Date: 2024-12-26 Page is: DBtxt003.php txt00015436

Blockchain / Cryptocurrency

What value a cryptocurrency

Brendan Bernstein ... Cryptocurrencies are money, not equity ... a very interesting essay well worth the effort to read

Burgess COMMENTARY

Peter Burgess

Cryptocurrencies are money, not equity

Developer incentivization and the power of holders

Naval recently incited a debate regarding developer incentivization and the value of holders. It spurred a number of responses and a fruitful discussion. This issue has just about been exhausted. But instead of banging my head against the wall in frustration, I figured I’d add my two cents and meander on the axiomatic issues in the cryptocurrency space that this revealed.

There are two questions Naval surfaced: (1) What’s the value of holders? and (2) How to incentivize developers?

Naval’s contention stems from a deep issue: the tech investing ethos in a space with monetary assets. The two are diametrically opposed. Like Ethereum and multi-sigs. Reconciling this matter should also answer his two questions.

The goal of this post is to remove these notions from your brain. I can’t promise it will work in its entirety…you may still eat vegetables after this. But hopefully you can rid yourself of the naive comparison of tokens to traditional startup investing and begin to understand the pivotal role investors play. Altcoin rehab, if you will.

Table of Contents:

i) Cryptocurrencies are money

ii) How cryptocurrencies capture value

iii) Crucial role of investors in value capture

iv) Investors run the show

Cryptocurrencies are Money, not Equity

The fundamental fallacy is treating cryptocurrencies like equity when in reality they are money. Sure, most “technical whitepapers” have no mention of money whatsoever. But given we’re talking about incentives, why would they?

Pretending tokens are equity-like differentiates their token from Bitcoin. Instead of appealing to the monetary nature, a whitepaper can propose notions that appeal to traditional equity investors. But really, all unpegged cryptocurrencies are money and need to be understood that way.

The majority have a stated use case as a medium of exchange within a quasi-decentralized economy. To many “technologists” dismay, that is economics speak. A medium of exchange and a currency is very different than equity

If it sounds like I’m just being petty, I promise I’m not. It’s a small distinction to some, but failure to make this crucial distinction will lead to a host of problems.

Value Creation != Value Capture

The value of any business, centralized or not, is the value of services it provides to its end user. But that does not necessarily mean that the business captures that value. The best equity investments both create and capture the most value.

An investment’s value is based on the market size and % of that market investors capture. The two are often times independent.This has traditionally been an issue for open source projects. Open source technologies, like Linux for example, have added immense value to the world but Linux itself is not able to capture it.

The freedom, security, flexibility and accountability of open source often is considerably better than proprietary alternatives — but capturing that value has often been futile. Tokens were supposed to be the white knight for open source developers of the world. Finally, developers could both open source their code and make money.

How to Capture Value?

Remember equity? An instrument startups used to raise money with before the millennials took over. Equity is a contract that gave its holders recourse to the balance sheet and liquidation value of a company. To oversimplify a little, equity investors are generally investing in increasing cash flow. But if tokens are not equity, what are buyers really investing in?

According to Fred Wilson (whom I have great respect for), the answer is “decentralized infrastructure”.

I think that Fred and others are directionally correct. But where I think some investors are going wrong is equating an equity-like infrastructure investment with a token and monetary investment. Keyword here being token.

Here’s my take on what’s happened:

Step 1: Convince investors that tokens are equity-like.

Step 2: Convince investors that the protocols will be “fat”.

Step 3: Create an “infrastructure” protocol.

Step 4: Sell to investors.

Step 5: Profit.

Tokens do indeed power (quasi) decentralized infrastructure, but that doesn’t mean that they necessarily capture any of the value they produce. Like our poor friend, Linux.

Value capture for a money boils down to supply and demand. MV = PQ (That’s the “equation of exchange” for the uninitiated.), for example, is interesting to the extent it captures this dynamic. It’s a helpful mental construct. But like wet dirt, it should not be used in a vacuum.

The next assertion may feel a little bit unpleasant as it starts to tug on the part of your brain where the aforementioned memes have their stranglehold. But bear with me and resist the urge to regress.

The market cap of anything is the amount of wealth held in it. It is the amount of units * the price of the asset. AAPL being worth $700bn means that $700bn of wealth is held in the stock. Gold being worth $7tn, means that $7tn of wealth is held in gold. BTC being worth $150bn means that $150bn of wealth is held in the token. The velocity discussion is just another way to elucidate this mechanism. For stocks and tokens alike, the more wealth that is held, the more it goes up in price.

Intuitively, this should make sense. If you buy something and sell it immediately that negates the benefit to price from buying it in the first place.

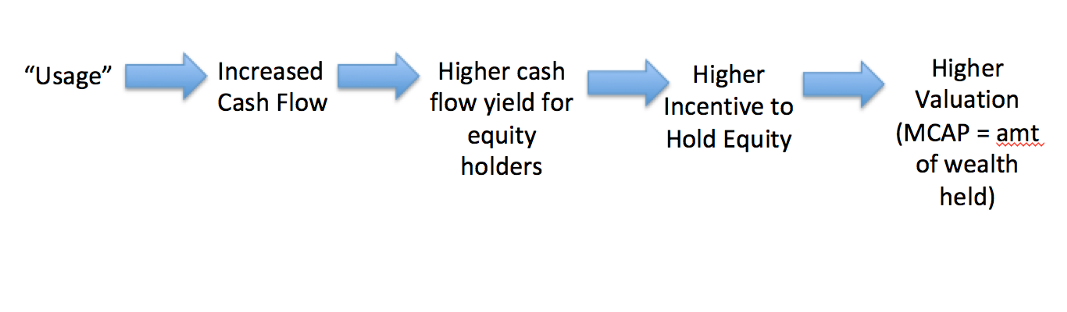

Investors in the equity world use KPIs and multiples to map value creation to value capture: LTV / CAC, DAUs and EBITDA multiples. The framework is that as “usage” increases, so does the valuation. The KPIs help to abstract this into digestible metrics. But these same mental models don’t belong in the cryptocurrency realm.

KPIs tend to work for equity because usage generally maps to cash flow. Tropes like follow the developer activity work for centralized platforms because they tend to generate more cash flow the more people work on it. Centralized aggregators — Google, Facebook, Netflix — need to garner a tremendous amount of usage for the positive feedback loops of value creation to kick into effect.

As a business’s cash flow increases, there’s a greater incentive to hold its stock because of the legal recourse to cash flow and concomitant increase in dividend yield / liquidation value. If the market cap was $100bn, and cash flow increases from $10bn to $20bn, yield doubles and the price should double as a result to bring the yield back in line with the market. Investor demand to hold increases to capture this yield. But even in the absence of price increases, an investor can still do well if the dividend increases.

There’s a tacit assumption in cryptocurrencies that the same link above — from usage to value creation — will hold true. That KPI improvement — say usage of Filecoin’s network for example — will lead greater wealth held in the cryptocurrency. But the biggest difference between equity and money comes down to the incentive to hold.

The Behavioral Nature of Money

Unlike equity, cryptocurrencies and money have absolutely no recourse to cash flow, no preferential rights, no dividend stream and no pro rata share of liquidation value. Money is not a productive asset.

If you are holding a money, you’re betting on the market cap staying the same or increasing in the future (hence, storing your value). Given the above framework, it’s a bet on either the same amount of, or more wealth, being held in the asset later on. But unlike equity, because money is not a productive asset, holding money makes you entirely dependent on the actions of others.

To the best of my knowledge you cannot consume tokens. At least, I hope you aren’t. The only way for them to get you anything in return is if other people accept it in exchange for consumable goods and services.

Money has value because everyone believes it has value. Absent the shared belief, there’s no intrinsic value in holding a money.

Every time you’re using a money, somebody is demanding the monetary asset from you. And given the monetary asset is not consumable, the only way somebody would demand it is if they also think they can use it to demand other goods and services. Money only has value because of the optionality it confers on holders, which is a byproduct of other people’s demand for money.

Investors bootstrap a new currency: Cryptocurrency “Regression Theorem”

Hopefully by now you understand that money and equity couldn’t be more different. Using the same mental models to invest in both is going to end disastrously. But you’re probably left wondering how any monetary asset can accrue value in the first place if it’s not just based on “usage”.

Below, I propose a cryptocurrency “regression theorem” — a three step process towards crypto-asset monetization (Mises coined the regression theorem for his theory on the origins of money) . This isn’t meant to describe the origins of money, but instead how a crypto-asset will accrue value and win based on where we stand today.

The only cryptocurrencies that accrue value will be those that traverse the three steps above. Before I shock you even more by saying this can only occur with one asset, let me introduce you to this concept.

First a cryptocurrency begins as an asset held for speculative purposes. Early investors in a new money are rewarded handsomely if it’s adopted. Initial holders don’t have many opportunities to exchange the asset for goods and services — with significant risk comes a commensurate reward.

Step 2 is the introduction of a narrow form of utility — ICOs for ETH and Silk Road for BTC are examples. I’d also consider BTC usage as a SoV for citizens in countries with hyper-inflating currencies an example today. It almost feels dirty using the word utility in this concept because dApp platform promoters have stolen it from us. But utility in this regard does not necessarily mean “dapp utility”. It just reflects the progression from a purely speculative asset to one with speculative demand and narrow usage.

Third and finally, it becomes money: an asset you need, use and is also an investment in future uncertainty. A true money isn’t just an asset with narrow utility, but one that you cannot survive without. It’s an investment in future uncertainty and a vehicle to transfer wealth across space and time. It’s like Star Trek. But with money.

There’s an important and under-appreciated time component. The key distinction between an SoV and MoE is that an SoV is a MoE in the future. To invest in the future optionality, investors today must have confidence that investors in the future will demand the same monetary instrument for savings. And investors in the future also require the same guarantees. The process ends up becoming self recursive and non-linear.

Investment in step 1 is predicated on the asset progressing to step 2. And prospective investors in step 2 will buy only if they think the asset can move to step 3. Thus, investors in step 1 will only enter if they believe it can complete the full loop. If there’s a leak anywhere in this process, it cannot start. If investors in step 1 don’t ultimately think it has the ability to become a widespread money, it should never be able to get off the ground in the first place.

This is why long term credibility of monetary policy is imperative. Uncertainty suffocates this process as the value of a money rests on the confidence of holders in the future nature of the monetary asset. Holders today won’t make a bet on holders in the future if they don’t know what monetary factors those future holders will be subject to.

But so many cryptocurrencies have defied the “cryptocurrency regression theorem” you say. Well yes, today, this process is extremely leaky. But it’s because it’s behavioral in nature and the behavior of most investors is akin to a drunk person at a yard sale. They’re buying everything regardless of price and utility.

Most investors today still mistakenly think cryptocurrencies will accrue value like a stock and that their investment success hinges on a mere transition from step 1 to 2. However, as cryptocurrencies attempt to progress through this process, usage alone will not be enough to sustain a cryptocurrency’s valuation. The transition to step 3 must occur. And those who usher others on the cryptocurrency monetization ride through this process are the long term investors and holders. Not a free rider in my book.

Why is step 2 not sufficient? There’s a widespread notion that money is valuable because it is useful as a medium of exchange, when in reality the opposite is true. If money were simply used as a monetary medium, but not held as savings, any increase in its value would immediately be negated as the user sells out of the asset. The only way the market cap of a money can increase is if people hold more wealth in an asset.

Since 1950s, usage and adoption of the USD increased dramatically. Used as a world reserve currency, the mechanism for all oil trade, and the preferred currency for large scale Equity ICOs (I mean IPOs), adoption has taken off. But since 1970 gold has still gone up 6x vs the USD. Clearly “usage” is not the only determinant of a money’s long term value.

Gold price vs USD

Thus a transition to the third step is necessary, with widespread investor adoption.

Transition to step 3: The (Un)intelligent Investor

Whereas equity’s value is independent of the markets belief because of its convertibility into assets and pro rata dividend share, money’s value is completely dependent on other investors.

Ben Graham, in his seminal piece on valuation, The Intelligent Investor, extolled the virtue of separating the price of an asset from Mr. Market. You can be a contrarian — in fact you have to be — and succeed in the equity markets because equity has recourse to cash flow. A low price relative to value represents a good buying opportunity. In the equity markets, if you invest in what everyone else believes to be true, the efficient market hypothesis will prevail. If you believe what the market believes, your return will equal the market’s and your LP capital will end up with Vanguard.

Unlike equities where you want to separate yourself from Mr. Market, with currencies you want to converge on what Mr. Market is telling you.

The more Mr. Market agrees with you, the more liquid and salable your currency is — that is, the more demand other people will have for your money.

Developer activity, buzz, dapp launches and ICOs are not leading indicators. Don’t follow the developers. Follow the money, and the developers will join.

Capiche?

When you are trading your time for money — also known as working in common parlance — you are betting that money will give you more optionality than your time / effort because other people will demand that money from you both now and in the future. Money, in this regard, is liquid time. Working for money is going long optionality. And holding that money vs getting rid of it today is betting that more people will demand that money in the future.

Unlike with equities, being an “intelligent” investor in money suffocates that optionality. You rarely benefit from being a contrarian when it comes to money. That’s why Bitcoin’s rise is teaching some bad lessons. If a stock doubles in price, ceteris paribus, it generally becomes less valuable because of the reduction in dividend yield. With money the opposite is true. BTC is orders of magnitude more useful today than when its price was $1 because it is more salable.

The market cap today is much higher, indicating more people accept and demand it

In money, you want to be an “Un-Intelligent Investor”. The best form of money will be the one that most people have accepted. The worst form of money, is the one that nobody demands to hold. Market cap is a representation of this dynamic.

The larger network a currency has, the better — which then causes more people to buy in, further reinforcing this value. As liquidity differences between two different moneys grow, there’s a disutility to holding whatever asset is less liquid. Holding a less liquid asset confers an opportunity cost and asset holders will seamlessly convert into the asset with highest optionality. As more people convert into the stronger asset, the differences between the two are exaggerated. Once other people recognize this, it becomes a self-fulfilling prophecy. The worse currency ultimately hyper-inflates and the other in relation to it hyper-deflates. Investors will be forced to converge on what the rest of the market is telling them, constantly recalculating and making internal predictions of what asset is most likely to do so.

On the free market there tends to only be one reserve currency because of these strong positive feedback loops of value. Step three is ultimately the process of all wealth converging into a single monetary asset. And the winner of that is determined by the long term holders dem.

Without long term holders, there’s no way to bootstrap a new currency and progress through the cycle above. No cryptocurrency market would exist without them. And cryptocurrencies would have zero chance of taking down any reigning monetary SoV’s without investors continued intransigence and unrelenting will to hold.

Investor obliviousness is a wrench in the gears of the regression theorem. But he who exits last from the old monetary asset will end up hanging their private keys on the wall like Zimbabwe dollars. Fear of missing out turns into fear of getting out.

Investors Control and “Incentivize” the Cryptocurrency Development

As we just saw, the market cap and valuation of any money is dependent on how much wealth is held in it. Per the cryptocurrency regression theorem, investing in a cryptocurrency is ultimately a bet on other people demanding to hold the asset in the future. For any cryptocurrency to win — for any of us to make money — we need to appease the long term investors. The money with the most intransigent and largest holder base will win.

Developers could try to launch an objectively better currency, but that doesn’t necessarily mean it will overtake the inferior one. To do so, investors need to follow. The only way developers get paid from a cryptocurrency is if they create something investors want to hold.

Good developers are invaluable. But in this regard, they’re like pilot fish who follow sharks around feeding off their spoils. Developers (and miners too) are forced into working on whatever investors are signaling they desire (segwit2x showed this too). The value of the tokens that they receive as their compensation is based on investor demand for it. Developers are ultimately dependent on investors (there’s some nuance here — yes BTC needs lightning network, for example).

Don’t mistake this as an assertion that developers are not important. I’d give up my first born to be Greg Maxwell or Elizabeth Stark. My broader point is that there is a feedback loop that exists which is catalyzed by investor interest. Investors signal that Bitcoin is the most likely to win through it holding the most wealth. The top developers work on it and buy bitcoin to capitalize on its rise. More investors join because of the strong technical roadmap. Victory.

But developers, are only incentivized — compensated — from a cryptocurrency if investors value it highly. Developers cannot create value in a vacuum with a crypto-asset. They need to create something that investors demand to hold. And ultimately, because of the crypto-regression theorem, a high initial valuation — which usually determines a significant portion of the dev pay — will be predicated on a high long term valuation.

Developer Incentives

Back to Naval’s initial assertion, the only reason utility tokens currently “incentivize” devs is because fly-by-night speculators and investors are holding tokens mistakenly, as I alluded to above. Developers are capitalizing off of investor uncertainty and the attendant overvaluations.

Bitcoin developer compensation hasn’t been nearly as explicit as with ICOs — but that doesn’t mean that it doesn’t exist. Unfortunately for many traditionalists many things often tend to work better in practice than in theory. Bitcoin Core is one of the most active open source repositories to ever exist. If that’s from ignoring incentives, it sounds like we need to banish so-called incentives from all open source projects.

What’s relatively unique to bitcoin is that because a salary or pre-sale allocation isn’t granted to developers, many of them are forced holders if they want to capitalize on their development work. Given long term holders are pivotal to a cryptocurrency’s success, there could be no better synergy than having the holder base and developer base overlap. And this is the most common form of developer incentive in bitcoin. Rather than ignoring developer incentives, bitcoin almost elegantly forces their alignment. Developers only get paid if they appease the investors through token appreciation — and often times they are the largest investors. It’s forced skin in the game.

This next point may hurt the most to those aforementioned SV-ethos infected investors. But it frankly may be the case that this “tech revolution” can succeed without the help of VC investors disrupting crypto-incumbents. As exciting as it is to take down Goliath, sometimes it can be more beneficial to have him on your side. And the notion that you can take down Bitcoin through a large pre-mine allocation to developers is like trying to fight Apple by poaching its engineers with monopoly money.

I think it’s unfortunately the case that most developers cannot and should not be contributing to cryptocurrencies at the protocol level because they don’t have the requisite knowledge. And that’s fine. There are lots of other problems in the world for developers to work on and VCs to fund. It’s not necessarily a good thing that ICO funding is outpacing traditional, non crypto equity financing. Most of that capital could also be re-allocated to supporting the best crypto-money that exists.

Developers follow the investors. And so long as investors continue to value ICOs, developers will launch them. When this inevitably changes, so will the “developer incentives”. The sooner investors complete altcoin rehab, the better we can correctly incentivize developers.

Conclusion

Investors are the most important piece of the puzzle. Investors aren’t free riding, they are (1) signaling to the market which currency they desire and (2) compensating devs and other holders for their work.

Devs and early VCs should be gracious to investors, for that is how they get paid.

Valuation is predicated on investor behavior and so is developer compensation. Devs ultimately follow the holders in terms of valuation. Investors are the most important aspect

Holders control the protocol.

----------------------------------------------------------------------------

Disclaimer: The comments, views, opinions and any forecasts of future events reflect the opinion of the quoted author or speaker, do not necessarily reflect the views of Tetras Capital Partners, LLC (“Tetras”) or other professionals at Tetras, are not guarantees of future events, returns or results and are not intended to provide financial planning or investment advice.

Thanks to Nic Carter, Arjun Balaji, Gabe Bassin, Pierre Rochard, Marcus Dent, and Christian Langalis.

BlockchainCryptocurrencyBitcoinEthereum

Like what you read? Give Brendan Bernstein a round of applause.

From a quick cheer to a standing ovation, clap to show how much you enjoyed this story.

Go to the profile of Brendan Bernstein

Brendan Bernstein

@TetrasCapital Founding Partner

Token Economy

Token Economy

Keeping track of new developments in the distributed ledger technology space

More from Token Economy

Token Economy #53: phew

This week’s Token Economy is supported by Coinbase, whose mission is to create an open financial system for the world.