Date: 2024-08-16 Page is: DBtxt003.php txt00019290

Taxation

Tax Avoidance

Watershed data indicates more than a trillion dollars of corporate profit smuggled into tax havens ... UK, Switzerland, Luxembourg and the Netherlands – the “axis of tax avoidance” – are responsible for 72 per cent of global tax losses

My blood is boiling. Thank you for this article. I qualified as a Chartered Accountant in 1965 (ICAEW) after being articled to one of the big firms in London. As part of my training, I did some of the grunt work on the design of complex international tax shelters. Over the years I have come to realize how much the amazing progress in science and technology has been hijacked by owners and the people with wealth and power. Why is it that technology that is many orders of magnitude better than when I was in my 20s has produced so little global happiness. Productivity and profits have increased maybe 700% over the past 40 years, but wages perhaps around 7%. Rates of taxation are very low compared to 40+ years ago and insufficient to pay for essential public services and investment. On top of this sophisticated tax avoidance. Worldwide people are better educated than at any time in history, and a growing number understand that what is happening at the top of society is not right ... and explains to some extent the political turmoil that is spreading around the world.

Peter Burgess

Rows of bank deposit boxes

UK, Switzerland, Luxembourg and the Netherlands – the “axis of tax avoidance” – are responsible for 72 per cent of global tax losses

Analysis of new OECD data published yesterday, on the basis of a reporting standard developed by the Tax Justice Network, has tracked for the first time $467 billion worth of corporate profit shifted by multinational firms into corporate tax havens, with associated corporate tax losses of $117bn. The data from 15 countries provides only a partial picture into global corporate tax abuse and confirms previous estimates by the Tax Justice Network that governments lose $500 billion in corporate tax to tax havens every year.1 The UK, Switzerland, Luxembourg and the Netherlands – aka the “axis of tax avoidance” – together are responsible for 72 per cent of the corporate tax losses the world suffers.

The underlying data published by the OECD yesterday2 marks a major policy success for the Tax Justice Network and global efforts to tackle corporate tax abuse. The data was collected under the OECD’s country by country reporting standard, which is based on an 2003 proposal from the Tax Justice Network that was originally dismissed as unrealistic and utopian. The data consists of aggregate information on the country by country reporting of multinationals from 26 countries. However, due to inconsistencies in data format and quality, the Tax Justice Network analysis data from only 15 countries.

The Tax Justice Network, which previously warned governments they “cannot build back better on top of a tax haven trap door”3, is calling on governments to tackle the problem by requiring firms to publish their individual country by country reports each year, and then taxing them according to where the reports show profits are generated before they are shifted into tax havens. But for now, yesterday’s OECD publication represents the biggest single step taken towards international corporate tax transparency.

The scale of corporate tax abuse

The analysis reveals that instead of declaring profits in the countries where they were generated, multinational firms operating around the world are shifting over $1 trillion in profits every year to corporate tax havens, where corporate tax rates in practice are far lower or non-existent, in order to underreport their profits where they operate and consequently pay billions less in tax each year.4

The partial picture provided by data from the 15 countries that report at a sufficiently high degree of granularity allows the Tax Justice Network to identify $467 billion worth of profit shifted across the world and $117 billion in corporate tax lost around the world annually. With higher quality US data for 2017 for comparison, the Tax Justice Network estimates that actual profit shifting is approximately 50 per cent higher than reported by the 15 countries, around $840bn, with direct corporate tax losses of $203bn. Extrapolating to the global picture indicates total profit shifting of $1.3 trillion each year, and direct corporate tax losses of $330bn. Coupled with indirect effects from the race to the bottom in corporate income tax rates, the overall annual losses imposed by multinational companies’ use of tax havens is likely in line with or in excess of the Tax Justice Network’s estimate of $500bn, based on a methodology created by researchers at the International Monetary Fund.

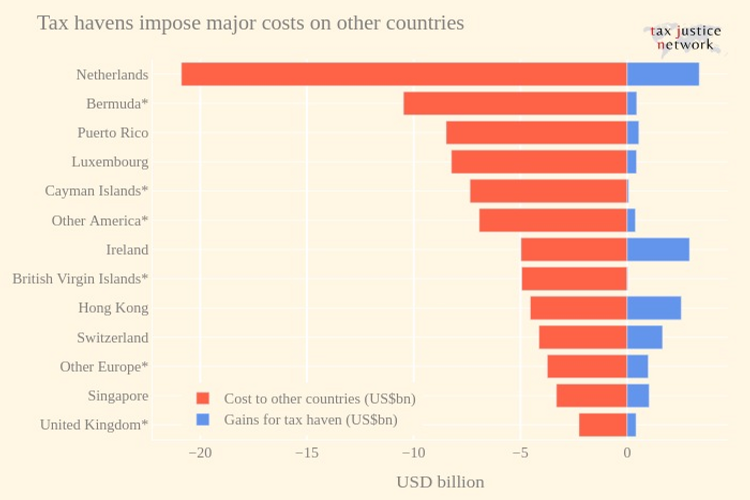

Of the $467 billion in shifted profited reported by the 15 countries, most profit was shifted to the Netherlands ($95 billion), followed by the British Overseas Territory of Bermuda ($44 billion), US Territory Puerto Rico ($36 billion), Hong Kong ($33 billion) and Luxembourg ($32 billion). The corporate tax havens most responsible for the reported $117bn billion in corporate tax lost by governments around the world were the Netherlands ($24 billion), followed by the British Overseas Territory Bermuda ($10.9 billion), US Territory Puerto Rico ($9 billion), Luxembourg ($8 billion) and Ireland ($7.9 billion).

Figure 1. Tax revenue losses and gains due to profit shifting by the displayed countries. UK territories and Crown dependencies are marked with an asterisk

In 2019, the Tax Justice Network’s Corporate Tax Haven Index estimated, based on deep analysis of countries tax laws, financial systems and economies, that the UK, Netherlands, Switzerland and Luxembourg – dubbed the “axis of tax avoidance” – are together responsible for half of the world’s corporate tax avoidance risks.5 Analysis of the new OECD data finds that the axis of avoidance are responsible for 72 per cent of the corporate tax loss revealed in the data.

The data highlights the highly wasteful nature of the corporate tax haven model. In return for costing other governments at total of $117 billion in lost corporate tax a year, corporate tax havens collected just $14.8 billion in additional corporate tax a year. For every $1 dollar in corporate tax collected by tax havens from the shifted profits of multinational firms, the world lost $6 in corporate tax from those firms.

The degree of wastefulness varies among corporate tax havens. The most wasteful tax havens were British Overseas Territories. In return for costing governments around the world about $5 billion in lost corporate tax a year, the British Virgin Islands collected just $0.02 billion in additional corporate tax a year. For each additional $1 the British Virgin Islands collected from multinational firms shifting profit into its jurisdiction, the world lost $314. British Overseas Territory Cayman collected an additional $0.07 billion in return for costing the world $7 billion ($112 in corporate tax lost by the world for each $1 collected by British Overseas Territory Cayman). British Overseas Territory Bermuda collected an additional $0.4 billion in return for costing the world countries $10.9 billion ($24 in corporate tax lost by the world for each $1 collected by British Overseas Territory Bermuda). Luxembourg collected an additional $0.4 billion in return for costing government around the world $8 billion (almost $20 lost for each $1 collected). US Territory Puerto Rico collected an additional $0.5 billion in return for costing the world $8 billion ($16 lost for each $1 collected).

Country by country data published by OECD is a “landmark moment”

The data published by the OECD yesterday is the first time countries’ aggregated country by country reporting data has been made public, with the exception of the US’s aggregated country by country reporting data which the US published earlier this spring. By requiring multinational firms to publish how much profits and costs they incur in each country they operate in instead of publishing all of their profits and costs as a global sum, country by country reporting exposes profit shifting, helping government detect and deter corporate tax abuse.

The Tax Justice Network is welcoming the OECD commitment to publishing the data as a “landmark moment” in the fight against corporate tax abuse. Developed by the Tax Justice Network in 2003, country by country reporting eventually gained backing from the G20 in 2013 and was formalised by the OECD in 2015, making it a requirement for OECD members to collect country by country reporting data with a later commitment to publish the data in aggregated format in 2019 – subsequently delayed to yesteray.

The Tax Justice Network analysed the US’s country by country reporting data in April to reveal that US firms alone were shifting $115 billion in profit into the UK, Switzerland, Luxembourg and the Netherlands, costing the EU over $27 billion in lost corporate tax.6 Using the new country by country reporting data from 15 countries provides a bigger picture of corporate tax abuse – but comprehensive data is needed to reveal the complete picture.

Global pandemic recovery jeopardised by corporate tax havens

The Tax Justice Network’s analysis confirms that measures taken recently by EU countries to stop Covid-19 bailouts from ending up in tax havens will be largely ineffective at tackling profit shifting. Recognising that measures to tackle the economic fallout of the Covid-19 pandemic are undermined by corporate tax havens, several EU countries banned companies registered in tax havens from receiving bailouts in the spring. However, the ban only extended to countries blacklisted on the EU’s list of non-cooperative jurisdictions, which leaves out almost all of the world’s most dangerous tax havens. The Tax Justice Network had previously warned that the EU’s tax haven blacklist covers just 7 per cent of financial secrecy risks posed by tax havens, leaving the door wide open to tax abuse.7 Analysis of the new OECD data confirms that jurisdictions on the EU tax haven black list are responsible for at least 7 per cent of the profit shifting revealed, with British Territory Cayman the only significant player on the list, accounting for 98 per cent of that.

While a number of EU countries put forward legislation requiring multinational firms to publish country by country reporting as a condition to receive Covid-19 bailouts8, as the Tax Justice Network proposed in April9, no government passed the requirement. Revelations made possible today by the country by reporting data published by the OECD demonstrate the large volume of corporate tax abuse country by country reporting requirements can detect and deter. The Tax Justice Network is calling on the EU to show global leadership by acting as a bloc to require public country by country – this would encompass most reporting multinationals in the world, and thus deliver a major public good to the world.

UK reneges on commitment, blocks OECD from publishing UK data

The UK has blocked the OECD from publishing its aggregated country by country data, reneging on its 2016 commitment to do so. Under then-Chancellor George Osborne, who lobbied the EU to commit to publishing country by country reporting, the UK Treasury was among the first to commit to publishing country by country reporting data both at a national level and at an international level as part of a multilateral process. However, in May 2020, the UK Treasury confirmed to parliament its reversal on the commitments, prompting the Tax Justice Network to raise the alarm on the UK’s regression into tax havenry.10

Under the Finance Act 2016, the UK government has had the power to require multinational firms based in the UK to publish their country by country reporting data; however, the UK government has yet to exercise the power. While the UK has collected the data since 2016, the UK Treasury said in May 2020 that it would not publish the data as doing so would be in violation of the OECD process – the same process under which the OECD yesterday published aggregate data, but in which the UK refused to participate.

By not exercising the power to require individual firms to publish their country by country reporting under the Finance Act 2016, the UK is estimated to have missed out on at least £2.5 billion in corporate tax a year, amounting to at least £10 billion today.11 An extra £10 billion is exactly how much NHS England Chief Simon Stevens has recently said is needed to prepare the country’s National Health Service for a potential second coronavirus wave.12

Failures to disclose data

A striking feature of the OECD data release is just how many countries have failed to disclose to the agreed template for aggregate reporting. Many OECD members failed to allow any data at all to be published, like the UK. Many others restricted the disaggregation to the extent that their data is effectively useless to understand the profit shifting patterns of multinational firms headquartered in their jurisdictions.

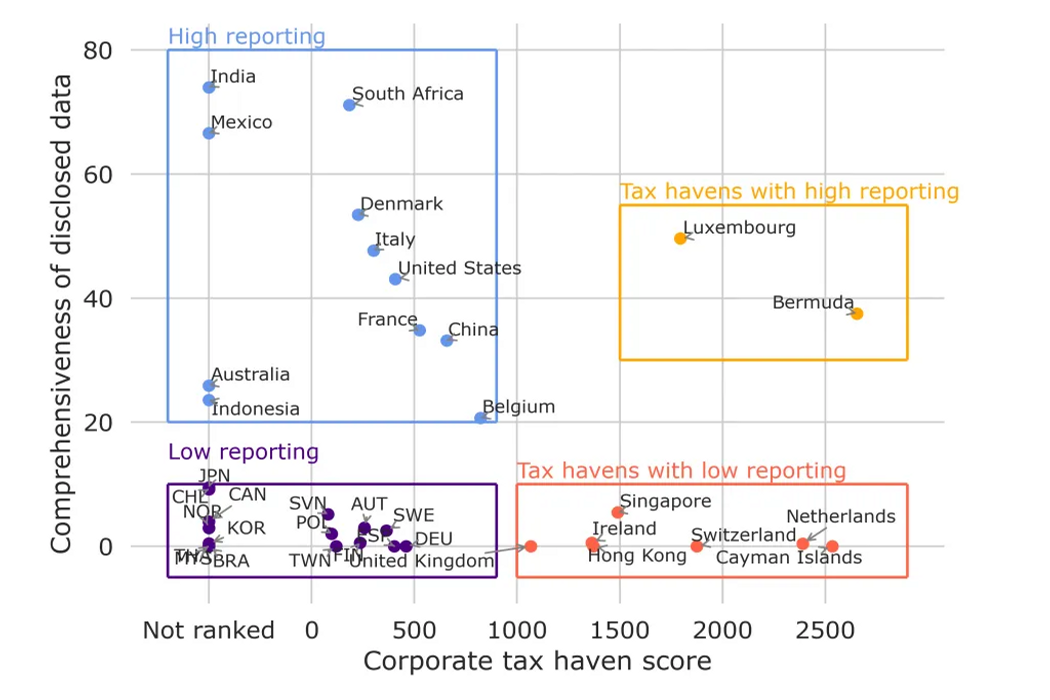

The below summarises the extent of disclosure in this data release, against the ranking of each country on the Tax Justice Network’s Corporate Tax Haven Index. Four groups are easily identified: high disclosure and low disclosure non-havens, and high disclosure and low disclosure tax havens. Notably among tax havens, Bermuda and Luxembourg have been relatively cooperative and transparent on country by country reporting, while the remainder of the most aggressive corporate tax havens, including many OECD members, have been deliberately opaque.

Campaigners call on governments to publish details on multinational firms

The data published by the OECD aggregates the country by country reporting data collected by each country from the multinational firms based within their borders. The process of aggregating the data anonymises multinational firms’ individual data. For country by country reporting to be truly effective, the Tax Justice Network is calling on governments to require multinational firms to publicly disclose their country by country reporting data.

A number of corporate groups have already committed to voluntarily publishing their country by country reporting data, with Vodafone being among the first to do so in 2018. Global standard-setter GRI launched the GRI Tax Standard in December 2019, establishing the most comprehensive standard for multinationals to publish their country by country reporting data under.13 GRI standards are practiced by 74 per cent of the world’s 250 largest corporations.14

Alex Cobham, chief executive at the Tax Justice Network, said:

“The coronavirus pandemic has exposed the grave costs of an international tax system programmed to prioritise the interest of corporate giants over the needs of people. This new data confirms that corporate tax havens like the UK, Switzerland, the Netherlands and Luxembourg have been fuelling a race to the bottom for years, allowing the biggest corporations to syphon wealth and power away from the nurses, public services and local businesses we’re all relying on today.Rosa Pavanelli, General Secretary of Public Services International (the global union federation for public sector trade unions), said:

“This is the greatest, longest running robbery of our times, but the good news is we’ve now got one of the best alarm systems in place – we just need governments to switch it on.”

“Now more than ever, governments must reprogramme their tax systems to prioritise people’s wellbeing over the interests of the biggest corporations. That starts with transparency. The new data published by the OECD is a landmark moment in bringing transparency to the tax affairs of the world’s largest multinational firms in aggregate. To truly tackle the billions in corporate tax abuse committed each year, governments must require firms to publish their individual country by country reports each year – and then tax them according to where they actually make profit, not where they pretend to.”

“These data confirm the scale of profit shifting by multinational companies, and the cost to public revenues. This is a direct contributing factor to the shocking underfunding of our public services, which the COVID-19 pandemic has fully exposed. Policymakers must act urgently to stem these losses and support public services – we can’t afford to wait.”Dereje Alemayehu, executive coordinator of the Global Alliance for Tax Justice, said:

“The irony of the OECD – the club of rich countries – publishing data that shows the tax abuse of their members’ largest multinational companies should be lost on no one. This is an organisation that has illegitimately usurped the role of reforming international tax rules and unsurprisingly failed to deliver on its promise to reform the tax rules that are responsible, and all the while it is non-member countries from the Global South and their citizens who suffer the worst effects. It could not be clearer that the responsibility for international tax rules must shift to the UN – just as quickly as profits are shifted to tax havens including leading OECD member states.”-ENDs-

------------------------------------

Contact the press team: media@taxjustice.net or +44 (0)7562 403078

Download methodology

OECD Corporate Tax Statistics available for here.

Notes to editor

- Previous research by the Tax Justice Network estimated annual corporate tax losses due to profit shifting by multinational corporations to be $500 billion.

- OECD has for the first time published aggregated country by country reporting data available for download here.

- The Tax Justice Network published a five-step bailout test to help governments makes sure Covid-19 bailouts go to protecting jobs instead of to tax havens. While the bailout test gained wide traction, including support from German SPD leader Walter-Borjans and a Scottish Greens amendment that did not pass, two key elements of the bailout test were not implemented: going beyond the EU tax haven blacklist and making country by country reporting a condition of receiving aid.

- This practice is known as profit shifting. There are a number of ways corporations can shift profit into corporate tax havens in order to artificially drive down their tax obligations elsewhere in the world. One method involves is basing the corporation’s intellectual property in a tax haven and charging subsidiaries in other parts of the world fees to use the intellectual property. For example, a coffee company can place its brand’s intellectual property in Luxembourg and then charge its subsidiary in Italy a fee to use the brand. For each cup of coffee bought in Italy, the subsidiary in Italy would pay the Luxembourg subsidiary a branding fee, in so doing reducing the profit made in Italy. Often there is no reason to park a brand intellectual property in a corporate tax haven like Luxembourg other than to shift profit to the tax haven and pay less tax. Another way to shift profit is for a corporate group to lend money to itself with interest. A subsidiary in the Netherlands that gives a loan to a subsidiary in France would then receive interest on the French subsidiary’s loan repayments, helping shift the French subsidiary’s profits into the Netherlands. Again, it is not uncommon for such loans to be given for the purpose of rerouting profits into a corporate tax haven. For more examples of profit shifting, see chapter 3 of our report on how British American Tobacco avoided tax.

- The Corporate Tax Haven Index is biennial ranking of the world’s most corrosive corporate tax havens. See the 2019 results here.

- April analysis of US country by country reporting data available here.

- See our analysis of the EU’s blacklist here.

- See Scotland joins wave of countries blocking tax haven-tied corporations from receiving Covid-19 bailouts; Tax Justice Network responds

- See note 3 above.

- The UK’s u-turn on country by country reporting came a week after the Tax Justice Network’s analysis of the US’s country by country reporting data revealed that the UK had cost the EU $1.5 billion in lost corporate tax. In February this year, the UK received harsh criticism in for increasing its ranking to 12th place on the Tax Justice Network’s Financial Secrecy Index, a global ranking of countries most complicit in helping individuals to hide their finances from the rule of law. Read our full story, published in May 2020, about the UK’s u-turn here.

- Analysis by the University of Oxford estimated that the UK can prevent £2.5 billion a year in corporate tax from being lost to profit shifting. The report found that the UK loses £25 billion in corporate tax a year to multinational corporations shifting profit out of the UK. Assuming that multinational corporations may use other means to abuse their tax obligations, the researchers conservatively estimated that country by country reporting could retrieved 10 per cent of that corporate tax loss. In practice, the amount of corporate tax retrieved can be far greater. The Tax Justice Network estimates that over a four year period, public country by country reporting could have prevented at least £10 billion in corporate tax from being avoided by multinational corporations.

- The Observer: NHS chiefs in standoff with Treasury over emergency £10bn

- The GRI Tax Standard was developed in consultation with businesses, investors, civil society groups, labour organisations. Read more about the standard here.

- More information about the GRI available here.

- In Apple’s victory lies a defeat for women’s rights

- UK u-turns on commitment to tax transparency, giving up £10 billion in corporate tax

- When the factory gates are bolted shut, women need country by country reporting