Date: 2024-09-27 Page is: DBtxt003.php txt00021847

RUSSIA - UKRAINE WAR

THE ENERGY SECTOR

Why the Toughest Sanctions on Russia Are the Hardest for Europe to Wield ... Moscow relies on the money it makes by selling oil and gas, but that energy fuels Europe’s economy and heats its homes.

THE ENERGY SECTOR

Why the Toughest Sanctions on Russia Are the Hardest for Europe to Wield ... Moscow relies on the money it makes by selling oil and gas, but that energy fuels Europe’s economy and heats its homes.

Original article: https://www.nytimes.com/2022/02/25/business/economy/russia-europe-sanctions-gas-oil.html

Burgess COMMENTARY

Sanctions are a very blunt and clumsy instrument with all sorts of unintended consequences. They are especially difficult to use in the modern interconnected world where almost all international trade has been optimized for financial return and all sorts of risks ignored to the maximum extent possible.

There is one possible silver lining and that is that local small scale solar and wind power systems become much more attractive than they have been in the much more fragile totally financialized world of right now!

Peter Burgess

Moscow relies on the money it makes by selling oil and gas, but that energy fuels Europe’s economy and heats its homes.

The Luhansk power station in Shchastia in eastern Ukraine was heavily bombed on Tuesday.Credit...Tyler Hicks/The New York Times

Written by Patricia Cohen and Stanley Reed

February 25th, 2022

The punishing sanctions that the United States and European Union have so far announced against Russia for its invasion of Ukraine include shutting the government and banks out of global financial markets, restricting technology exports and freezing assets of influential Russians. Noticeably missing from that list is the one reprisal that would cause Russia the most pain: choking off the export of Russian fuel.

The omission is not surprising. In recent years, the European Union has received nearly 40 percent of its gas and more than a quarter of its oil from Russia. That energy heats Europe’s homes, powers its factories and fuels its vehicles, while pumping enormous sums of money into the Russian economy.

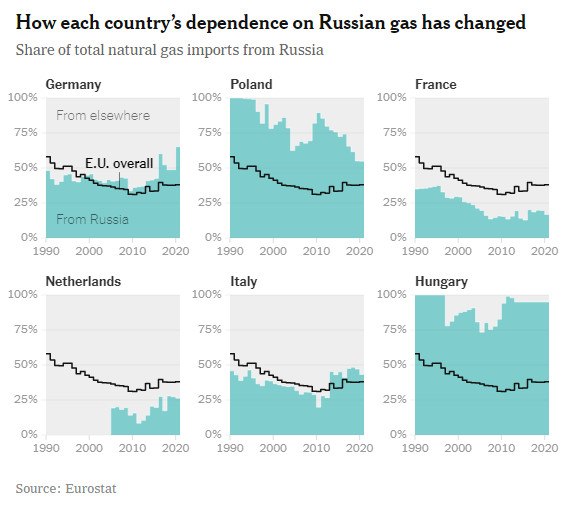

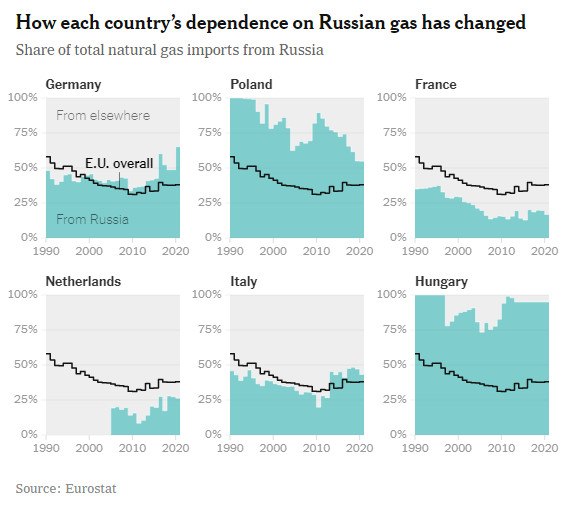

How each country’s dependence on Russian gas has changed

Share of total natural gas imports from Russia ... Source: Eurostat

Losing out on those revenues would be hard for Russia, which relies heavily on energy exports to finance its government operations and support its economy. Oil and gas exports provide more than a third of the national budget. But a cutoff would hurt Europe as well.

“You want the sanctions to hurt the perpetrator more than the victim,” said David L. Goldwyn, who served as a State Department special envoy on energy in the Obama administration.

The situation would surprise some of last century’s cold warriors. Throughout most of the post-World War II era of superpower confrontation, many analysts believed that the more economically intertwined the Soviet Union and the West became, the less likely it was that conflicts would arise. Trade and economic self-interest would ultimately make allies out of everybody, the argument went.

Now, the European Union is Russia’s largest trading partner, accounting for 37 percent of its global trade in 2020. About 70 percent of Russian gas exports and half of its oil exports go to Europe.

The flip side of mutual interest is mutual pain.

European leaders are caught between wanting to punish Russia for its aggression and to protect their own economies.

The Nord Stream 2 gas receiving station on Germany’s Baltic coast on Wednesday.Credit...Abdulhamid Hosbas/Anadolu Agency via Getty Images

So far, Germany’s decision on Tuesday to halt Nord Stream 2 — the completed gas pipeline that directly links Russia and northeastern Germany — is among the most consequential that Europe has taken, said Mathieu Savary, chief European investment strategist at BCA Research.

As for the gas that is already flowing to Europe, Western leaders are reluctant to reduce it further given that during the last three months of 2021, Russia shrank its pipeline exports by close to 25 percent compared with a year earlier, according to the International Energy Agency. Europe’s reserves stand at just 30 percent, and Europeans are already paying exorbitant prices for energy.

Daily business updates The latest coverage of business, markets and the economy, sent by email each weekday. Get it sent to your inbox. The conflict is occurring when supplies of both oil and natural gas have been tight for months, driving up prices.

“There are serious concerns” that Moscow will tighten exports further and send prices higher, said Helima Croft, head of commodities at RBC Capital Markets, an investment bank.

Germany, Russia’s largest trading partner in Europe, gets 55 percent of its supply from Russia. Italy, the second-biggest trading partner, gets 41 percent. At a forum in Milan last week, the Russian ambassador Sergey Razov said President Vladimir V. Putin had told the Italian prime minister, Mario Draghi, that “if Italy needs more gas we are ready to supply it.”

Mr. Putin also made a point of saying that roughly 500 Italian businesses have operations in Russia and that bilateral investments are worth $8 billion.

Austria, Turkey and France are large consumers of Russian natural gas. In central and Eastern Europe, Hungary, Poland, the Czech Republic and Slovakia are the biggest customers, the Russian energy giant Gazprom said.

On Thursday, the International Energy Agency, which would probably coordinate any response to a global energy disruption, said the supplies of oil “most immediately at risk” were 250,000 barrels a day from Russia that move through Ukraine to Hungary, Slovakia and the Czech Republic. That amount is relatively small in a global market that consumes 100 million barrels a day, but its loss could create severe shortages in those countries.

How each country’s dependence on Russian oil has changed

Share of total crude oil imports from Russia

The West is not without tools. Mr. Goldwyn, the former State Department envoy, said Russia’s energy sales would still likely be hurt by sanctions on Russian financial institutions and other measures, even if oil and gas exports were not directly targeted.

The money that Russia makes from energy exports could also be reduced if shippers, wary of the growing complexity of transporting Russian crude and supplies, raise what they charge Moscow, Mr. Goldwyn said.

He added it was possible that the White House would ban imports of Russian crude to the United States. Such a move, experts said, would force American refiners to rely on other suppliers and Moscow to find other buyers for around 700,000 barrels a day. China would most likely be one, after the two countries pledged to “strongly support each other.”

A liquefied natural gas plant in Prigorodnoye, Russia, last year. Supplies of L.N.G. to Europe from Russia have recently been outpaced by other sources.Credit...Sergey Ponomarev for The New York Times

Eurasia Group, a political risk consultancy, pointed out in a note on Thursday that while the United States and Europe would try to avoid directly targeting Russian fuel exports, “the blizzard of new restrictions will force many traders to be exceedingly cautious in handling Russian barrels.”

Sanctions might also aim at blighting Russia’s future prospects. “If the U.S. targets energy, I expect it would be through technology controls that target future Russian liquefied natural gas and hydrogen,” said Scott Modell, managing director of Rapidan Energy Group, a consulting firm based in Washington.

If Russia cuts back on gas exports, Europe will try to make up the difference from already strained supplies kept in storage, and by scouring the world for more liquefied natural gas. Flows of L.N.G. from elsewhere, mostly the United States, have exceeded Russian gas volumes to Europe in recent weeks. Such measures would probably help Western European countries like Germany and Italy more than those in southern and Eastern Europe with fewer alternatives to Russian gas.

Even without a clear cutoff of fuel by Moscow or a disruption by war, there is a substantial risk that extraordinarily high gas and electricity prices will continue, squeezing hard-pressed consumers and, possibly, pushing more businesses to scale back their operations. In recent months, some energy-intensive businesses, including fertilizer makers, have announced closures because of high gas costs.

An oil refinery in eastern Ukraine last week.Credit...Lynsey Addario for The New York Times

Patricia Cohen is the Global Economics Correspondent based in London. Since joining The Times in 1997, she has also written about theater, books and ideas. She is the author of “In Our Prime: The Fascinating History and Promising Future of Middle Age.” @PatcohenNYT • Facebook

Stanley Reed has been writing from London for The Times since 2012 on energy, the environment and the Middle East. Prior to that he was London bureau chief for BusinessWeek magazine. @stanleyreed12 • Facebook

A version of this article appears in print on Feb. 25, 2022, Section B, Page 1 of the New York edition with the headline: Toughest Sanctions Are the Hardest For Europe to Wield. Order Reprints | Today’s Paper | Subscribe

----------------------------------------------------------

The Russia-Ukraine War and the Global Economy

- Rising concerns. Russia’s attack on Ukraine has started reverberating across the globe, adding to the stock market’s woes and spooking investors. The conflict could cause dizzying spikes in prices for energy and food, and severely affect various countries and industries.

- The cost of energy. Oil prices already are the highest since 2014, and they have jumped as the conflict has escalated. Russia is the third-largest producer of oil, providing roughly one of every 10 barrels the global economy consumes.

- Gas supplies. Europe gets nearly 40 percent of its natural gas from Russia, and it is likely to be walloped with higher heating bills. Natural gas reserves are running low, and European leaders have accused Russia’s president, Vladimir V. Putin, of reducing supplies to gain a political edge.

- Food prices. Russia is the world’s largest supplier of wheat and, together with Ukraine, accounts for nearly a quarter of total global exports. In countries like Egypt and Turkey, that flow of grain makes up more than 70 percent of wheat imports.

- Shortages of essential metals. The price of palladium, used in automotive exhaust systems and mobile phones, has been soaring amid fears that Russia, the world’s largest exporter of the metal, could be cut off from global markets. The price of nickel, another key Russian export, has also been rising.

- Financial turmoil. Global banks are bracing for the effects of sanctions intended to restrict Russia’s access to foreign capital and limit its ability to process payments in dollars, euros and other currencies crucial for trade. Banks are also on alert for retaliatory cyberattacks by Russia.

Editors’ Picks

- A First-Time Buyer Invested Her Savings in Brooklyn. Which Option Would You Choose?

- Alex Ovechkin Skates Into Canada’s Ukrainian Enclave as a Scorned Star

- LeBron Fandom, and the Making of a Friendship in ‘King James’