Date: 2024-12-26 Page is: DBtxt003.php txt00021337

Finance

Development Finance

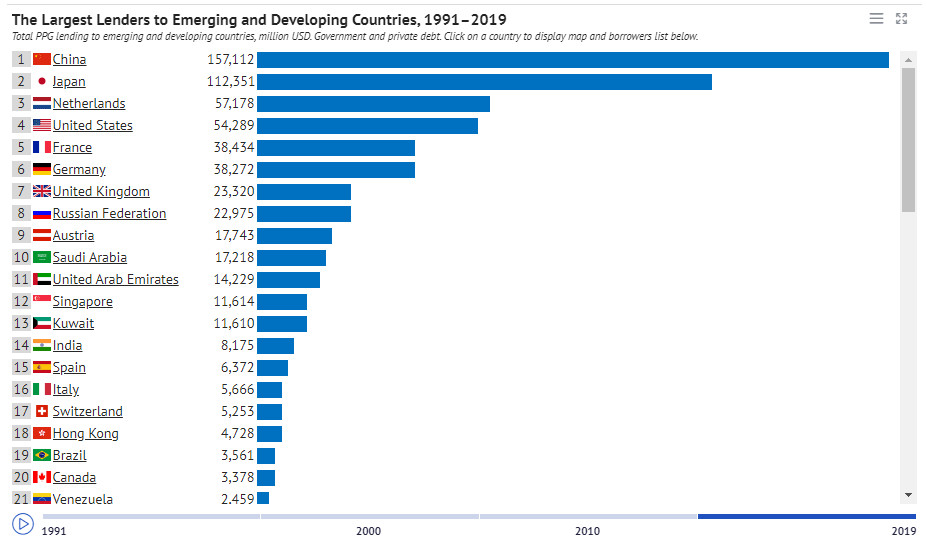

Knoema ... China Has Become the Developing World's Largest Creditor

Original article: https://knoema.com/infographics/vsnfkkg/china-has-become-the-developing-world-s-largest-creditor

Burgess COMMENTARY

In my view the USA and more broadly the free world in the West has made a huge strategic mistake that goes back to the 1980s.

The USA has spent aggresively to build up a massive military establishment. One is reminded of the French and their investment in the Maginot Line prior to WWII that proved so ineffective when a real war happened.

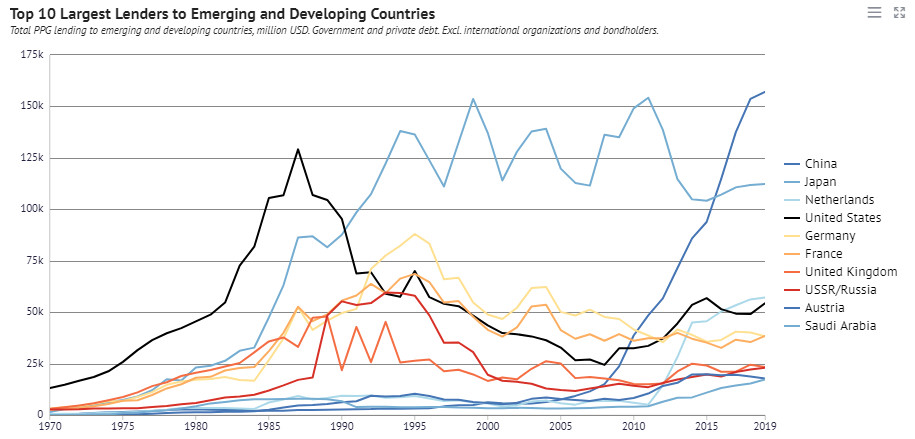

Meanwhile, the USA has reduced its financing to LDCs dramatically since the 1980s.

Japan became a big players in global finance for LDCs in the 1990s and remains an important player.

Countries in the West like Germany, France and the UK have reduced their reported financing to Less Developed Countries (LDCs) by substantial amounts since the 1990s, as has Russia. It is unclear how much unreported financing is taking place. It might be quite significant, but it might not.

The biggest change is that since around 2008, the increase in LDC financing originating in China has been huge and China has become the largest source of finance for LDCs in every part of the world. China may have rather modest military reach compared to the USA and its allies, but in terms of finance, China dominates at this point in time. This is massively underreported in the Western media but could well be one of the biggest weaknesses that the West needs to face.

Most of my international work was done in the 1970s. 1980s and 1990s. In the 1970s many countries were in the early days of post-colonial independence and development assistance was an important component of international policy. Looking back at that time, I am struck by the amount of waste and ineffective policy dialog that only seemed to get worse over time. I did some work for the World Bank in 1978 and at that time there were a large number of former colonial officers in their employ who had relevant experience around the world. This knowledge base declined over time and was replaced by a much more academic staff with much less appreciation of the practical difficulties of sustainable development.

China had not been a colonial power in much of the world, but they were already establishing a presence in many countries around the world during the 1980s and 90s. I visited many Chinese embassies in connection with UN work with refugees and was struck by the willingness of the Chinese to give assistance to modest but impactful projects to help refugees. This was in stark contrast to the lack of cooperation that was the norm in US embassies where local circumstances did not seem to matter very much and everything seemed to have to be 'cleared' by Washington.

Peter Burgess

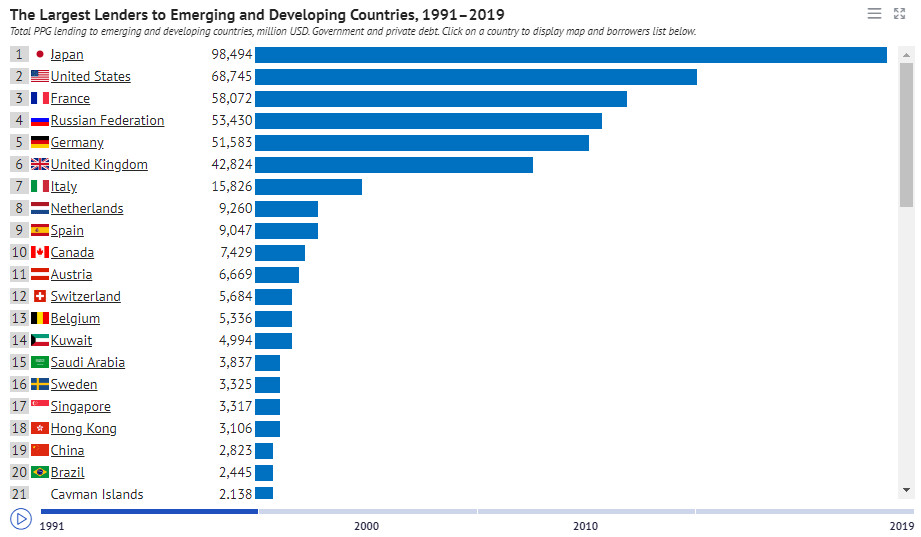

Largest Lenders to LDCs in 1991

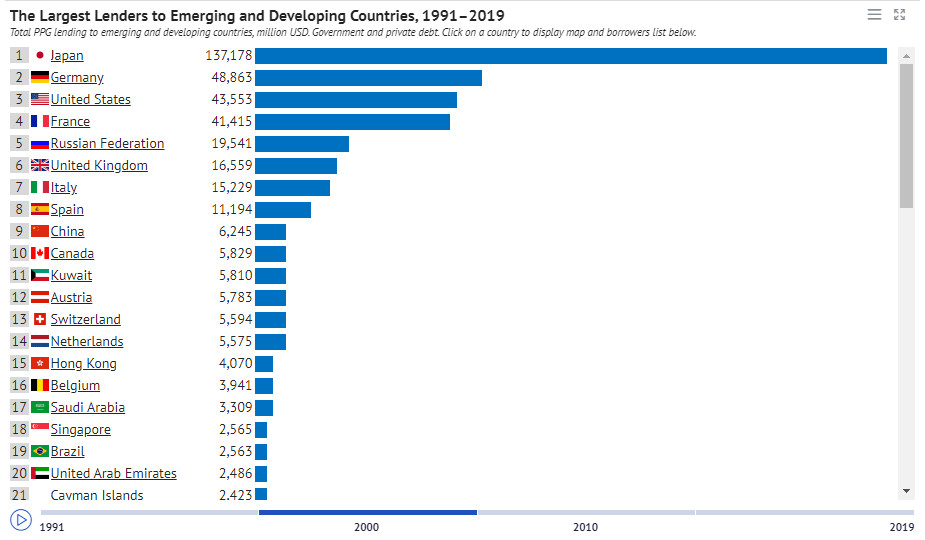

Largest Lenders to LDCs in 2000

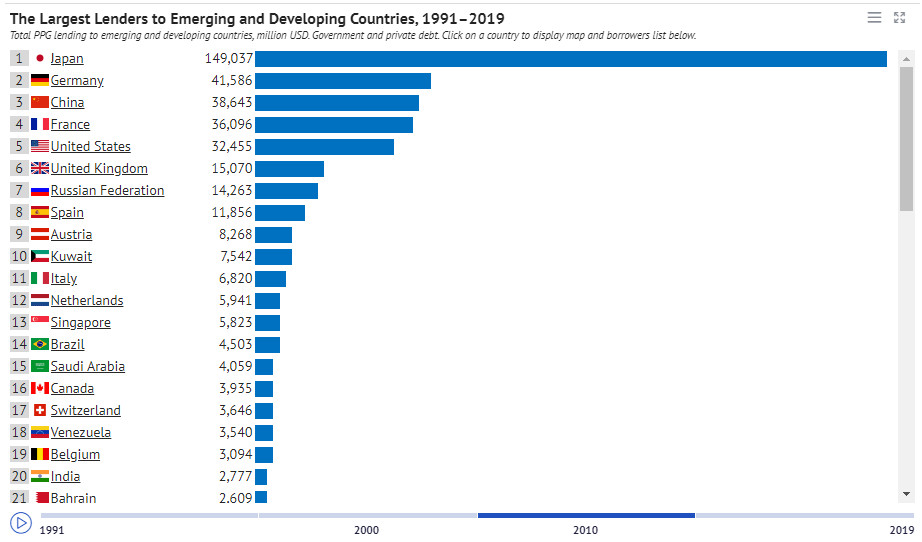

Largest Lenders to LDCs in 2010

Largest Lenders to LDCs in 2019

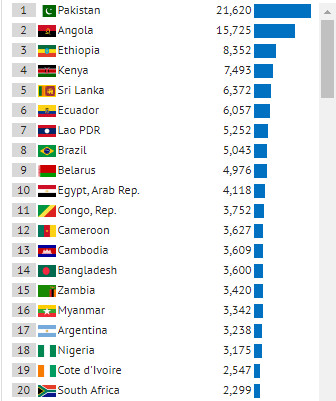

China: Top Borrowers , 2010–2019

|

|

|

|

| ||

China Has Become the Developing World's Largest Creditor

Published: Tuesday, November 16, 2021

As a part its 2021 International Debt Statistics Report, the World Bank has published data on the external debt of emerging and developing countries, broken down by creditors. This data not only reveals countries — the largest single creditors — but can also be used to estimate the financial power of particular creditors within a specific debtor economy. Detailed external debt data from the World Bank is now available from Knoema.

The World Bank data shows that since the 2008 global financial crisis China has dramatically increased lending to foreign countries. The total public and publicly guaranteed (PPG) external debt stock of emerging and developing countries that is owed to China increased from $11 billion in 2007 to $157 billion in 2019.

Thirty-nine countries owe China over $1 billion. Pakistan, Angola, Ethiopia, Kenya and Sri Lanka have the largest debt to China.

The graphs below explore the top lenders to emerging and developing economies, dig into the lending geography and totals of the major creditor countries, and provide detailed profiles of debtor countries. Choose a nation in the drop-down menu below to view country details at the bottom of this page.

Definition: 'External debt stock' is the amount of a country's debt borrowed from public or private foreign lenders.

Source: The World Bank data was retrieved from WB IDS API and assembled by David Mihalyi and Balint Parragi.