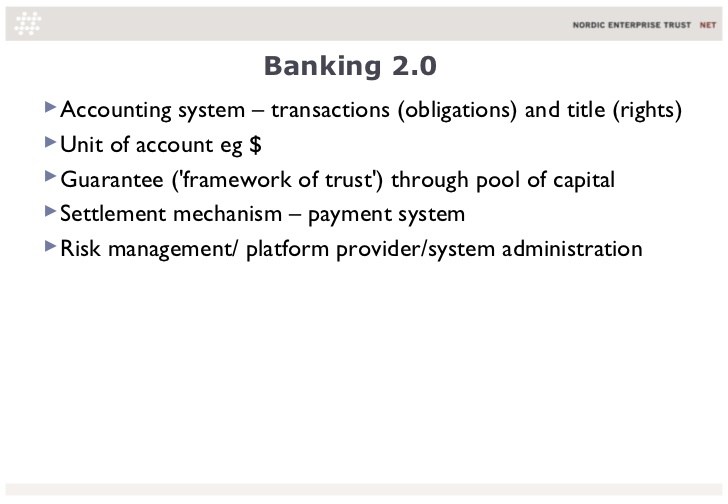

6. Banking 2.0 Accounting system – transactions (obligations) and title (rights) Unit of account eg Guarantee (framework of trust) through pool of capital Settlement mechanism – payment system Risk management/ platform provider/system administration

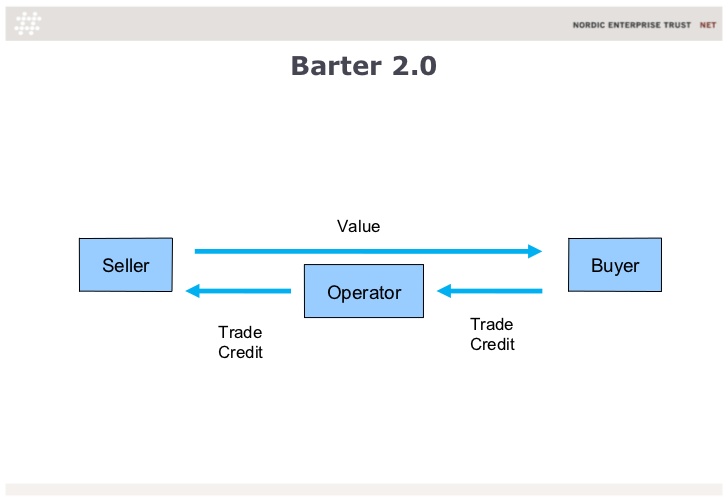

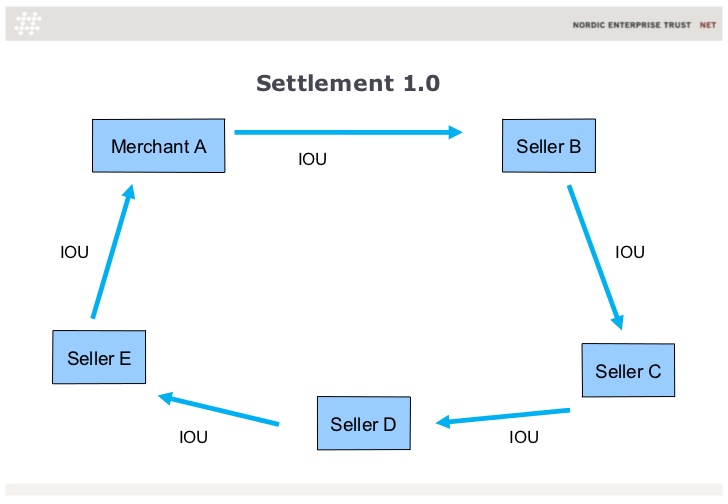

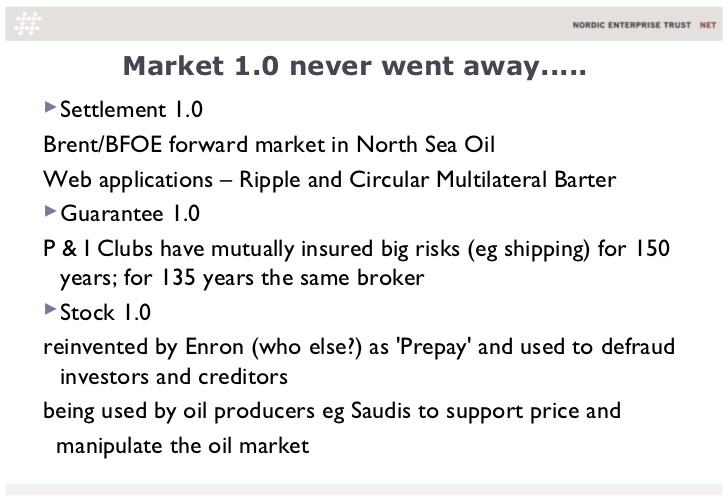

7. Barter 2.0 ValueSeller Buyer Operator Trade Trade Credit Credit

8. Lets look back to Market 1.0

9. Settlement 1.0 Merchant A Seller B IOUIOU IOUSeller E Seller C Seller D IOU IOU

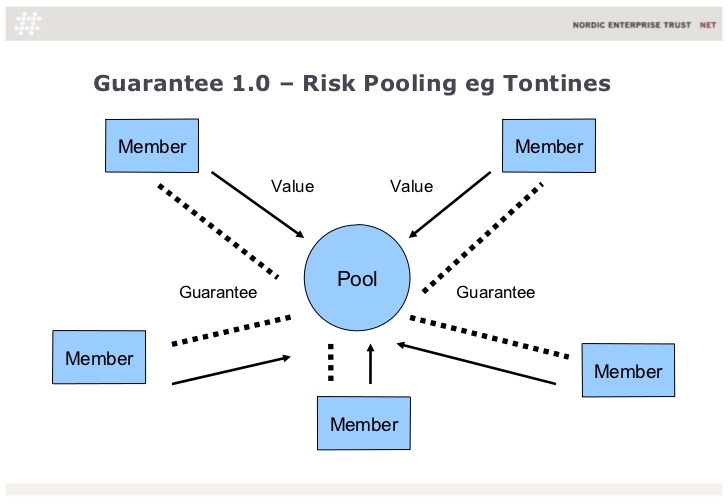

10. Guarantee 1.0 – Risk Pooling eg Tontines Member Member Value Value Pool Guarantee GuaranteeMember Member Member

11. Credit 1.0 - Stock

12. Market 1.0 never went away..... Settlement 1.0Brent/BFOE forward market in North Sea OilWeb applications – Ripple and Circular Multilateral Barter Guarantee 1.0P & I Clubs have mutually insured big risks (eg shipping) for 150 years; for 135 years the same broker Stock 1.0reinvented by Enron (who else?) as Prepay and used to defraud investors and creditorsbeing used by oil producers eg Saudis to support price and manipulate the oil market

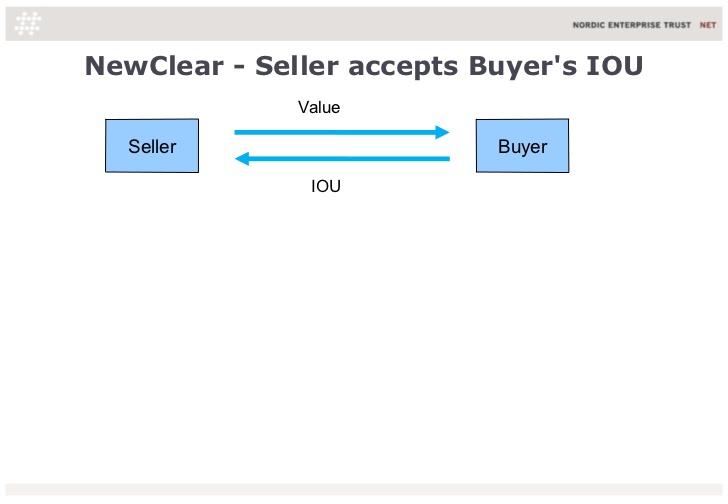

13. NewClear - Seller accepts Buyers IOU Value Seller Buyer IOU

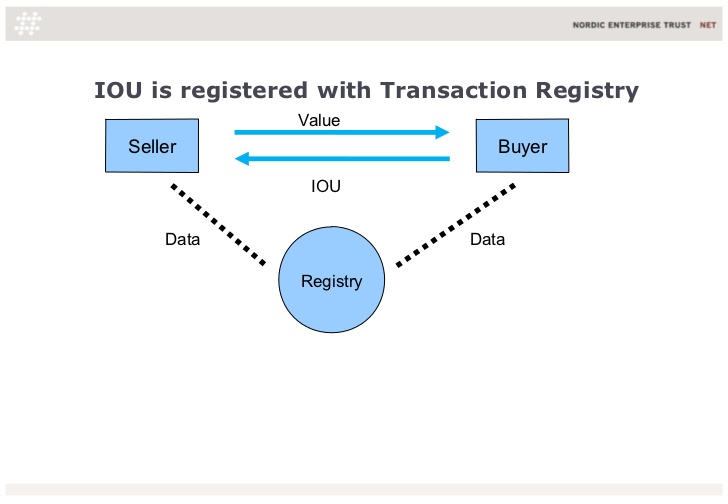

14. IOU is registered with Transaction Registry Value Seller Buyer IOU Data Data Registry

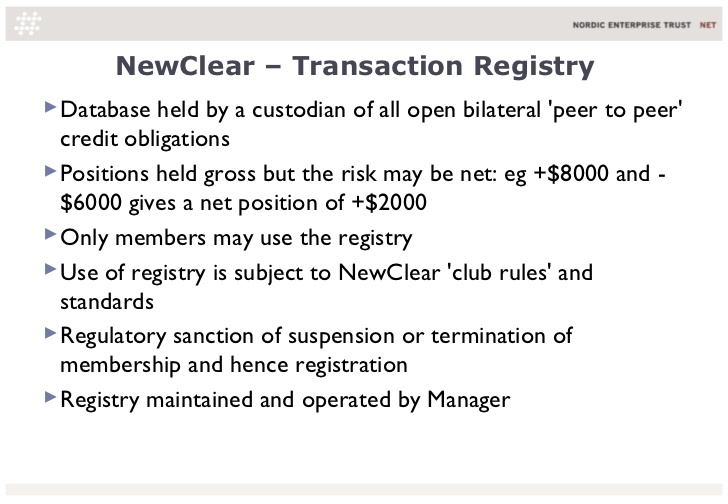

15. NewClear – Transaction Registry Database held by a custodian of all open bilateral peer to peer credit obligations Positions held gross but the risk may be net: eg +$8000 and - $6000 gives a net position of +$2000 Only members may use the registry Use of registry is subject to NewClear club rules and standards Regulatory sanction of suspension or termination of membership and hence registration Registry maintained and operated by Manager

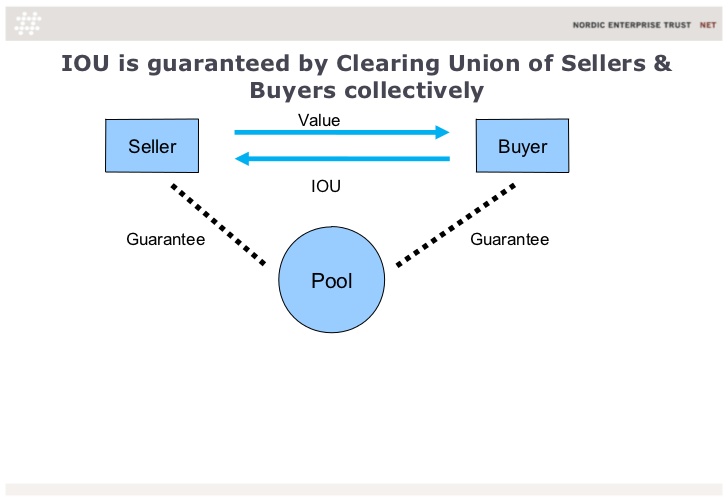

16. IOU is guaranteed by Clearing Union of Sellers & Buyers collectively Value Seller Buyer IOU Guarantee Guarantee Pool

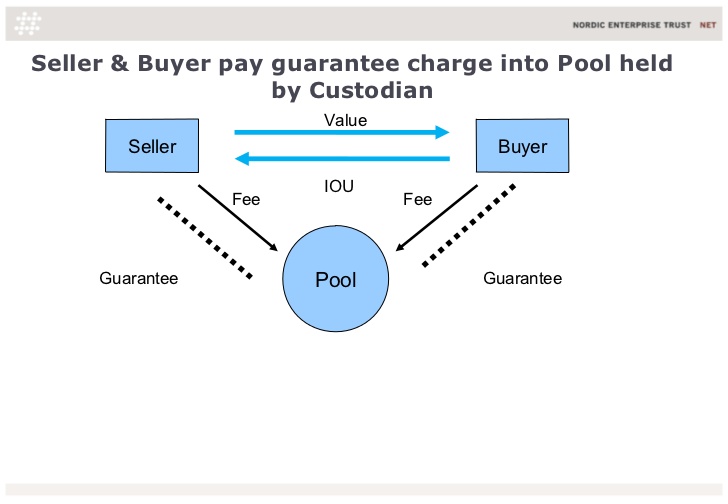

17. Seller & Buyer pay guarantee charge into Pool held by Custodian Value Seller Buyer IOU Fee Fee Guarantee Pool Guarantee

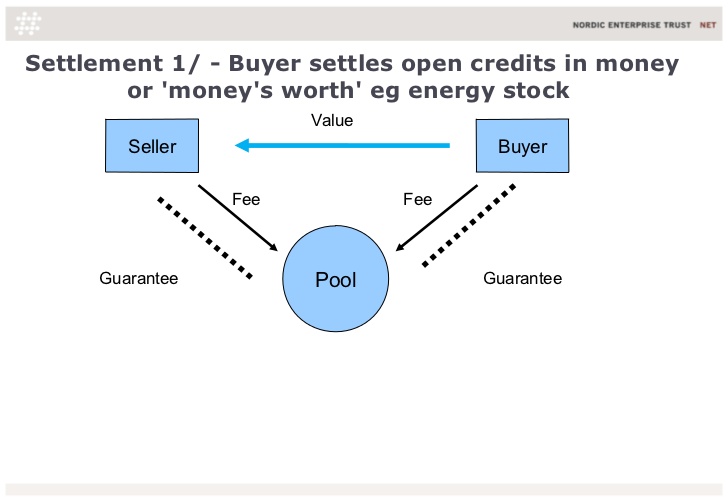

18. Settlement 1/ - Buyer settles open credits in money or moneys worth eg energy stock Value Seller Buyer Fee Fee Guarantee Pool Guarantee

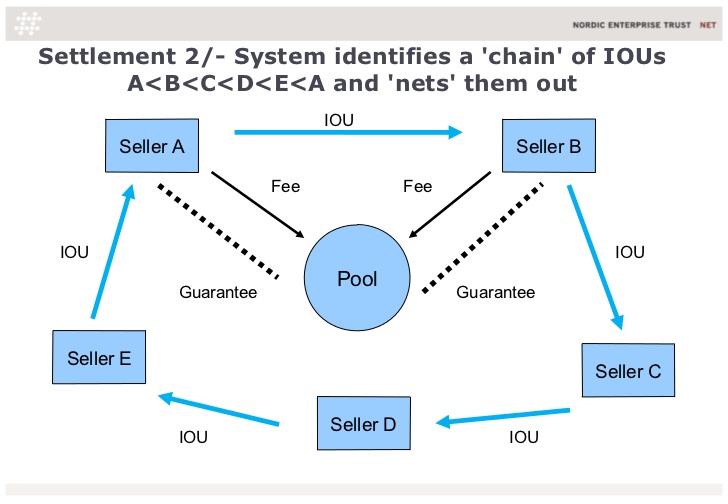

19. Settlement 2/- System identifies a chain of IOUs A

20. Settlement 3/ - Buyer defaults: system pays sellers and collects from buyer if possible Seller A Buyer Default Collects Pays Default Pool Seller B Pays

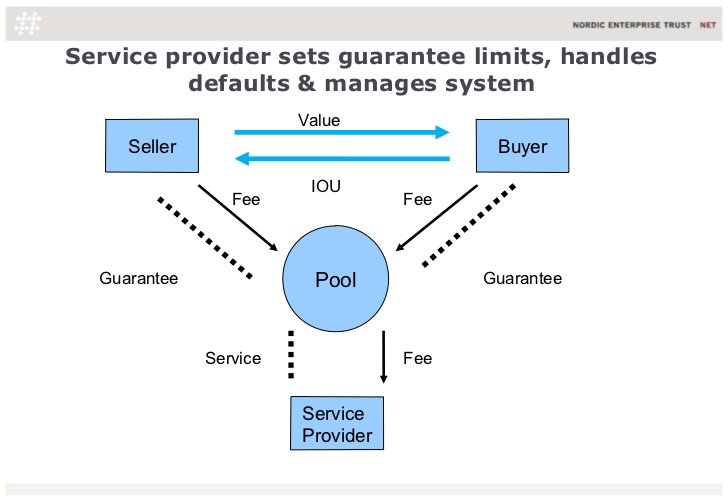

21. Service provider sets guarantee limits, handles defaults & manages system Value Seller Buyer IOU Fee Fee Guarantee Pool Guarantee Service Fee Service Provider

22. Outcome – the community is the currency Communities have a common bond eg geographical or functional Community-based credit provided at cost with shared operating and default costs Service providers interests are aligned with system users No interest (money for the use of money) means system will out-compete conventional for profit credit Sharing of risk and reward B2B credit may be extended to B2C

IRTA Conference - Barter 3.0 transition — Presentation Transcript