Date: 2025-01-14 Page is: DBtxt003.php txt00017533

ESG

What correlation with stock value

Facebook, Visa among the stocks with high ESG marks — enough to outrun the S&P 500 ... Companies with increased environmental, social and governance scores have put up outsized returns over the past five years, FactSet research shows

I don't find this research very convincing. Some types of company may be able to have strong ESG metrics and improve profit performance, like for example tech companies, but major companies in many other sectors cannot have ESG improvement and higher profits without fundamental structural and technical change. Yes ... eventually there will be outperformance, but it won't come without a profit hit in the short run! .

Peter Burgess

These big stock names have a reputation for higher ESG scores, and they’re outperforming the S&P 500.

These big stock names have a reputation for higher ESG scores, and they’re outperforming the S&P 500.

Companies that improve their environmental, social and governance reputations outperform the S&P 500 — major technology and financial services firms among them.

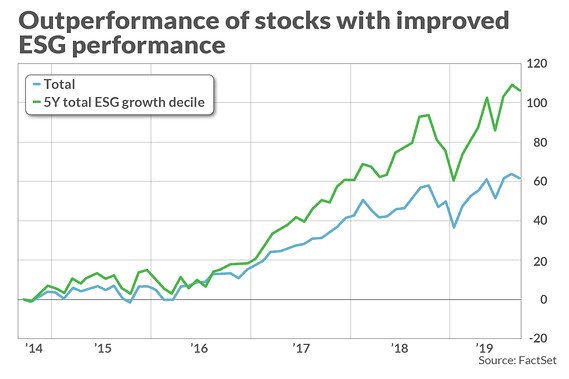

That’s according to researchers at FactSet, who broke out the S&P 500 into deciles based on ESG improvement scores using Sustainaylitcs ratings and then compared the top decile (e.g. the companies that improved ESG scores the most) to the S&P 500 SPX-0.41% as a whole.

The chart below shows their findings.

While it is always difficult to say outperformance is due to any one factor, raising the question of whether causation or correlation is most at work, the figures do seem to indicate that companies are likely to see outperformance relative to their peers if they place an emphasis on improving ESG factors.

Primarily, if demand is boosted for these stocks because impact investors perceive the underlying companies as “doing good,” or at least doing better than rivals, there is an effect on share price, even with other factors also having an impact.

“The data indicates that companies that have increased their ESG scores — or exhibited ESG momentum — have seen outsized returns over the last five years as investor perception of and focus on ESG as an important factor has grown,” said Tyler Chaia of FactSet.

The performance gap is wide. The top decile of companies within the S&P 500 that improved their ESG scores over a five-year period, as ranked by Sustainalytics, put up over 4,500 basis points of outperformance relative to the index overall. A basis point is 1/100th of 1%.

The S&P 500 is up roughly 19% in the year to date, up 58% over the past five years.

Some notable names on the outformance list include Facebook FB-2.41% , Mastercard MA-1.82% , Visa V-1.39% , Salesforce CRM-1.87% , and Microsoft MSFT-1.66% .

Tech-sector companies drove much of this ESG-over-S&P 500 outperformance, but even within that group, companies that improved their ESG scores outperformed industry peers by 3,700 basis points.

Other data show the growing importance of ESG factors, even the perception of such factors, in investing decision-making, including in the fund industry. In 2018, US SIF, also known as the Forum for Sustainable and Responsible Investment, identified $12 trillion in U.S.-domiciled assets whose managers either review ESG issues as part of their investment analysis or portfolio selection or file shareholder resolutions on ESG issues at their portfolio companies’ annual meetings. This total is an increase of 38% since 2016.

Lisa Woll, CEO of US SIF, has been outspoken on what she says can be unfair analysis of ESG-linked stock returns. She wrote about it in a counter argument for MarketWatch this summer, saying that critics, including noted retirement expert Alicia Munnell, also writing for MarketWatch, too easily dismiss a “preponderance of substantive evidence that sustainable investing does not produce worse results for investors.”

------------------------------------------------------------------

Opinion: For ESG investors, the newest challenge is separating fact from ‘greenwashing’

Read: ESG investing trend has powered index giant MSCI to market outperformance in 2019

--------------------------------------------------------------------

Peter BurgessStatus is online Peter Burgess You Founder/CEO at TrueValueMetrics.org developing True Value Impact Accounting

7h I don't find this research very convincing. Some types of company may be able to have strong ESG metrics and improve profit performance, like for example tech companies, but major companies in many other sectors cannot have ESG improvement and higher profits without fundamental structural and technical change. Yes ... eventually there will be outperformance, but it won't come without a profit hit in the short run! .

Like Peter Burgess’ comment ·

3 Likes 3 Likes on Peter Burgess’ comment

· 1 Reply 1 Comment on Peter Burgess’ comment

Phil BaileyStatus is reachable Phil Bailey 1st degree connection1st CEO

4h ESG metrics is pointless without measuring who or what is lobbied at Congress, Senate and Whitehouse vs what people actually invest in... Its too vague and politically biased. Unlike Phil Bailey’s comment ·

2 Likes 2 Likes on Phil Bailey’s comment

Jeff MowattStatus is reachable Jeff Mowatt 1st degree connection1st Director, People-Centered Economic Development UK

7h Here in the UK the Chartered Institute of Management Accountans say 'An endless flow of business crises has shown the harm that can be done by focussing purely on profits and maximising shareholder value. We face a systematic problem – and solving it means asking deep questions about some of the basic assumptions which shape how businesses behave.'

CEO Anne Franke says 'The bottom line result is that purpose-driven, people-centric, values-driven companies outperform. Not just because they do better sustainably over time, but because they avoid the risk.'

That's not my experience of being a people-centered purpose driven business. http://www.blueprintforbusiness.org/the-what-why-and-how-of-purpose/

Unlike Jeff Mowatt’s comment ·

1 Like 1 Like on Jeff Mowatt’s comment

Raghavan (Ram) Ramanan Raghavan (Ram) Ramanan 1st degree connection1st Seeking corporate EHS/CSR/Sustainability position.

3h Brad this is the manifestation of inadequate and incorrect metrics and measurement. Most ESG measures focus on the triple bottom-line - Profit, Planet and People and the 4th bottom-line, Purpose is often ignored, or claimed to be marginally included in Governance.

Ram, Author Environmental Ethics & Sustainability and Introduction to Sustainability Analytics

Unlike Raghavan (Ram) Ramanan’s comment

· 1 Like 1 Like on Raghavan (Ram) Ramanan’s comment

Brad ZarnettStatus is reachable Brad Zarnett 1st degree connection1st Sustainability Strategist / Blogger / Speaker

4h Facebook is a stain on truth, competition and democracy. Clearly ESG has no measure for contribution to overall societal wellbeing. Please explain the value of ESG to me...like I was in kindergarten. (edited)