Date: 2024-12-26 Page is: DBtxt003.php txt00014011

Worker Wages / Executive Compensation

Top Management

GE Comp Plan Changes Will Likely Align Pay and Performance

Burgess COMMENTARY

Fifty years ago ... or a little more in my early days as a Chartered Accountant working for Cooper Brothers & Co in London I prepared tax returns for some of the top people in industry. Compared to corporate leaders today these people were paupers, albeit at the top of the corporate pyramid and just as powerful as modern day corpoerate executives.

So what changed!

Many things have changed, but one of them is that the top business schools have taught several generations of business leaders about financial engineering. What is financial engineering? My understanding is that it is the ways in which real value is turned into the maximum of financial value. It is a numbers game and is perhaps the biggest reason why inequality has been able to grow over the past few decades in ways that have never happened before!

Peter Burgess

GE Comp Plan Changes Will Likely Align Pay and Performance

General Electric (GE) recently garnered attention when its new CEO John Flannery—who has not been shy about making changes in his as-yet-early tenure—shared that the company would be making significant changes to its executive compensation plan. While initial reports did not go into detail, Equilar examined GE’s executive compensation plan for former CEO Jeff Immelt, and looked at how pay aligned with performance for its peers.

In short, there isn’t much unusual about GE’s existing long-term incentive plan in comparison to general best practices for large-cap companies. However, given the way that cash and bonus structures paid out to Immelt, it would not be surprising to see the company make strides to better align both short- and long-term goals, particularly as it changes the course of its business—such as the possibility that the company will exit the railroad business.

Overall, GE's executive compensation, particularly for Immelt, has been fairly aligned with Dow 30 over the years in terms of incentive plans. (GE disclosed that it uses the Dow 30 as its compensation peer group.) However, the catch is that the Dow 30 has taken off, but GE's stock price has been basically flat. As an example, Equilar conducted a study in February 2017 on the 'Trump Bump,' which showed that Dow 30 CEOs gained an average of 18.4% in the value of their stock ownership in the three months after the election, whereas Immelt's was close to the bottom, at 1.4% growth.

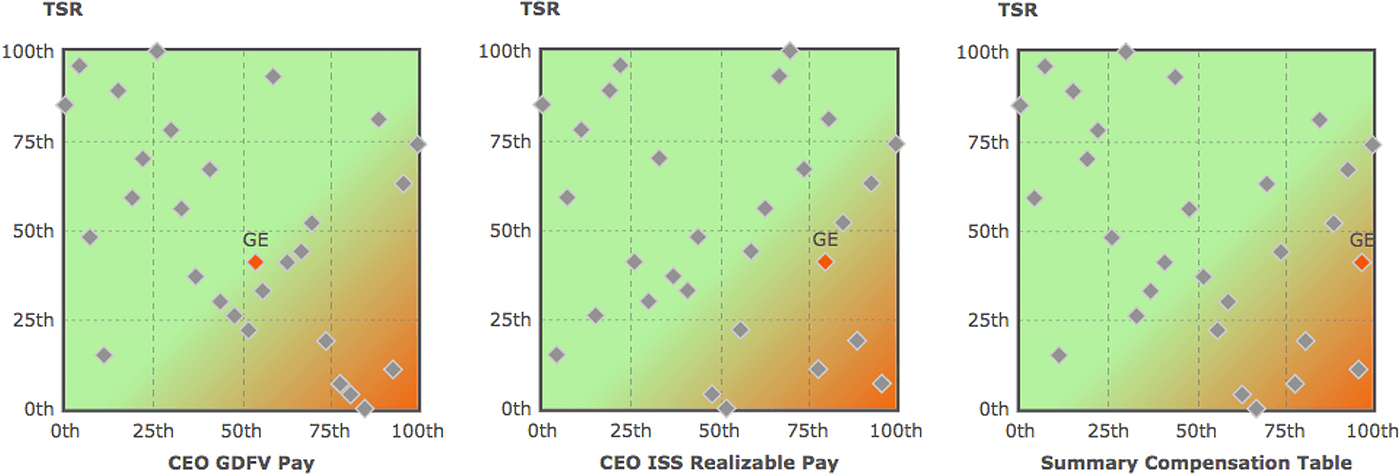

So, while GE is paying in line with peers in terms of pay mix and total compensation at face value, there is a bit of pay for performance disconnect relative to the rest of the Dow 30, depending on methodology. For example, in looking just at summary compensation table pay, Immelt was at the 97th percentile vs. the 41st for three-year TSR. His three-year realizable pay value was in the 80th percentile of its peer group compared to the 41st percentile for three-year TSR. Yet, when looking at the grant date fair value of Immelt’s equity awards, the company was at the 54th percentile, right near the median of the Dow 30.

br>

chart

br>

This is of course just one measure, but it's an important one that the compensation committee certainly will take into account when they are reevaluating incentive plans and pay packages.

The question is what may be misaligned here, and what GE can do to bring its pay levels more in line with its peers. And one place where GE has been at the top of the range is in cash compensation. Jeff Immelt had the highest salary of any CEO in the annual study Equilar 200 study with The New York Times at $3.8 million. Meanwhile, median salary for large-cap CEOs was about $1.2 million in 2016, by comparison. Furthermore, Immelt's annual bonus was about $4.3 million in 2016. (Median bonus was $2.2 million for large-cap CEOs.)

There isn’t much information about Flannery's new incentive package, but The Wall Street Journal did report in the article linked above that he would be receiving a salary of $2 million with a 150% target bonus (so $3 million at target). That would turn out to be much less than the $8 million-plus Immelt received in salary and annual bonus in 2016 even if targets are met and exceeded. There was also some concern around excessive perks for Immelt, so it won’t be surprising to see those reined in as well.

For the most part, GE is already in line with best practices in long-term incentive (LTI) pay design in terms of performance metrics. GE already had a mix of performance LTI in line with peers, including metrics such as TSR and return on invested capital, and that will probably continue. The board could add LTI metrics that are non-financial in nature, which is not typical, but it wouldn’t be surprising to see given what the company seems to be eyeing in terms of restructuring and strategic planning. In other words, GE may introduce quick changes that provide a kick into the incentive program that would be removed over time.

Ultimately, any restructuring of the pay plan will likely aim to better align both short- and long-term goals to performance. GE is already linking short-term bonus to operating profit/margin, and now it seems like the board will include reducing costs in the short-term plan. There's a perception out there that GE bought high and sold low in asset management, selling off profitable business units and keeping less profitable ones. In many financial analysts' view, there has been a criticism that the company has made the wrong moves at wrong times, and so it will likely try to better align executive payouts with shareholder value. Trian Fund Management, which recently gained a seat on the GE board, may also have some influence. Similar to the investor's concerns at P&G, Trian wants to see robust target goal-setting so that when shareholders win, so do execs, but not the other way around.

Matthew Goforth, Senior Governance Advisor, and Dan Marcec, Director of Content & Communications, authored this post. Please contact Dan Marcec at dmarcec@equilar.com for more information on Equilar research and data analysis.