Date: 2024-09-27 Page is: DBtxt003.php txt00010087

Low Carbon Economy

Are low fossil fuel prices bad news?

The Oil Price Roller Coaster ... Amory Lovins

Burgess COMMENTARY

Peter Burgess

The Oil Price Roller Coaster

Oil’s place in the global energy mix is transforming, including in mobility, which uses three-fifths of world oil. Image copyright Thinkstock / curraheeshutter. Why do oil prices go down? Because they went up. Why do oil prices go up? Because they went down. That’s what they do. To avoid oil-price volatility, you must kick the oil habit.

You can do this by switching to efficiency and renewables. You’ll get cheaper energy services at steady prices; free price insurance; and lower risks to climate, health, environment, global development and security, and America’s independence and reputation.

In contrast, the oil for which the U.S. pays $1 billion a day — and paid $2 billion a day until mid-2014, when $100+ per-barrel prices halved — comes with price risk and far bigger hidden costs that at least triple the real societal cost to upwards of $4 billion a day.

So why, after four relatively placid years, did the world oil price tumble starting in mid-2014, and what’s next?

Why Oil Prices Fluctuate

People burn 1.3 cubic miles of oil a year, or 93 million barrels a day (each barrel equal to 42 U.S. gallons or 159 liters). Scott Pugh, energy advisor to the Department of Homeland Security, visualizes those barrels, each 20 inches in diameter, laid end-to-end and joined to form a pipeline. It’d stretch 1.8 times around the earth. To traverse that pipeline in 24 hours, the oil must flow at 1,835 miles per hour — 2.44 times the speed of sound.

Crude oil’s price fluctuates at more like the speed of light, varying with global, regional, local, and firm-specific market conditions. Despite many complexities, some broad observations are usually valid.

Oil prices tend to rise with instability in major exporters — Persian Gulf, Nigeria, Venezuela, Russia — though diversified supplies, suppliers, and delivery routes have made markets more placid. Strong economic growth also tends to raise prices — until they get high enough to dampen or reverse the economic growth. Conversely, oil prices fall when major exporters do what John D. Rockefeller used to do regularly: “sweat the market” with oversupply to bankrupt high-cost producers and thus raise one’s own monopoly rents.

With cheaper per-barrel oil prices and global oversupply, high-cost producers are being severely tested. Image copyright Thinkstock / Stockbyte.

Causes of the Current Price Drop

Instability and surplus are both occurring today, but surplus is proving more important. The world market is glutted with several million extra barrels per day (Mbbl/d), mainly from fracked U.S. oil and Canadian tar sands. The U.S. is now the world’s largest oil producer, with output at a 31-year high.

Late last year, the Saudis and allies announced they wouldn’t cut output to rebalance the market as they had in the past. Why should they? They’d simply give up market share to higher-cost producers. And the Saudis didn’t cause the imbalance; North Americans and other non-OPEC members did.

Until recently, only the Saudis (and to a lesser extent their Gulf allies) had big surplus production capacity, and at the world’s lowest cost. Saudi oil costs about one-tenth as much to extract as fracked U.S. oil or Alberta tar sands need to break even. Now an added reality is roiling markets: only the Saudis have enough cash to weather a prolonged price drop. While Iran, Iraq, Venezuela, Russia, and Nigeria are financially stressed, the Saudis claim 2.5 Mbbl/d spare oil capacity and $0.7–0.9 trillion of monetary reserves — enough to sustain several years of $50 oil and keep funding their $40-billion renewable-power program (meant to save oil for export).

To avoid oil-price volatility, you must kick the oil habit. Yet we still burn 93 million barrels each day.

Against that backdrop, competitors are fish in a barrel. The biggest oil companies’ capital expenditures quintupled since 2000 but their production barely budged. That’s a seriously diminishing return per barrel at any price, let alone lower prices that undermine profitability. When oil prices suddenly fell nearly 60 percent in seven months, firms frantically cut costs and axed massive Arctic, deepwater, and other high-cost projects. In what analysts Wood Mackenzie call “the biggest threat to oil and gas industry earnings and financial solidity since the financial crash of 2008,” investments may fall by $200+ billion this year.

Tar-sand and fracking operators will be severely tested: frackers in the oil-rich Bakken are producing a gusher of red ink despite falling service costs and continuing technological improvement. Even those North American operators who survive the downturn may lose skittish investors to safer pursuits — such as renewable power, whose lower risks now attract capital several percentage points cheaper than utilities get. It was, after all, the former Saudi oil minister, Sheikh Ahmed Zaki Yamani, who famously said, “The Stone Age did not end for lack of stone, and the Oil Age will end long before the world runs out of oil.”

The Demand Side Strikes Again

All this talk of oversupply is lopsided, though, because it leaves out half the supply/demand balance. The tepid global economy, with deflationary pressures in Europe and Japan, slowing growth in China, political gridlock in the U.S., and the gloom of uncertainty everywhere, continues to weigh on oil demand. But so, very importantly, does the invisible “fifth fuel” — energy efficiency, which the International Energy Agency recently found is even bigger than any other fuel.

Rich countries’ oil use peaked in 2005. Developing countries’ oil demand is moderating. Start with mobility, which uses three-fifths of world oil. Strong auto efficiency standards already widely adopted (including China and India) will keep gasoline demand subdued or even shrinking, despite sharply lower fuel prices.

U.S. driving has been falling since 2007 and hasn’t rebounded with nearly halved gasoline prices. Bloomberg New Energy Finance (BNEF) notes that in the past 10 years, Americans’ driving fell 10 percent below trend, while in the past 13, their vehicles got 29 percent more efficient. Result: innumerable negabarrels.

Thus, what’s normally described as an oil supply surplus is at least equally a shortfall in forecast demand. Suppliers invested to meet demand that’s not there. The resulting oversupply pushes prices down relentlessly. This deflation could be quite persistent. As the International Energy Agency said on 16 January 2015, “It is clear that the market is undergoing a historic shift. OPEC’s embrace of market forces…is a game changer… Oil’s place in the global energy mix is also transforming… [T]he next few years could…prove a period of reckoning for a market and an industry that, through the course of their 150-year history, have had to periodically reinvent themselves.”

The Stone Age did not end for lack of stone, and the Oil Age will end long before the world runs out of oil.

In short, the oil industry pays far too little attention to demand. As my November 2014 Shell paper “Efficiency: The rest of the iceberg” explains, suppliers can run their tankers into that iceberg and sink without ever knowing what they hit, because it’s not on their chart and they’re hardly tracking it. The notion that countries like the United States could profitably eliminate oil use by 2050 (see RMI’s Winning the Oil Endgame, 2004, and Reinventing Fire, 2011) may be novel, yet huge and lucrative oil savings aren’t: they’re well demonstrated but conveniently ignored.

Underlying Oil-market Dynamics

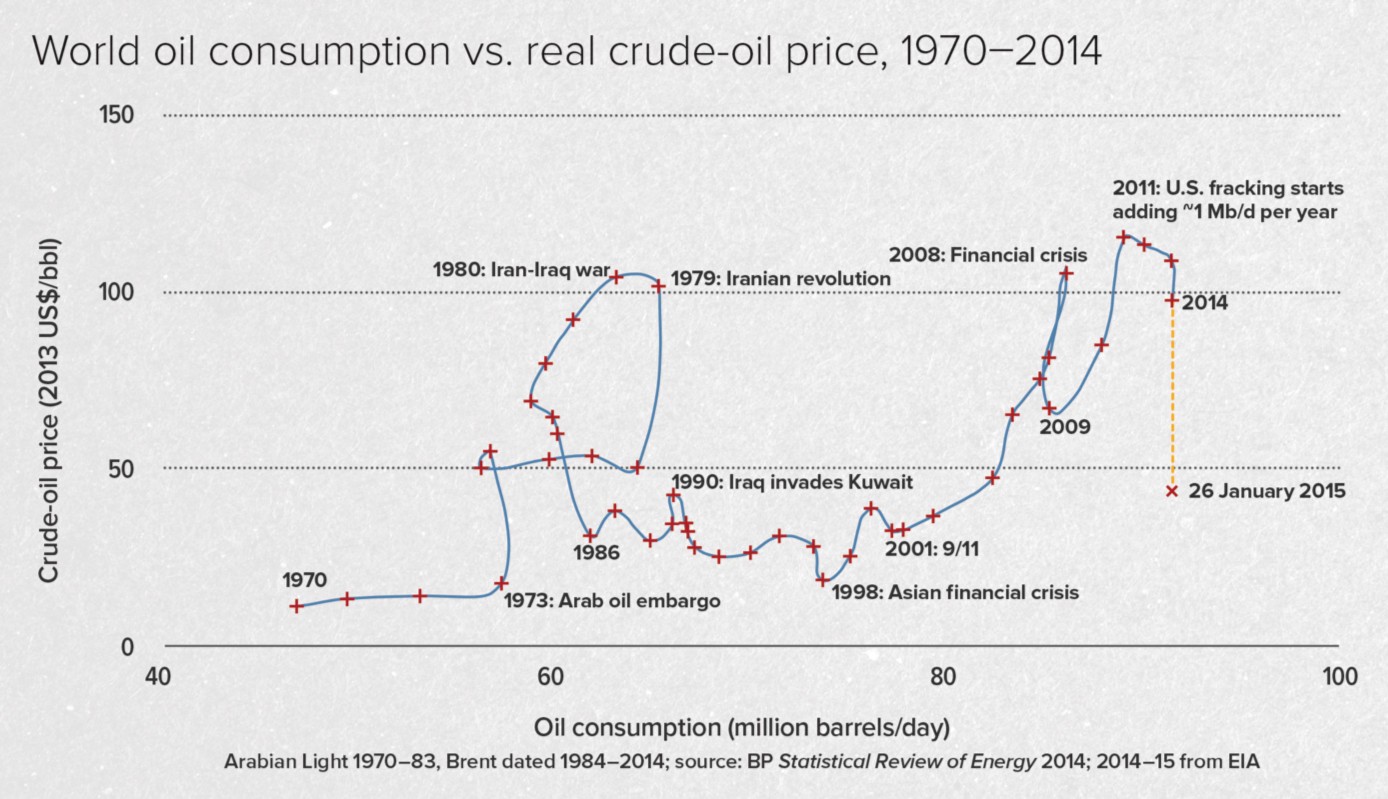

Oil prices have yo-yoed persistently since 1973. Graphing world oil use vs. price reveals multiple loop-the-loops when oil prices rose so high that efficiency, alternative supplies, and elastic consumer behavior shrank demand, crashing prices. Gradually demand regrew at lower prices until the cycle repeated. BP’s CEO warns that the oil industry now faces its deepest slump since 1986, and it’s a very deep slump indeed.

Meanwhile, the costly projects needed to find and exploit big new frontier oilfields often take a decade or more to build, while oil’s biggest competitors — including slumping demand through efficiency gains — can emerge much faster. This was revealed in 1977–85, when the U.S. cut its oil use per dollar of GDP by 35 percent. In those eight years, GDP rose 27 percent, oil use fell 17 percent, oil imports fell 50 percent, and imports from the Persian Gulf fell 87 percent.

The biggest U.S. contribution came when President Ford’s 1975 auto standards raised new domestic cars’ efficiency 7.6 miles per U.S. gallon (mpg) during 1977–85. They drove 1 percent fewer miles on 20 percent fewer gallons. The U.S. proved it could save oil faster than OPEC could adapt to selling less oil.

Image copyright Thinkstock / Dewitt.

Starting in 1981, the Reagan Administration strove to expand big, slow, costly supplies from fossil fuels plus nuclear energy. Efficiency proved faster, grabbed the customers, crashed prices in 1984–6, and bankrupted suppliers. Policymakers, alas, hit the snooze button. By the 1991 Gulf War, we put our kids in 0.56-mpg tanks because we hadn’t put them in 32-mpg cars — enough to displace Persian Gulf oil. After 20-plus years of stagnant auto efficiency standards, net oil imports rebounded to 60 percent of oil use in 2005. Regaining their 1973 level has taken 40 years.

How Long Will Low Prices Last, and What Will Happen Meanwhile?

Frackers, sweating on the junk-bond treadmill to keep drilling to sustain cashflow, are praying oil prices will rebound swiftly. Their prayers may go unanswered. Drilling has fallen in peripheral areas but continues in the richest core areas, such as the North American Bakken, keeping output high and prices low. Meanwhile, inventories of cheaper oil are brimming — at their highest U.S. level since 1931. These huge stockpiles may require even bigger supply cuts to rebalance the market. That prolongation could prove very painful for frackers and their investors, and fatal for tar-sands operators, with oil prices remaining low enough to deter new fracking. The simplest way to raise prices would be for oil giants to stop mining their money-losing Alberta tar sands whose oil the Keystone XL pipeline was supposed to carry.

Cheaper oil’s basic dynamic could become self-reinforcing. It defers development of costlier, often higher-carbon resources. This buys more time for efficiency and renewables to get bigger, hence cheaper, hence bigger, hence cheaper — even as cheaper oil seems to superficially compete with them — further softening demand and requiring even bigger supply cuts that take still longer. The next stage of the mobility revolution begins to emerge too, replacing many private autos with shareable and even autonomous ones powered by electricity, not gasoline. All the while, oil demand drops further, deepening drillers’ distress.

Some alarmists — including The Independent in a December 2014 article — have warned “the collapsing oil price…could derail the green energy revolution by making renewable power sources prohibitively bad value.” Except that, as Bloomberg and others have countered, that’s precisely wrong.

The story should not be how falling oil prices will impact the shift to clean energy, it should be how the shift to clean energy is impacting the oil price.

What does the renewable energy revolution have to do with cheaper oil? Almost nothing, and that’s the point. Less than five percent of the world’s electricity and less than one percent of U.S. electricity is made from oil, so oil and renewable power scarcely compete. Electricity’s competitive landscape is virtually oil-free except on some islands and such other remote sites as mines and military bases where imported diesel and heavy fuel oil power the generators. On the contrary, cheaper oil means less fracked oil, less byproduct natural gas, higher gas prices, hence even more-competitive wind and solar power. And as batteries get cheaper, electric cars will increasingly threaten oil’s core mobility market.

Cheaper gasoline may admittedly stretch the payback of electric cars, but residential electricity averaging 13¢/kWh runs a Nissan LEAF at less than half the cost per mile of $2 gasoline in a typical 25-mpg car. BNEF estimates that 37-percent-cheaper gasoline could cut electric vehicles’ share of the 2020 U.S. auto fleet from 9 percent to 6 percent. Yet electric autos continue to get cheaper while customer adoption grows — Norway’s strong “feebate” boosted their 2014 market share to 12.5 percent.

Conclusions

BNEF Advisory Board Chairman Michael Liebreich said: “The orthodox view of unlimited oil demand growth simply does not hold in a world of superefficient engines, electric vehicles, desperate air pollution problems, and action on climate. The U.S. economy has grown by 8.9 percent since 2007, while demand for finished petroleum products has dropped by 10.5 percent. Improvements in gas mileage and reduction in miles driven per person have had more impact on cutting U.S. oil imports than unconventional production. The story should not be how falling oil prices will impact the shift to clean energy, it should be how the shift to clean energy is impacting the oil price.”

Image copyright Rocky Mountain Institute.

Further, as efficiency and renewables take over global energy markets — because they work better, cost less, deploy faster and more flexibly, and incur less risk — oil and coal companies will own ever more carbon that’s unburnable for climate reasons, but they’ll own still more carbon that’s unsellable because it can’t compete. These firms are more at risk from market competition than from climate regulation.

Investors increasingly understand these differences and value their ability to deploy capital with more granularity, speed, transparency, and risk avoidance — not least in geopolitical stability, national security, and fairer global development. Oil companies’ varying abilities to repurpose their capabilities and assets to thrive in this new energy world will ultimately divide the quick from the dead.

Written by Amory Lovins, the cofounder, chief scientist, and chairman emeritus of Rocky Mountain Institute. He wrote about energy efficiency’s ‘secret revolution’ in the Summer 2014 issue of Solutions Journal.

Web Extra For more information on this topic visit: rmi.org/reinventingfire