Date: 2024-12-26 Page is: DBtxt003.php txt00012965

Water

Water Infrastructure

Barclays: US Will Need $1trn Of Water Infrastructure Spending By 2030

Burgess COMMENTARY

Peter Burgess

Barclays: US Will Need $1trn Of Water Infrastructure Spending By 2030

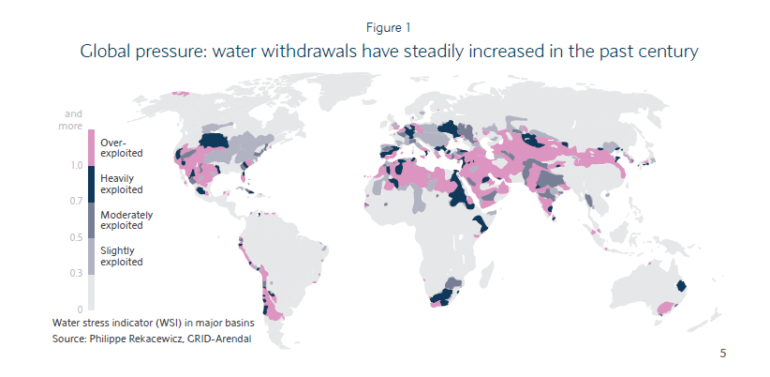

Water is undoubtedly the world’s most important commodity. While humans have taken their access to water for granted for much the past 3000 years, experts are increasingly asking if the current level of water consumption around the world is sustainable and what can be done to ensure we don’t run out of clean water.

The newest report on this topic comes from analysts at Barclays, who published a report entitled “The water challenge: preserving a global resource” at the beginning of this week.

The report doesn’t discuss the topic of water investing but it does cover the state of the water industry and actions companies can take to help improve water efficiency, access to clean water and alleviate water shortages.

Clean Water

kloxklox_com / Pixabay

Barclays: US Will Need $1trn Of Water Infrastructure Spending By 2030

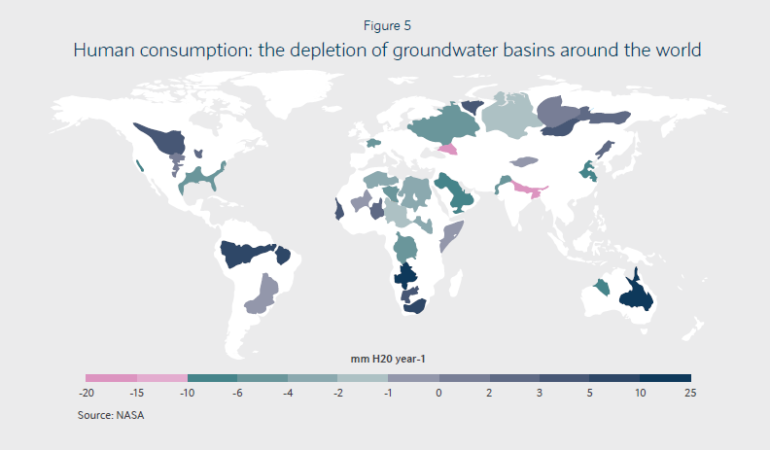

The pace at which water on the planet is being consumed by humanity is staggering. Only 2.5% of the world water is fresh, yet the US depends on it for 90% of withdrawals for public and industrial use. At the same time, according to Barclays’ groundwater, which is present under the earth’s surface and makes up 30% of all freshwater, is under widespread stress, with NASA reporting that a third of major water basins globally are being rapidly depleted by human consumption. As freshwater sources are quite literally sucked away, the Organization for Economic Cooperation and Development estimates that 4 billion people will be affected by water shortages by 2050, up from 1.5 billion today thanks to a 50% increase in the demand for water resources.

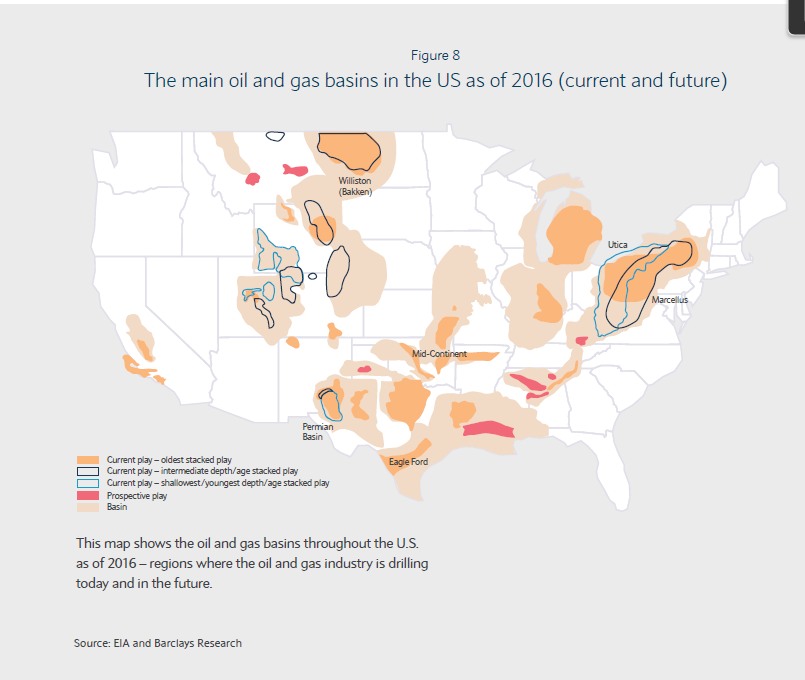

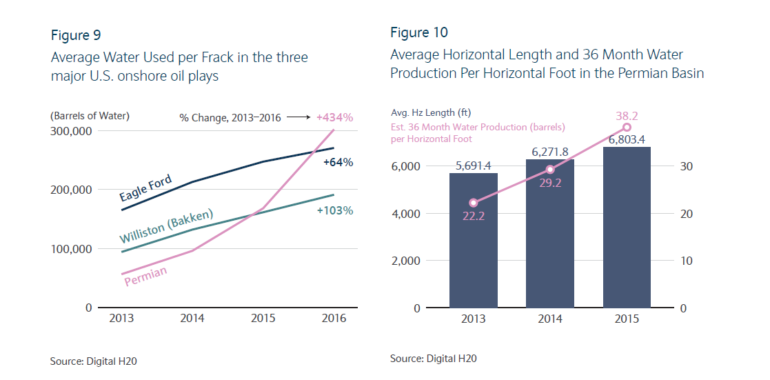

Barclays argues that the best way to reduce water consumption around the world and improve the longevity of finite freshwater resources is to improve water use efficiency. The one market where this will have the most pronounced impact is in the energy and utility market. These two industries are interconnected with water as energy companies use water in most aspects of their supply chain while water companies use energy to treat water and convey it from source to destination.

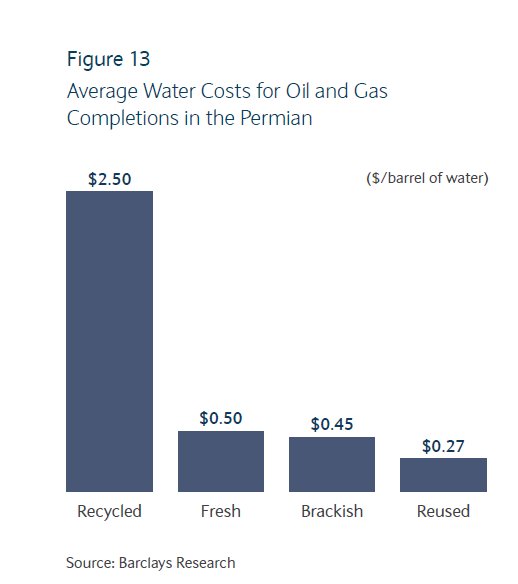

The sectors for investors to target are those which help companies reuse and recycle water. Sectors such as the mining and energy industry use an enormous amount of water in their operations, but a large volume of this water is currently wasted. The market is changing, slowly but there’s a huge growth opportunity here for companies active in the space:

“Over the past few years, new opportunities for collaboration with industries, such as agriculture, have created sustainable solutions for water management. The industry calls these collaborations “beneficial reuse”, though we refer to them as recycling. There are many possible uses for recycled wastewater, especially for livestock watering, irrigation or industrial reuse for crops. For example, in Midland, Texas some farmers are experimenting with using recycled water from oil and gas for irrigation on non-food crops such as cotton.32 In California, Chevron sells 21 million gallons per day of its treated wastewater to neighboring farmers for irrigation, according to the LA Times.”

On the energy side, the number of power generation alternatives that do not rely on the production of steam are growing. Technologies such as saline water, the use of which has helped reduce freshwater use between 2005 and 2010 by 13%. Recycled and reclaimed water and wind, as well as sun power, are other solutions.

Energy efficiency gains are also required to help reduce freshwater consumption around the world. Less energy use equals a lower demand for water. Small changes are already starting to impact electricity demand. In the United States, for example, weak economic growth and energy efficiency programs, such as low-energy light bulbs, have resulted in no electricity usage growth since the mid-2000s.

No matter which course of action providers choose to take, one thing is clear, the water and water services market is massive, and big bucks are on offer for operators that manage to capitalize on this opportunity.

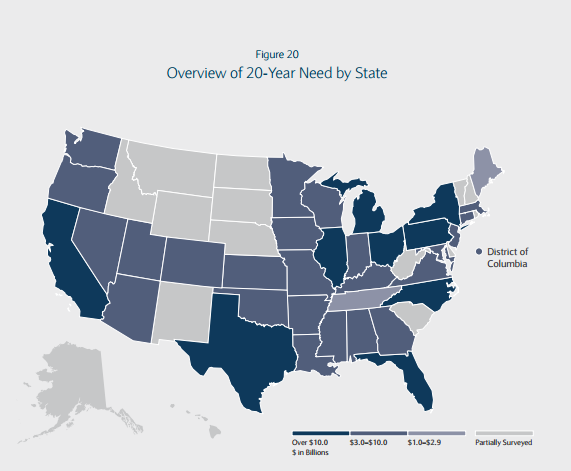

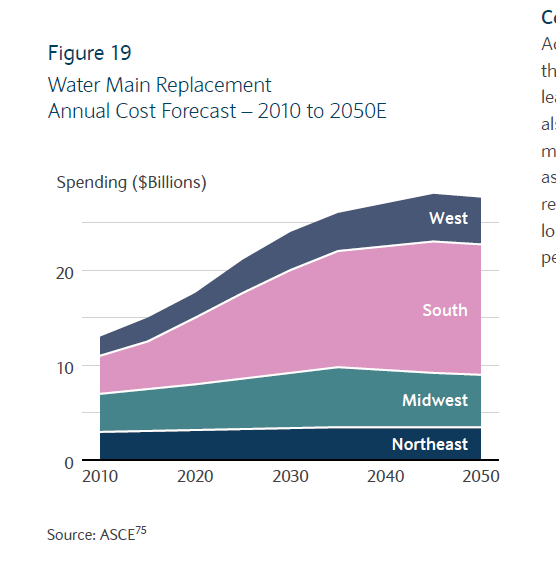

“Projected spending needs vary, but the American Society of Civil Engineers (ASCE) estimates that drinking water investment will be more than $1 trillion in the next 25 years, while the EPA predicts that the infrastructure needs will reach $384.2 billion over the next 20 years, excluding waste water systems. However, as water utilities are mainly owned by municipalities and publicly traded water companies have a combined market capitalization of only $18 billion to $20 billion, it is evident that investment will need to come from both the public and private sectors. The outdated water infrastructure is the main reason such large investments are needed. The EPA estimates that the cost of replacing water mains alone could approach $25 billion annually by 2030.” – Barclays