Date: 2025-03-11 Page is: DBtxt003.php txt00003521

Economics

Trade Deficits and Fiat Currencies

Robert Murphy ... Mises Institute ... Trade Deficits and Fiat Currencies

Burgess COMMENTARY

Peter Burgess

Trade Deficits and Fiat Currencies

In my opinion, given the current political and cultural climate, the two biggest threats to economic liberty are environmentalism and trade protectionism. On these pages I've written numerous articles[1] on the latter, where I restated the traditional case for free trade, and defended it in light of new concerns such as outsourcing and global capital mobility.

Although Austro-libertarians have always been staunch supporters of free trade, many are worried over the unusually large current account deficits of recent decades. Even though they concede that a truly free market trade deficit would be perfectly benign, they believe that the current 'global imbalances' in trade patterns largely reflect the behavior of central bankers, rather than voluntary exchanges between private individuals across the planet.

Although isolated passages may have been ambiguous, I have tried to always stress the caveat that my 'defense' of trade deficits was conditional. In particular, I have used my hypothetical examples to illustrate that a trade deficit need not be alarming. I felt this was necessary to defuse the popular misconception — held even by serious analysts — that it is literally impossible for a country to experience perpetual trade deficits, or that a trade deficit is necessarily analogous to buying a fancy dinner with a credit card.

To reiterate, this type of extreme position is simply false. If an American entrepreneur starts up a new company and issues equity or debt to raise capital from foreigners, then that contribution to the 'capital account surplus' is at the same time an addition to the current account deficit. To put it differently, if you prefer that foreigners invest more capital here than Americans invest in other countries, then the rules of accounting force you to favor a trade deficit.[2]

In reaction to arguments along these lines, many bona fide Austrians have objected that America's recent trade deficits are not due to infusions of capital in productive enterprises. Rather, as expressed in the so-called 'twin deficits' theory, according to which government budget deficits cause trade deficits, the US trade balances have been skewed by massive government debt finance. In a nutshell, foreign central banks, particularly China's, have gobbled up hundreds of billions of dollars worth of bonds from Uncle Sam. According to the alarmists, this injection of foreign savings has allowed American consumers to maintain a high level of apparent prosperity, despite their abysmally low savings rate. But as Austrian business cycle theory informs us, this fiat house of cards must eventually collapse.

There is no doubt that the world monetary and banking system is unsound, and would be unbelievably better off if governments returned these vital institutions to the free market. For their part, my Austrian critics have always agreed that tariffs and other government barriers to trade are immoral and inefficient.

Thus we all agree on the theoretical economics and the value judgments. Our real disagreement, then, is empirical. Namely, is the current situation really perched on the edge of a precipice?

I believe the answer is no, and that's why I predicted that (absent a terrorist attack) the dollar would strengthen against the euro in 2007, and that (despite the inverted yield curve) there would be no recession, as officially defined. In making such predictions, I am fully aware that I run the risk of mimicking Irving Fisher's infamous statements immediately before the Crash in 1929.

On the other hand, the alarmists have also gone out on a ledge. For example, Paul Craig Roberts has predicted that if outsourcing and other trends continue, the United States will be a 'third world country' by 2024. One of the more vocal critics of my last article apparently has a public wager that the US Federal Reserve Note won't see its 100th birthday (in 2014). So while I take seriously the possibility that my predictions will turn out to be as naïve as those of Fisher, I think Paul Craig Roberts and other alarmists should recall the example of Paul Ehrlich.

As I said above, this isn't an issue that can be settled with a priori arguments, since it's theoretically possible for a large trade deficit to signify either a healthy, growing economy or a debt-ridden, capital-consuming one. For the remainder of this article, therefore, I lay out some figures that may surprise the reader who tends to side with Peter Schiff and others who are very worried about the US trade deficit.

Are Trade Deficits Sustainable?

Many analysts acknowledge that a trade deficit for a year or two may be perfectly healthy. Yet they point to the string of massive (and growing) consecutive trade deficits, going back some 30 years, as an apparently obvious sign that something is seriously wrong with the current system of world trade.

Again, I won't go so far as to say these analysts are necessarily wrong in their conclusions, but I do claim that their argument is invalid. We can see this by looking at historical trade data.[3] According to my quick eyeballing, in the United States during the period from 1845 to 1875, there were only two years in which the 'balance on goods and services' was positive; we had trade deficits in all the others, and moreover the size of the surpluses in those two years was dwarfed by the magnitude of some of the deficit years. Now did the United States fall off the map after this thirty-year period of 'unsustainable' consumption? Or, would it be fair to say that the US economy was in decent shape relative to the rest of the world, by the late 1800s?

For gold bugs who explore the historical tables, I also bring to your attention another surprise. From 1904 to 1914, the 'balance on goods and services' was positive, but never higher than $427 million. Yet in the aftermath of the Federal Reserve (which opened for business in 1914), the trade balance surplus shot through the roof, averaging well over $1 billion from 1915 until the Great Depression.

Now before you email me and explain that World War I production had a lot to do with this… I totally agree. But to listen to some of the harshest critics of our current trade deficits, one might have expected that the United States had a 'healthy' trade surplus until the establishment of the Fed, after which our trade balance went into the red. Yet that's the exact opposite of what happened.

Let me reiterate: the Federal Reserve and the federal government in general of course grossly distort the world economy. Yet many of the strongest critics of this intervention have a poor understanding of the mechanics of trade. I am not trying to defend the Federal Reserve, but rather trying to correct faulty arguments.

Twin Deficits?

Besides inflating the money supply, the federal government is blamed for running huge budget deficits that exacerbate the trade deficit. In particular, when Uncle Sam sells bonds to foreigners in order to finance current consumption, it makes the trade deficit higher than it otherwise would be.

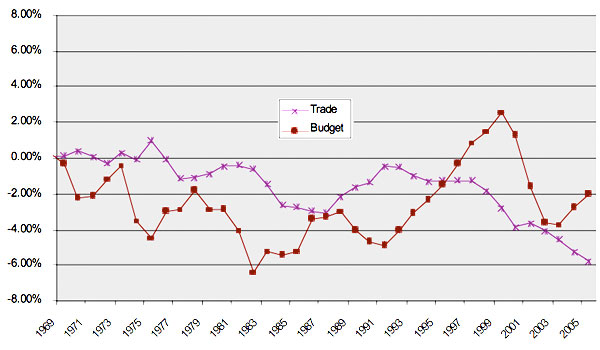

This argument is correct so far as it goes. However, we can't therefore conclude that our massive trade deficits in recent decades are merely the symptom of government profligacy. If they were a simple reflection, then you'd expect to see budget and trade deficits moving in lockstep. And yet, that's not what we see at all, as I show in the following chart.

'Twin Deficits' in the United States, as percentage of GDP

Contrary to the arguments of the alarmists, if anything the trade and budget deficits have moved in opposite directions over the last few decades. In particular, some of the largest trade deficits occurred just as Clinton 'officially'[4] balanced the federal budget.

How to explain this? Well, if we recall that a current account deficit is the flip side of a capital account surplus, a plausible theory would run like this: when the United States adopted pro-growth policies, it led to increases in tax revenue and an inflow of foreign investment. Hence, better economic policies would tend to cause lower budget deficits yet higher trade deficits.

One last point about the Clinton years: disregard the rhetoric from Fox News. It's true that Clinton raised taxes early on. But in 1997 Clinton (prodded by congressional Republicans) cut the capital gains tax from 28% to 20% and allowed a much more generous exemption for capital gains on home sales. This policy shift partially explains the growth in stock and real estate values; the markets aren't completely helpless in the face of a fiat currency, and some of the 'bubbles' aren't so irrational after all.

The China Syndrome

The last topic I'd like to address is China. Part of the reason I have been so adamant in critiquing (what I believe are) faulty claims about our trade situation is that much of the overall discussion is very suspicious of China. Inasmuch as the hawks would love another Cold War, it seems crucial to me to exonerate the Chinese on some of the more ridiculous charges.

For one thing, there is an apparent contradiction in the alarmists' rhetoric. On the one hand, we are supposed to be terrified of the massive liabilities that are mounting with foreign central banks. Yet at the same time, we are supposed to be horrified that our money is tied to nothing, that the dollar is just a worthless piece of paper. Well that's true (in a sense), but doesn't this cancel out the first objection? Why should we worry about owing foreigners trillions of pieces of 'worthless' paper?

Another common charge we often hear is that China is 'financing our government's irresponsible deficit spending.' Yes, that's certainly true. But why should we be angry at the Chinese over this? Without the influx of their savings, US interest rates would be higher than they are now. And contrary to the claims of some Austrians, it is not a Misesian boom-bust cycle if a foreigner (even a foreign central bank) lowers interest rates by providing real savings.

$17 Again to avoid confusion: Of course the actions of the Chinese government are distorting world trade patterns and US interest rates. But it is distorting in our favor. If the Chinese government stole a bunch of TVs from its people and shipped them to Americans chosen randomly from the phone book, that would also distort international production and trade patterns. But it certainly wouldn't make Americans poorer.

Conclusion

All Austro-libertarians can agree that central banking, as well as government barriers to trade, are immoral and inefficient. Yet these a priori principles do not immediately inform us as to the strength or weakness of today's economy. Contrary to the doomsayers, I do not believe that the world financial system, and the US market in particular, is headed for certain disaster.

Yes, government intervention always causes distortions and makes us all poorer than we would otherwise be. Yet as the 20th century experience of the United States demonstrates, the market can often overcome the obstacles put in place by the politicians. The recent innovations in finance and international trade are largely beneficial, and reflect the efforts of countless entrepreneurs to make our lives better.

Robert Murphy is the author of The Study Guide to Man, Economy, and State and the headmaster of the Mises Classroom.

Notes

[1] Some examples are 1, 2, and 3.

[2] Strictly speaking, the goods and services balance is only one component of the current account, but for our purposes this subtlety can be ignored.

[3] For the historical data, I used this [large pdf] from the Census Bureau. The tables I cite appear on pages 867 and 868 of the scanned document (i.e., not Adobe's numbering).

[4] I put this in quotation marks because the gross federal debt, even by the government's own accounting, increased every year under Clinton. Even so, his profligacy was relatively modest compared to other recent presidents.

You can receive the Mises Dailies in your inbox. Subscribe or unsubscribe.

About the Author

Robert P. Murphy

Robert Murphy is an adjunct scholar of the Mises Institute, where he teaches at the Mises Academy. He runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to 'Man, Economy, and State with Power and Market,' the 'Human Action' Study Guide, The Politically Incorrect Guide to the Great Depression and the New Deal, and his newest book, Lessons for the Young Economist.