Date: 2025-03-06 Page is: DBtxt003.php txt00012966

Investment Analysis

Correlation or Cause and Effect

A Massive Detour On The Road To Inflation

Burgess COMMENTARY

Peter Burgess

A Massive Detour On The Road To Inflation

Summary

Inflationary pressures took an abrupt turn south in 2011.

The U.S. stock market became a safe-haven for world capital flows from 2011 to 2015.

After a peak in deflationary fears in early 2016, the inflationary narrative has gotten back on track.

'A 60:40 allocation to passive long-only equities and bonds has been a great proposition for the last 35 years,' …'We are profoundly worried that this could be a risky allocation over the next 10.' - Sanford C. Bernstein & Company Analysts (January 2017)

'If I had to relive my life I would be even more stubborn and uncompromising than I have been. One should never do anything without skin in the game. If you give advice, you need to be exposed to losses from it' - Nassim Taleb

'Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria' - Sir John Templeton

(Source: William Travis Koldus, Detour Photo)

Introduction

Macroeconomic investing, or 'macro' investing for short, is very difficult, as it is very hard to find accurate economic forecasters. We have all heard the jokes, and read the statistical data, about how almost all professional economists fail to see major turning points, particularly recessions, and that is why many value investors prefer to focus only on bottoms-up or company-specific research.

Over my 20-plus-year career actively investing, I have found that even the best value investors can get stuck in value traps. On a personal note, I have had my share of material miscues and value traps, and they can be very painful as fundamentals and historical valuations ultimately do not matter in these situations.

Perhaps the best example of this occurred in 2007 and 2008, when value investors heavily over-weighted financial stocks in their portfolios, as they appeared cheap on fundamental metrics, including price-to-earnings and price-to-book rations, only to see some of the perceived safest companies in the world act like the riskiest companies in the world.

During this time, formerly AAA-rated American International Group (NYSE:AIG), Fannie Mae (OTCQB:FNMA), Freddie Mac (OTCQB:FMCC), and General Electric (NYSE:GE), all venerable blue-chip assets during much of the bull market rise from 1982 through 2007, suffered Depression-level declines.

Additional highly-rated financial stocks like Bank of America (NYSE:BAC), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), JPMorgan (NYSE:JPM), and Morgan Stanley (NYSE:MS) suffered tremendously too, not to mention the non-survivors, which included Lehman Brothers and Bear Sterns, two formerly venerable, world-leading investment banks.

In summary, many hallowed value investors learned or re-learned the importance of macroeconomic analysis to complement their company-specific research.

From my perspective, 'macro research' is critically important today, as the global bond market remains in the midst of a transition phase from an epic secular bull market (i.e. rising bond prices and falling yields) to potentially a new secular bear market (i.e. falling bond prices and rising yields). The catalyst for this transition is increasing inflationary pressures and rising inflationary expectations.

This transition has not been smooth, but if the secular 30-year-plus bull market in bonds is ending, it has massive investment implications for all investors, particularly those that have chased yields over the course of the current bull market that began in March of 2009.

Thesis

Inflation pressures are rising, sparking a transition from a three-decade-plus bull market in bonds to a bear market in bonds, changing the investment landscape dramatically.

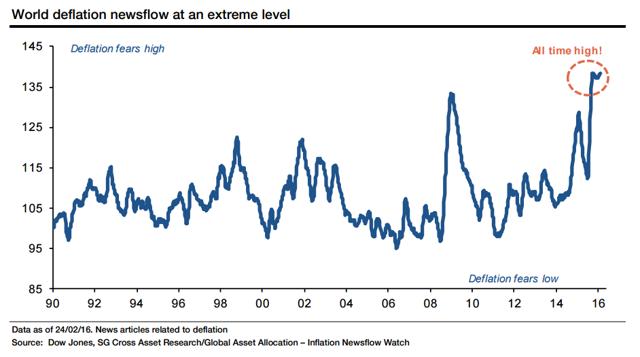

Deflationary Fears Peaked In 2016

Similar to the sound of an oncoming train, deflationary fears peaked with a loud roar early in 2016.

(Source: Dow Jones, SG Cross Asset Research/Global Asset Allocation)

This prompted roughly one-third of global sovereign bonds to trade at negative interest rates in nominal terms, not even considering real rates, after considering the impact of inflation.

(Source: Bloomberg, U.S. Global Investors)

Looking back, it is easy to see the palpable, cresting fear of deflation in the bond markets, stemming in part from investors' memories of the 2007/2008 global financial crisis, accelerated by the growth downturn in emerging markets, and punctuated by demographic worries.

U.S. Assets Became A Safe Haven

Global capital-flows reverted back to the United States, the proverbial best house in a bad neighborhood, even though the collapse in the speculative U.S. housing market was the catalyst for the previous downturn.

As a result of capital flows, the U.S. dollar strengthened, rising from its lows in 2011, and taking flight in 2014, and U.S. securities, particularly large-cap U.S. equities, dramatically outperformed the rest of the world.

(Source: WTK, www.stockcharts.com)

In the second chart above, the S&P 500 Index, as measured by the SPDR S&P 500 ETF (NYSEARCA:SPY), has registered a gain of 101.2% the past decade, dramatically outperforming the iShares MSCI EAFE ETF (NYSEARCA:EFA), which has posted a gain of 9.3%, and the iShares MSCI Emerging Markets ETF (NYSEARCA:EEM), which has posted a gain of 24.2%.

China Bottomed in 2016

China, which has led the performance of emerging markets, experienced a growth recession from 2011 to 2015, but this period of contraction ended in 2016.

China's official Purchasing Managers' Index has been above 50, the dividing line for expansion and contraction for seven straight months, and the private sector Caixin China Manufacturing PMI has been above 50 for eight consecutive months as the chart below illustrates:

(Source: Bloomberg)

(Source: Bloomberg)

The manufacturing upturn in China, which remains the world's manufacturing center, has boosted the shares of the iShares China Large-Cap ETF (NYSEARCA:FXI), which has outperformed the S&P 500 index by a healthy margin in 2017, gaining 13.1% versus SPY's 5.2% gain.

(Source: WTK, www.stockcharts.com)

Over the past year, the iShares China Large-Cap ETF has gained 22.3%, outpacing SPY's still healthy gain of 17.6%.

(Source: WTK, www.stockcharts.com)

The story changes over the past decade, which has been a disinflationary/deflationary decade. Even though China led the performance of international markets, it has still markedly trailed the performance of America's large-cap equity benchmark.

(Source: WTK, www.stockcharts.com)

In the chart above, I also added the 10-year return of the iShares 20+Year Treasury Bond ETF (NYSEARCA:TLT), which has been the second-best performing ETF of the group above, showing clearly that global investors have preferred both U.S. stocks, and U.S. bonds over the past decade as world financial markets have been stuck in a disinflationary/deflationary quagmire.

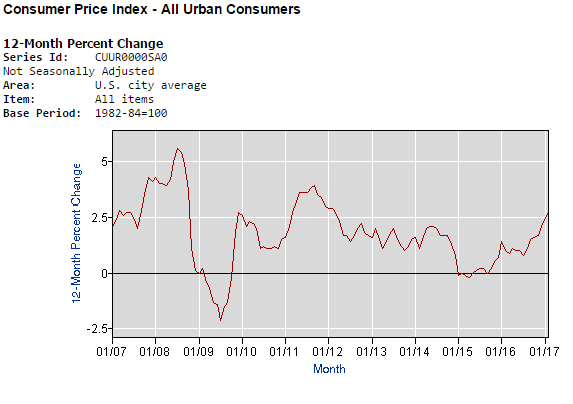

Inflationary Pressures Bottomed in 2016

China's return to manufacturing expansion in 2016 has propelled inflationary readings higher around the globe.

In the United States, the rising level of inflation is clear, yet it has remained in the background. Year-over-year inflation, per the Bureau of Labor Statistics, is currently registering 2.7%, posting a five-year high as the graphic and table below depicts:

(Source: Bureau of Labor Statistics)

With the labor market improving on a steady basis for the past eight years, and commodity prices higher from increased demand and reduced supply, inflation could continue to surprise to the upside for the duration of the current economic expansion.

Bonds Yields Have Reversed Higher

In the United States, the United Kingdom, Germany, and Japan, bond yields have all risen substantially from their 2016 lows, paying more attention to rising inflationary pressures than official policymakers, as deflationary fears abated and inflationary readings surprised to the upside.

(Source: WTK, www.stockcharts.com)

The charts above clearly show that 10-Year yields have reversed, and increased from their 2016 lows. However, it is not clear that the downward trends in yields have been broken.

Once that happens, and I believe it will at some point in 2017, there is the potential to see a large move higher in rates, similar in magnitude to the 2013 U.S. Taper Tantrum.

What would cause the next leg higher in sovereign interest rates?

Higher inflation spurred by global growth that exceeds expectations and higher commodity prices could do the trick.

An additional catalyst could be an unwinding of the Federal Reserve's massive balance sheet, which could spark a rise in U.S. yields as hedge funds and traders front-run the anticipated central bank selling.

What Investors Should Have Their Eyes On

From my perspective, I think investors should be paying attention to the rate differential between the U.S. 10-Year Treasury Yield and the German 10-Year Treasury Yield.

(Source: WTK, www.stockcharts.com)

A narrowing of this gap will be positive for the inflationary/reflationary trade, in my opinion, particularly commodities, commodity stocks, and international equities.

An additional metric to pay attention to is the U.S. two-year Treasury yield shown in the chart below:

(Source: WTK, www.stockcharts.com)

The two-year Treasury yield has been a more reliable barometer of economic strength and economic weakness than longer-term yields, and it is showing a positive divergence when compared to longer-term yields.

What should investors not pay attention to? The answer is simple, the news.

Inflationary Assets Are Poised To Continue Outperforming

Over the past decade, U.S. stocks and U.S. bonds have outperformed almost everything, as disinflationary/deflationary fears have dominated the investment landscape.

It should come as no surprise that commodities, and particularly commodity stocks, have been some of the worst performers over the past 10 years, as inflation has not been on the minds of investors, speculators, or traders.

This is visually shown with the 10-year performance chart of the SPDR S&P Metals and Mining ETF (NYSEARCA:XME), the VanEck Vectors Gold Miners ETF (NYSEARCA:GDX), and the Energy Select Sector SPDR ETF (NYSEARCA:XLE) alongside the performance of the SPDR S&P 500 ETF, and the iShares 20+Year Treasury Bond ETF.

(Source: WTK, www.stockcharts.com)

Clearly, the commodity stocks have underperformed, with precious metals equities, and industrial metals equities, performing the worst over the past decade.

Energy equities have underperformed too, but they have been buoyed by the relative outperformance of large-cap behemoths like Exxon Mobil (NYSE:XOM), and Chevron (NYSE:CVX), which have both benefited from dividend-focused investors and passive fund flows into index funds.

Over the past one year and three months, the performance picture has been reversed, with commodity stocks now leading the broader stock market's advance, in what I believe are the final innings of the current bull market.

Source (WTK, www.stockcharts.com)

Stocks like U.S. Steel (NYSE:X), Freeport-McMoRan (NYSE:FCX), and Cliffs Natural Resources (NYSE:CLF), all profiled in my 'Too Cheap To Ignore' series of articles earlier in 2016, have risen from the graveyard, as out-of-favor stocks have reversed course, causing short investors to cover their positions, and enticing trend following investors on the long side.

The turnaround in the balance sheets of these companies has been dramatic, particularly at Cliffs Natural Resources, with the dramatic reversal in fortunes occurring in less than one year's time.

With stock prices that are still depressed today relative to the past decade, there could be more room for appreciation potential, in my opinion, as pessimism gives way to skepticism, which will give way to optimism, and then, if we are lucky, euphoria.

Conclusion - Look Forward, Not Backwards

Investors and policy makers have a habit of adapting their investment styles to mitigate the consequences of the previous bear market. Thus, today, monetary policy on a global basis is designed to prevent disinflation/deflation, and the resulting framework has provided the most potential to spark an out-of-control inflationary environment since the 1970s, in my opinion.

Ironically, while almost everyone is worried about a repeat of 2007-2009, or 2000-2002, or even the Great Depression, the far more likely scenario, from my perspective, is that investors, speculators, and traders face an environment that many have not lived through previously, and that is an inflationary environment.

In summary, if you look back over the past 50 years, it has paid dividends to be a contrarian investor roughly 20% to 30% of the time. Thus, every decade, it often pays, sometimes substantially, to have portfolios that are materially different than the market for two or three years out of a 10-year time frame.

Being contrarian was rewarding in 2000-2002, and from 2007 to 2009, and I believe we are in the midst one of those crucial several year periods right now.

Investors should look for inflationary/reflationary assets to continue to outperform, as they have done since the beginning of 2016. Thus, commodities, commodity stocks, emerging market equities (international equities too), cyclical companies, and financial stocks should continue to have a tailwind for the duration of the bull market, as opposed to the headwind over the past decade.

To close, the investment landscape is changing, and if you are interested in joining a unique, growing community of contrarian, value investors, and would like to see all of the historical trades and current positioning of the 'Bet The Farm,' and the 'Best Ideas' Portfolios, please consider signing up for my premium research service, 'The Contrarian.' This service has been well-reviewed by its members, and I believe we are once again at a unique inflection point.

-----------------------------------------------------

To receive my future public articles on Seeking Alpha, please click the 'Follow' button above. Thank you for your readership.

Disclosure: I am/we are long BAC, C, CLF, FCX, FMCC, FNMA, AND X.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Every investor's situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

About this article:Expand

Get Exclusive Articles from William Koldus, CFA, CAIA

25 Reviews

'Best Ideas' equity portfolio gained 126.3% in 2016. 'Bet The Farm' options portfolio gained 1172.8%.

Access to model portfolios, including 'Bet The Farm', 'Best Ideas', and 'Contrarian All Weather'.

The years 2000 and 2008 were inflection points. 2016 was too. Find out why.