Date: 2024-12-21 Page is: DBtxt003.php txt00012413

Thinker

Shelly Palmer

Shelly Palmer ... 2016 Consumer Electronics Trend Report ... very thought provoking, but only valid from the technology perspective

Burgess COMMENTARY

Peter Burgess

Shelly Palmer 2016 Consumer Electronics Trend Report

The Shelly Palmer 2017 Consumer Electronics Trend Report will be published in late December 2016. In the meantime, please enjoy our 2016 report.

Researched and written by Shelly Palmer, Jim Turner, Dan Dubno, and Jared Palmer with special contributions from David Lawrence.

Introduction

Consumer Spending

Screens

Media Consumption

Automotive

Internet of Things (IoT)

Drones

Cyber-Security

3D Printing

Virtual & Augmented Reality

What’s Next

Introduction

Consumer electronics continue to tell a story of connectivity, data, security, privacy, access vs. ownership, changes in media consumption, and the emerging on-demand economy. The Internet of Things (IoT) continues to be part of every conversation as billions of new devices are purpose-built to help us live more connected lives. We’ll look at how processing power will impact consumer experiences, explore the future of manufacturing, think about virtual reality, and give a quick overview of screens, wearables, drones, streaming video, self-driving cars, and much, much more.

Before we get started, here are four observed laws that will help you think about technological progress and when any given technology may become important to you.

Moore’s Law

The number of transistors on integrated circuits doubles approximately every two years.

This isn’t accurate. It’s more like one year, and the rate of change is accelerating. However, Moore’s law does speak to the idea of exponential growth.

Metcalfe’s Law

The value of a telecommunications network is proportional to the square of the number of connected users of the system (n²).

While the math here is also debatable, it is very obvious that the value of a network increases with each additional user. The only question is, by how much?

The Law of Accelerating Returns

The rate of change in a wide variety of evolutionary systems tends to increase exponentially.

This is the least obvious of the four laws, but understanding the exponential rate of technological progress is critical to understanding how consumer behavior is likely to evolve.

The Palmer Postulate

The velocity of information is increasing and will always increase.

This is a simple truth that highlights our need for bigger, faster networks, more storage, and significantly greater processing power to cope with the accelerating data deluge.

What Does This All Mean to You?

Taken together, these observed laws suggest that today is the slowest rate of technological change you will ever experience in your lifetime; the more people are connected, the more powerful the network becomes; and, finally, data is a new frontier.

Consumer Spending

At a time when overall market growth for consumer electronics remains fairly flat, consumers seem to be embracing rich online gaming experiences and are virtually inseparable from their smartphones. According to the CTA, consumers spent $285 billion on electronics in 2015. Holiday spending was up 2.3 percent as three-quarters of all consumers planned heavy outlays on electronics, and one-third more money went toward online purchases.

What Tech Are Consumers Buying?

While fewer dollars were spent on televisions this year, 60 percent of consumers were looking to purchase 4K screens, with a third of consumers eager to get screens 60” and up. Sales of tablets were down, but laptops grew as more than half of consumers looking for notebooks sought Yoga PCs and other flexible form factors. Although “Wearables” were the fastest-growing sector, this relatively new collection of devices (like smartwatches and fitness bands) represented only about 12 percent of spending on consumer electronics.

$53 Billion on Smartphones Alone

Smartphones, tablets, TVs, laptops, and desktops are responsible for more than half of consumer electronics spending. Almost 80 percent of households added one or more new smartphones, spending over $53 billion worldwide. According to Adobe, the mobile device is leading the way consumers make shopping decisions. About a third of all online sales were made on a mobile device—with iOS devices leading Android devices in sales (as they have in the past).

Peripheral Profits

One surprising resurgent area of consumer electronics spending is in audio and peripheral devices, particularly wireless audio devices and headphones. Half of consumers are considering buying audio gear, with a quarter focusing on Bluetooth headsets and another 25 percent looking at wired headphones. No surprises here; these accessories complement consumers’ growing affection for, and addiction to, mobile devices—the powerhouse segment of consumer electronics spending.

iPhone 6s

Screens

Smartphones, tablets, PCs, and TVs

It’s a Mobile World

Smartphones are the number one device for 92 percent of millennials—they are more likely to have a smartphone than a PC. Over two-thirds of all digital media time is now spent on mobile devices, with a staggering 90 percent of that time being spent in just a few applications. comScore says we use about 50 percent of our mobile time on a single, favorite app (mostly social media). Meanwhile, time spent on mobile browsers declined by half. Handheld mobile devices have become our fastest-growing entertainment centers, with blistering usage growth of 240 percent in video and gaming content. Mobile devices are now getting as much of our time as television! (Flurry). And Google says mobile searches (which exceed 100 billion per month) have surpassed desktop searches (Cynopsis). The trend is clear; communication is becoming more mobile every day.

Laptops and Tablets Are Cheap and Plentiful

Purchases of laptops and desktops continue their decline, but manufacturers are trying to reinvigorate the market with two-in-ones. As for tablets, the end is near. According to the CTA, 53 percent of potential buyers were shopping for computing devices, with 26 percent planning on buying a tablet and 23 percent a notebook. Fourteen percent planned to purchase external storage and another 14 percent eyed getting an e-reader.

Tablets were supposed to be laptop killers. To hear Apple tell it, with the introduction of its new iPad Pro, we are one step closer to a tablet-centric world. But the facts don’t support the optimism. Using Apple as a proxy for the entire tablet market (since Apple basically invented the category back in 2011 and still accounts for the highest percentage of sales), the market is shrinking fast.

Big smartphone screens make small tablets seem redundant, and yoga PCs and brilliantly featured MacBooks, MacBook Airs, Microsoft’s Surface Book, and other exceptionally capable laptops do much, much more than even the most sophisticated Android or iOS tablets. Microsoft made some noise with its Surface Pro—it’s a Windows PC in tablet form. But it’s expensive, big, and heavy. To quote Business Insider, “More and more, the tablet is looking like a fad. Now that phone screens have gotten larger, there’s just not that much use for a slightly-bigger touch-screen device that works like a phone, but without the phone part.” “Fad” may be too strong of a word; Moore’s Law will surely take the tablet form factor to new places in the very near future. Of course, Moore’s Law will also apply to smartphones and PCs, so tablets may well have their best days behind them.

TVs

Sales: The flat screen TV business is all about Ultra-HD (“UHD” or “4K”) sets. Not surprisingly, 4K sets will be bigger, thinner, and cheaper than they were last year. The picture quality will increase as well. Competition for your 4K TV dollars is fierce. Prices are in a freefall, with several good choices below the $1,000 threshold. Samsung leads in the United States, as its TV sales hit $1 billon monthly this past October. The company delivers over half of all UHD sets in North America.

New Features: While sets under 55” really don’t benefit from 4K technology, the feature battle between manufacturers focuses on four key areas: pixel resolution, frame rate, color gamut, and dynamic range. Wide Color Gamut (WCG) specifies the total number of colors a screen can display. Many sets claim the feature, but there is no agreed-upon standard. High Dynamic Range (HDR) is a feature that, in layman’s terms, offers blacker blacks and whiter whites. There are competing standards for this specification as well. LG, which is investing $8.7 billion in a new plant, offers organic light-emitting diode (OLED) technology, which does feature an exceptional HDR image. Even so, engineers and techs will argue about what HDR and WCG really mean for the foreseeable future.

Is there anything to watch in 4K? Yes, but not much. Unfortunately, delivery of 4K content requires more bandwidth than is available in 80 percent of US households. Most industry professionals suggest you need 30Mbps down to enjoy 4K content; Netflix recommends 25Mbps for its customers. Is it possible that Blu-ray could make a minor comeback in 2016 with 4K capabilities?

Streaming TV ... Media Consumption

How consumers consume

Video viewers are continuing their migration to time-shifted and on-demand services. The numbers paint a very clear picture: only sports and some live events remain “appointment TV.” Viewers are watching more video than ever, but less and less traditional television. For millennials, who now basically watch video on TV and on mobile about equally, the shift is toward mobile.

The year 2016 will be another transitional year for the television industry. Everyone has a personal story about cord cutting and skinny bundles and the death of television—“You know nobody watches TV anymore. By the way, can you believe what Meredith said to Cali’s girlfriend on Grey’s last night?” And absolutely everyone has a personal timeline for the advent of à la carte cable programming. “Consumers want it. It’s going to happen soon.”

That said, a recent study by Clearleap Digital opines,

Streaming service penetration is now on par with cable. Of those surveyed, 78.85 per cent reported currently subscribing to cable, and 71.37 per cent confirmed that they had used a streaming service (either previously or currently). Millennials are leading the OTT revolution, leaving cable behind. Of respondents between the ages of 18-29, 70.32 per cent use a streaming service, while only 64.41 per cent have a cable subscription. Additionally, just over one quarter (26.48 per cent) of respondents in this age category have never subscribed to cable, confirming that younger viewers don’t have the same attachment as their parents or grandparents.

Time-Shifting and the Big Binge

T-Mobile is boosting video consumption offering free online video bingeing (“Binge On”) from 24 powerful content providers including Netflix, Hulu, SlingTV, WatchESPN, Crackle, and the like. It’s no wonder that your smartphone battery is always dying: In 2015, the average US consumer spent three hours and 40 minutes per day on mobile, a 35 percent increase over 2014.

Time-shifting has won. Many top shows are getting more audience in the week after live broadcasts than are watching them live. Millennials watch live airings only about 30 percent of the time. Video apps have become even more appetizing: 181 million people will watch online video on an app or website this year, and that’s projected to grow to 200 million by 2019. YouTube is the leader, with 94 percent penetration. Netflix is at 63 percent, Amazon at 36 percent, and Hulu at 33 percent. Amazon and Hulu are growing at a faster rate, as YouTube and Netflix have largely achieved their potential audiences in the United States.

Fifty-eight percent of US households use at least one streaming service every month, and more than a quarter use two or more. About 43 percent of US households have a Netflix subscription, 19 percent have Hulu, and 17 percent have Amazon. Besides these big three, top services include MLB.TV, WWE Network, and HBO Now. SlingTV is at #10. About 64 percent of streaming service users share passwords. Millennials are the worst offenders, as a remarkable 79 percent of them share passwords—which some suggest caused Netflix to raise its prices.

The average user, between 18 and 45, watches 204 minutes of video per day, split roughly 50/50 between TV and online. The “connected TV” audience is now at 140.5 million in the United States, with 36.8 percent of that viewing on game consoles. Use of Pay TV and streaming is also nearly equal to each other as of this year.

“Over-the-Top” (OTT) wired services are predominately watched on TVs—62 percent of Hulu viewers do so on a television. Hulu’s ad-free service has limited pickup—only about 7 percent. Viewers want more quality program access yet are still willing to endure commercials (if they can’t time-shift through them). Remarkably, “Over-the-Air” (OTA) devices are making a comeback as they let consumers use antennas for free TV and assist cord-cutting for people who prefer OTT premium content.

Streaming Box sales are climbing, and they are getting deeper household penetration, reaching half of the US baby-boomer households. And the “unbundling to rebundle” of content services is happening very fast. Hulu offers Showtime at a discount for subscribers, and Amazon is rumored to be ready to bundle up other OTT services. Consumers are feeling overwhelmed and confused with choices. Eighty-six percent of US users want a single authenticated app. (They used to call this integrated technology a television set). Discovery and search are becoming key; cross-service search like Roku and TiVo is serving a very demonstrated need.

The squeeze is on by viewers reluctant to pay premium prices for premium content. There’s been a drop in Pay TV subscriptions for the first three quarters of 2015, and that’s the largest decline ever—the sixth consecutive quarter of declines—but that rate is slowing, and it looked much better in the third quarter of 2015.

Sports programming is saving subscriptions. Thirty-seven percent of cord cutters are considering returning for sports programming. Greater consumer reluctance to pay for programming is not diminished by consumers’ eagerness to seek more programming that’s convenient to access. This shift will continue to change TV industry dynamics, leading to greater audience fragmentation, limited advertising dollars, and likely at some point a cap on how much new content production will emerge after a relatively “golden age” of new productions. Although there are more “TV quality” shows in production now than ever, it’s counter-intuitive to think that the industry’s answer to smaller audiences is to increase production. But that is exactly what is happening, and it’s a trend that will continue until the economics prohibit it.

Overall home entertainment spending was steady, up just 0.9 percent (just under $9 billion for the year). Digital will be about half of the total this year and is growing. The year 2015 will be the first year subscription video on demand (SVOD) spending beat out physical rentals (SVOD was up 23 percent). The end of physical media seems to creep closer every year.

Music and Audio

The music business finally stopped its free-fall in 2015, and there’s been a surprising resurgence of consumption in the audio sector. Music sales had been flat year over year, finally stopping their decline with an estimated $32 billion in revenue. Importantly, online purchases, including iTunes revenue, is trending downward.

Music streaming services are the big story. Nielsen says that 41 million globally pay for a music service (that’s an audience smaller than Netflix) and 75 percent of US consumers listen to music online every week. Most people are still discovering new music on the radio (61 percent), 45 percent from family and friends, and 31 percent from movies and soundtracks, and 27 percent discover music on YouTube. About 66 percent of US baby-boomer households use a streaming audio service, and 26 percent subscribe to a paid music service. Estimates are that 97 million wireless speakers will be sold globally in the next three years. Soundbars are finally making their move in the marketplace, despite having been around for nearly a decade. Again, it’s the millennials who are snapping up the devices, accounting for 44 percent of sales, up 9 percent year-on-year. Sales of soundbar units under $200 are up more than 10 percent, while sales of units priced over $500 are down 34 percent. Hi Res audio is finding this new audience. Even vinyl is making a comeback.

Self Driving Car ... Automotive

Autonomous, semi-autonomous, and connected vehicles

Semi-Autonomous Vehicles

Semi-autonomous vehicles are an emerging consumer tech category. The car continues to be the most expensive mobile device consumers own, and the automotive industry is doubling down, aggressively participating in CES (the “Car Electronics Show”) again this year. The automotive industry’s strategy to use driver-assistance to facilitate man/machine partnerships is sure to work. In America, there still are nearly a hundred automobile deaths each day. As we become more comfortable and reliant on adaptive cruise control, lane assist, autonomous parking, and other safety features, we will become acclimated to the idea that cars can do most (or all) of the work. The accident rate has been slowly declining in the United States over the past five years, but manufacturers expect semi-autonomous technology improvements to lower it further and faster. Man/machine partnerships are a big trend in consumer electronics, and nowhere is it more evident than in the automotive industry.

Connected Cars

Connected car features continue to improve. We’ll see better smartphone integration, more in-car hotspots, and add-ons for tracking and monitoring like Verizon’s Hum. Hum plugs into the onboard diagnostic system, and for a monthly fee, monitors vehicle health, provides maintenance reminders and stolen vehicle assistance, and even interfaces with a parking location tracker. The device features hands-free communication when paired with a smartphone and offers emergency roadside assistance. Cross-device connection is coming—you’ll soon be able to plan routes on your tablet and pass that to car systems, and even integrate smartwatches or smartphones for navigation. However, the consensus of analysts is that the smartphone will remain the key integrator of automotive mobility services for the foreseeable future.

Data-Driven Driving

Crowd-sourcing data through programs like WAZE and those under development at Ford will continue to improve traffic flow and arrival times. Real-time street data collection will also aid traffic managers to rapidly respond to potholes, icing, and other hazards. Insurance companies are also huge proponents of technologies that track safe driving, automobile conditions, and vehicle maintenance. And while these better versions of connectivity might not seem game-changing, the impact of reduced friction in any ecosystem cannot be overstated.

When Will My Car Drive Itself?

As soon as possible! GoogleX’s well-publicized self-driving cars have already racked up more than 1.2 million miles—the equivalent of 75 years of an average driver’s time—and have done so with just a handful of minor accidents. Nearly every car manufacturer has announced autonomous car projects with target dates circa 2020 for autonomous vehicles. Tesla and Mercedes have significant offerings, but this is an industry trend. Tesla has released software “still in beta form” for its Model S that gives drivers (who must still keep one hand on the wheel) a “semi-autonomous” driving experience. After the driver touches the turn signal, the Tesla automatically changes lanes.

Mercedes and Volvo allow for a self-driving mode at slower speeds but also require drivers’ hands on the steering wheel. Volvo is teaming up with Microsoft to co-develop self-driving cars. They’ll be demoing their first autonomous vehicle Concept 26 with a 25” flat-screen console display and “cradle seats” that adjust from “drive” to “create” to “relax.” Cadillac will be the first GM brand introducing “Super Cruise” in 2017 on the CT6 model. This auto will feature facial monitoring to be sure the driver is staying engaged or else it will vibrate the driver’s seat. Nissan is also street-testing a self-driving prototype based on the Leaf. Nissan wants to sell production cars featuring a semi-autonomous mode by the end of 2016, the ability to change lanes by 2018, and full road and intersection navigation by 2020.

Developments of automotive autonomy have been so rapid that ethicists and pundits are now debating what life-or-death decisions cars should automatically make when faced with an inevitable crash. As you can imagine, as formidable as the technological hurdles might be, the biggest obstacles to fully autonomous vehicles will be from regulators and societal and behavioral inertia. Fasten your seatbelt—this is going to be a wild ride.

Internet of Things (IoT)

The Data Economy, Smart Home, Wearables ... Smart Home of the Future

Smart Everything

We are just a few years away from smart everything. It’s a story being told thousands of different ways at CES this year, but it’s also a story being told at the Kitchen & Bath Show, the Detroit Auto Show and every other trade show for every other industry. IoT is more than a trend; it’s a road that we will all travel into the future.

Internet of Things (IoT)

Every physical object or “thing” that can be embedded with sensors will be embedded with sensors. Whether you call it the Internet of Things, the Internet of Everything, M2M, a smarter planet, the Industrial Internet or something else, the trend is clear. With so much activity and interest, it is unfortunate that a de facto communications standard has not emerged. However, there is progress (or managed conflict) in the right direction.

The AllSeen Alliance and the Open Interconnect Consortium are just two of the major organizations vying for IoT superiority. AllSeen Alliance’s certification program is now open, with the AllJoyn framework. The latest estimates are that 120 million products built with AllJoyn are in the market (or will be upgraded to meet certification standards). They’re facing off against the Open Interconnect Consortium, which has its certification program starting by the end of 2015, with its open source reference implementation called IoTivity. OIC bought Universal Plug and Play Forum (UPnP), a 15-year-old standard used on about 3 billion devices, in an attempt to make home integration between standards somewhat easier. Apple’s HomeKit and Nest Weave standards are not necessarily compatible either. It’s important to note that the majority of IoT technology is not projected to end up in homes, but in businesses. A McKinsey study says that the total potential value of IoT devices in a decade will soar toward a staggering $3.9 to $11.1 trillion, with the majority of devices being factory and operations equipment. Consumers are projected to spend only a third of that amount. McKinsey warns that companies that fail to invest in the development of IoT technology will find themselves left behind.

Smart Home

Smart Home is growing, but it is also facing headwinds created by the struggle for communications standards. That said, most industry analysts believe Smart Home presents a massive opportunity. NextMarket Insights projects that $10.1 billion will be invested just in “smart kitchens” by 2020. Twenty-five percent of cooks are already using tablets or smartphones to help prepare meals in the kitchen. For example, Bluetooth and infrared thermometers are already finding their way into the hands of sophisticated home chefs.

However, Smart Home growth will require a unified series of protocols, so beware the coming shakeout as various Smart Home networks fight for dominance: Alphabet’s Nest Weave, Samsung’s SmartThings and Apple’s HomeKit, to name a few. Nest Weave is leveraging its intuitive series of thermostats and cameras. With 11,000 developers signed on to its protocols (with an expected early 2016 release), Nest partners include Philips, Yale (locks), August, Mimo (baby monitors), SkyBell, Petnet, GE, Tyco and Earth Networks (weather bug). In the United Kingdom and Europe, Nest’s third-generation thermostat also features the ability to control hot water systems. Samsung’s SmartThings work with Philips, Bose, Belkin, Aeon, GE switches and several dozen other devices. And Apple’s HomeKit adds functionality from a wide variety of lighting, locks, heating and cooling devices, plugs, switches, sensors, window shades and more.

While the standards fight continues, home automation devices are getting better and easier to use. Nebia, a smart shower-head announced on Kickstarter, will use 70 percent less water by atomizing droplets to create greater surface area for greater skin contact. iRobot’s new Roomba 980 uses a low-resolution camera to map your entire home while it performs a very thorough cleaning job. One day, iRobot expects their robotic map will play a part in helping control other parts of your smart home. Wondering who would own that invariant map of your home and what might be done with it? You should.

Wearables

Wearables are still growing fast, but they are also still trying to find their market. Fitness trackers are the dominant force. According to Juniper Research, the fitness wearable market is projected to grow by $10 billion by 2020, up from $3.3 billion in 2015. Apparently, people really do like to count their steps, measure their heart rates and time their sleep patterns.

Smart watches, especially in the fashion category, will be testing the water (although most are not waterproof). Park Associates claims that sales of smart watches will top 100 million units by 2019. Apple has already sold more than 7 million smart watches through October 2015, though that number is less than projected. TAG Heuer has entered the AndroidWear market with a hefty but elegant smart watch at a premium price tag of $1,500. While the TAG Connected watch is waterproof, it does not feature a heart-rate sensor or GPS. But the watches do come with a guarantee to let consumers switch to a conventional mechanical watch within two years if they don’t like it. Interestingly, LG entered the fitness watch arena with a high-end “Luxe” gold-cased luxury connected watch (offering a higher-pixel count display), then sheepishly yanked it just six days into the market, citing hardware issues.

Fitness bands still outsell smart watches (Fitbit and Xiaomi in the lead). Smart clothing is doing everything it can to start a fashion trend, but smart track suits are not getting much traction. Ralph Lauren has introduced “PoloTech” shirts with embedded fitness trackers for heart rate, heart variability, breathing depth and recovery, intensity of movement, stress levels, steps taken and calories burned. The shirt requires a “black box” of sorts to be carried along to transmit data to iOS devices, including the watch. Expect new form-factors in fitness devices: “bandage-like” strips are coming, as are earrings and finger rings.

BioSense’s “Ear-o-smart” earring uses ear lobe sensing for more accurate heart function monitoring. Fitlinxx has a transparent, thin, bandage-like sensor strip that’s waterproof to monitor heart rate. This year, some of the biggest news in wearables will come from the medical community as insurers and employers improve healthcare outcomes with sensors and associated apps. Employers will integrate more than 13 million wearable devices into employee wellness programs by 2018, says ABI Research. There are even sensors that track whether patients have taken their medicine: Proteus Digital Health and Otsuka Pharma combine Abilify with a sensor and wearable patch that relay daily dosage intake by phone to a healthcare provider.

Drone ... Drones

The only place to see more drones than in the air is at CES, where the number of presenting companies will continue to fly high, as they have over the past two years. While these high-flyers remain interesting, they are also a relatively small niche market. CTA says that during the 2015 holiday season about 700,000 drones will be sold. Interest is clearly growing, and so is federal attention as regulators from the FAA, the Department of Transportation, and other agencies puzzle out what to do with these fun flyables. Pilot sightings of drones have doubled in the last year, with the FAA getting about 100 reports a month. An incident where a drone penetrated security at the White House led law enforcement officers to coin a new term, “Drunk Droning.” Such careless actions by a few drone pilots have resulted in Congress and almost most pilots associations to call for registration of drones. The FAA is setting up a task force, which means regulations and restrictions are soon to follow.

DJI, the Chinese company that is one of the largest manufacturers of small-scale drones, has built geo-fencing into its newest devices. These units come with a database of restricted locations including all of Washington, D.C., airports, prisons, power plants, and others. The technology doesn’t actually restrict the pilot, but notifies them, limiting liability for the company.

Meanwhile, retailers like Walmart, Amazon, Google, and others have asked for permission to test using drones for deliveries. (Walmart is also interested in using drones to survey its properties.) Google wants to start consumer drone package deliveries by 2017. A new “Drone Racing League” has been formed in Los Angeles—backed by investments from owners of the Miami Dolphins and others. It will use virtual reality (VR)-like goggles with drone video feeds to allow pilots to fly through a swarm of obstacles. The plan is for spectators to view the VR feeds as well. Fun? You decide.

Information Warfare ... Cyber-Security

By David Lawrence, founder and chief collaborative officer at Risk Assistance Network + Exchange (RANE), with contributions from Daniel Garrie, editor-in-chief of the Journal of Law and Cyber Warfare and co-head of the cyber security practice Zeichner Ellman & Krause; Tim Murphy, former deputy director, FBI; John Squires, senior partner, Perkins Coie; Radhika Tiwari , director at Law and Forensics; and Matthew Lawrence, legal and IP researcher, Perkins Coie.

The cyber threat landscape is evolving at a blistering speed and hitting the corporate shores of America without respite. One certain prediction is that the complexity and maturity of the cyber threat landscape and actors engaging in these activities are only going to expand in 2016.

In 2016, the pace and magnitude of cyber threats and attacks are going to escalate, and what is already visible to some will become evident to all—the vast majority of companies operating domestically and abroad really have no recourse beyond playing defense and reaching out to the authorities. Under current legal schemes, they are allowed to do no more than affirmatively defend their networks, their data, their facilities, and their intellectual property—and then hope for the best. The axiom of the FBI director James Comey that there are only two types of companies—those that have been hacked and those that don’t yet know they’ve been hacked—will continue to prove true.

In 2016, companies will increasingly realize that the Internet was built for access and speed, not security. With no silver bullet solution, they will need to think and rethink the various pieces to secure their systems and data. Balance sheet, legal, and reputational exposures will continue to be part of cyber’s risk management equation. The insurability of this risk will remain a work-in-progress, requiring more data and modeling.

Enterprises will also increasingly realize the profound limits on the government’s ability to provide a semblance of safety and security on the information superhighway. Out of necessity, companies will continue to need to band together to form self-help and self-defense networks for information sharing.

Companies, not political leaders, will need to lead the charge to evolve the legal system to provide mechanisms through which they can either affirmatively defend themselves or engage authorities that can truly assist in remediating and defending against cyber threats. Companies have been left essentially defenseless when the attackers are state actors. (See Sony.) A framework for nation-state responsibility for ensuring cyber-security was conspicuously absent from the TransPacific Partnership agreement. Significantly, we need to look no further than the US response to the OMB attack by China—notwithstanding a mutual agreement not to hack.

The truth is, as this year ends and 2016 starts, there is arguably a greater chance that a US company will be charged for zealously defending itself in a cyberattack by a state actor than the United States government itself doing something to assist companies in defending themselves against cyberattacks by state actors.

And lest we “miss the forest from the trees,” there is the existential risk that lives beyond the firewalls and boundaries of what companies can control. The cyber risk we all share. This involves the emerging and growing hostile state and terrorist threats to our critical infrastructures—utility, transportation, finance, military, and others. Based upon the best intelligence, the threat is not hypothetical. It is no longer a matter of “if,” just when, where, and the extent of the damage. Enterprises, not just government agencies, will have to expand the “table-top” resiliency exercises that envision previously unimaginable worst-case scenarios.

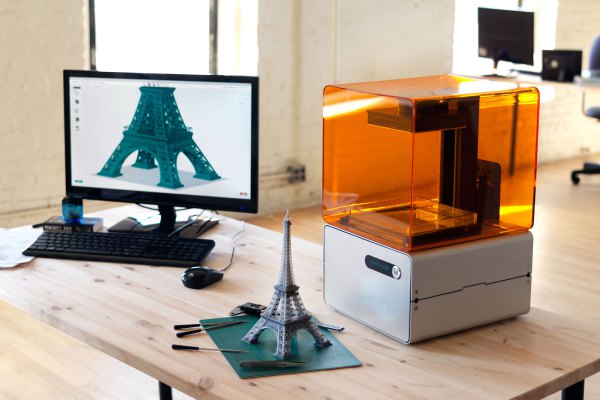

3d Printing ... 3D Printing

The 3D printing industry is doubling annually. According to Gartner, worldwide shipments of 3D printers will reach 496,475 units in 2016, up 103 percent year over year. Sales are expected to double every year, reaching 5.6 million units per year by 2019.

If you follow the maker movement, you’ve seen plenty of 3D printing demonstrations resulting in single-color Yoda heads or edible ribbon candy or jewelry or even an occasional replacement part. But 3D printing is maturing quickly. It has wide-ranging uses across the manufacturing spectrum from prototyping to high-volume production, and it is quickly changing the fundamental nature of factories worldwide.

Consumers are starting to use 3D printing in four basic ways: concept modeling, functional prototyping, pre-production tooling, and digital manufacturing.

Feature sets are important differentiators in consumer-grade 3D printers. Savvy buyers are looking for a file-to-finished-part speed, part cost, resolution and accuracy, capacity, and color capabilities, and are expecting to work in an ever-expanding universe of materials.

While consumer-grade 3D printers are slowly trending upward, fuller-featured devices are selling better than entry-level units.

If the factory is everywhere, everyone is a designer. Turning bits into atoms (making physical objects from digital files) creates significant design opportunities for open-source communities and promises to dynamically change the manufacturing paradigm.

VR and AR —Very Virtual, Not a Reality!

VR (virtual reality) and AR (augmented reality) are going to be huge! Everyone says so, but just because you say it doesn’t make it true. These are very early days for consumer VR and AR. We’ll see new display technology, new production tools, new headsets, and new creative ideas, but VR is the 3D of 2016. It will eventually find its place, but it’s a technology that requires consumers to change their viewing behaviors, directors to find new ways to direct, writers to evolve new narrative techniques, and production crews to work in completely new ways. VR also requires a completely new production ecosystem to evolve. VR is super exciting, but it’s not a trend.

Of the two, AR is the technology to watch. It is easy to predict several brand new, billion-dollar businesses based on AR. Unlike VR, AR does not ask for radical changes in consumer behavior or production techniques. It requires network connections and cloud computing tools (which advance on a predictable curve) to get to a specific level, but then consumers will be empowered to see the world in ways they’ve never seen it before. AR is not a trend either, but it is a technology we’re taking very seriously.

What’s Next?

The Data Economy—Data is more powerful in the presence of other data.

Every new connected device generates data, and the data (if properly interpreted) can be converted into action. For marketers, connected devices generate actionable data without active engagement.

IoT—Anything that can be connected will be connected.

Smart everything is going to evolve along a predictable curve. Pick a point for your business to enter and be prepared for a bumpy ride.

The On-Demand Economy—I want it now!

On-demand food, shelter, and transportation are obvious. On-demand retail and services of every kind are less so, and the wildcards are the metaservices that will evolve to make sense of our on-demand world.

Machine Learning and AI—Computers do not need to think like humans to take your job.

If your job is moving a number from one cell in Excel to another and trying to create a narrative about that action, you’re about to be replaced by a computer that is nowhere near as smart as you are. If you can do it, a machine-learning algorithm can do it faster and cheaper. The future belongs to those who truly understand what human brains can do better in a man/machine partnership.

Cyber-Threats Will Never Go Away—Anything that can be hacked will be hacked.

We will never be done fighting cyber-crime, cyber-terrorism, or cyber-wars. They are an immutable fact of life.

Access vs. Ownership—People are willing to pay for access with both cash and data.

People continue to demonstrate behaviors that indicate that they are willing to pay for access to goods and services with data or cash as opposed to using pure cash to purchase goods and services. This trend has significant implications for almost every business.

Last year we closed with the following questions:

What does a funds manager do when an app that uses cloud computing to do your research based on a data-set created by your private investment behavior replaces his job (both strategically and transactionally)?

What does a skilled repairperson do when manufacturers can diagnose problems over the public Internet and deploy outsourced semiskilled workers who will do a better, faster, cheaper job?

What happens when the manufacturer solves your problem by deploying unmanned vehicles and robots?

How much closer are we to the answers this year? Closer than you think.

600,000 subscribers and counting...

We write a daily newsletter featuring current events and the top stories in technology, media, marketing and entertainment.

Copyright © 2016 Shelly Palmer. All Rights Reserved.

SLP Productions, Inc., PO Box 1455, New York, NY 10156-1455 (212) 532-3880 info@shellypalmer.com