Date: 2024-12-21 Page is: DBtxt003.php txt00018662

Investment Fund / Portfolio

The REIT Component

About: Realty Income Corporation (O) ... Realty Income: Do Not Let This Opportunity Get Away

Peter Burgess

- Realty Income is one of the most well-run REITs on the market today and is trading at levels last seen in 2015.

- As we learned from the last recession, Realty Income proved to recover rather quickly from trough to a new peak.

- Realty Income is yielding a dividend of 6%.

- Looking for more stock ideas like this one? Get them exclusively at High Yield Landlord. Get started today »

(Source: Realty Income Q4 Investor Presentation)

Many of the top tenants on the list above are well-known established names. Currently, Realty Income’s largest tenant, Walgreens (WBA), makes up 6.1% of its ABR. The company’s top 20 tenants make up 53% of its annualized rental revenue. Of the top 20 tenants, 12 are investment-grade rated, meaning they have credit ratings of Baa3/BBB- or higher from one of the three major rating agencies (Moody’s/S&P/Fitch). The breakdown of tenants within different industry groups is as follows:

- Retail - 83.0%

- Industrial - 11.5%

- Office - 3.7%

- Agriculture - 1.8%

Source: Yahoo Finance

A Lesson From The Great Recession

The Great Recession was the last major downfall we experienced in the United States and it is important to learn from the past. During the Great Recession, the company hit a low of $14.25 in March 2009, which was the trough of the financial crisis. Fast-forward less than 20 months after that trough and the company had gained roughly 130% from trough to peak during this time. To say the least, the company came roaring back.

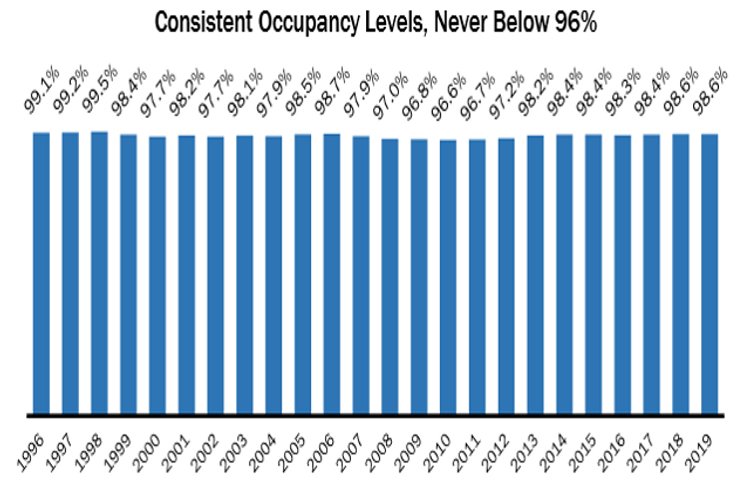

One area the company has been extremely strong is its ability to maintain strong occupancy levels even during slow economic times. The performance of the portfolio is pretty impressive as well. The past two years have seen the highest occupancy levels since before the start of the Great Recession. It is worth noting that the worst levels of occupancy the company has experienced over the last two decades occurred during the last recession from 2007 to 2009, when the figure dipped to a low of 96.6%, which is still impeccable. Even during one of the worst periods in recent U.S. economic history, Realty Income's portfolio stood strong.

Source: Realty Income Investor Presentation

The company is backed by a strong portfolio of properties and a stellar A3 and A- credit rating from Moody’s and S&P, respectively.

Strong Dividend Track Record

As I mentioned in the opening, Realty Income has been known for its strong dividend track record over the years. In fact, while many REITs were cutting their dividend during the Great Recession, Realty income continued to grow its dividend. Realty Income was one of only nine REITs in the S&P 500 to not cut their dividends during the Great Recession. This has continued during our current pandemic with Realty Income recently increasing its dividend yet again.

Realty Income has grown its dividend for 89 consecutive quarters. During these 89 quarters, the economy has experienced two recessions and now this pandemic we are living through today. Moreover, due to the recent slump of its stock price, Realty Income is now offering a staggering 6% dividend yield.

Investor Takeaway

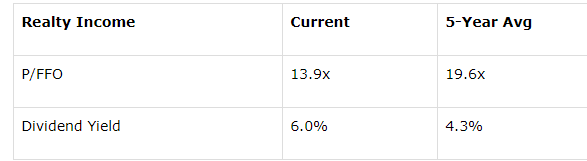

This is as good of a time as you have seen in the past five years to pick up shares of The Monthly Dividend Company. Like many REITs now, Realty Income is trading at an extreme discount based on its five-year averages.

Realty Income Current 5-Year Avg

P/FFO 13.9x 19.6x

Dividend Yield 6.0% 4.3%

The company has lost more than a third of its market cap in just over a month’s time period, but like I showed you above, we can learn from the past. Realty Income took it on the chin during the Great Recession, but quickly rose to a new peak within twenty months from the trough.

Due to the economy being on strong footing and this economic pause not related to anything wrong with the economy in particular, once companies return to normalization, which will take some time, we will see people getting back to work followed by a strong recovery. Due to continued volatility, I always suggest investors buying in tranches and not all at once.

Historic Market Opportunity! Act Now! The recent market crash has created exceptional opportunities. Many high-quality REITs are now offered at >10% sustainable dividend yields and have 100-200% upside potential in a recovery. At High Yield Landlord, we are loading up on these discounted opportunities and share all our Top Ideas with our 1,500 members in real-time. Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more. We have limited spots at a 20% discount. Get Started Today! Disclosure: I am/we are long O. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Like this article