Date: 2024-08-16 Page is: DBtxt003.php txt00003352

Metrics

PULSE

The Alphabet Soup of Impact Measurement Tools: PULSE Makes Data Easier to Digest ... PULSE is the only software on the market that works seamlessly with Salesforce.com and integrates with the IRIS taxonomy.

Burgess COMMENTARY

This is interesting ... and in many ways I understand where PULSE fits in. From the article I picked up on the following:

PULSE is preconfigured with the IRIS taxonomy; however, the tool is flexible enough to support other frameworks and/or custom metrics that are specific to your organization. This means social investors of all types, from foundations to nonprofits to private equity firms, can just as easily track the non-financial metrics of an investment as the traditional, financial return.This is well and good ... but the core problem of social impact metrics remains, that is, the metrics are all about the organization and what it does or says it does rather than being impact as seen from the perspective of the beneficiaries.

Separately TrueValueMetrics has analyzed the IRIS taxonomy. TRM will develop a revised taxonomy that (1) could work with a community perspective and (2) has the TVM methodology for state, progress and performance built in.

Peter Burgess

The Alphabet Soup of Impact Measurement Tools: PULSE Makes Data Easier to Digest

PULSE is the only software on the market that works seamlessly with Salesforce.com and integrates with the IRIS taxonomy.

By Beth Busenhart

Now that we have established a basis for understanding the roles of IRIS and GIIRS in measuring and evaluating impact, let’s shift back to the individual fund manager or organization that is exploring business process management for impact measurement.

Ask any portfolio manager and they will likely tell you that tracking the impact of their investments is one of their greatest challenges. According to a recent report from J.P. Morgan, the impact investing industry’s biggest risk is around investment illiquidity and uncertainty of financial returns. Organizations must be able to effectively demonstrate impact in order to mitigate these risks by making a case for a long view and a more patient form of capital.

For impact data to be useful to an organization, it needs to be collected and managed in an organized way. This is where PULSE comes in as a technology solution to support these processes and manage impact data. A discussion of PULSE also brings us back to the initial question that prompted this series: a question our team gets frequently from impact investors, nonprofit organizations and foundations: “We’d like to start using PULSE to track our impact and show the benefits in a measurable way. Where do we begin?”

What is PULSE?

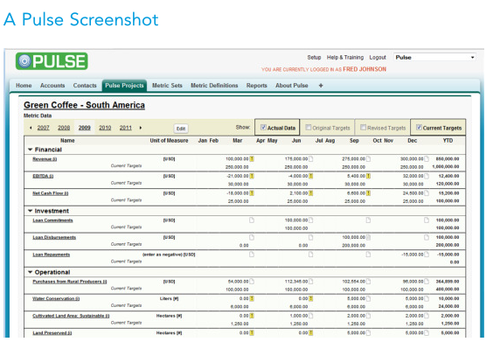

PULSE is a database that allows for flexibility in how data is collected, managed and reported. As a cloud-based application, PULSE can be accessed through a web browser and data is securely stored off-site. This means data can be accessed and entered anywhere with an internet connection, making it a flexible solution for organizations all over the world. For example, multiple users can access the same data in real time, allowing for increased transparency across the organization with easy access to information and the ability to share institutional knowledge. The ultimate benefit of PULSE, however, rests with the ability to look at data across a portfolio and truly manage impact. Data can be queried and analyzed using robust reporting functionality.

How Does PULSE Work?

PULSE is preconfigured with the IRIS taxonomy; however, the tool is flexible enough to support other frameworks and/or custom metrics that are specific to your organization. This means social investors of all types, from foundations to nonprofits to private equity firms, can just as easily track the non-financial metrics of an investment as the traditional, financial return. Social investors including Acumen Fund, Kellogg Foundation and Accion International are using the cloud-based software to track and benchmark financial, operational, environmental and social data to better demonstrate impact and be better informed about where to allocate future funds.

What is the PULSE Story?

In 2006, Acumen Fund – one of the largest social investment firms globally – recognized the need to move social impact investing into the world of reporting and accountability. Equally important, Acumen Fund sought to lead the way toward a standardized set of data to globally benchmark and better understand the impact of social investing.

So Acumen Fund recruited a team of volunteer engineers from Google to build the first prototype of a portfolio management system. The developers produced a system called PDMS (Portfolio Data Management System), which was implemented across the Acumen Fund portfolio. The software generated widespread interest and was further developed to be more flexible and include a wider range of features, which ultimately evolved into the software known today as PULSE.

In 2006, Colorado-based software company Application Experts won the bid to become the exclusive PULSE Manager. By accepting the bid, Application Experts signed on to develop PULSE and take it to market.

PULSE is the only software on the market that works seamlessly with Salesforce.com and integrates with the IRIS taxonomy, and the software is provided free to nonprofits and discounted for B-Corps worldwide.

Which Organizations Benefit Most From PULSE?

PULSE is a good fit for an organization that already has a monitoring and evaluation program in place for tracking impact. This means that a mission aligned theory of change has been established, outputs and outcomes have been identified, and metrics and indicators have been chosen to measure progress against goals or objectives. This begs the question, however, that if processes are already working, why does an organization need a system like PULSE?

It’s really a matter of scale. It might make sense in the beginning to simply track data in an excel spreadsheet, but as an organization or portfolio grows the spreadsheet method can prove cumbersome and unstable. It also has substantial limitations when it comes to reporting and sharing data.

Begin PULSE With The End in Mind

If your organization’s overarching goal is to gather support for and proof of a theory of change, it is imperative to collect useful impact data. Organizations will vary greatly in how they choose to position their data to make their impact cases. This may mean contributing to industry benchmarks through IRIS or getting GIIRS rated, but it may also mean having strong internal controls around meeting stated objectives presented through robust annual reporting. PULSE allows these large periodic efforts to be streamlined by having a consistent means of capturing data.

In addition, a well maintained database makes information useful any time you are looking to answer questions about your portfolio. Imagine a scenario in which you are on a conference call with a group of stakeholders when you are pressed for details about the specific impact in Sub-Saharan Africa of the investments in your water portfolio. Now imagine that you have at your fingertips a query that demonstrates how in the first quarter there were 51 full-time jobs created and 543 lives impacted over the life of the water projects in that region.

That is powerful stuff.

Other Technology Solutions for Impact Investors

Finally, keep in mind: Your organization’s impact management should not occur in a vacuum. The systems you use should be integrated with your company’s overall technology strategy. Because PULSE is built on the Salesforce.com platform, integration is possible with CRM (customer relationship management) systems and other business process management tools.

When integrated, these systems provide a full front-office solution that can deliver powerful advantage by organizing and leveraging institutional knowledge. Accion International, for example, uses an integrated technology strategy that includes PULSE and Salesforce.com. Accion also uses a cloud-based software product called AIM for pipeline management. The integrated system has facilitated process improvement, transparency, and knowledge sharing across the Accion team.

Implementing and maintaining technology to support your organization’s business processes, including impact management, is not a small undertaking. A plan must be thoughtfully laid out and executed, which will require an investment of resources. As the PULSE manager we have seen nonprofit clients who have been successful implementing PULSE themselves with a dedicated internal champion who has the technical skills to customize the solution. We also have clients who prefer to work directly with a consultant who understands their business, has the technical expertise to get the software up and running efficiently, and can train the team with minimal disruption to operations.

Whichever approach is right for your organization, the return on your investment will lead to more transparent, reportable, and flexible impact management.

Previously:

How GIIRS Flavors Impact Investing’s Alphabet Soup of Measurement Tools

Decoding Impact Investing’s Alphabet Soup of Measurement Tools