Date: 2024-08-16 Page is: DBtxt003.php txt00011350

Finance

European Strategy

Why Brexit May Be the Straw that Breaks the Camel's Back

Burgess COMMENTARY

Peter Burgess

Why Brexit May Be the Straw that Breaks the Camel's Back

The head of Germany's financial regulatory authority is sounding the alarm on Brexit risks to large German banks. Two banks cited as having the largest business dealings in London are Deutsche Bank (DB) and Commerzbank (CRZBY), with shares of DB breaking to new all-time lows.

deutsche bank new lows

Source: StockCharts.com

Consider 'Brexit' would cause big problems for German banks: German financial watchdog

A British vote to leave the European Union would hit large German banks, given their heavy exposure to London, the head of German financial watchdog Bafin said in an interview with German newspaper Tagesspiegel.

Bafin President Felix Hufeld told the newspaper in an article to be published on Monday that he hoped Britons would vote to remain in the European Union.

If not, 'the biggest banks would have the biggest problems,' the newspaper quoted Hufeld as saying. 'They have the most activities in, and with, London,' he said.

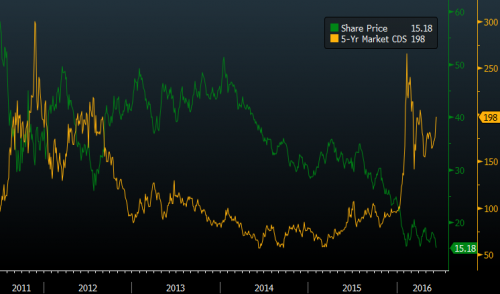

Starting out this year, credit default swaps—insurance against the risk of default—on Deutsche Bank shot straight up matching levels not seen since the European debt crisis. Though off their February highs, default risks appear to be rising again:

deutsche bank cds

Source: Bloomberg

Though a vote by UK citizens to leave the EU next week on June 23rd could be the catalyst for wider concerns regarding the fate of European Union, we should not reverse cause with effects. See 'Desperate' ECB risks destroying European project with negative rates, warns Deutsche Bank:

The European Central Bank's loose monetary policy risks destroying the European project, Deutsche Bank has warned.

In a blistering attack, Deutsche suggested the ECB had 'los[t] the plot' and that its 'desperate' actions raised the risk of a potentially 'catastrophic' mistake by the central bank.

David Folkerts-Landau, Deutsche's chief economist, said negative interest rates and quantitative easing had hurt savers and allowed politicians to delay badly-needed structural reforms.

'ECB policy is threatening the European project as a whole for the sake of short-term financial stability,' he said in a note titled 'The ECB must change course'.

It said: 'The longer policy prevents the necessary catharsis, the more it contributes to the growth of populist or extremist politics.

'The benefits from ever-looser policy are diminishing while the litany of distortions, perversions and disincentives grows by the day. Savers are punished and speculators rewarded. Bad companies survive while good companies are too scared to invest.'

Given the current risks, Cumberland's David Kotok sent out a note on June 10th saying 'We have taken banks and financials to max underweight' and 'We have raised cash.' Here's the reasons he gave:

Brexit is a risk to banks

Flattening yield curves hurt banks

Tighter capital rules hurt banks

Negative rates hurt banks

Both political presumptive nominees are unfriendly to banks

But here was the key nugget: 'Using the price/sales ratio we examined the financials with the help of Ned Davis Research. The Financial Sector is more than 2 standard deviations above its 30-year average. It is the highest ever using weekly data.'

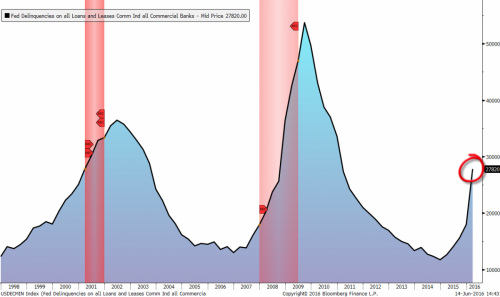

If true, and the financial sector is massively overvalued, it certainly doesn't look good for their bottom line when bank loans at or near default are spiking to recessionary levels.

bank loan default delinquencies

Source: Bloomberg

For a complete archive of our podcast interviews on finance, economics, and the market, visit our Newshour page here or iTunes page here. Subscribe to our weekly premium podcast by clicking here.