Date: 2025-04-05 Page is: DBtxt003.php txt00007685

Ideas

John Coates

John Coates ... The Biology of Risk ... John Coates is a research fellow at Cambridge who traded derivatives for Goldman Sachs and ran a desk for Deutsche Bank. He is the author of “The Hour Between Dog and Wolf: How Risk Taking Transforms Us, Body and Mind.”

Burgess COMMENTARY

Peter Burgess

The Biology of Risk

JONATHON ROSEN

SIX years after the financial meltdown there is once again talk about market bubbles. Are stocks succumbing to exuberance? Is real estate? We thought we had exorcised these demons. It is therefore with something close to despair that we ask: What is it about risk taking that so eludes our understanding, and our control?

Part of the problem is that we tend to view financial risk taking as a purely intellectual activity. But this view is incomplete. Risk is more than an intellectual puzzle — it is a profoundly physical experience, and it involves your body. Risk by its very nature threatens to hurt you, so when confronted by it your body and brain, under the influence of the stress response, unite as a single functioning unit. This occurs in athletes and soldiers, and it occurs as well in traders and people investing from home. The state of your body predicts your appetite for financial risk just as it predicts an athlete’s performance.

If we understand how a person’s body influences risk taking, we can learn how to better manage risk takers. We can also recognize that mistakes governments have made have contributed to excessive risk taking.

Consider the most important risk manager of them all — the Federal Reserve. Over the past 20 years, the Fed has pioneered a new technique of influencing Wall Street. Where before the Fed shrouded its activities in secrecy, it now informs the street in as clear terms as possible of what it intends to do with short-term interest rates, and when. Janet L. Yellen, the chairwoman of the Fed, declared this new transparency, called forward guidance, a revolution; Ben S. Bernanke, her predecessor, claimed it reduced uncertainty and calmed the markets. But does it really calm the markets? Or has eliminating uncertainty in policy spread complacency among the financial community and actually helped inflate market bubbles?

We get a fascinating answer to these questions if we turn from economics and look into the biology of risk taking.

ONE biological mechanism, the stress response, exerts an especially powerful influence on risk taking. We live with stress daily, especially at work, yet few people truly understand what it is. Most of us tend to believe that stress is largely a psychological phenomenon, a state of being upset because something nasty has happened. But if you want to understand stress you must disabuse yourself of that view. The stress response is largely physical: It is your body priming itself for impending movement.

As such, most stress is not, well, stressful. For example, when you walk to the coffee room at work, your muscles need fuel, so the stress hormones adrenaline and cortisol recruit glucose from your liver and muscles; you need oxygen to burn this fuel, so your breathing increases ever so slightly; and you need to deliver this fuel and oxygen to cells throughout your body, so your heart gently speeds up and blood pressure increases. This suite of physical reactions forms the core of the stress response, and, as you can see, there is nothing nasty about it at all.

Far from it. Many forms of stress, like playing sports, trading the markets, even watching an action movie, are highly enjoyable. In moderate amounts, we get a rush from stress, we thrive on risk taking. In fact, the stress response is such a healthy part of our lives that we should stop calling it stress at all and call it, say, the challenge response.

This mechanism hums along, anticipating challenges, keeping us alive, and it usually does so without breaking the surface of consciousness. We take in information nonstop and our brain silently, behind the scenes, figures out what movement might be needed and then prepares our body. Many neuroscientists now believe our brain is designed primarily to plan and execute movement, that every piece of information we take in, every thought we think, comes coupled with some pattern of physical arousal. We do not process information as a computer does, dispassionately; we react to it physically. For humans, there is no pure thought of the kind glorified by Plato, Descartes and classical economics.

Our challenge response, and especially its main hormone cortisol (produced by the adrenal glands) is particularly active when we are exposed to novelty and uncertainty. If a person is subjected to something mildly unpleasant, like bursts of white noise, but these are delivered at regular intervals, they may leave cortisol levels unaffected. But if the timing of the noise changes and it is delivered randomly, meaning it cannot be predicted, then cortisol levels rise significantly.

Uncertainty over the timing of something unpleasant often causes a greater challenge response than the unpleasant thing itself. Sometimes it is more stressful not knowing when or if you are going to be fired than actually being fired. Why? Because the challenge response, like any good defense mechanism, anticipates; it is a metabolic preparation for the unknown.

You may now have an inkling of just how central this biology is to the financial world. Traders are immersed in novelty and uncertainty the moment they step onto a trading floor. Here they encounter an information-rich environment like none other. Every event in the world, every piece of news, flows nonstop onto the floor, showing up on news feeds and market prices, blinking and disappearing. News by its very nature is novel, adds volatility to the market and puts us into a state of vigilance and arousal.

I observed this remarkable call and echo between news and body when, after running a trading desk on Wall Street for 13 years, I returned to the University of Cambridge and began researching the neuroscience of trading.

In one of my studies, conducted with 17 traders on a trading floor in London, we found that their cortisol levels rose 68 percent over an eight-day period as volatility increased. Subsequent, as yet unpublished, studies suggest to us that this cortisol response to volatility is common in the financial community. A question then arose: Does this cortisol response affect a person’s risk taking? In a follow-up study, my colleagues from the department of medicine pharmacologically raised the cortisol levels of a group of 36 volunteers by a similar 69 percent over eight days. We gauged their risk appetite by means of a computerized gambling task. The results, published recently in the Proceedings of the National Academy of Sciences, showed that the volunteers’ appetite for risk fell 44 percent.

Most models in economics and finance assume that risk preferences are a stable trait, much like your height. But this assumption, as our studies suggest, is misleading. Humans are designed with shifting risk preferences. They are an integral part of our response to stress, or challenge.

When opportunities abound, a potent cocktail of dopamine — a neurotransmitter operating along the pleasure pathways of the brain — and testosterone encourages us to expand our risk taking, a physical transformation I refer to as “the hour between dog and wolf.” One such opportunity is a brief spike in market volatility, for this presents a chance to make money. But if volatility rises for a long period, the prolonged uncertainty leads us to subconsciously conclude that we no longer understand what is happening and then cortisol scales back our risk taking. In this way our risk taking calibrates to the amount of uncertainty and threat in the environment.

Under conditions of extreme volatility, such as a crisis, traders, investors and indeed whole companies can freeze up in risk aversion, and this helps push a bear market into a crash. Unfortunately, this risk aversion occurs at just the wrong time, for these crises are precisely when markets offer the most attractive opportunities, and when the economy most needs people to take risks. The real challenge for Wall Street, I now believe, is not so much fear and greed as it is these silent and large shifts in risk appetite.

I consult regularly with risk managers who must grapple with unstable risk taking throughout their organizations. Most of them are not aware that the source of the problem lurks deep in our bodies. Their attempts to manage risk are therefore comparable to firefighters’ spraying water at the tips of flames.

THE Fed, however, through its control of policy uncertainty, has in its hands a powerful tool for influencing risk takers. But by trying to be more transparent, it has relinquished this control.

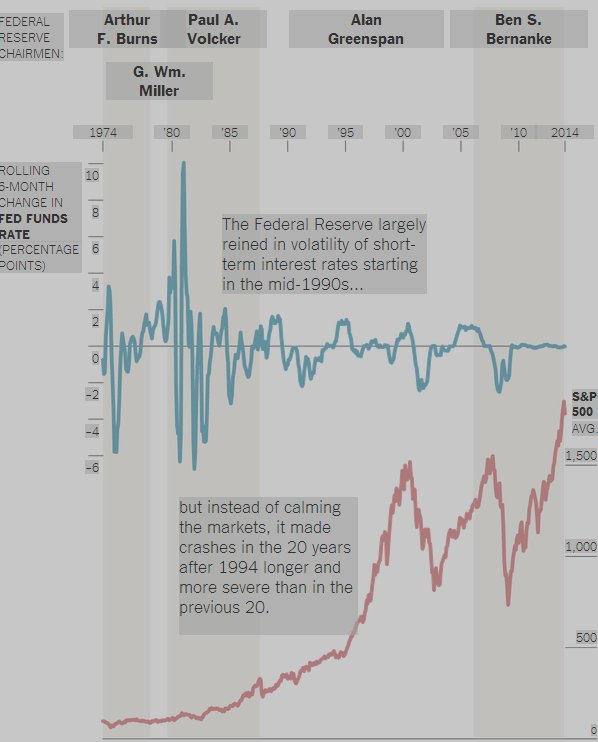

Forward guidance was introduced in the early 2000s. But the process of making monetary policy more transparent was in fact begun by Alan Greenspan back in the early 1990s. Before that time the Fed, especially under Paul A. Volcker, operated in secrecy. Fed chairmen did not announce rate changes, and they felt no need to explain themselves, leaving Wall Street highly uncertain about what was coming next. Furthermore, changes in interest rates were highly volatile: When Mr. Volcker raised rates, he might first raise them, cut them a few weeks later, and then raise again, so the tightening proceeded in a zigzag. Traders were put on edge, vigilant, never complacent about their positions so long as Mr. Volcker lurked in the shadows. Street wisdom has it that you don’t fight the Fed, and no one tangled with that bruiser.

Under Mr. Greenspan, the Fed became less intimidating and more transparent. Beginning in 1994 the Fed committed to changing fed funds only at its scheduled meetings (except in emergencies); it announced these changes at fixed times; and it communicated its easing or tightening bias. Mr. Greenspan notoriously spoke in riddles, but his actions had no such ambiguity. Mr. Bernanke reduced uncertainty even further: Forward guidance detailed the Fed’s plans.

Under both chairmen fed funds became far less erratic. Whereas Mr. Volcker changed rates in a volatile fashion, up one week down the next, Mr. Greenspan and Mr. Bernanke raised them in regular steps. Between 2004 and 2006, rates rose .25 percent at every Fed meeting, without fail... tick, tick, tick. As a result of this more gradualist Fed, volatility in fed funds fell after 1994 by as much as 60 percent.

In a speech to the Cato Institute in 2007, Mr. Bernanke claimed that minimizing uncertainty in policy ensured that asset prices would respond “in ways that further the central bank’s policy objectives.” But evidence suggests that quite the opposite has occurred.

Cycles of bubble and crash have always existed, but in the 20 years after 1994, they became more severe and longer lasting than in the previous 20 years. For example, the bear markets following the Nifty Fifty crash in the mid-70s and Black Monday of 1987 had an average loss of about 40 percent and lasted 240 days; while the dot-com and credit crises lost on average about 52 percent and lasted over 430 days. Moreover, if you rank the largest one-day percentage moves in the market over this 40-year period, 76 percent of the largest gains and losses occurred after 1994.

I suspect the trends in fed funds and stocks were related. As uncertainty in fed funds declined, one of the most powerful brakes on excessive risk taking in stocks was released.

During their tenures, in response to surging stock and housing markets, both Mr. Greenspan and Mr. Bernanke embarked on campaigns of tightening, but the metronome-like ticking of their rate increases was so soothing it failed to dampen exuberance.

There are times when the Fed does need to calm the markets. After the credit crisis, it did just that. But when the economy and market are strong, as they were during the dot-com and housing bubbles, what, pray tell, is the point of calming the markets? Of raising rates in a predictable fashion? If you think the markets are complacent, then unnerve them. Over the past 20 years the Fed may have perfected the art of reassuring the markets, but it has lost the power to scare. And that means stock markets more easily overshoot, and then collapse.

The Fed could dampen this cycle. It has, in interest rate policy, not one tool but two: the level of rates and the uncertainty of rates. Given the sensitivity of risk preferences to uncertainty, the Fed could use policy uncertainty and a higher volatility of funds to selectively target risk taking in the financial community. People running factories or coffee shops or drilling wells might not even notice. And that means the Fed could keep the level of rates lower than otherwise to stimulate the economy.

IT may seem counterintuitive to use uncertainty to quell volatility. But a small amount of uncertainty surrounding short-term interest rates may act much like a vaccine immunizing the stock market against bubbles. More generally, if we view humans as embodied brains instead of disembodied minds, we can see that the risk-taking pathologies found in traders also lead chief executives, trial lawyers, oil executives and others to swing from excessive and ill-conceived risks to petrified risk aversion. It will also teach us to manage these risk takers, much as sport physiologists manage athletes, to stabilize their risk taking and to lower stress.

And that possibility opens up exciting vistas of human performance.

John Coates is a research fellow at Cambridge who traded derivatives for Goldman Sachs and ran a desk for Deutsche Bank. He is the author of “The Hour Between Dog and Wolf: How Risk Taking Transforms Us, Body and Mind.”