Date: 2025-01-02 Page is: DBtxt003.php txt00011107

Energy Economics

Crude Oil

April 2016 ... Crude Oil: Is OPEC Going To Surprise?

Burgess COMMENTARY

Peter Burgess

Crude Oil: Is OPEC Going To Surprise?

Summary

Crude oil remains weak.

Fundamentals are still negative with one bright spot.

Technicals are at a tipping point.

April 17 - The market is dubious.

Three reasons for a surprise from Doha.

Crude oil is in a holding pattern as the April 17 meeting in Doha, Qatar, approaches. With less than two weeks to go, crude oil is hovering just below $40 per barrel. It is likely to remain around current levels until the results of the meeting are released.

There are three potential outcomes from the Doha gathering of the world's most influential oil producers minus the United States and Libya, who RSVP'd negatively. If the group negotiates a 'freeze' in the spirit of the one discussed last month between the Saudis, Russians, Venezuelans and Qataris, crude oil is likely to remain above $30 per barrel and may even work its way to the mid-$40s. If the group decides to shock the market with a production cut, the price could vault higher to $60 per barrel. However, if the meeting ends and there are no concrete results, we are likely to see a repeat of the action that followed the last three OPEC meetings. In each case, crude oil fell to a new multi-year low. The fundamentals for crude oil remain on shaky ground. However, there is one bright spot.

Crude oil remains weak

The world remains awash in crude oil. In 2000, the Energy Information Administration (EIA) projected total world oil supplies at 1.018 trillion barrels of the energy commodity. At the end of 2014, the EIA raised that number to 1.656 trillion barrels - an increase of over 60%. More than half the world's reserves are located in the Middle East, with the lion's share of reserves outside in Russia and North America. Inventories in the United States, aside from the Strategic Petroleum Reserve, stand at 529.9 million barrels. This is a huge number for this time of the year.

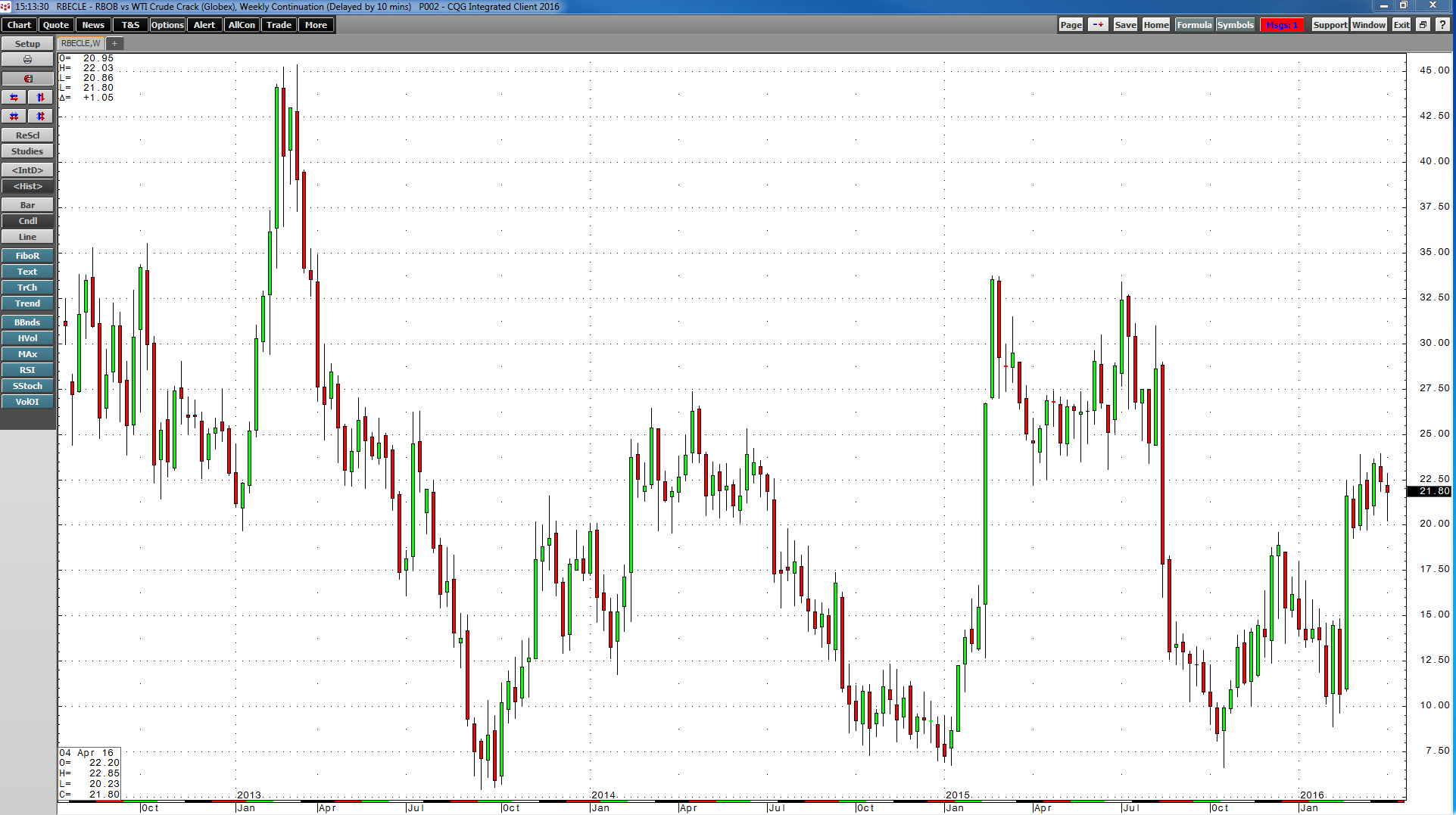

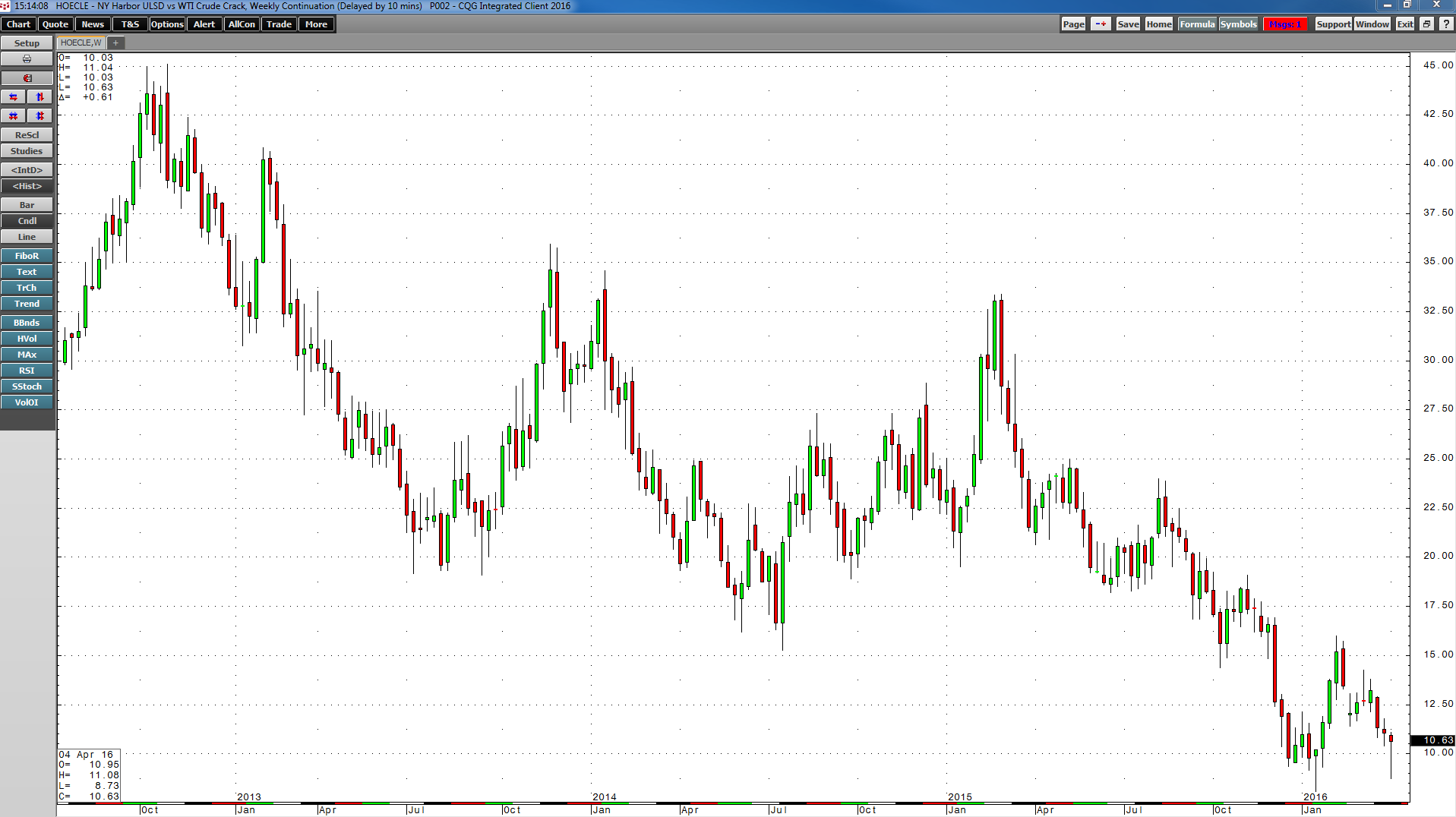

Oil product prices have been providing little support for the price of raw crude oil these days. With May NYMEX crude oil at $39.72 per barrel, the price of May gasoline futures is at around $1.46 per gallon while May heating oil futures are at the $1.19 per gallon level. Oil processing spreads, or crack spreads, remain below last year's levels.

May gasoline crack spreads are at the $21.80 per barrel level, around $3 lower than they were during the first week of April 2015.

Heating oil cracks, which serve as a proxy for diesel fuel, are at the $10.60 per barrel level; last April these refining spreads were at $21 - double the current price. Huge inventories of gasoline and distillates weigh on the prices of oil products. Even as peak demand season approaches for gasoline, we have not seen evidence of a wave of demand that will take the price higher. However, raw crude oil inventories announced last week brought some much needed positive hope to the market.

Fundamentals are still negative with one bright spot

The American Petroleum Institute (API) reported a decline in inventories of 4.3 million barrels as of April 1, and the EIA confirmed those numbers with a draw of 4.9 million barrels. The market had expected yet another increase in stockpiles, with the average expectation for a rise of 2.9 million barrels for the week. Meanwhile, rig counts continue to drop. Baker Hughes reported last Friday that rigs in operation stand at all-time lows of 354, eight lower than last week and 406 less than last year at this time. Fewer rigs will eventually translate to less North American production. There has been a long lag; U.S. production has remained at over 9 million barrels per day despite the falling number of rigs in operation. However, that is bound to change in the future.

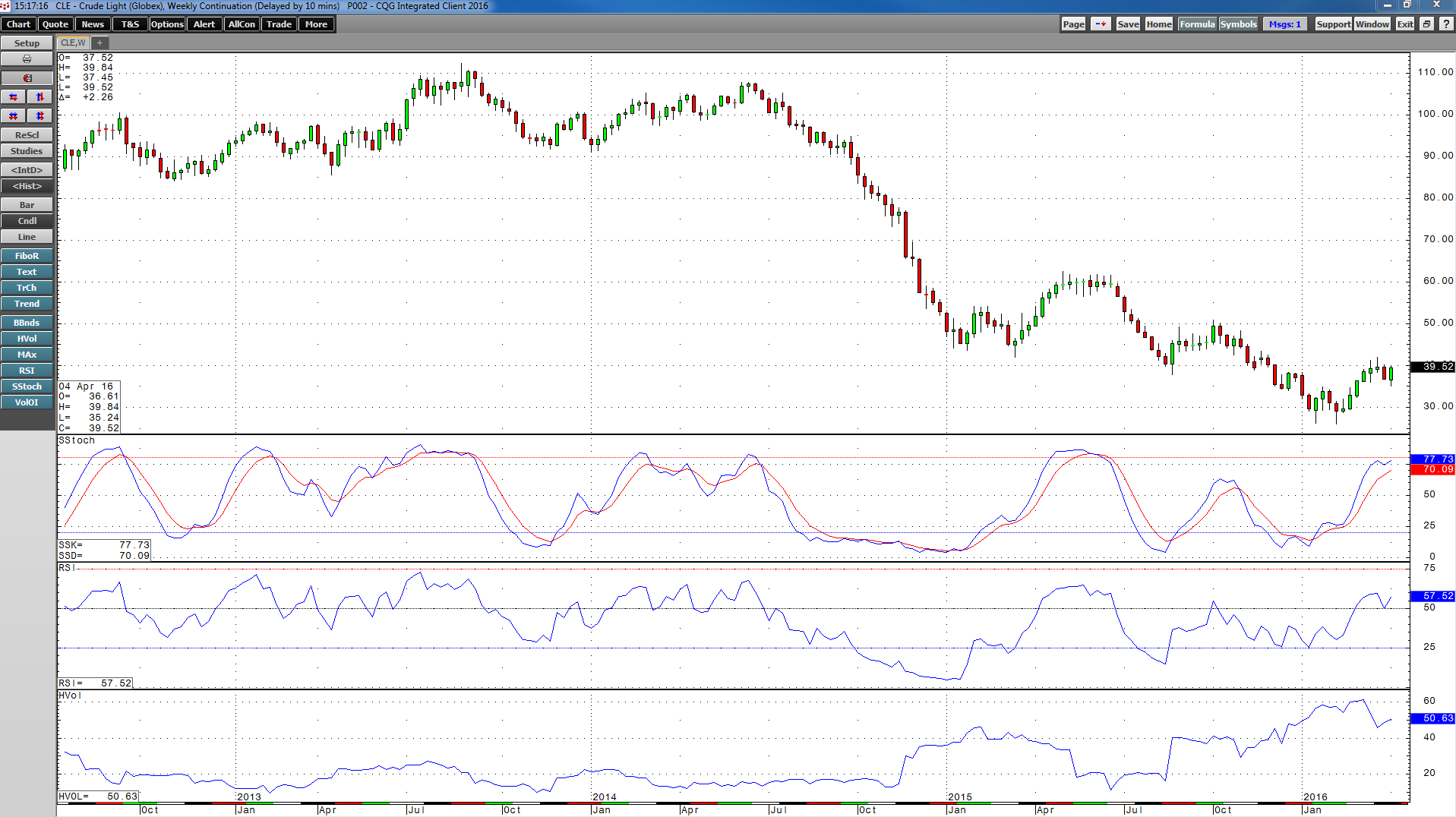

Technicals are at a tipping point

On a technical basis, crude oil is in the midst of its third recovery since the bear market commenced in June 2014.

The initial move that took NYMEX crude oil from $107.73 to $42.03 in March 2015 was followed by a recovery rally that peaked at $62.58 in early May. That rally took less than two months. After inaction at the first OPEC meeting of 2015 in June, the price fell again, this time to a low of $37.75 in August. The rebound that followed took the price of NYMEX crude to highs of $50.92 on the active month futures contract in six weeks. After a brief consolidation under $50, oil started to fall again. When the cartel once again offered no support for price and told its members to pump to their hearts' content last December, the price plunged to the lowest level since 2003 when it traded at $26.05 per barrel on February 11 of this year. The latest rally off the lows peaked at $41.90 in late March and has been sitting just below $40 in April waiting for the next word from the world's largest producers. On a technical basis, momentum indicators are in overbought territory, and the market is looking like it can go lower if the cartel once again pushes it off a cliff.

April 17 - The market is dubious

After three OPEC meetings and three new lows, the oil market is dubious when it comes to the special meeting on April 17 in Doha.

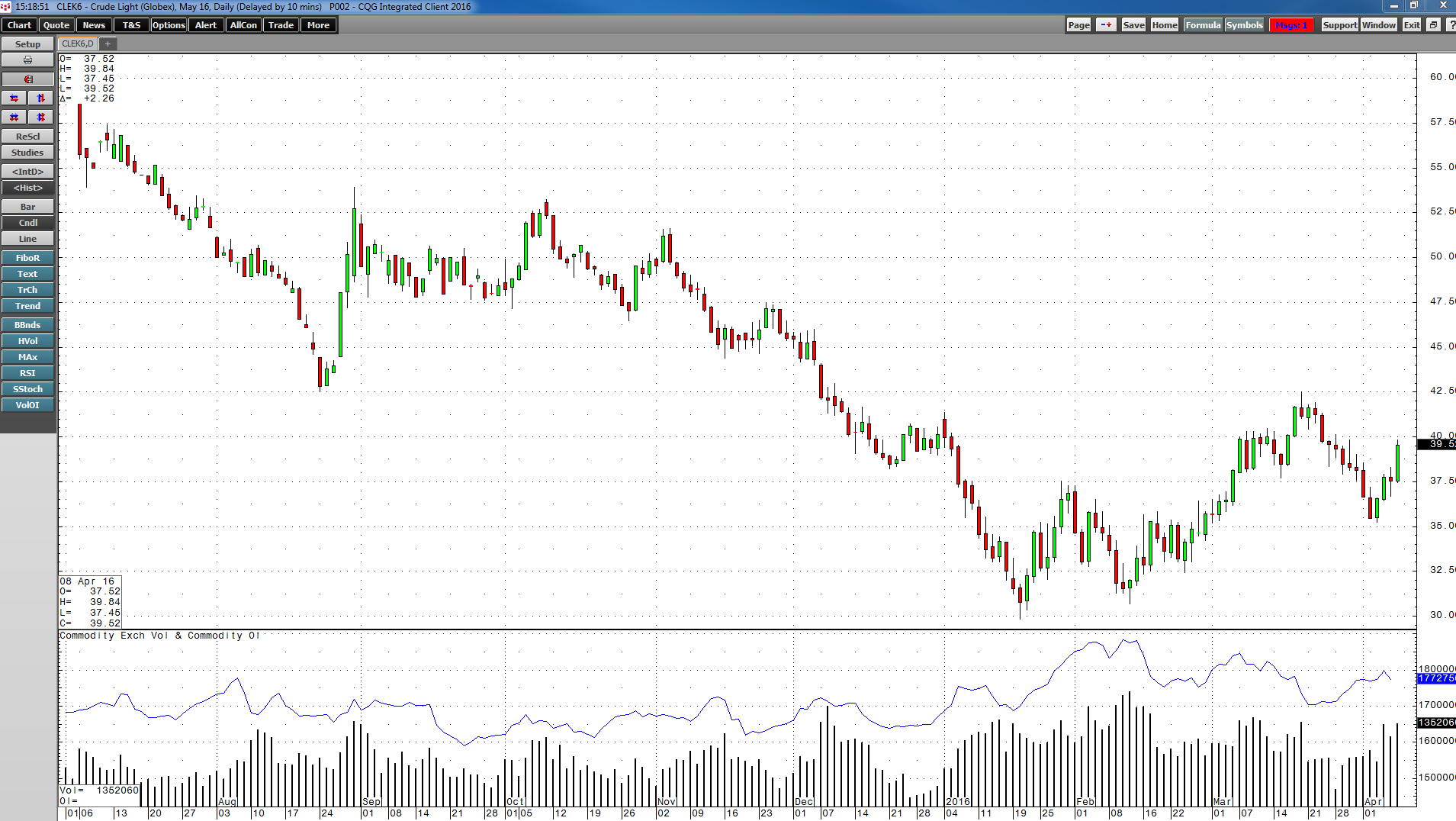

The daily chart of NYMEX May crude oil futures shows that lots of shorts hopped on board the bearish train as crude oil plunged to lows in February. Open interest, the total number of open long and short positions on NYMEX futures, moved from lows of around 1.64 million contracts in late December 2015 to highs of over 1.88 million as oil fell to the lows on February 11. The increase of 14.6% in open interest was a sign of the overwhelmingly bearish sentiment that gripped the oil market. During the recent relief rally that took crude over 60% higher from the lows, open interest fell to just over 1.70 million contracts on March 21 as market participants reduced risk positions. With the meeting in Doha fast approaching, open interest has begun to rise, closing last week at just under 1.773 million contracts. This time, the open interest could be rising as longs and shorts position for an outcome at the meeting.

Three reasons for a surprise from Doha

In baseball, you get three strikes and then you are out. However, for OPEC, a new umpire has appeared on the scene. The reason that this is a 'special' get-together for the cartel is that the world's second-largest producer of the energy commodity, Russia, will be in attendance. Russia is a close ally of Iran and they are not a member of the cartel. Iranian-Saudi relations have deteriorated over recent months given the proxy war in Yemen and a cessation of diplomatic ties over the execution of a Shiite cleric in Saudi Arabia earlier this year. Iran has been vocal about their intentions to increase production now that sanctions have eased. The theocracy claims it is their sovereign right to produce and sell more oil in the months ahead given their re-emergence on the world scene. However, the Saudis have said that there is no way they will agree to a 'freeze' unless all parties adhere to it. Thus, there appears to be a stalemate. Last week the Kuwaiti oil minister told reporters that there will be a freeze in production, prompting denials from the Saudis. All of the pre-meeting positioning leads up to perhaps the most important OPEC meeting of this century, that is not even a scheduled meeting, but a 'special' gathering. There are three reasons why I believe the oil market will finally receive a concrete policy initiative from the cartel after the April 17 congregation.

First, Russia and its leader, Vladimir Putin, have a huge interest in a higher price for oil. As the world's second-largest producer to the Saudis, Russia has a unique role at the meeting as a comrade-in-arms with Saudi Arabia as their interests are aligned. The stage was set for this meeting at a get-together between the Russians and Saudis. At the same time, Russia's close relationship with Iran means that Putin and company can influence the theocracy in ways that other members of the cartel cannot. The Iranians have stated that they wish to raise production to 4 million barrels per day. Between Russia and the Saudis, combined output tops 20 million barrels per day. In the interest of a higher oil price, the two largest producers could make concessions, covering the increase in Iranian production and splitting the difference. After all, a 10%-20% rise in the price of oil is well worth a marginal cut in production to satisfy the wishes of Iran.

Second, the Saudi Kingdom now has a vested interest in a short-term increase in the price of oil that is sustainable for the next six months to one year. The Saudis have been vocal about diversifying away from crude oil and building a $3 trillion sovereign wealth fund. To accomplish this, they will offer shares in Aramco to the public. The success of an IPO for the sale of 5% or more of Aramco shares depends on the valuation of the company. The higher the oil price, the more money the IPO will fetch. The Saudis are preparing for this IPO; they terminated a long-standing refining arrangement with Shell (NYSE:RDS.A) (NYSE:RDS.B) in March. A result from Doha that causes the price of oil to rise is in the best interest of Saudi Arabia at this point.

Finally, a successful conclusion will increase the stature of Vladimir Putin on the world stage. Over the past few years, forays into Ukraine and petulance at the West have decimated the Russian economy. However, recently Putin's star has been rising again. The Russian leader played a positive role in the final agreement between the West and Iran. Putin has cooperated with the U.S. and Europe in terms of fighting ISIS in Syria and surrounding areas. A diplomatic victory in Doha will be yet another feather in the Russian leader's cap with an economic bonus. Higher oil will take the pressure off the Russian economy and cement his domestic position. It will also leave Russia with an unofficial, yet powerful role in the cartel for the future.

It appears to me that the stage is set and interests are aligned for some type of agreement in Doha on April 17. The low oil price has been one of the causes of tremendous volatility in world markets. A stable oil price would be welcomed by most governments and monetary authorities around the world. If there is an agreement, it will be Mr. Putin who will receive the credit and adulation. Therefore, I am quite sure he is working behind the scenes to make the gathering nothing more than a formality.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.