Date: 2025-12-13 Page is: DBtxt003.php txt00012114

Carbon

Incentivizing Carbon Conservation

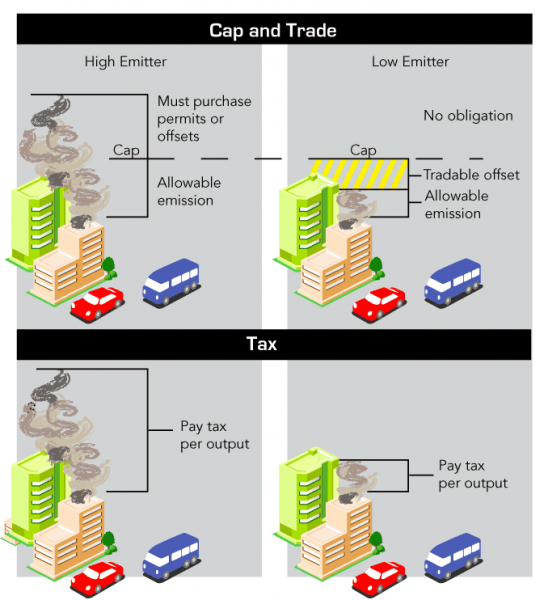

Pricing Carbon: Tax vs. Cap and Trade

Burgess COMMENTARY

Peter Burgess

Pricing Carbon: Tax vs. Cap and Trade

| Addressing a Market Failure: the costs of emissions to US health and welfare are paid by the public. | |||

| A Market Solution puts the costs of emissions on the emission, not on the consumer. Two solutions are Cap and Trade and a Carbon Tax. | |||

| The ways pricing carbon by either mechanism are similar | |||

|

Harnesses market forces to achieve the lowest cost reductions in green house gas emissions

Imposes compliance obligations on targeted industries Requires monitoring, reporting and verification Can have adverse impact on high emitting states and communities A comparison of the differences | |||

| Cap and Trade | Tax | ||

|

Emission Certainty

Allowed emission are set The costs vary as market forces affect technologies and financing |

Cost Certainty

The tax is set by Congress. Since it requires a vote of Congress, rate changes are not expected to be frequent, although they are expected to respond to major shifts in the economy Emissions reduction harder to predict since some companies will pay the tax rather than reduce emissions | ||

|

Permits for emissions

Sets a maximum level of pollution, distributing emissions permits among firms that produce emissions Companies can obtain permits either through an initial allocation or auction, or through trading with other firms |

Tax on emissions

Imposes a tax on each unit of greenhouse gas emissions Gives firms an incentive to reduce pollution whenever doing so would cost less than paying the tax | ||

|

Complying with the cap

Company decides how to meet emissions reduction through investments in carbon reducing activities, such as installing new equipment or buying offsets Can purchase offset from company that has emissions below their allowable cap |

Complying with the tax

Company decides how to balance costs of taxes against installing emissions reductions Can not trade reductions with another firm | ||

|

Indirect costs to consumer

Indirectly affects consumer as costs integrated into capital costs through long term investment, loans and other financing |

Direct costs to consumer

Can directly affects consumer as a tax tends to impact cost of goods | ||

|

More complexity

Continuing government involvement in administrating a complex system that measures current emissions against the cap, predicts emission reductions from installed new technologies or upgrades, and balances the trade of offsets from one company to another |

More transparency

Less government involvement, as tax is levied against verified emissions yearly | ||

|

Flexible

Market sets pricing In a good economy, market will tend toward higher pricing of offsets and technologies, and vice-versa Companies can use long term strategies to finance projects that reduce emissions |

Set

Government sets tax rate It takes an act of Congress to change that rate Companies set policy on a yearly basis as they asses the impact of the tax Long term planning affected by the potential for congressional changes in future years | ||

|

Slow impact

Cap rises over time, so slower impact on business |

Fast impact

Tax hits at the same time, so faster impact on business | ||

|

Extensive global implementation experience

In the US and Europe |

Limited global implementation experience

Taxes on the supply side -- fuels -- have been very successful Some failures, as in Australia where voters demanded an end due to increases in electricty costs | ||

|

Higher preference among Progressives

Greater assurance of carbon reductions Revenue goes towards supports for research and development of technologies that lower green house gases |

Higher preference among Conservatives

Taxes the problem -- the externality -- rather than income Can be revenue neutral: that is dollars are returned to the tax payer | ||

|

Potential Best Use

Large industrial plants and utilities |

Potential Best Use

Transportation, heating and cooling |