Date: 2026-03-06 Page is: DBtxt003.php txt00021639

ECONOMICS

WEALTH AND INCOME

Wonking Out: Are Billionaires Making Out Like Bandits? ... by Paul Krugman, NYT Opinion Columnist

WEALTH AND INCOME

Wonking Out: Are Billionaires Making Out Like Bandits? ... by Paul Krugman, NYT Opinion Columnist

Photo from Larry Fink

Original article: https://messaging-custom-newsletters.nytimes.com/template/oakv2

Original article: https://www.nytimes.com/2022/02/04/opinion/income-wealth-inequality-pandemic.html

Burgess COMMENTARY

This is not a particularly serious analysis given the importance of the topic. Yes ... the top part of the economy has been increasing its wealth at record rates, while 'essential workers' go about their 'essential' work in ways that put them at health risk and without any significant incremental wage reward. More than anything the analysis should be addressing the ongoing chronic dysfunction that is being ignored by most of those with a platform to talk about it, or more important, to do something about it.

I am appalled at the conversation that is going on about inflation and the way both academic economists, media reporters and political hacks are bending the story to suit their points of view. Mostly I get annoyed by the general failure to go back to the inflation of the 1970s which was in many ways the beginning of the end of US industrial power. As soon as OPEC and not Texas started to dominate global pricing for crude oil, the USA lost much of its competitive edge and it was not until the 1980s that product cost reduction was accomplished by massive outsourcing of production to low wage countries mostly at the expense of American workers.

Talk about inflation in the modern world of very sloppy data analysis and very rapid dissemination of news stories is setting the stage for price gouging and enabling more profit on top of already substantial profits ... at the expense of people who work, get rather mundane wages and consume rather high priced products.

Peter Burgess

By Paul Krugman ... NYT Opinion Columnist

February 4, 2022 ... 1:03 p.m. ET

Did you hear about Jeff Bezos and the bridge? The Amazon billionaire’s new superyacht, under construction in Rotterdam, the Netherlands, is so big that the city might have to partially take down a historic bridge so that it can reach open water. The story has quickly become a metaphor for soaring inequality, and it feeds the perception that billionaires have done very well during the Covid-19 pandemic while ordinary people have suffered.

But is this perception accurate? It’s actually a bit complicated. Obviously we don’t need to shed any tears for Bezos; and who among us is immune to schadenfreude over Mark Zuckerberg’s recent losses? Furthermore, I still believe that substantial increases in taxes on the rich would be a very good idea.

When you ask how different groups have done during the pandemic, however, it’s important to distinguish between wealth — which is strongly affected by, among other things, fluctuations in the stock market — and income. I’ve written about this before but can now say quite a bit more thanks to a terrific new statistical tool — Realtime Inequality — developed by economists at Berkeley. It lets us track changes in the distribution of both wealth and income in, well, real time, and it’s hugely illuminating.

Let’s start by talking about wealth.

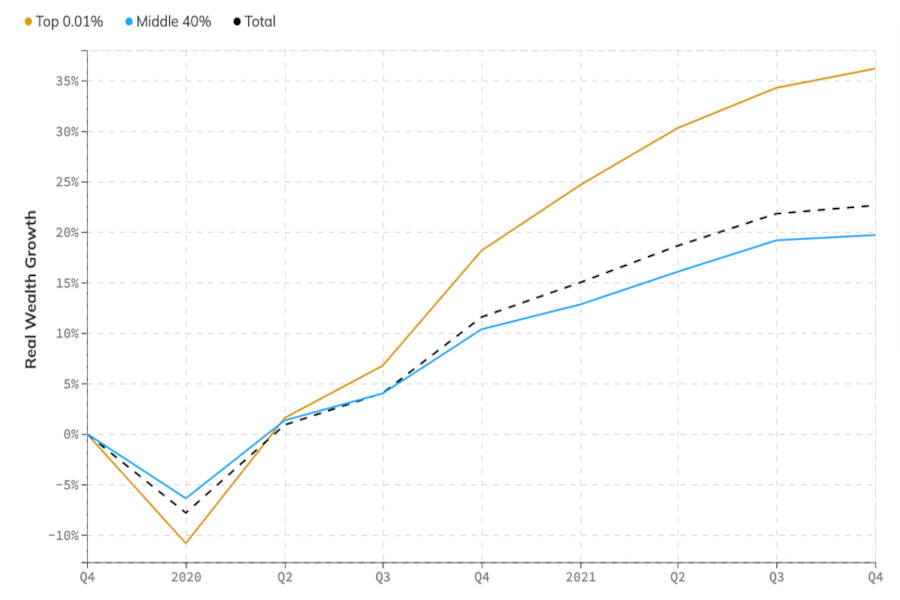

The rich have, in fact, gotten considerably richer over the past two years; so, actually, have most Americans, but the gains have been especially big at the top:

Yes, the rich have gotten richer …Realtime Inequality

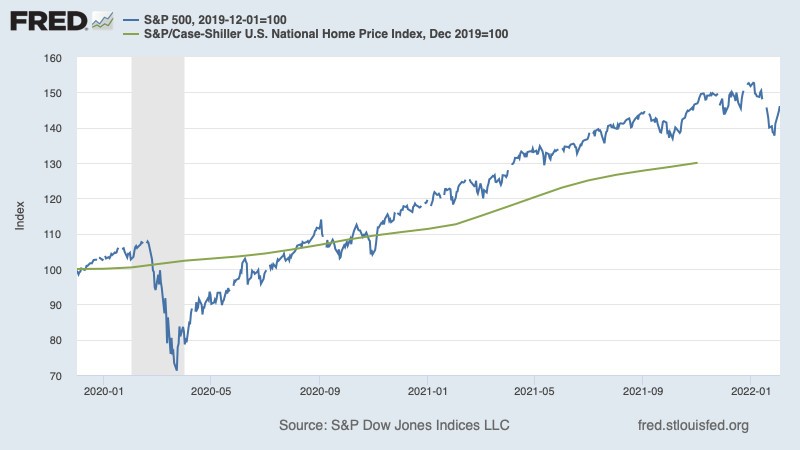

Underlying these gains have been rising asset prices. Faster growth at the top probably reflects especially large gains in the stock market; stocks are held disproportionately by the wealthy, while much middle-class wealth is in housing:

… mostly thanks to the stock market.FRED

But here’s the thing about asset prices: While they’re driven in part by the income people receive from the assets they own — dividends, rent and so on — they’re also affected by the returns investors expect on alternatives. As I tried to explain in a newsletter a few months ago, a lot of the rise in asset prices actually reflects bad news, a decline in the expected rate of return on new investments.

And if, say, the value of your stocks has gone up because of low interest rates, but the dividends you receive have stagnated or gone down, have you really come out ahead? It’s not that easy of a question to answer.

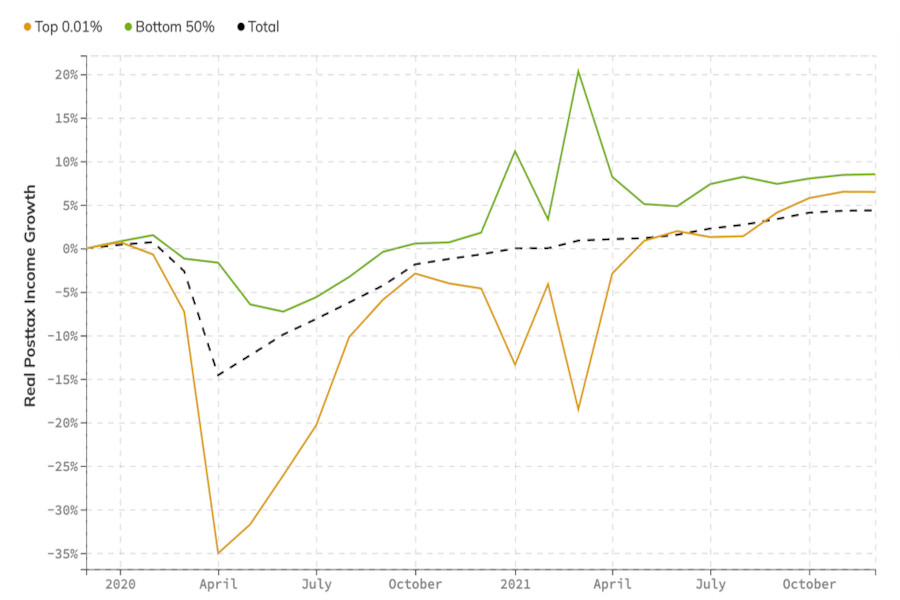

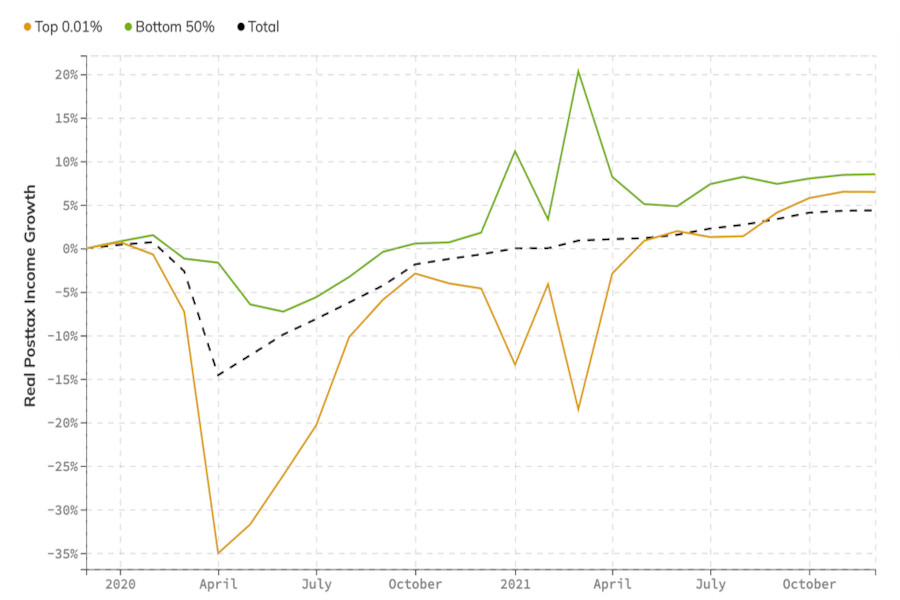

So what has been happening to the income of the very wealthy? It’s up, but not nearly as much as their wealth — and in fact, their gains have lagged behind those of the bottom half of the population:

But the big income gains have been at the bottom.

Real Time Inequality

Real Time Inequality

Why have lower-income Americans seen relatively large income gains? (from a low base — we’re still an incredibly unequal society). Part of the answer is government aid during the pandemic: You can see that the spikes in income when stimulus checks went out and from other programs like the expanded child tax credit — which I still hope can be brought back — made a big difference.

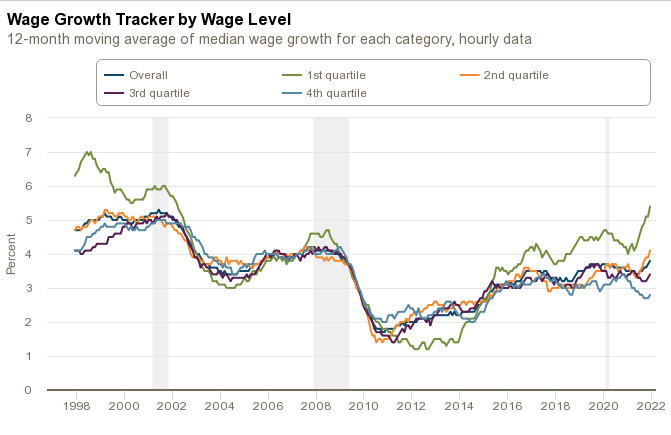

But that’s not the whole story. Lately we’ve been experiencing a tight labor market, which has led to rising wages — with wages increasing much faster for lower-paid workers:

Full employment is good for low-paid workers.Federal Reserve Bank of Atlanta

Yes, inflation has eroded these gains in real terms, although gains for workers at the bottom appear to have outpaced price increases. The point for now, however, is that a tight labor market seems to be reducing pay inequality.

So the simple story that the pandemic has been great for the wealthy and bad for the working class doesn’t hold up. There are, of course, other ways in which the pandemic has had a hugely unequal impact; the past two years have been very different for those Americans — mostly highly educated and well paid — who could work from home than for those who couldn’t. But that’s another story.

Is there a policy moral in all this? It’s pretty much a given that the Federal Reserve will be raising interest rates in the months ahead, in an effort to cool inflation. And it will be right to do so. Some people will, however, also be cheering on interest hikes because they tend to reduce stock prices, which makes the wealthy less wealthy — and this, they imagine, reduces economic inequality.

Well, that’s a bad take, confusing wealth and income inequality. And if you care about the incomes of working-class Americans, you should want the Fed to be cautious about rate hikes, lest they hurt the job market. Full employment, it turns out, is a very good thing for less-well-paid workers, and we don’t want to endanger that good thing merely because we’d like to reduce the paper wealth of billionaires.

------------------------------------------------------------------

------------------------------------------------------------------

--------------------------------------

Christian López commented 3 minutes ago C Christian López Ciudad de México 3m ago It's a good analysis Paul. I think that this is the question for all de economist the distribution have to be equal for all the people. I will like a colaboration with Thomas Piketty I read something about this in his books. ReplyRecommendShareFlag

--------------------------------------

MikeH commented 4 minutes ago M MikeH Upstate NY 4m ago I'm not so sure there is such a clear distinction between wealth and income. After all, wealth can be converted to income at any time by selling some of those appreciated assets. It's much harder to convert income to wealth when most of that income is needed just to live on. ReplyRecommendShareFlag

--------------------------------------

Steve Stern commented 4 minutes ago S Steve Stern Jacksonville, Florida 4m ago It seems to me this analysis may be flawed in that it does not take into account the differential between income and capital gains taxes. It's far cheaper to see long-term assets to fund discretionary spending than it is to have to make those same purchases out of earned income. ReplyRecommendShareFlag

--------------------------------------

Some Idea commented 6 minutes ago S Some Idea US 6m ago I'm hoping for two effects from the raise in interest rates: 1) A rise in mortgage rates to deflate the housing bubble, and 2) To stop the fed from purchasing corporate bonds of their choosing. I don't care about the stock market, nor do I want to 'stick it to the rich'. I just don't want a housing bubble to impoverish young adults before they can get started in life. ReplyRecommendShareFlag

--------------------------------------

Guynemer Giguere commented 11 minutes ago G Guynemer Giguere Los Angeles 11m ago Many economists, like Thomas Piketty and Robert Reich, have sounded the alarm on the consequences of increasing wealth and income inequality. Perhaps even more dangerous is the concentration of power in high tech behemoths like Amazon and Facebook, who wield financial dominance greater than that of many countries—and yet are not really dedicated to the common good while at the same time having great influence on political power. Who controls the controllers? And in whose interest? Not the people. Reply1 RecommendShareFlag

--------------------------------------

Stuart Levine commented 12 minutes ago S Stuart Levine Baltimore, Maryland 12m ago All this is true, however, over the past 30 years or so the fraction of this country's wealth held by the upper 1 and 10% has grown dramatically over the fraction held by the lower 90%. (I have a chart from FRED that shows that the lower 90% share has dropped by about 25-33%, while the share of the upper 1% has grown by roughly that amount, but I don't think the rules of the NYT's comment section allows me to post that chart or a link to the chart.) ReplyRecommendShareFlag

--------------------------------------

Cris Perdue commented 12 minutes ago C Cris Perdue Silicon Valley, CA 12m ago But wait, for those 'very wealthy' whose income has not gone up as much as their wealth, I have a genius idea. Sell 'just a little bit' of that wealth to help the income side. Let's see, if you are worth $100 billion and you sell, say, 1%, that's around a billion dollars of, well, capital gains. Yes, that should help. I must call Jeff Bezos right away and let him know. Of course then he would have to pay tax on that billion. So if he doesn't need the extra income perhaps he should just hold onto the assets. Maybe he will remember me in his will. ReplyRecommendShareFlag

--------------------------------------

1 REPLY Larry Figdill commented 10 minutes ago L Larry Figdill Seattle 10m ago @Cris Perdue Yes, one cannot ignore the fact that wealth is potential income. And it's hard to even understand what 'income' means for the top .01% as analyzed here - their incomes are probably whatever they want them to be due to this potential. ReplyRecommendShareFlag

--------------------------------------

Jeff Sallot commented 18 minutes ago J Jeff Sallot Ottawa, Canada 18m ago Very interesting analysis. What happens if you run the numbers without the tax cuts introduced by the Trump administration? Does the analysis change much? And can you project out what the numbers would show over two years or so if Biden is able to fully implement his tax plans? ReplyRecommendShareFlag

--------------------------------------

Tom Victory commented 19 minutes ago T Tom Victory North Palm Beach, FL 19m ago Any tax increase should be with the Estate Tax. Bezos' wealth is due to the run-up in the value of AMZN, caused by others trying to buy into a good thing. Bezos has built a better mousetrap, but there's no good reason that his great grandchildren should be billionaires before they are born. Reply4 RecommendShareFlag

--------------------------------------

alix commented 22 minutes ago A alix portland or 22m ago Growth on a small income, is still a small number even if the percentage comparison looks good. Reply5 RecommendShareFlag

--------------------------------------

A. Stanton commented 26 minutes ago A. Stanton A. Stanton Dallas, TX 26m ago I number among my nodding acquaintances one multi-billionaire (real estate and shopping centers) and at least six multi-millionaires (law and medicine primarily). These five men and two women will tell you that on an any given day they hardly have a clue as to what their net worth will be on the very next day. Their money is primarily kept in real estate and the stock market. Up a few hundred thousand dollars one day, down by a million or more the next day. Not a bad way to live, when you consider the millions of Americans who live their lives with virtually nothing; and still do even after Trump’s bogus promises of tax relief were widely understood by the American people to have been the sham they were and still are. The complexities of our current tax system encourage massive cheating and conniving by rich people on a scale that severely compromises the nation’s ability to attend to its most urgent social and environmental problems. I say let’s make a law that says enough is enough and that people with net worths over 100 million dollars will be subject to tax rates that will keep those net worths essentially locked in where they are now, in combination with scrupulous annual tax audits that will prevent them from further robbing the country blind. Reply14 RecommendShareFlag

--------------------------------------

Jp commented 29 minutes ago J Jp Ml 29m ago What happened to the sights that were set on the one-percenters? Remember the 99% movement? It looks like it's easier to hate on Bezos and Musk than it is all those physicians. Reply1 RecommendShareFlag

--------------------------------------

BillSwan commented 35 minutes ago BillSwan BillSwan Seattle 35m ago Would it be an idea to put income, wealth, and capital gains in inflation-adjusted terms? ReplyRecommendShareFlag

--------------------------------------

1 REPLY Jack Toner commented 22 minutes ago J Jack Toner Oakland CA 22m ago @BillSwan Yes. But not a new idea. Professor K does it all the time. Pay more attention! Reply2 RecommendShareFlag

--------------------------------------

Eric Harold commented 38 minutes ago E Eric Harold Alexandria VA 38m ago Here is one answer to “ if, say, the value of your stocks has gone up because of low interest rates, but the dividends you receive have stagnated or gone down, have you really come out ahead? It’s not that easy of a question to answer.” I chose stocks based on the amount of cash paid by the dividend, not the yield. Since retirement in 2017 the value of my portfolio has gyrated greatly but the total portfolio dollar value of the dividends has albeit slowly increased. So for my objective- steady perhaps slow dividend growth- I am, at least today, ahead. (PS. Love the column.) Reply4 RecommendShareFlag

--------------------------------------

Curmudgeon51 commented 39 minutes ago C Curmudgeon51 Sacramento/L.A. 39m ago The company building the yacht for Jeff Bezos should NOT have accepted the order if the company knew in advance that the bridge would be a problem getting the ship out to the open ocean. An alternative would be to have the boat stay in the dry dock and become an Airbnb. Bezos might actually like that idea and make tons more money, as if he needs any more.

The New York Times Company. 620 Eighth Avenue New York, NY 10018