Date: 2026-02-01 Page is: DBtxt003.php txt00007056

Energy

Game Changer

Blowing Up: Tesla's Gigafactory Is Going To Revolutionize The Auto And Utility Industries

Burgess COMMENTARY

Peter Burgess

Blowing Up: Tesla's Gigafactory Is Going To Revolutionize The Auto And Utility Industries

Very soon, Tesla is going to announce plans to build the world’s largest battery factory here in the United States. It desperately needs to get started on the project in order to have enough lithium-ion capacity to power its third-generation car that it hopes to sell for $35,000 just 3 years from now. To do this, the company will enlist longtime partner Panasonic, who is rumored to be investing upwards of $1 billion of its own money; likely raise significant capital of its own; and quite possibly even bring in additional outside players. That alone should be enough of an undertaking. But Elon Musk is thinking bigger. Not only is this multi-billion-dolllar venture going to set his automaker up for a move to the big time in the world market, it’s also going to give him a wedge to basically destroy the utility business in the U.S. And, those companies have no one but themselves to blame.

Batteries included

Under existing agreements with Panasonic, Tesla is already planning on buying 1.8 billion lithium-ion cells over the next 4 years. The reason it needs so many is because it uses thousands of them in each of its vehicles. Those nearly 2 billion batteries will barely give Tesla the ability to produce 250,000 Model S sedans and Model X SUVs and it’s likely the less-expensive “Model E” as its often referred to will sell nearly that many in its first year alone. Enter the Gigafactory, as Musk has taken to calling it, which will produce upwards of 30 gigawatt-hours worth of batteries per year. How much is that? “We are talking about something that is comparable to all of the lithium-ion battery production in the world in one factory,” Musk has said.

And it’s enough for hundreds of thousands of Tesla vehicles, assuming they offer similar packs to today’s cars, which Musk has also promised on a number of occasions. The marvel of the factory is that it will take in raw materials — lithium and the other metals needed — and spit out finished packs on the other end, in whatever sizes Tesla requires. Today, that’s 60 and 85 kilowatt-hours in a “large format” that will support both the S and X. The future vehicle likely will require a smaller pack and it seems probable a 100-kilowatt pack (or larger) is coming to the big vehicles soon.

Power to the people

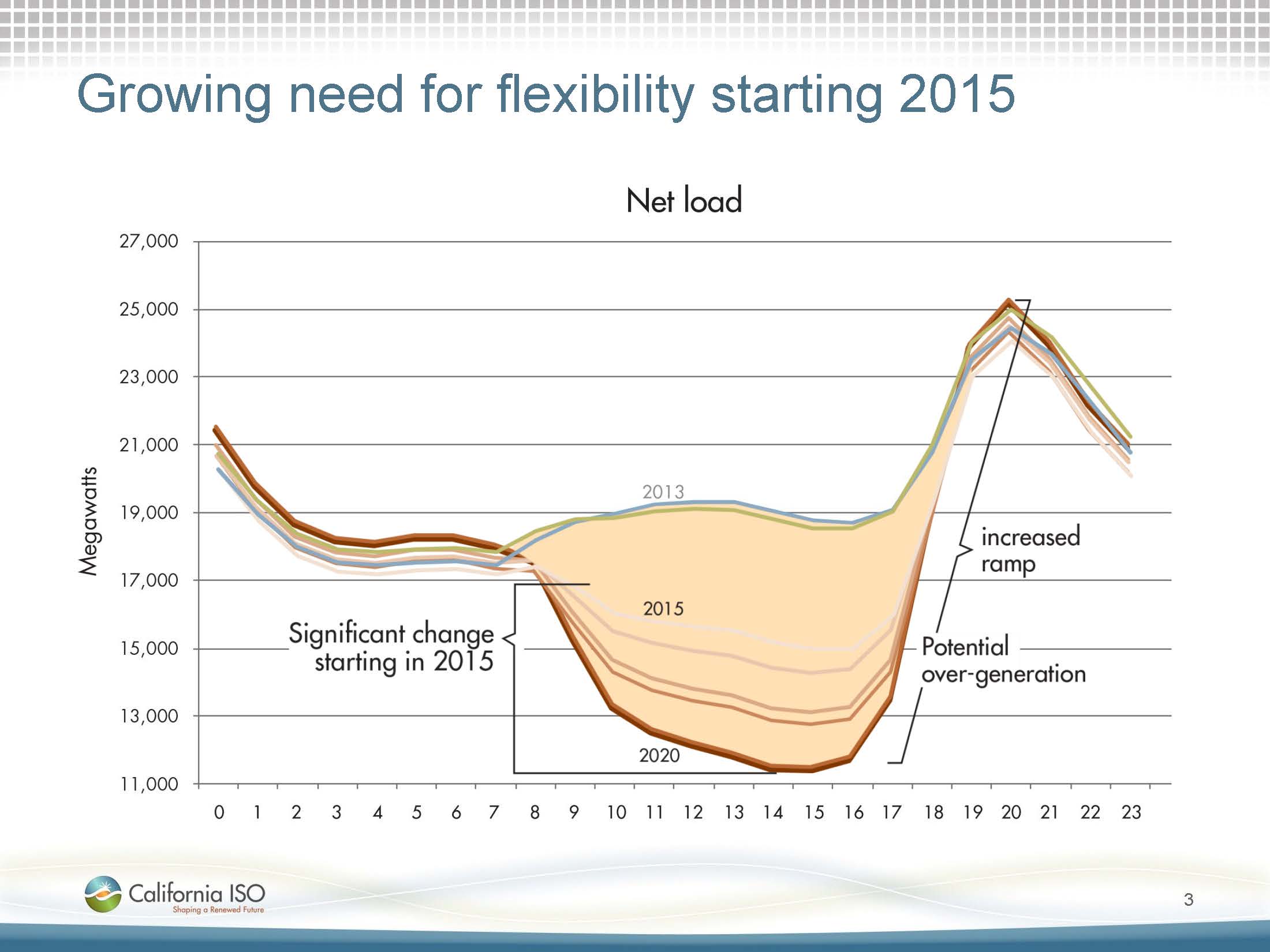

But there’s much more. Tesla has already been running trials with SolarCity, which is run by Musk’s cousin Lyndon Rive, on a storage unit. What it does is hold onto some excess power generated by the panels on the roof of a home or business rather than immediately sending it to the grid. In the short run, this has the potential to solve a very big problem that’s headed California’s way brought on by the success of solar in the state. It’s something called “the duck graph” and what it shows is what happens when the sun starts to set and people head home from work. The result is a big mess where net demand for electricity spikes to the highest levels of the day all in the space of one hour. California is so concerned it has mandated significant energy storage be brought online to reel in the length of the duck’s neck before it gets too long.

Batteries — even in small quantities — can shorten it a great deal. All the solar customers who are sending excess power back to the grid all day can, instead, keep some at home, filling a battery unit that might roughly 1/4 to 1/2 of a day’s generation depending on time of year, weather, etc. When the sun goes down, those batteries could start feeding power into the home or even back to the grid if the homeowner didn’t need it, allowing that person to earn money for it as they do today. Sounds good, right? In fact, it’s so good for everyone that if done right, the systems could communicate in real time and “solar plus batteries” could be used to smooth out the grid at an increasingly lower peak, with the most expensive and carbon-intensive sources being phased out over time.

But the utilities have instead begun a war on solar. In Arizona, the state’s largest utility sought a fee of roughly $50 per month from each solar customer for the right to connect back to the grid. They lost and the fee will be $3-6 instead. Five other states are now seeking similar money grabs. Their problem is that solar customers are supposedly not paying their fair share of grid costs and are are costing everyone else money by selling power back to the grid they don’t use at the same retail rates they buy power, something called “net metering.”

The danger for utilities, though, is that they get exactly what they want. If net metering is killed, more customers will simply install storage and hardly ever tap the grid at all. While those customers will end up paying something to be on the grid, it will be a minimal amount. All their excess power will fill their battery pack and their electric vehicle and none of it will go to stabilizing the grid. It turns out the utility model isn’t well designed to lose even small numbers of customers yet in many states, it’s already cheaper to roll your own power than to buy it from the local utility. Make it punitive to play nice with the grid and more people will simply choose not to. That sets off a chain reaction that basically kills the utility business in a matter of a few years.

Where the Gigafactory fits in is that it’s likely going to drive the cost of that storage into the ground. While Tesla has played it close to the vest on how much its batteries really cost, those who actually understand believe they are already below $200 kilowatt-hour. Musk has suggested the Gigafactory will drive costs down by perhaps 30% and lithium-ion costs have generally improved slowly over time. It’s not hard to imagine that eventually the cost of adding storage to a home solar system will fall below $2000. Given that will provide protection against short blackouts and the ability to opt out should net metering disappear, it will become commonplace — especially from companies that lease systems, like SolarCity.

Tesla’s stock hit yet another all-time high yesterday as a Morgan Stanley analyst put some of these pieces together. Anyone want to bet other automakers are still just going to catch up and surpass Tesla in electric vehicles? Or that utilities are going to suddenly become nimble technology companies? It seems a better bet that we’ll be talking about a second Gigafactory before decade’s end than either of those outcomes.