Date: 2025-10-18 Page is: DBtxt003.php txt00005889

Environment

Carbon

Al Gore: world is on brink of 'carbon bubble' ... Gore and partner David Blood call on companies to 'do their fiduciary duty' and identify carbon risks in their portfolios

Burgess COMMENTARY

B-Team

Simply put, we can't burn 2/3 of the existing fossil fuels if we are to prevent the worst aspects of climate change. At the same time we can't afford to write off 2/3 of the value of the fossil fuels

Jae Mather Director of Sustainability HW Fisher & Company

Al Gore: world is on brink of 'carbon bubble' theguardian.com Gore and partner David Blood call on companies to 'do their fiduciary duty' and identify carbon risks in their... [see below for full text]

Peter Burgess

Founder/CEO at TrueValueMetrics ... formerly international business and development consultant and corporate CFO

This article highlights the inherent dysfunction of the metrics that are being used to report on the social and economic progress of society. We have used money as the measuring stick and it is just not suited to the job. There needs to be a number we can talk about that is not money, but reflects the value people put on the item. The idea of quantifying value is at the core of the emerging impact analysis system of TrueValueMetrics (TVM) that is now being called Multi Dimension Impact Accounting (MDIA)

People tell me all the time that you cannot quantify things like happiness and measure it and give it a number. I disagree. Worse, by refusing to number important things like happiness and damage to the environment, the default is zero, which is absolutely wrong. Different people think of value in different ways, but all this means for the quantification project is that one item is going to have a different number when viewed from different perspectives. I might value a steak dinner at 20, while my vegan friend may only assign it a value of 1. I will pass on the salad, but my vegan friend will be perfectly happy with it.

The TVM value numbering project is not simple. Economists have done a lot of work on the underlying behaviors, but in the end have not set up the numbering system that will make impact value analysis meaningful through easy to understand numbering. An item will have many numbers associated with it depending on the situation and depending on the perspective. Water has one value in a drought and a very different value in a flood. Money has a very different value when you have none and cannot buy even the basic essentials than it does when buying a handbag for $5,000 is chump change!

In the MDIA framework every individual may have their own value profile. These profiles may be aggregated for a community, a place, a region, a country and for the planet. The profiles are normalized in the sense that the aggregation process adds up and averages.

In MDIA progress and performance are not just the profit performance of an organization and the wealth impact for investors, but something more nuanced. Progress is the improvement in 'state' arising from economic activity over time ... progress for the individual person, family and community, progress for the place and progress for the organization and investors. State is like a balance sheet except it has value elements as well as just the money denominated assets and liabilities. Performance is the relationship between progress and the net consumption of resources (of the planet) that are used to generate the change in state and the environmental damage arising from this economic activity.

Measurement like that envisioned in the MDIA initiative will identify an even bigger bubble than the one being talked about in this article. The scenario of a carbon bubble described ends up being a losing proposition because the measure of performance being used is the discredited money accounting and wealth system. The MDIA analysis would, on the other hand be describing the change from where we are to where we need to be in a positive light and be a highly desirable event rather than being another disastrous bubble!

Peter Burgess - TrueValueMetrics

Multi Dimension Impact Accounting

Delete Edit Comment You have 14 minutes

Peter Burgess

Al Gore: world is on brink of 'carbon bubble' ... Gore and partner David Blood call on companies to 'do their fiduciary duty' and identify carbon risks in their portfolios

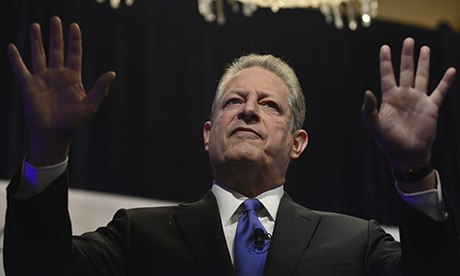

IMAGE Al Gore: 'If investors look in clear-eyed, traditional risk management way, they can be in time to avoid the bubble.' Photograph: Miguel Juarez Lugo/Zuma Press/Corbis

The world is on the brink of the 'largest bubble ever' in finance, because of the undisclosed value of high-carbon assets on companies' balance sheets, and investment managers who fail to take account of the risks are failing in their fiduciary duty to shareholders and investors, Al Gore and his investment partner, David Blood, have said.

'Stranded carbon assets' such as coal mines, fossil fuel power stations and petrol-fuelled vehicle plants represent at least $7tn on the books of publicly listed companies, and about twice as much again is owned by private companies, state governments and sovereign wealth funds.

As the danger from climate change intensifies, and as rules on carbon and the introduction of carbon pricing in many parts of the world start to bite, these assets are expected to come under threat, from regulation and from the need to transform the economy on to a low-carbon footing. The 'carbon bubble' has been identified by leading thinkers on climate change in recent years, but so far the findings have had little real effect on investor behaviour.

Now Gore and Blood, the former US vice-president and ex-chief executive of Goldman Sachs, who are partners in the Generation Investment Management firm, have brought forward a four-point plan that they say will protect future investors. They are calling on companies, investors and regulators to identify the carbon risks in their portfolios; to demand of company managers and boards that the risks should be publicly disclosed; to diversify their investment portfolios to include low-carbon infrastructure such as renewable energy and electric vehicles; and finally to take their money out of fossil fuels and other high-carbon assets, or turn them into low-carbon assets - for instance, by installing carbon capture and storage units on power stations.

Gore told the Guardian: 'This is potentially the largest bubble ever. If investors look in clear-eyed, traditional risk management way, they can be in time to avoid it.' He said it was not feasible to wait for a global agreement on climate change, on the lines of the Kyoto protocol which he helped to forge in 1997, but that investors must take action sooner. He urged individual investors to demand that their pension companies or fund managers should seek to evaluate their exposure to carbon risk.

The highest carbon assets such as tar sands and dirty coal represent the highest immediate risk, but other infrastructure such as transport and construction is also involved.

If the risks associated with high-carbon assets are not taken into account, Gore warned, the consequences for other assets - in a decade or more - could be dire. Those assets include 'real estate, agricultural land and infrastructure' that is all at risk from the effects of climate change, and the value of which could plummet as the effects are increasingly felt in the form of floods, droughts and storms.

Gore compared the carbon bubble to the financial crisis of 2007-08, when the owners of assets such as sub-prime mortgages and credit agreements that were suddenly found to be worthless were 'embarrassed that they did not see what was blindingly obvious in retrospect'.

As the risks of climate change have been well known for some years, Blood added that any fund managers failing to take them into account in investment risk strategies were 'failing in their fiduciary duty' to their investors and shareholders. This could give rise to lawsuits in future, though Blood said he hoped that could be avoided, if the report's recommendations were followed. He said investors were currently finding 'a false comfort in the status quo' by failing to factor in carbon risks and climate change.

New regulations on carbon are being brought forward in many countries, such as the US and China, though there have also been withdrawals from climate action, such as the demise of carbon trading in Australia.

The Generation report follows the publication of the Intergovernmental Panel on Climate Change's assessment of current global warming science, which set out a 'carbon budget' of how much carbon dioxide we can continue to pump into the atmosphere before triggering dangerous levels of warming. By extrapolating from that, other scientists have suggested there could be as little as 30 years of burning fossil fuels before the threshold is reached. This suggests that many of the world's remaining fossil fuel resources must be left unexploited if the climate is not to be put in danger, and prominent scientific and political leaders are increasingly calling for this to be recognised.

Gore and Blood's recommendations could take a decade to complete, the partners admit, but they insist that the first steps at least should be undertaken urgently.

Blood said there were an increasing number of investors with a clear understanding of climate change, but added: 'There needs to be more engagement.'

Gore and Blood founded Generation Investment Management in 2004, with the aim of pushing forward low-carbon finance and promoting alternatives to the fossil fuel economy.