Date: 2025-07-10 Page is: DBtxt003.php txt00006032

Sustainability

Corporate ESG

Environment, Society & Governance – Value Rises, but the Language is Still Lacking

Burgess COMMENTARY

Peter Burgess

Environment, Society & Governance – Value Rises, but the Language is Still Lacking

Earlier this week Jo Confino talked at the Sustainable Brands conference about the need to develop a new narrative for the sustainable space. “This is the biggest challenge for sustainability going forward…We come from CSR to sustainability, but sustainability as it is currently is not going to save the world. We need to move on to a completely new version,” he said.

While this is true for every part of the sustainable business world, it seems relevant in particular for the part that is constantly searching to make the business case for sustainability, including investors, shareholders and the C-suite.

The good news, as we learn from a new webcast from PwC on integration of ESG issues in deals and valuing their impact, is that a new narrative that investors and business can understand and relate to is actually emerging faster than we might think. The bad news though is that there are still plenty of obstacles ahead before this narrative can become a game changer.

Interestingly, it all starts with translating sustainability into ESG (Environmental, Society and Governance), a term that investors and companies seem to feel more comfortable with: “Sustainability is a business approach that creates long-term shareholder value by embracing opportunities and managing risks deriving from economic, environmental and social developments.”

This definition, used by PwC (and originally created by Sustainable Asset Management) at the beginning of the webcast sets the tone for the whole discussion – this is not about vague goals like saving the planet or meeting the needs of future generations, but about a straightforward business approach that aims to create a long-term value. Could it be any clearer than this?

With this definition in hand it becomes easier to understand the argument that PwC makes in this webcast, which is that investors are increasingly taking ESG factors into consideration when assessing the value of a company, while most executives are still unsure how to truly unlock ESG value.

First, let’s look at the business’ side. According to PwC, companies around the world are spending increased time and resources on ESG. What do they do exactly? PwC points out three key stages: risk management, cost savings and value enhancement.

The first stage of risk management is where many companies start and it includes financial reporting, operational risk, regulatory compliance and environmental liability. The next stage is cost savings and it is mainly about eco-efficiency – environmental impact reduction, development of sustainability metrics, search for further cost savings and a shift towards integrated reporting. The most advanced stage, where you can find sustainable business leaders, is value enhancement – here companies work on developing strategic advantage through brand enhancement, product innovation and stakeholder engagement.

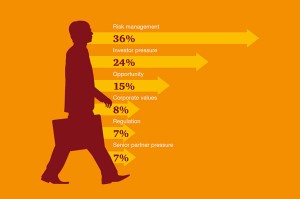

From the investors’ side, as identified by PwC in a survey it conducted among private equity investors, the most important driver to address ESG issues is risk management (36 percent worldwide). Yet, value creation is also an important factor. “Investors and private equity managers increasingly believe ESG management adds value,” explains Phil Case of PwC UK.

One indication for the growing importance of ESG in terms of both risk management and value creation can be found in mergers and acquisitions (M&A). This trend impacts both buy and sell side, PwC explains – as buyers consider ESG implications, sellers need a story to tell. The result is that we can see how ESG inputs become an integral part of the deal process, from identifying ESG risks and future regulations in the due diligence stage to identifying opportunities in terms of revenue growth or cost reduction in the exclusivity/completion stage.

“A company’s ESG strategy, or lack thereof, can have direct and indirect impacts on value, positive or negative. In the deal context, it can be important to identify and measure those ESG factors, whether risks or benefits, that have the most potential impact on value and ROI so that they can then be built into pricing decisions. Identifying risks or benefits that others miss can make the difference in winning an auction or earning the planned ROI for a deal,” said Donna Coallier, a partner in PwC’s Valuation practice.

Still, companies struggle to value the impact of ESG. While PwC provides a shareholder value framework that can be expanded to accommodate the difficult-to-quantify benefits of sustainability initiatives, it still seems that both investors and companies have difficult time putting a dollar value on ESG investments. This is especially true when it comes to soft benefits like workforce diversity or the value of being a good citizen.

From PwC data it’s becoming very clear that the importance of ESG will only increase in the upcoming years both to investors and companies. It looks like on the narrative side these two parties are on the same page. Now it’s time to work on developing a simple language they can share because unless we have a simple standardized framework to evaluate ESG value, we won’t see ESG becoming as material as it should be for a long time.

[Image credit: PwC]

Raz Godelnik is the co-founder of Eco-Libris and an adjunct faculty at the University of Delaware’s Business School, CUNY SPS and Parsons The New School for Design, teaching courses in green business, sustainable design and new product development. You can follow Raz on Twitter.

PwC link to webcast

http://www.pwc.com/us/en/cfodirect/events/webcasts/deals-environmental-social-governance-issues-october-22-2013.jhtml

Peter Burgess LinkedInComment

Group ... Corporate Social Responsibility (CSR) Leaders Corporate Social Responsibility (CSR) Leaders 1,045 members Member Information and settingsShare group DiscussionsPromotionsJobsSearch Your comment has been posted successfully. Close Raz Godelnik Follow Raz Discussion ... ESG - Value Rises, but the Language is Still Lacking Raz Godelnik Adjunct Professor at CUNY, the New School and the University of Delaware

Environment, Society & Governance - Value Rises, but the Language is Still Lacking triplepundit.com

A webcast from PwC shows how a new narrative is emerging faster than we might think. The bad news is that there are still plenty of obstacles ahead.

Like Comment (1) Share Unfollow Reply Privately1 day ago Comments 1 comment

Peter Burgess Peter Burgess ... Founder/CEO at TrueValueMetrics ... formerly international business and development consultant and corporate CFO

Money profit financial accounting is very powerful, and a tremendous tool for corporate management and the goal of high performance profit making.

As a tool for making modern society high performance in ALL the aspects that are important, the accounting tools are impotent, and no tinkering at the edges is going to change much of anything.

I have gone back to the basics starting off with trying to understand what is the purpose of economic activity. In my view, the purpose of economic activity is to make life better for people, to improve quality of life and standard of living.

Adam Smith suggested about 240 years ago that a market driven enterprise economy was going to deliver on this better than other forms of economic organization, but the enterprise at that time was very small and the market reflected the interaction of millions of decision makers. Nobody could game the Adam Smith market environment as they can game the modern 'so called' markets.

Before the industrial revolution ... and the agricultural revolution before it, it was difficult for everyone to find enough to eat, and it was clear that economic activity was very much linked to quality of life.

There is no question that technology and the use of energy have been a key factor in the improvement in quality of life over the past 200 years, and this has been helped to some considerable extent by the modern corporate organization and its ability to invest on a scale that improves productivity.

In my view academics, economists the accounting profession have failed to differentiate between the measures that fundamentally matter and those that are mere indicators that depend on correlation that may or may not change over time. GDP growth is such a stupid measure that anyone that utters it should be ashamed. GDP growth merely makes it easier for the business to make profit and have stock value growth.

We absolutely must understand the behavior of business as productivity is improved. The conventional business model for these times that productivity enables less labor and more profit is dangerous for society and for people's quality of life. More and more economic activity is dangerous for the environmental stability of the planet.

The idea that a company being sustainable is more profitable is only part of the picture. The metrics are incomplete. There needs to be metrics about impact on people and planet that are as rigorous as the metrics being used by corporate accountants ... the bean counters who are the gate-keepers of corporate efficiency.

There are many concepts in traditional money profit accounting that can be used to establish a new framework to account for and value the performance of economic activities. I call this architecture Multi Dimension Impact Accounting (MDIA). It is not a small increment to the prevailing system of accounting but a radically different architecture because it has to address the problem of bad actors ignoring their critics and going on their merry way with no consequences.

It is good news that the major accounting firms seem to understand the need to have metrics about things like sustainability, but in my view the motivation of the big firms is more about self preservation than it is about helping to improve the performance of society and the economy. I would like to be proved wrong on this, but the indicators suggest that I am right.

Peter Buirgess - TrueValueMetrics Multi Dimension Impact Accounting