Date: 2025-02-05 Page is: DBtxt003.php txt00025765

HONG KONG

IPO FOR J&T GLOBAL EXPRESS

Hong Kong’s Second Biggest IPO of Year Seals Founder’s Fortune ... J&T Global Express shares trade near IPO price in debut ... Founder’s wealth stands at $1.5 billion after share sale

IPO FOR J&T GLOBAL EXPRESS

Hong Kong’s Second Biggest IPO of Year Seals Founder’s Fortune ... J&T Global Express shares trade near IPO price in debut ... Founder’s wealth stands at $1.5 billion after share sale

Original article: https://www.bloomberg.com/news/articles/2023-10-26/hong-kong-s-second-biggest-ipo-of-year-to-seal-founder-s-fortune

Peter Burgess COMMENTARY

This article reminds me of some of the time I spent in London in the 1960s. I was in my 20s and one of the things that I did was to organize an 'investment club' called the Fisrt Cambridge Investment Club (FCIC) which had a fairly strong financial performance during the two years of its life. At the time, I was also helping with the accounting for a very large investment club that was eventually 'reorganized' into one of the first 'Mutual Funds' in the UK.

The idea that the IPO in Hong Kong for J&T Global Express Ltd. can raise $500 million while being unprofitable in most of its markets should be something of a red flag ... but apparently not for a lot of people with more money than sense. It is not easy to understand (nor explain) how a loss making company can make a founder with 11% of the stock a billionaire worth $1.5 billion as a result of an IPO!

One of the IPOs that I worked on during the time I was in London in the 1960s was in connection with the 'Bloom Organization'. I forget much of the detail, it is a long time ago, but the saga was all about 'boom and bust' ... massive growth of sales and then a crash ... massive reported profit growth and then losses ... massive IPO valuations and then a company worth nothing. The stock market is not meant to be a casino or betting shop but something a lot more serious.

But what were considered 'excesses' in the 1960s have become normalised in recent years and to a great extent are now 'baked in' to the way modern stock markets and the broader ecosystem works. I am not at all sure that this is 'stable' and I am convinced that a dramatic crash is in our future.

The good news, however, is that there have been huge improvements in real productivity over the past several decades since around 1980. While there is in my view quite high risk that markets associated with money will be eak going forward, there is substantial potential for environmental and social risk to be reduced and the true value of global quality of life to improve significanly. Sadly this is now at risk as a result of the prevailing geopolitics ... Putin's aggression and the Ukraine War ... the multiple stresses in the Middle East ,,, the tensions between China and the West related to Taiwan ... the growing poverty in many pooer countries ... and the list goes on. But this is a failure of management in the global political space more than being a fundamental problem (constraint) of socio-enviro-economic potential.

Peter Burgess

October 26, 2023 at 5:00 PM EDT ... Updated on October 27, 2023 at 4:52 AM EDT

Another billionaire has been minted thanks to the online shopping boom that’s expanding from China to Southeast Asia.

J&T Global Express Ltd. debuted on Friday in Hong Kong after completing the city’s second-biggest initial public offering of 2023, leaving its founder Li “Jet” Jie with a $1.5 billion net worth, according to the Bloomberg Billionaires Index. Shares closed at the listing price of HK$12, after swinging between slight gains and losses during the session.

The courier firm, which provides delivery services for online stores like Shein and Pinduoduo, raised $500 million in the IPO. The muted performance at the debut comes at a tough time for IPOs in Hong Kong, traditionally one of the world’s busiest venues for new share sales globally. It was the biggest offering in the city since ZJLD Group Inc.’s $676 million listing in April, and happened the same week the financial hub announced efforts to revamp activity in equities trading.

Proceeds from new share sales in the city’s exchange slumped 63% to about $4.1 billion year-to-date, hit by headwinds ranging from high interest rates to economic and geopolitical woes tied to China. The flat performance compares to an average drop of 4.8% in the first trading day for ten companies that listed in the city after raising over $500 million over the past two years, according to data compiled by Bloomberg.

Li, who has an 11% stake in J&T, is the latest Chinese billionaire to be created from the online shopping surge of the past two decades, and the first with a fortune that originated in Southeast Asia, according to the Bloomberg index.

The online retail frenzy has produced several shopping moguls from China, including Jack Ma of Alibaba Group Holding Ltd., China’s largest e-commerce company, who’s worth $28.5 billion. There’s also SF Holding Co.’s Wang Wei, ZTO Express Cayman Inc.’s Lai Meisong and Yunda Holding Co.’s Nie Tengyun, who are all billionaires.

A spokesperson for J&T declined to comment.

Li, 48, started J&T after spending more than 15 years at Chinese smartphone maker OPPO, helping to expand its operations in Southeast Asia. After founding J&T in Jakarta in 2015, the company grew throughout the rest of the region and then into China in 2020. As of 2022, J&T represented more than 20% of the express delivery industry’s market share in Southeast Asia and handled more than three times the package volume of the next biggest player, according to the prospectus.

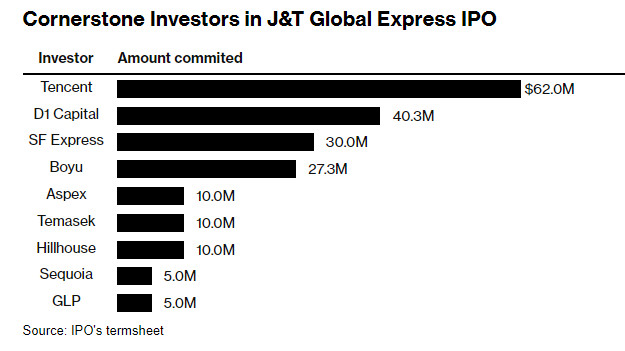

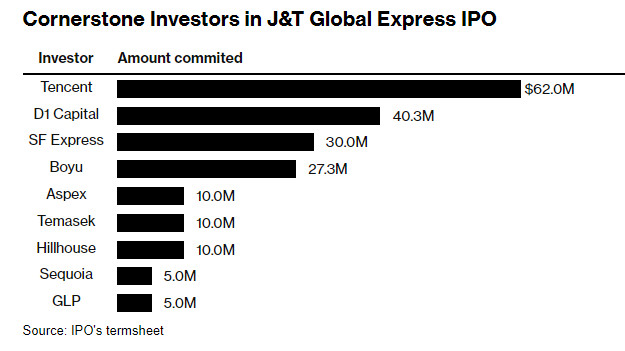

J&T’s quick expansion attracted a group of big name investors, including Tencent Holdings Ltd., SF Express, Sequoia Capital and Li’s former employer, OPPO.

Cornerstone Investors in J&T Global Express IPO

Source: IPO's termsheet

Source: IPO's termsheet

J&T’s presence in China has also been growing. More than half of the company’s $7.3 billion revenue in 2022 came from business in the country, overtaking Southeast Asia as its biggest region, according to the prospectus.

“J&T’s mainland China expansion is eye-catching,” said Wang Ting, analyst at Essence Securities in a report, “but the low-cost strategy is hard to sustain in mid-to-long term.”

J&T recorded $1.5 billion in adjusted losses last year and is only profitable in Southeast Asia, according to the prospectus. The company launched operations in the United Arab Emirates, Saudi Arabia, Mexico, Brazil and Egypt in 2022, bringing the number of countries it works in to 13. Last year, it also named soccer star Lionel Messi as a brand ambassador. “Though profitability of the company’s China business has improved, Southeast Asia margins continue to decline, hence our analysis suggests that J&T may not be able to generate profits in the near-term,” said Shifara Samsudeen, an analyst at LightStream Research, in a blog post. She added that the IPO stock price was “overvalued.” A British Virgin Islands vehicle tied to Chen “Tony” Mingyong, founder of smartphone maker Oppo, owns 4.2% of J&T, according to the filings. Liang Xiaojing, Chen’s wife, separately controls a 3.7% stake in J&T, the filing shows. (Updates second paragraph with closing price)