Date: 2025-04-03 Page is: DBtxt003.php txt00014955

Taxation

Massive private sector liquidity ... public sector essentially bankrupt

USA ... Despite a strong economy, American states are desperate for revenue ... Even conservative governors and legislatures are contemplating tax increases

Burgess COMMENTARY

Peter Burgess

Despite a strong economy, American states are desperate for revenue ... Even conservative governors and legislatures are contemplating tax increases

Graphic detail

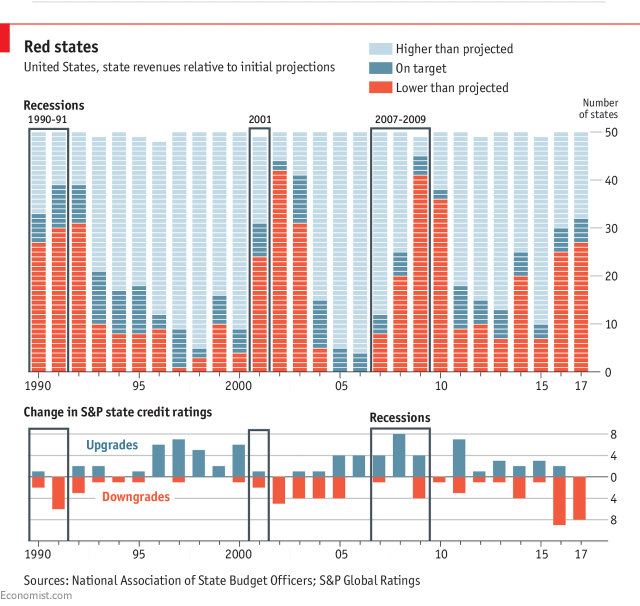

WITH unemployment at a 17-year low and stockmarkets near all-time highs, one might expect the coffers of American state governments to be overflowing. Yet despite these favourable economic conditions, many of them are still struggling to make ends meet. According to the National Association of State Budget Officers, 27 states saw their revenues fall below expectations in 2017. Standard & Poor’s, a credit-rating agency, has downgraded over a dozen states since 2016.

Many of these fiscal woes can be blamed on sluggish revenue growth. Antiquated tax systems designed to collect sales taxes on goods like cars, furniture and clothing have failed to keep up with America’s increasingly services-led economy. Low inflation has also weighed on revenues in recent years. Since 2013, the prices of services have risen by 2.6% per year, whereas those of goods, which generate most sales-tax receipts, have fallen at an annual rate of 0.4%.

To balance their books, many states have relied on rainy-day funds and other one-time gimmicks. In May, Texas voted to close a $2.5bn revenue shortfall by siphoning $1bn from its rainy-day fund and delaying a payment to its highway fund. In November, Pennsylvania agreed to borrow $1.5bn against future payouts from its Tobacco Settlement Fund, a pot of money set aside for health-related programmes. Other states have exhausted such quick fixes. Last month, pressured by striking public-school teachers, Oklahoma’s Republican-dominated legislature voted to raise taxes and fees in the state by $400m. It is the state’s first tax rise in 28 years.