Date: 2025-12-13 Page is: DBtxt003.php txt00011212

Energy

Solar

Solar Power ... the price of solar generation projects hits new low

Burgess COMMENTARY

Peter Burgess

Solar power price hits new low after strides made in Middle East

04/05/2016

By Diarmaid Williams

International Digital Editor

http://www.powerengineeringint.com/articles/2016/05/solar-power-price-hits-new-low-after-strides-made-in-middle-east.html

The price of solar power has come down once more, eclipsing last month’s record drop.

Renewable energy developers working in the United Arab Emirates shrugged off financial turmoil in the industry to promise projects costs that undercut even coal-fired generators.

Developers bid as little as 2.99 cents a kilowatt-hour to develop 800 MW of solar-power projects for the Dubai Electricity & Water Authority.

It amounts to a price 15 per cent lower than the previous record set in Mexico last month, according to Bloomberg New Energy Finance.

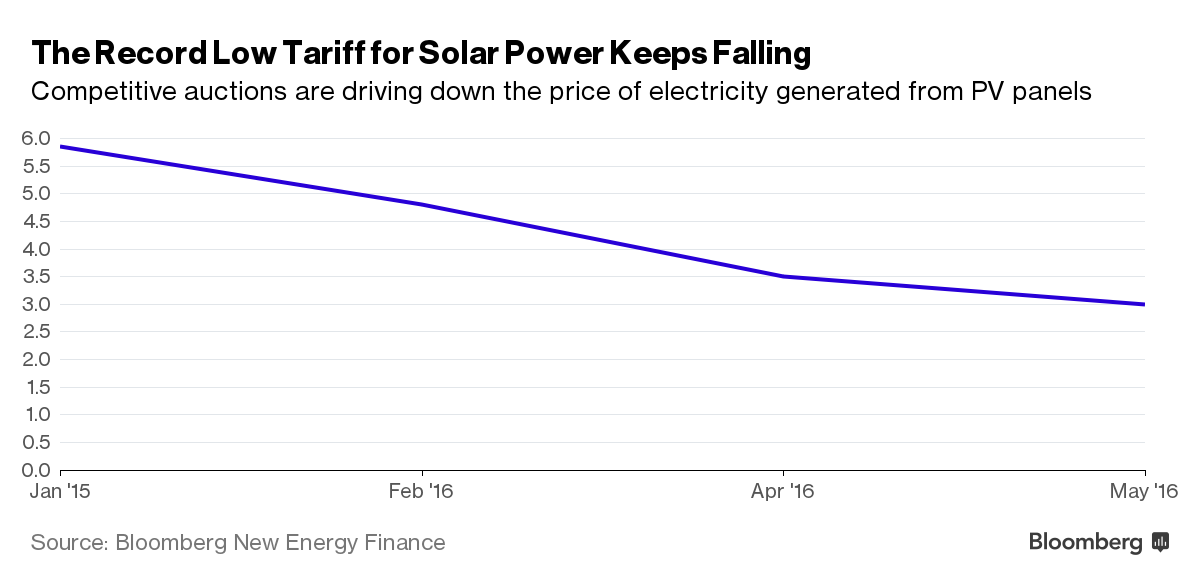

The lowest priced solar power has plunged almost 50 per cent in the past year.

Records had been set in Peru and Mexico before Dubai reclaimed its mantel as purveyor of the world’s cheapest solar power.

Solar Power ... the price of solar generation projects

Solar power set another record-low price as renewable energy developers working in the United Arab Emirates shrugged off financial turmoil in the industry to promise projects costs that undercut even coal-fired generators.

Developers bid as little as 2.99 cents a kilowatt-hour to develop 800 megawatts of solar-power projects for the Dubai Electricity & Water Authority, the utility for the Persian Gulf emirate, announced on Sunday. That’s 15 percent lower than the previous record set in Mexico last month, according to Bloomberg New Energy Finance.

Solar Energy

The lowest priced solar power has plunged almost 50 percent in the past year. Saudi Arabia’s Acwa Power International set a record in January 2015 by offering to build a portion of the same Dubai solar park for power priced at 5.85 cents per kilowatt-hour. Records were subsequently set in Peru and Mexico before Dubai reclaimed its mantel as purveyor of the world’s cheapest solar power. “This bid tells us that some bidders are willing to risk a lot for the prestige of being the cheapest solar developer,” said Jenny Chase, head of solar analysis at BNEF. “Nobody knows how it’s meant to work.”

Plunging costs along with the bankruptcy for the biggest developer, SunEdison Inc., has spurred questions about whether the cheapest projects will ever be profitable. The collapse of the world’s largest renewable energy company made some banks wary of financing projects. The winners of recent auctions in Mexico, Peru and Chile were diversified power companies like Enel SpA, which perhaps prioritized market share over profit maximization.

Dubai’s utility didn’t identify the developers behind the record-low bid it received. MEED reported that it’s a group including Masdar Abu Dhabi Future Energy Co., Spain’s Fotowatio Renewable Ventures BV and Saudi Arabia’s Abdul Latif Jameel. Among those companies, only Masdar could be reached for comment, and it didn’t confirm that it was the low bidder.

“A consortium led by Masdar, Abu Dhabi’s renewable energy company, was one of a number of bidders to have submitted a proposal for the third phase of the Mohammed bin Rashid Al Maktoum Solar Park,” a spokesperson for the consortium said in an e-mailed statement. “This is an active bid, with the technical and commercial proposals being evaluated by Dubai Electricity and Water Authority.”

Tender Process

The shift to tenders from feed-in tariffs for clean energy globally has helped governments rein in support for renewables while prodding companies to deliver lower costs. That’s shifted pressure away from government budgets and toward developers, which must strike a balance between a winning new contracts and maintaining profits.

Enel Green Power’s Chief Executive Officer Francesco Venturini, whose company bid 3.5 cents a kilowatt hour in Mexico last month, said in an interview that his projects will still make decent money even with record-low prices for electricity.

Enel’s Strategy

“There is no value in winning without margin attached,” Venturini said in an interview in Brussels last month. “I have two investment committees and two boards of directors I need to present my projects to and they want to see the money attached to it. So trust me, there is margin.”

Dubai’s state utility said it received five bids for the 800-megawatt project, which will be the third phase of the Mohammed bin Rashid Al-Maktoum solar park. It has not awarded the building permits yet. The facility is planned to have a capacity of 5 gigawatts by 2030.

“This price is borderline in terms of viability, but it’s an outlier project,” said Josefin Berg, solar analyst at IHS Inc., an industry researcher. “The size of the installation makes it easier to get good conditions on their procurement. It shouldn’t be used as a benchmark.”

The 2.99 cents bid for the solar project is a third lower than the electricity that will be generated by a coal plant commissioned by Dubai in October. That facility, set to begin generating in 2020, is expected to feed power onto the grid at 4.501 cents per kilowatt-hour under a 25-year power purchase agreement.

Watch Next: Musk vs. Buffett, a Solar War in the Desert Heats Up

iframe src='http://www.bloomberg.com/api/embed/iframe?id=_A~veRpsSl6RQfRCjBS1mQ' allowscriptaccess='always' frameborder='0'>

Musk vs. Buffett, a Solar War in the Desert Heats Up

Recommended

Bruce Lehman looks out on new home construction. Photographer: Tom Moroney/Bloomberg

Country Club Members Are Bearing the Brunt of the Golf Recession

Lars Rohde.

Don’t Bet Against the Danish Central Bank

Senior male carpenter using digital tablet while working in workshop

‘I’ll Never Retire’: Americans Break Record for Working Past 65

Millennials, Don't Worry. You'll Be Able to Retire.

2.99 U.S. cents per kilowatt-hour is 15% lower than old record

Cheaper than new coal-fired electricity in the Gulf emirate

Price of Solar Hits Record Low Again!

July 10th, 2015 by Nicholas Brown

Originally published on Kompulsa (some edits).

http://cleantechnica.com/2015/07/10/price-solar-hits-record-low/

NV Energy, a Berkshire Hathaway-owned utility company, has signed a PPA to purchase electricity from the 100 MW Playa Solar 2 power plant at a stunningly low price of $0.0387/kWh!

CleanTechnica just reported on “the world’s cheapest solar” landing in Austin, Texas, with bids under 4 cents/kWh (and the assumed unsubsidized price of solar thus being below 5.71 cents/kWh), and that was incredible news, but it looks like that staggering news wasn’t even the highlight of the month!

Note that 3.87 cents/kWh is approximately 68% cheaper than the national average electricity price. I’s also well below the low levelized cost of electricity of coal, natural gas, or nuclear, according to Lazard. The only electricity generation option that can compete with that is wind energy. Furthermore, it’s much lower than the low of 6 cents/kWh that Lazard was predicting for solar in 2017, even if you add in the expected federal subsidy boost (which brings the price up to 5.53 cents/kWh).

Lazard wind energy

“That’s probably the cheapest PPA I’ve ever seen in the US,” Bloomberg Intelligence utility analyst Kit Konolige said. “It helps a lot that they’re in the Southwest where there’s good sun.”

Certainly. More sunlight translates to more power per solar panel, resulting in a lower cost per kWh.

The growth of the solar industry contributes to the price decline we’ve been seeing over the years. The declining cost of solar PV technology certainly helps too. If solar panels get extremely cheap (and at this rate, that might happen), that makes the idea of purchasing extra solar panels to compensate for cloudy weather (as opposed to energy storage or gas backup) more attractive.

Ian Clover from PV Magazine noted:

“Having paid $0.1377/kWh for renewable energy in 2014, this new, lower price is an encouraging reflection of the rapid decline in solar costs over the past 12 months. Nevada’s Public Utilities Commission, which oversaw the submission of the 20-year, fixed-rate PPA, called the price point ‘very reasonable’ when compared to both existing solar contracts and other fossil-driven generation sources.”

The cost of solar power will continue to decline across the nation as older solar power plants are upgraded or replaced with the newer, cheaper panels from First Solar — the supplier of the solar panels for this record-cheap solar power plant — and other manufacturers. Doing this will help solar power plant owners to stay in the game and compete with not only the fossil fuel plants, but also the renewable ones. The future of solar is glowing!

Health & Science Wind, solar power soaring in spite of bargain prices for fossil fuels

Cattle graze in a pasture against a backdrop of wind turbines that are part of the 155-turbine Smoky Hill Wind Farm near Vesper, Kan. (Charlie Riedel/AP)

By Joby Warrick January 1

https://www.washingtonpost.com/national/health-science/wind-solar-power-soar-in-spite-of-bargain-prices-for-fossil-fuels/2015/12/30/754758b8-af19-11e5-9ab0-884d1cc4b33e_story.html

Wind and solar power appear set for a record-breaking year in 2016 as a clean-energy construction boom gains momentum in spite of a global glut of cheap fossil fuels.

Installations of wind turbines and solar panels soared in 2015 as utility companies went on a worldwide building binge, taking advantage of falling prices for clean technology as well as an improving regulatory and investment climate. Both industries have seen stock prices jump since Congress approved an extension of tax credits for renewables as part of last month’s $1.14 trillion budget deal.

Orders for 2016 solar and wind installations are up sharply, from the United States to China to the developing economies of Africa and Latin America, all in defiance of stubbornly low prices for coal and natural gas, the industry’s chief competitors.

“We’re seeing very good momentum across the board globally,” Anders Runevad, chief executive of Vestas Wind Systems, the world’s biggest producer of wind turbines, said in an interview. “We’re seeing growth in every region.”

Vestas, based in Denmark, is one of three major turbine makers whose stock price doubled in 2015 amid a surge of new orders from North America, Europe, Africa and Asia. Among the leading customers were U.S. utility companies, many of them in conservative Southern states such as Texas, the biggest U.S. producer of wind- generated electricity. In December, wind energy in the United States passed the 70-gigawatt threshold, with 50,000 spinning turbines producing enough power to light up 19 million homes.

Solar panels facing a solar tower taken in Sanlucar de Barrameda, Spain. (Cristina Quicler/AFP/Getty Images)

Energy analysts say the boom is being spurred in part by improved technology, which has made wind and solar more competitive with fossil fuels in many regions. But equally important, experts say, is better access to financing, as major Wall Street investment houses adopt a more bullish posture toward an industry that was once considered financially risky. In November, Goldman Sachs announced it was quadrupling its investments in renewables to $150 billion.

[This could be the one of the biggest thing to come from the Paris climate talks]

“Renewables have turned a corner in a fundamental way,” said Dan Reicher, a former Energy Department assistant secretary who is now executive director of Stanford University’s Steyer-Taylor Center for Energy Policy and Finance.

While solar and wind power have been expanding in the United States for years because of steadily falling costs, decisions by Congress and the White House in 2015 have set the stage for continued growth, Reicher and other energy experts say.

These decisions include last month’s extension of the production tax credit, which encourages investments in solar and wind through 2019, as well as the Obama administration’s Clean Power Plan, a regulation adopted in August that requires states to reduce emissions from power plants. Clean-energy companies also received an important boost from last month’s climate accord in Paris, where more than 190 countries approved a plan to reduce pollution from fossil-fuel burning worldwide.

“The policy base for renewables has strengthened, both on the incentives side and through mandates,” Reicher said. “At the same time, the financing of renewable-energy projects has become a mainstream business for Wall Street. The early-stage investments from Silicon Valley for clean energy were small potatoes compared to the massive investments Wall Street is making. It truly is a global business.”

Signs of the industry’s momentum appear in surprising places.

In China, the world’s leader in coal consumption and greenhouse-gas emissions, demand for coal is down for the second straight year, while investment in solar and wind is soaring, according to figures released last month by the International Energy Agency. China is expected to double its wind-power capacity to nearly 350 gigawatts over the next decade, more than any other country. Officials also intend to generate 200 gigawatts of solar by 2020.

India recently unveiled plans to install 175 gigawatts of renewable energy by 2022, and African nations have committed to adding 300 gigawatts of clean-energy capacity by 2030.

A gigawatt — a billion watts — is roughly the amount of energy needed to power 700,000 typical U.S. households. By comparison, the capacity of the entire U.S. electric grid is just under 1,100 gigawatts.

Still, the industry is experiencing rapid growth across the country. Solar installations were on track to hit a new yearly high in 2015, with 7 gigawatts installed and more in the construction phase. Nationwide, wind power accounts for nearly a third of all new electric-power capacity.

“We are experiencing a clean- energy revolution in the United States,” Energy Secretary Ernest Moniz said in November. “We have the tools for a cleaner and more secure energy future.”

[The best year yet for U.S. solar power]

Energy experts caution that renewables still have far to go. Wind and solar together account for only about 6 percent of U.S. electricity generation, compared with about 39 percent for coal. And wind and solar companies have yet to conquer the biggest challenge for renewables: how to cheaply store energy so it is reliably available on cloudy or calm days.

Analysts also warn that renewables could suffer if prices for natural gas remain at such historically low levels for many months or years. For now, however, industry officials say cheap fossil fuels are having little impact on purchase orders.

Runevad, the Vestas CEO, said the recent drop in prices for traditional fuels has prompted some of his customers to increase their spending on wind farms, especially in countries that are heavy importers of petroleum.

“Some countries are having a budget surplus now because of low oil prices, and they’re using that money to invest in new infrastructure,” he said. “For importing countries, it’s a net positive. Because of the uncertainty with gas prices, we haven’t seen any of our wind customers say, ‘Let’s build a gas-fired plant instead.’ ”

Runevad, who recently signed major deals to sell turbines to China and India, is confident that developing economies will ultimately choose renewables over cheap coal. India and China suffer from high levels of air pollution — mostly because of their heavy use of coal — which contributes to thousands of premature deaths annually.

“These countries need additional electricity,” he said, “but they’re also seeing a good opportunity with wind to skip over a generation of technology.”

Joby Warrick joined the Post’s national staff in 1996. He has covered national security, the environment, and the Middle East, and currently writes about terrorism. Follow @jobywarrick

Energy and Environment This may be the biggest news yet to come out of the Paris climate meeting

By Joby Warrick December 4, 2015

https://www.washingtonpost.com/news/energy-environment/wp/2015/12/04/this-may-be-the-biggest-news-yet-to-come-out-of-the-paris-climate-meeting/

Wind turbines at the Sere Wind farm, close to Vredendal, in South Africa. (RODGER BOSCH/AFP/Getty Images)

When it comes to electric power, Africa is still a continent in the dark. More than half of its 1.1 billion inhabitants lack access to electricity, and Africa’s total generating capacity, from Cairo to Cape Town, is only 160 gigawatts, or about half as much as Japan, a country with one-tenth of its population.

Against that backdrop, the plan unveiled this week by the African Union and African Development Bank is remarkably ambitious. Officials from the two organizations announced a goal of delivering at least 300 gigawatts—300 billion watts—of electricity-generating capacity to the continent by 2030, all from clean or renewable energy.

Put another way, in just 15 years Africa would be producing twice as much electricity from solar panels, wind farms, geothermal plants and hydropower than it currently generates from all sources combined.

“Our sunshine should do more than nourish our crops, it must light up our homes,” African Development Bank President Akinwumi A. Adesina said Tuesday at the formal launch of the Africa Renewable Energy Initiative, which was announced during the international climate talks in Paris. “Our massive water resources should do more than water our farms, they must power our industries.”

Citing the continent’s “massive potentials” for renewable energy, Adesina said the plan would “renew Africa and turn it into a place full of light,” while offering the benefits of electric power to nearly 700 million people who lack it.

For a sense of the project’s ambitious scale, consider that China, the world’s leader in renewables, has a generating capacity of about 380 gigawatts, mostly from wind farms and hydropower. African nations would seek to build nearly as much capacity in less than two decades.

Bank officials said the huge undertaking was possible in part because of commitments from a $100 billion annual fund pledged by wealthy countries to fight climate change. The World Bank Group has pledged $16 billion to pay for low-carbon energy development for the continent, and France and Germany have promised billions of dollars for clean energy.

By funding clean-energy projects, the initiative would hasten the delivery of electric power to impoverished areas while allowing many African states to jump directly to advanced clean-energy technology rather than building power plants that burn fossil fuels, backers of the project said. At the same time, the projects will help reduce emissions of greenhouse-gas pollutants blamed for climate change.

World Bank Group President Jim Yong Ki, in announcing new funding for African energy projects last week, described sub-Saharan Africa as “highly vulnerable to climate shocks,” with potential impacts ranging from increases in malaria epidemics to famine.

Adesina, in announcing the initiative, suggested that Western countries were morally obligated to help finance the continent’s energy transition, noting that Africa emits less carbon pollution than the rest of the world while also bearing the brunt of the impacts of climate change.

“Africa suffers more from the scorching heat from rising temperatures, he said. “Droughts are now more frequent and with greater intensity than ever before.”

Adding 300 gigawatts of clean-energy capacity in 15 years will require martialing resources on an unprecedented scale, but Adesina said he believed the target could be met and even exceeded.

“We must not have low ambitions for Africa,” he said.

Joby Warrick joined the Post’s national staff in 1996. He has covered national security, the environment, and the Middle East, and currently writes about terrorism. Follow