Date: 2025-01-02 Page is: DBtxt003.php txt00011106

Company

Under Armour, Inc. (UA)

About: Under Armour, Inc. (UA) ... Why Did Under Armour Fall By 50% On Friday?

Burgess COMMENTARY

Peter Burgess

Why Did Under Armour Fall By 50% On Friday?

Summary

The company announced earlier in the year that they had approved an additional share class in order to change the current ownership structure.

The move was an effort to protect voting rights as the company’s recent performance has continued to dilute current shareholders.

The approval of this ownership structure illustrates the confidence that shareholders and board members have in Kevin Plank, Under Armour’s CEO.

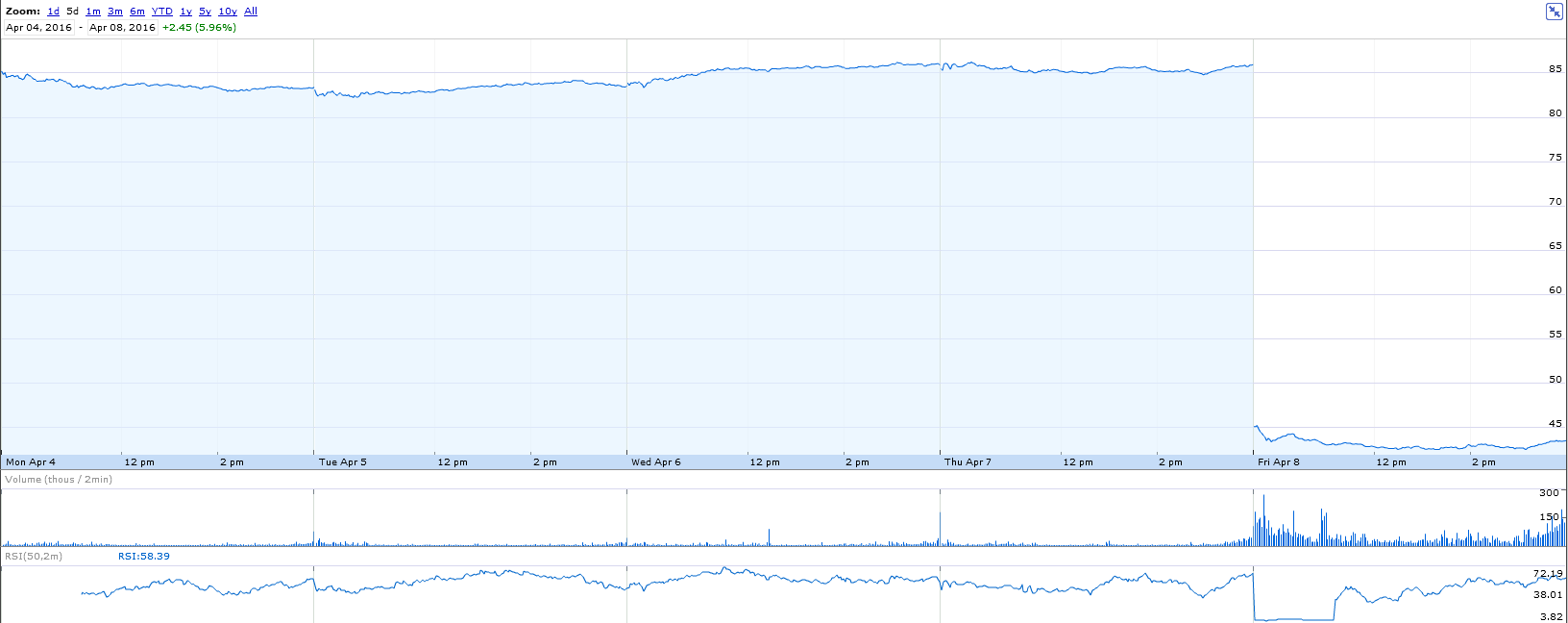

For shareholders of the popular apparel company Under Armour (NYSE:UA), Friday's 49.35% decline in the company's share price was a rather frightening sight, which alarmed a lot of misinformed investors. For those who have been following the company's recent press releases, Friday's decline should come as no surprise as Under Armour took a page out of Google's (NASDAQ:GOOG) (NASDAQ:GOOGL) book and reorganized its ownership structure.

^Sourced from Google Finance

On March 16th, 2016, the company released a statement outlining its desire to issue class C shares as a stock dividend on a one-for-one basis to all existing holders of Under Armour's Class A and B common stock. Adding an additional class of shares has the same effect as a two-for-one stock split where the current number of outstanding shares is doubled in order to allow for the one-for-one conversion process. For stockholders of Class A and B shares, the stock dividend was distributed this past Thursday, April 7th, at the end of the trading day.

The main reason behind the move was for Kevin Plank, Founder and CEO of Under Armour, to protect his ownership control of the company in the face of the growing need for stock issuances covering employee compensation, acquisitions, and other expenses, which could dilute his voting power. Under the previous structure, both class A and B shares held voting rights which pressured current shareholders as the company's incredible growth rate continued to increase the share count.

This move signals to shareholders that Mr. Plank is expected to remain firmly in control of the company as was outlined in a letter to shareholders in 2015:

'These non-voting shares will give us a new form of currency for corporate uses, including equity-based employee compensation and stock-based acquisitions. The change will also allow me the flexibility of selling these non-voting shares of Under Armour over time while maintaining our founder-led approach.'

The company has outgrown its current dual-class structure and the stock dividend is an effort to change the long-term ownership and governance of the company. Kevin Plank noted that:

'One thing to keep in mind is that immediately after the Class C dividend, all stockholders, including me, will retain the same voting interests they hold prior to the dividend. The dividend is designed to maintain our governance structure over the long-term, not result in any immediate changes to any stockholder's voting power.'

Therefore, even with Under Armour's stock falling by 50%, the overall value of the company remained unchanged. Originally, a stock dividend is an issuance of additional shares to stockholders in proportion to the shares held; this is also known as a scrip dividend. Compared to a general scrip, Under Armour's move is essentially a stock split where shareholders who own 'x' amount of shares are given the same amount in class C shares through the dividend. This clearly explains the decline in Friday's stock price as the share count doubles through the dividend, which essentially cancels out the 50% drop.

Thus, current shareholders will not see any impact to their portfolio, as they will receive a Class C share for every A or B class they hold while new shareholders will be able to own a share of Under Armour at a lower market price. Under Armour has previously completed two stock splits in the past three years under the dual class system, which was an effort to reduce the climbing share price in order to make it more accessible for investors. This new share class marks a change with regards to how the company offers shareholders access to owning a piece of the business, which will impact the overall strength of leadership and consolidate current voting power.

Management Analysis

^Sourced from Harvard Business Review

Now that investors have a better understanding of the ownership structure, another important question is whether this stock dividend and new class structure is beneficial for future shareholders. The question is rather difficult to answer as for many companies, the separation between the founding members and incoming leadership can generate conflict, also known as 'founder's syndrome.' With regards to Under Armour, the ascent of the company has been truly remarkable as the founding member, Kevin Plank, remains the CEO and has done a great job in connecting with shareholders and meeting expectations.

In general, the founder's syndrome originates from the emotional attachment founding partners have for their company which interferes with the overall financial development and governance of the evolving organization. Kevin Plank has not only handled the growth in his company but has also accepted the necessary administrative responsibilities that come with running a corporation proven through the climbing share price. His ability to lead a corporation and continue to exhibit his founding legacy is the main reason why the board and shareholders accepted this move to allow Mr. Plank to protect his ownership control in the company.

Under the dual class system, the established corporate governance structure had set in place a rule whereby if Kevin Plank's ownership fell below 15% of the total Class A and Class B shares, the share structure would end and only one class of shares would exist. With his control approaching this 15% level, it was necessary for Kevin to push forward a new non-voting share class in order to limit such a possibility.

Under such a scenario, the continued dilution of his equity would translate to a weaker influence upon the company and the increased risk of a possible exit from his current role. Therefore, the allowance of this change in structure is both a positive for leadership control in addition to a vote of confidence from controlling shareholders and board members who approved the additional class. The general consensus remains supportive of Kevin Plank and his leadership results. Thus, shareholders should expect him to remain in his current CEO role for the foreseeable future.

While the allowance of this additional share class was a sign of strength, there were certain concessions that were set in place in order to ensure strong corporate governance. In Kevin Plank's letter, he outlines the rules limiting what he can do with his ownership stake, he writes:

'To that end, the Special Committee required a number of governance changes designed to ensure this continued alignment with our stockholders, which I have agreed to support. These changes include the following:

- There will be a cap on how many shares I can sell in any year while maintaining the dual-class voting structure.

- If I leave Under Armour, the dual-class voting structure would end.

- I have signed a non-compete agreement, which I did not have before, and it will last for 5 years if I were to leave. Our charter will be amended to enhance provisions that help ensure that all stockholders are treated fairly from an economic perspective in change of control transactions'

In the short term, this agreement does not cause any alarm for investors as it was expected for Kevin Plank to remain in his CEO role. However, in the longer term (5+ years), the possibility of him leaving the company could dramatically impact the share structure which could dilute voting rights. Kevin Plank is only 43 years of age and with no public health concerns, there is little risk that a departure in the following years is possible.

However, it remains a possibility, which investors should consider. Overall, when considering the change in share structure, the move was generally accepted by the market as investors continue to remain positive on the growth prospects of Under Armour and its visionary leader. With a better understanding of both the risks and rewards of the additional share class, only time will tell whether or not letting Kevin Plank maintain control of his company was a positive long-term move.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.