Date: 2024-08-16 Page is: DBtxt003.php txt00020807

Investment

NYSE

INVESTMENT ... After last week's Friday slump spilled over into a Monday sell-off, investors would have been justified about what was next for stocks.

Peter Burgess

INVESTMENT ... After last week's Friday slump spilled over into a Monday sell-off, investors would have been justified about what was next for stocks.

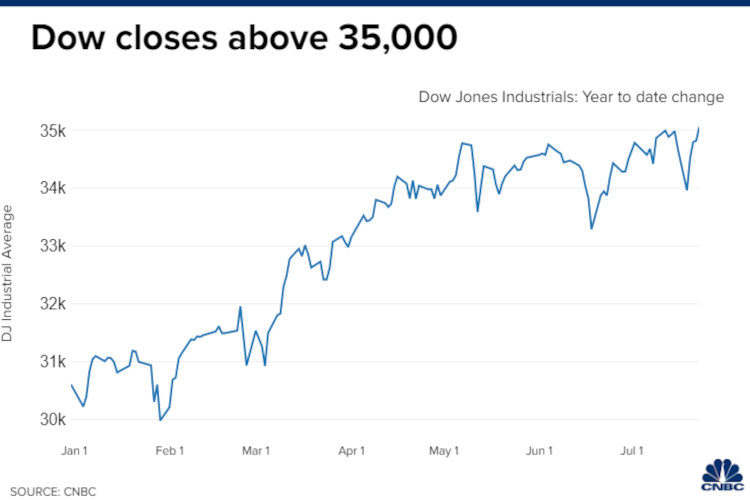

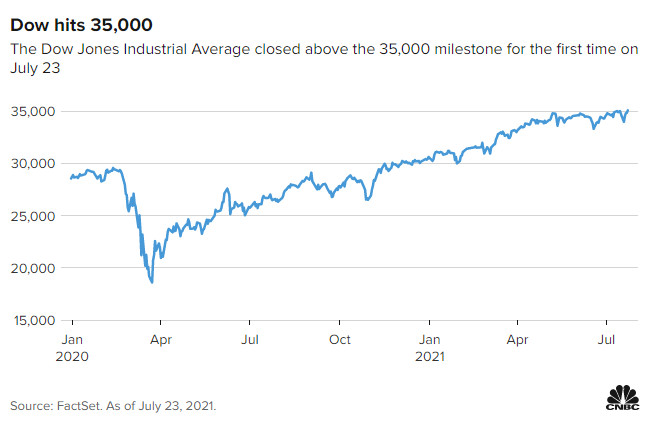

But Tuesday was a different day, as the market quickly regained much of its losses and then continued to churn higher throughout the week. On Friday, the Dow Jones Industrial Average closed above 35,000 for the first time, and all three major indexes closed at records.

This quick recovery doesn't mean volatility is in the rearview mirror for investors, but the underlying trends still look strong in the back half of 2021, according to Edward Moya, senior market analyst at Oanda.

'The growth story is still there for the third and fourth quarter, and while Wall Street could see a sell-off once we get beyond peak everything (stimulus, earnings, and growth), the S&P 500 index is still likely to finish the year much higher once the dust settles,' Moya said in a note to clients.

The S&P 500 closed on Friday up 1.01% and 4,411.79. The Dow rose 238.20 points to close at 35,061.55, while the Nasdaq added 1.04% to finish at 14,836.99.

Looking ahead, earnings reports from major companies including Apple and Amazon will likely drive the market next week, as well as the Federal Reserve's July policy meeting. Another potential story is the debt ceiling, which Treasury Secretary Janet Yellen is pushing for Congress to raise in early August.

Jesse Pound | CNBC Markets Reporter @jesserpound

TOP NEWS

Dow jumps more than 200 points to close above 35,000 for the first time ever

Dow jumps more than 200 points to close above 35,000 for the first time ever

PUBLISHED THU, JUL 22 20216:02 PM EDT ... UPDATED FRI, JUL 23 20218:08 PM EDT Tanaya Macheel @TANAYAMAC Hannah Miao @HANNAHMIAO_ DOW -0.02 (-0.03%) After Hours WATCH NOW VIDEO01:12

Barrage of Big Tech earnings to come out next week

U.S. equities rose Friday with the the major averages hitting new records as they overcame concerns about economic growth from earlier in the week.

The Dow closed above 35,000 for the first time ever, bringing its gain for 2021 to more than 14%.The blue chip average rose 238.20 points, or 0.68%, to 35,061.55, gaining for a fourth straight day. It made the 1,000-point trek rather quickly, having closed above 34,000 for the first time ever back in mid-April.

The S&P 500 gained 1.01% to 4,411.79 and the Nasdaq Composite climbed 1.04% to 14,836.99, both new closing highs for the benchmarks.

The 10-year Treasury yield bounced on Friday to 1.281%, easing concerns about the economy that the bond market triggered on Monday. The 10-year yield fell to a 5-month low of 1.13% earlier this week.

“The bond market has surprised everybody,” said Nick Frelinghuysen, a portfolio manager at Chilton Trust. “The strength of the rally is telling the equity market that what’s happening with inflation is probably an overshoot, that a lot of these things are not endemic and they’re not going to be things that we’ll have to live with like we did in the ’70s and ’80s.”

Strong earnings from tech stocks made investors optimistic ahead of reports next week from the biggest names in the sector. Twitter and Snap each jumped Thursday following better-than-expected second-quarter earnings reports. Twitter traded 3% higher, while Snap shot up 24%.

“The Snap and Twitter results are just a reflection that digital advertising spend is coming back with a vengeance,” Frelinghuysen said. “You’re seeing that ripple through into Google and Facebook.”

Facebook gained more than 5% on the results from its social media competitors. Alphabet added 3%. Both report next week along with Apple, Microsoft and Amazon.

All three U.S. stock averages closed the week in the green, rebounding from last week’s losses and Monday’s sharp sell-off. The Dow dropped more than 700 points to start the week as yields fell, unnerving equity investors about the economy.

The S&P 500 rose 2% for the week and the Nasdaq Composite added 2.8%. The Dow ended the week up 1%.

Strength in tech shares also comes with the continued spread of the highly contagious delta variant of Covid.

“We saw during the depths of the pandemic that tech stocks and their earnings held up the best, so I think a lot of investors are going back to the well, given we have a Covid resurgence,” Yung-Yu Ma, chief investment strategist at BMO Wealth Management, said. “Long term interest rates coming down as much as they have also makes those stocks more attractive.”

The stock market overall has been bolstered by a strong earnings reporting season, with nearly a quarter of the S&P 500 having already reported. Of those companies, 88% have reported a positive surprise, according to FactSet. That would mark the highest percentage of reported surprises within the S&P since 2008 if that figure holds throughout the earnings season.

Profit growth for the second quarter is expected to come in at 76%, according to Refinitiv, which would be the best growth since 2009. Profit margins have also held up in the face of rising inflation, with companies reporting average profit margins of 12.8% so far for the second quarter, above the historic range, according to S&P Global.

American Express reported better than expected quarterly results Friday morning, giving its shares a 1.3% boost.

TRENDING NOW

JJ and Rudy Jimenez are the co-owners of Enchilositos Treats. These siblings bring in $105,000 a year making sweet and spicy Mexican-American chilito candy

People receive a dose of the Pfizer-BioNTech Covid-19 vaccine inside a Covid-19 mass vaccination center at Rabin Square in Tel Aviv, Israel, on Monday, Jan. 4, 2020. Israel says Pfizer shot is just 39% effective as delta spreads, but still prevents severe illness A dietitian shares the ‘power nutrient’ she eats for a longer life—that most Americans don’t get enough of Another 2.2 million stimulus checks have gone out. Here’s who received the payments