Date: 2025-04-03 Page is: DBtxt003.php txt00021215

Transport

Ocean Shipping

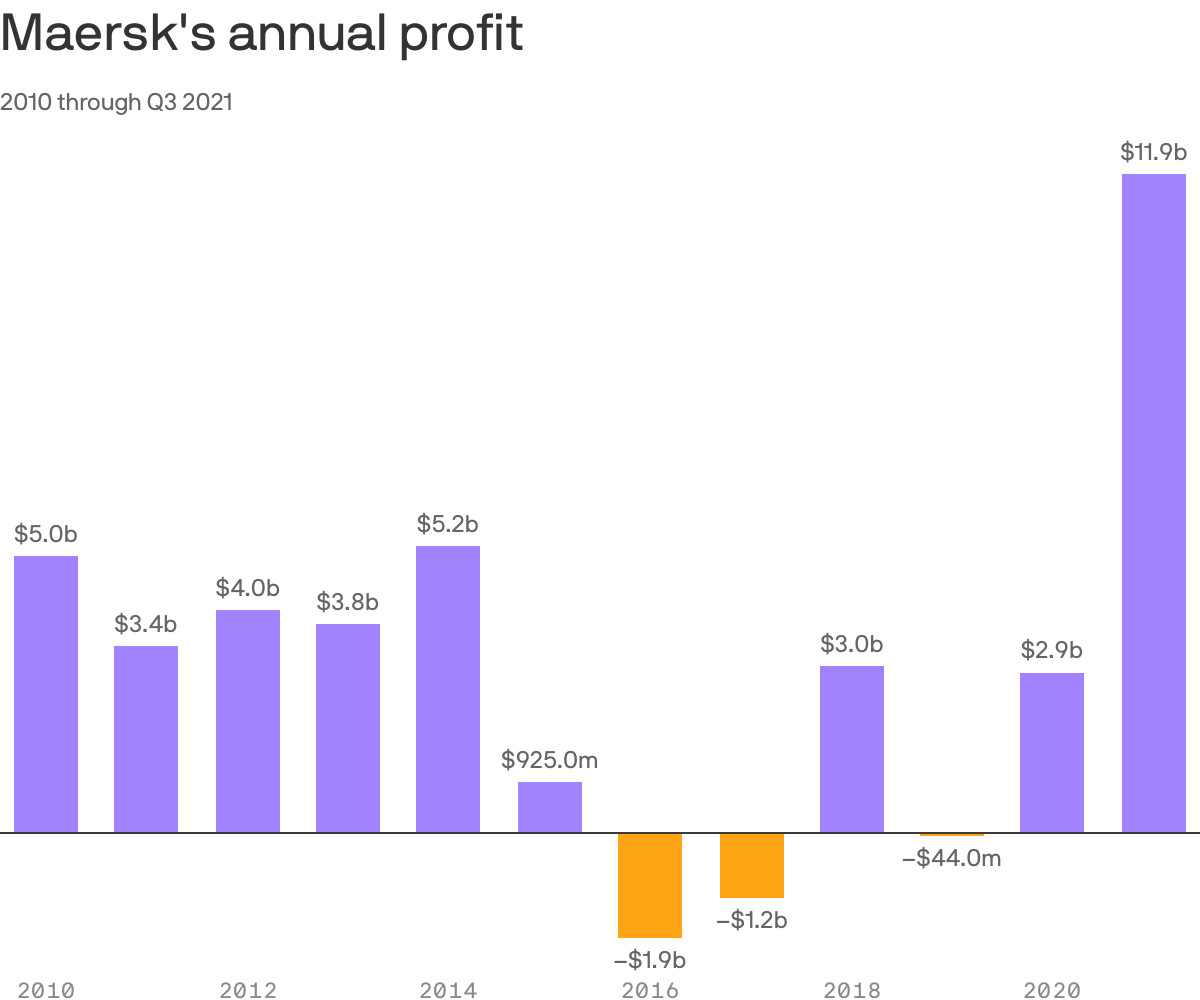

Global shipping cashes in on pandemic demand ... Few have benefited from the tangled supply chain like Maersk, the globe's biggest shipping company

Data: FactSet and company filings; Chart: Sara Wise/Axios

Illustration of shipping containers arranged like a bar graph. Brendan Lynch/Axios

Original article:

Burgess COMMENTARY

Peter Burgess

May 5, 2021 - Economy & Business

Hope King

Consumer demand for goods grew voraciously during the pandemic, providing the perfect springboard for shippers.

Why it matters: The pandemic impacted services and goods economies disproportionately, and the recovery looks to be just about as uneven.

Driving the news: Global shipping and logistics giant Maersk on Wednesday reported record profit for the first quarter with no slowdown in sight.

Net income reached $2.7 billion, or 91% of Maersk’s entire 2020 net income.

“Maersk now expects these extraordinary conditions to last well into [the fourth quarter],” David Kerstens, with Jefferies’ research, tells Axios.

What they're saying: 'Consumer spending on goods surged during lockdown, for example, related to home office equipment and furniture, laptops for the kids to facilitate home schooling, increased spending on DIY, [and] gardening equipment,' Kerstens says.

'[Meanwhile,] demand for services fell, as restaurants were closed and foreign holidays banned.'

The big picture: Lockdowns led to services shutdowns — pushing income (fueled by stimulus and savings) into goods. That fueled unprecedented demand, exacerbating supply chain bottlenecks, pushing up transport prices and driving extraordinary results for cargo movers.

Evergreen Marine Corp, the company that operates the Ever Given, saw record sales in the first part of the year with $3.2 billion in revenue, more than double the prior year.

German shipping company Hapag-Lloyd saw its 2020 net profit grow more than 150% to $1.1 billion and will report first quarter earnings next week.

The demand spike also led to a global container shortage that is expected to persist through next year, which means companies that make or lease containers to shipping lines are also benefiting. Soren-Skou-CEO-Maersk-21215-a.jpg

State of play: Maersk CEO Soren Skou told investors that its customers (retailers, car makers, etc.) are simultaneously trying to 'cater to strong basic demand because of all of the stimulus packages and the savings that were going up over the last year and are now being consumed, and at the same time, replenish inventories that are too low.'

“That is driving very, very strong demand to the point where the ports are really not able to meet all the demand and we get bottlenecks.”

What to watch: Customer inventories are “too low” and order backlogs are continuing at record-highs as of April, according to the Institute for Supply Management.

Respondents to ISM's monthly survey noted that they have never seen anything like these extended lead times and rising prices in 35 years, that market capacity is oversold, and that demand will continue to strengthen, leading to more disruptions.

If more savings from stimulus checks turn into disposable income, retailers may find it opportune to play with prices, passing on higher shipping and logistics costs.

----------------------------------------

Few have benefited from the tangled supply chain like Maersk, the globe's biggest shipping company, writes Axios' Courtenay Brown.

The company operates 20% of the world's shipping containers, per the BBC — rates for which have skyrocketed.

The bottom line: Profits are already over four times (!!) higher than 2020, the company reported this week — and this year isn’t over yet.

Maersk will expand air freight operations as companies turn to the sky as a way to get their goods.