Date: 2026-01-21 Page is: DBtxt003.php txt00014904

Country / Venezuela

Cryptocurrency / Petro

A closer look at the petro crypto / Venezuela’s 🇻🇪 Initial Country Offering / A Barrel Full of Empty Promises

Burgess COMMENTARY

Peter Burgess

A closer look at the petro crypto / Venezuela’s 🇻🇪 Initial Country Offering / A Barrel Full of Empty Promises

Bitcoin and cryptocurrencies in general are changing the current geopolitical landscape in ways that were not possible before. As we venture into a borderless internet era where cryptocurrencies are more validated everyday as a sound form of money, we are going to witness a paradigm shift in the way people, communities and nations interact and transact with each other. The petro, however, is far from the true opportunities that the internet of money offers. The petro is a national cryptocurrency strategy announced by the Venezuelan government where each petro is backed by oil. Why would the Venezuelan regime even think about trying to launch its own crytocurrency this way? Let’s look at it more closely.

Venezuela, the petrostate

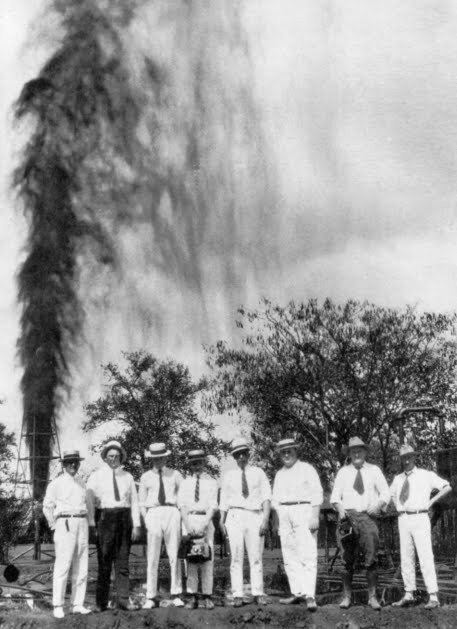

You cannot understand Venezuela without taking oil into consideration. With one of the largest proven oil reserves in the world, Venezuela has fallen into the unfortunate resource curse that has plagued other countries in the past. From the very first days back in the 1920s when Venezuela started to position itself as a major oil producer, Venezuela has always used its oil resources as the main economic driver. Today oil has permeated Venezuela to such a degree that it’s now deeply embedded in the very psyche and culture of Venezuelans. Some warned back in the day that if the economy was not diversified Venezuela was doomed, and today we witness a Venezuela experiencing a hyperinflation rate of around 3,500%, where Venezuelans are starving to death, and where people are fleeing the country in numbers that echo Syrians to Europe.

Barroso No. 2 well blowout in 1922

The petrodollar was born in the 1970s as an agreement between the Nixon administration and the Saudi Arabia government. The deal made between the USA and the principal OPEC member was simple: make every single oil deal in US dollars. The consequence was that the US dollar went from a gold standard to the petrodollar, an energy-backed currency based on fossil fuels. And as a main member of the OPEC, Venezuela has since lived on petrodollars both during the high-prices euphoria and the low-prices hangover.

Naturally, when facing alarming inflation rates Venezuelans have sought to exchange their money from the decaying Bolivar Fuerte to a more stable currency like the (petro) dollar. And as it has happened in other countries, the Venezuelan regime has implemented strict exchange rules in the past 15 years (formerly known as CADIVI) to regulate who is allowed to exchange their bolivares and by how much, which has created a parallel informal market to buy and sell dollars. Today amid the current crisis the country is going through, the petro crypto is the latest card the Venezuelan regime intends to play. The contradiction between the nature of decentralized, market-driven cryptocurrencies and a centralized, government-controlled cryptocurrency like the petro is hard to miss, but the Venezuelan regime must do everything they can if they wish to hold on to its grip of power.

Regular Venezuelan citizens, on the other hand, must do everything they can to simply survive in this hot tropical country. Bitcoin is one solution they have embraced to defeat the economic catastrophe they are facing by bypassing the currency exchange control. Bitcoin mining specifically has risen as a way to put food on the table: given electricity is cheap but unstable, they are buying an underpriced commodity and turning it into bitcoin to make a profit. The government is taking the entire population hostage by locking them into a currency that is sinking, bitcoin is freeing the hostages.

This is the current situation Venezuela faces as its regime introduces the petro in another ill-fated attempt to centralize and control money. This is where the real higher-level struggle of power comes into play: the elite versus the masses.

Tropical mining

Initial Country Offering

The petro is a recipe for disaster. It will be an ERC20 token deployed on the Ethereum blockchain, adapting open-source code to suit chavismo’s central planning and rent-seeking necessities. In addition, it serves one clear geopolitical use: the petro would help the Venezuelan regime circumvent international sanctions put on them.

They intend to issue 100 million petros with about 38 million to be sold in a pre-sale to foreign countries and institutional investors. Before launching the petro, however, the Venezuelan regime has arbitrarily raided and expropriated bitcoin mining machines from regular citizens by tracking down electricity use surges and using the Venezuelan intelligence police division. The true intentions of the regime in Venezuela are nefarious.

The petro is to be backed by oil and that means it will be directly at the mercy of the Venezuelan state-owned oil company, PDVSA, a company as corrupted and inefficient as its 19-year-under-chavismo performance numbers demonstrate: they have halved the oil production while almost more than tripling its headcount. The IMF predicts that Venezuela’s already quadruple-digit inflation will completely spiral out-of-control in 2018, soaring up to staggering 13,000 percent — largely due to their faltering oil exports. With the country's history of printing money to meet fiscal debt, the fact that petro's emissions will effectively be controlled by the government (i.e the Superintendency of Currency of Venezuela) is also a terrible omen for the new cryptocurrency.

If all of that by itself doesn’t clearly signal 'scam', then petro's pre-sale discounts should: they will go up to 60% — the perfect formula to selling air. It is self-evident that the only goal here is to quickly fill the pockets of Maduro and his inhumane, authoritarian regime.

We live in a world that is more connected than ever. We need to pay close attention to understand what are the true geopolitical repercussions of centralized, government-controlled cryptocurrencies such as the petro.

If you think you don’t have a say in all of this, I urge you to think differently. You can help by sharing and helping expose the true colors of the Venezuelan regime and the can of worms the petro really is. You can also help by supporting the work of Venezuelan dissidents.

My hope is that if a regular Venezuelan is ever presented with the choice of, say, bitcoin or petro, she will be able to tell apart freedom from empty promises. After all, bitcoin can’t be stopped by the Venezuelan regime or any other government for that matter.

Venezuela