Date: 2026-02-05 Page is: DBtxt003.php txt00012671

Burgess COMMENTARY

Peter Burgess

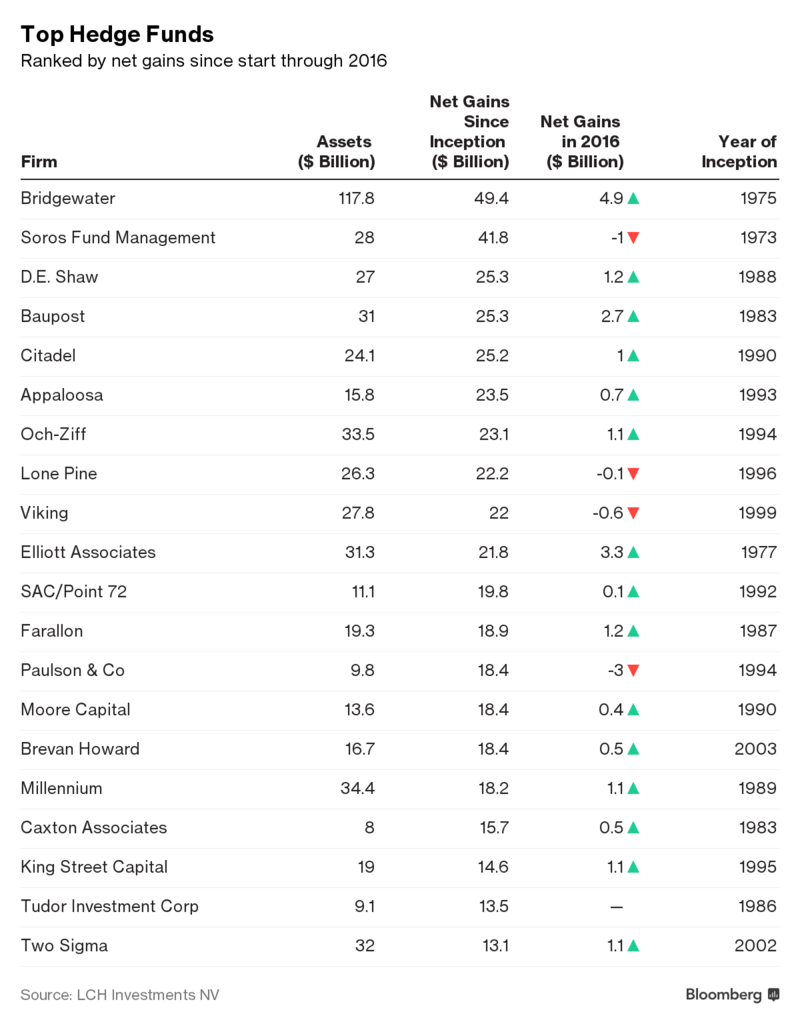

Ray Dalio Makes Clients $4.9 Billion in 2016 as Paulson, Soros Falter LCH Investments publishes its annual hedge-fund rankings Report shows biggest funds did no better than smaller peers

Ray Dalio. Photographer: Jason Alden/Bloomberg

Billionaire Ray Dalio’s Bridgewater Associates earned almost $5 billion for its clients last year while rivals George Soros and John Paulson lost money, according to a report by hedge-fund investor LCH Investments NV.

Bridgewater was the most lucrative, in absolute terms, of the top-20 hedge funds ranked, and bucked the trend of a generally disappointing year for the industry. Overall, the biggest funds earned $16 billion after fees, to provide a 2.6 percent weighted return that “was way below their historical standards,” according to the report set to be published Wednesday.

Ray DalioPhotographer: Simon Dawson/Bloomberg

The largest funds generally performed no better than the industry as a whole in 2016, unlike over the longer term, when the top money pools made their clients disproportionate amounts of cash. Hedge funds are facing an investor backlash against high fees and poor returns caused by ultra-low interest rates, and last year suffered the first net withdrawals since 2009.

“Even the managers with the greatest long-term records did not perform strongly and their results were no better than the average,” Rick Sopher, chairman of LCH, said in the report. “This underperformance by the world’s greatest money managers reflects the difficulties experienced by most active managers for much of 2016.”

Soros Fund Management and Paulson & Co. did worse than most of their large peers, losing a combined $4 billion last year, LCH’s research shows.

The long-term trend of the biggest hedge funds providing the best returns remained intact, though.

Since they started, the top-20 managers earned $449 billion for their investors, almost half the gains for the entire industry, according to the report. Dalio and Soros, whose investment firms were both launched in the 1970s, are still the best performers over their lifetimes, with returns of more than $40 billion apiece.