Date: 2024-10-19 Page is: DBtxt003.php txt00026958

CHINA

HOW STRONG IS CHINA?

Business Basics: Don’t Be Surprised by China’s Collapse.

India, USA & Mexico's Plan To Checkmate China

HOW STRONG IS CHINA?

Business Basics: Don’t Be Surprised by China’s Collapse.

India, USA & Mexico's Plan To Checkmate China

Original article: https://www.youtube.com/watch?v=dYLCkuFgKfY

Peter Burgess COMMENTARY

This material is thought provoking. I know some of the history at a 'schoolboy' level and have enjoyed the additional information from this presentation, including especially the transcript of the conversation.

Many of the events described remind me of a variety of friends and aquaintances of my family who were impacted directly by the big events of the day covered in this material.

One of my concerns at this time ... May 2024 ... is how little of world history is known by most young people in both the United States and the UK. I cannot speak in respect of young people in other countries, but I expect the issues are somewhat similar ... that is the dominant source of their knowledge is the 'social media' and mobile device ecosystem. Academic research seems to be showing that human brain development is being impacted negatively by these devices at a far greater scale than anyone expected!

This video is very long and covers a lot of ground ... I have hopes of splitting the video into several segments to help with a better understanding of the many issues that need addressing with considerable urgency!

Peter Burgess

India, USA & Mexico's Plan To Checkmate China

Business Basics

906K subscribers ... 716,396 views

Sep 29, 2023

- Sign up for FREE Geopolitics Newsletter: https://www.globalrecaps.com/subscribe

- Why I Blur my Videos (Full Story) • Why I Blur my Videos (Full Story)

- Sign up for FREE Global News Newsletter: https://rebrand.ly/GlobalRecaps

- Watch Uncensored videos & Support the channel on Patreon: / businessbasicsyt

- Facebook: / businessbasics1

- Twitter: / businessbasiics

- Get New Merch: https://www.businessbasics.shop/

- Join this channel to get access to perks: / @businessbasicsyt

- China Military Drills: CCP is Scared About Invading Taiwan

- ⚠️Webull: 5 x Free Stocks: https://a.webull.com/i/BusinessBasics

- China's Economy is Dying. India, USA, Mexico, Vietnam Team up Against China . CCP Collapse Happening

- China vs India, USA, Mexico, Vietnam. CCP Collapse Happening

- India, USA & Mexico's Plan To Checkmate China By Stealing Manufacturing

- Don’t Be Surprised by China’s Collapse. India, USA, Mexico, Vietnam team up against China.

- Mutiny in China: Why CCP Won't Invade Taiwan

- Investing For Beginners | Learn Investing (Free Course) • Video

- Passive Income: How To Retire Early Through Passive Income! • Video

- How you can focus like Warren Buffett? (2020) • Video

- some links above are affiliate links

DISCLAIMER: All of my investment strategies are based on my own opinions alone and are only done for entertainment purposes. If you are watching my videos, please Don't take any of this content as guidance for buying or selling any type of investment or security. I am not a financial advisor and anything said on this YouTube channel should not be seen as financial advice. Please keep in mind that there are a lot of risks associated with investing in the stock market so do your own research and due diligence before making any investment decisions.

Transcript

- India has launched a war against China and it's not a war that will be fought

- on the battlefield rather it's a war that will be fought economically India has started emerging as the next

- great Powerhouse of Asia in order to counter China's aggression New Delhi has now positioned itself as

- an alternative for companies that are getting tired of being used like a pawn in the ccp's grand ambition towards

- taking over the world companies like apple are already moving to India to set up for a world after

- China India has slowly launched its own Global projects to counteract China's growing

- influence from the Belton Road initiative Prime Minister Modi has started India's own lending program for

- its neighbors in order to stop China from Gaining influence by using its debt trap diplomacy

- so today let's go over how India became China's greatest threat the head of MI6

- last year accused China of using debt traps to gain leverage over countries Sri Lanka saw China's financial help the

- country took loans worth 45 billion dollars from various countries including more than 8 billion dollars from China

- in agreement for a 1 billion US dollar credit line from India fast Patrol vessel will be the fourth ship to be

- gifted by India to Seychelles Pakistan is all set to receive a 700 million loan

- from China to help ensure its foreign exchange results which are at a 10-year

- low this video took a lot of effort recently my videos have been getting age restricted which severely hurts their

- reach with the algorithm and doesn't really make that much sense so if you guys can please take a second and hit

- the like button below it will help me out a lot thank you so let's start from the beginning

- something that might surprise most of you is the fact that historically India and China were strong allies and

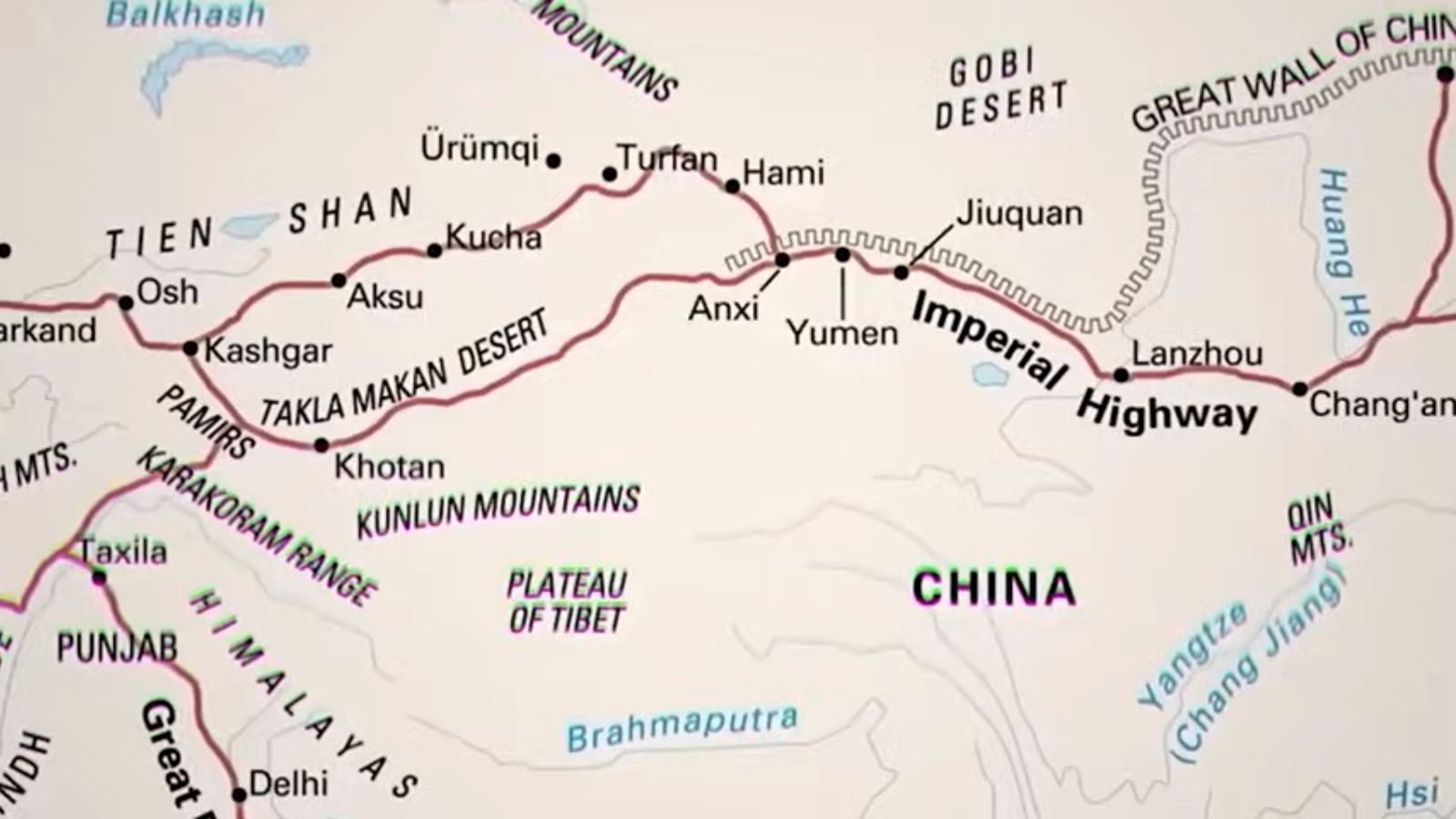

- friendly economic Partners the Silk Road linked the cities of Xi'an in China and

- petaloputra in India trade on the tea and Horse Road as the Chinese called it was a significant factor in the growth

- of Chinese and Indian civilizations coming into modern history both civilizations had their hands full with

- their colonizers as India had the British and China had the Japanese that didn't stop their leaders from

- supporting each other even under British rule Indian leaders publicly showed their support for China's struggles

- against the Japanese in 1939 future Prime Minister of India joaharlal nehru

- visited China as an honored guest of the government both countries actually helped each other in their battles India

- helped China against the Japanese and Western imperialism and in return China supported India's independence movement

- against the British then in 1947 India gained its

- independence from the British Empire and two years later in 1949 the People's Republic of China or PRC came into power

- in China this is where the relationship could have soured up to this point Indian

- leaders had been friendly with the ROC the Republic of China when Mao zedong's PRC came into Power The ROC fled

- mainland China and took over Taiwan I'm sure you guys are already familiar with the China Taiwan issue so I won't

- go into it right now but good relations between the two Nations continued even under new leadership in fact India was

- one of the first countries in the world to recognize the People's Republic of China as the official government of

- China Indian Prime Minister jawaharlal nehru also became the first foreign leader to visit the PRC in China in

- 1954. this time to meet with the PRC leader Mao Zedong nehru described the

- visit as the most important foreign mission of his life he considered India and China to be very similar he believed

- as a newly Free Nation they couldn't trust the West they needed to depend on

- each other to grow their economy and improve living conditions for their citizens they jointly signed and

- advocated for the five principles of peaceful coexistence but peace it didn't last long

- as soon as the CCP came into power in 1950 they forcibly took over the autonomous region of Tibet by sending

- loads of military personnel I have a full video on the story which was actually demonetized and restricted by

- YouTube the first time I uploaded it good times I highly recommend you check it out for the full details on this

- story but here's a quick recap after taking over the region in 1950 the

- CCP slowly kept increasing its military presence in Tibet as you can imagine this really pissed

- off the local Tibetan population as the CCP was not giving them their religious and cultural Freedom Chairman Mao wanted

- Tibet to be a Chinese territory it didn't matter to him that the people there had their own culture and history

- so in 1958 a rebellion broke out in Tibet against CCP forces Tibetans wanted

- to kick out the CCP and take back their land but Mao decided to send in even

- more forces to reassert his dominance local Tibetan Rebels stood no chance

- against the people's Liberation Army or pla who had a numbers advantage and

- experience on their side India was closely following this clampdown India had always had a

- friendly relationship with Tibet including an economic relationship where North India would freely trade with

- Tibet Indian leaders decided not to get involved in this fight as to not cause a

- war with their neighbor Mao on the other hand did not share the same feelings about keeping the peace

- Declassified documents from decades later have shown that Mao was always paranoid that India was colluding with

- the USA and the Soviets to overthrow Chinese leadership looking back this really doesn't make

- any sense the USA and the USSR were in a pretty intense cold war in the 1960s and

- while India was a neutral nation that was friendly with both sides I highly doubt the USA and the Soviet Union would

- set aside the Cold War and collude together to overthrow the leadership in China

- anyway coming back to the Tibet story in 1959 the Dalai Lama fearing for his life

- in Tibet fled to India where he was granted Asylum this of course didn't

- please Chairman Mao as he saw this action as India playing a role in supporting the rebels against the CCP

- this in turn made him more aggressive towards India and Mao decided to show his aggression by encroaching on India's

- borders speaking of borders there's one point I quickly want to go over that's actually pretty important in 1914 while India was

- still under British control representatives from Britain China and Tibet gathered to determine the status

- of Tibet China agreed to allow Tibet to be an autonomous region and remain under

- Chinese control but they refused to put the promise in a treaty Britain and

- Tibet on the other hand signed a treaty creating this line called the McMahon line

- India to this day accepts the McMahon line as the official legal border between India and Tibet the CCP on the

- other hand well they didn't accept the McMahon line and in 1959 they kept

- pushing the limits of these borders to show their displeasure this caused both sides to increase their military

- presence around the border and then in August of 1959 the first bloody Clash

- erupted between the two Nations on the west side of the Border Chinese soldiers pushed into Indian Territory

- then a month later clashes happened on the east border this is when India learned that China had built a road

- inside of Indian Territory which has remained a pretty big issue to this day

- to settle these issues China offered India the west side of the Border if India agrees to give China more

- territory on the east side India of course declined this offer and firefights kept happening for the next

- few years then in 1962 Chinese soldiers discovered an Indian Post in territory

- that they believed to be under China's borders this news traveled to Mao and he saw

- this as the final straw Mao decided to send tens of thousands of soldiers in

- secret to both East and West sides of disputed borders the people's Liberation Army swiftly

- launched an attack on both sides surprising the Indian soldiers who were both outnumbered and inexperienced the

- pla on the other hand had plenty of fighting experience from their Wars in Korea Vietnam and Taiwan

- Indian troops suffered a humiliating defeat and the CCP was able to capture

- much of Indian Territory the Indian army tried setting up a counter-offensive by bringing in more

- soldiers but Mao was ready for it and squashed it pretty easily this is when

- India asked the USA military for help to take back its territory at this time the USA was one of the only

- two countries who had nukes the second one being the Soviet Union surprisingly this was also one of the few issues that

- the USA and the Soviets agreed on they both saw China as the aggressor in this situation and since China didn't want to

- experience their own Hiroshima they decided to withdraw most of their troops from Indian Territory however the CCP

- did decide to keep control of a piece of Indian Territory here in the oxide China region the same area where they had

- built a road connecting xion Chang to lasa remember this says this is an issue still to this day another ideological

- goal Mao had with this attack was to stop India from aligning with the USA in the Cold War Mao's thinking was that if

- he can show India that China is much stronger India will be afraid to do anything that will piss off China

- but this attack kind of caused the exact opposite to happen India and the US had become even closer as they both now had

- a common enemy in China this war also changed the borders between India and China now this is

- 10:05

- where the problems start China attacked India captured territory and the new unofficial border was

- basically in Indian Territory in 1967 another war broke out and this time

- India was able to push back some of the Chinese soldiers and regained some of its territories this changed what China controlled in

- terms of territory versus what China believed to be its territory China believes that everything claimed

- in 1962 is a part of China but it lost some of that in 1967. India still honors

- the McMahon line agreement and believes that China is still illegally occupying Indian Territory

- this is the reason behind a lot of subsequent clashes that have happened here both countries have soldiers

- patrolling the area and both countries have different definitions of where their borders end I mean you can tell

- why this is a recipe for clashes right luckily both countries realize that but

- China refused to come to a peaceful agreement about the Border dispute however they did agree that soldiers

- from both countries cannot use military weapons against each other meaning no guns allowed in the two-mile strip

- around the supposed line of actual control these border disagreements are a big reason behind the india-china

- bitterness towards each other but the problems don't stop here as China grew economically its Ambitions

- on the world stage grew as well after Mao's passing Deng Xiaoping opened China

- up to the rest of the world with his open door policy this policy quite

- literally changed China's economy and its place in the world it was able to

- attract foreign businesses to China and quickly transform the country into a manufacturing hub

- millions of people were lifted out of poverty and China went from a forming Nation to the second biggest economy in

- the world but as the population started getting older and growth from attracting foreign manufacturing slowed down the

- CCP was forced to look elsewhere for future growth so it decided to feed two birds with one scone you see for a

- nation to be a superpower for it to be a formidable force on the world stage it

- needs to increase its influence with other nations and it needs to decrease its dependency on its enemies

- in short China needed to get stronger and minimize its weaknesses now we skip

- forward a little bit in our story because this plan was set in motion by Xi Jinping when he was elected taking

- the center stage China's new president and commander-in-chief of the people's Liberation Army Xi Jinping Xi Jinping as

- votes were counted there was little surprise he got 99.86 of the vote

- China's belt and Road initiative the Bri is a gigantic plant for a Global Network

- of ports roads Railways and other infrastructure to connect China to the world

- after being elected president Xi Jinping launched the most ambitious project in history to increase China's influence

- around the world China would give out loans to poor struggling nations in the guise of

- helping Nations that once struggled like they did but in return China gained control over countries with valuable

- resources or in a strategic location they may ask what if these poor countries can't pay back the loans well

- China would then get control over important resources like gold silver oil

- and access China carefully used loans to gain influence on struggling Nations and

- also choke out its enemies a prime example being India if you look at the

- map of the Belton Road initiative you can clearly see that there is one country that's left out not only that it

- seems like India is being encircled by this project that is controlled by China before we get into how China is doing

- that exactly let's first go over why China is doing this you see China

- believes it needs to do this in order to survive China's economy is very interconnected to the rest of the world

- especially to Western countries around one-fifth of China's GDP is from its

- exports the USA being its biggest export partner accounting for more than 500 billion dollars or 17 of all of China's

- exports the dependency doesn't stop there if you look at China's top 10 export Partners nine of them are us

- allies more than 50 percent of China's exports are going to countries that are

- likely to side with the USA if there's a war additionally China is one of the biggest importers of oil

- and it Imports almost double the amount of oil that the USA does and the majority of that oil flows from the

- Middle East which is transported through the Indian Ocean all of this oil passes through what some

- might consider to be one of the most important geopolitical choke points here in the Strait of Malacca

- it's projected that 80 percent of China's oil flows through this Strait this Strait is in the territorial Waters

- of Indonesia Malaysia and Singapore this straight is a very big weakness for

- China in case of any war or political disagreement this straight could easily be blocked off by enemies like India or

- the USA without access to this route it's very hard for China to get the energy to fuel

- its economy let alone a war in today's world oil is the lifeblood of

- the economy and its government China's solution to this problem is to build its own alternate route using the

- belt and Road initiative China has built pipelines both in Myanmar and Pakistan from the coast to

- Intercity China it secured long Port leases in Pakistan and Sri Lanka

- similarly China has also set up a military base in Djibouti to control Bob El mondeb a vital Strait off the coast

- of Djibouti that links the Red Sea to the Indian Ocean Persian Gulf and Asian exports Bound for Western markets must

- first pass through Bob El mondeb before reaching the Suez Canal between 12 and a

- half and 20 percent of all global trade passes through this Strait only eight miles from China's base is Camp limoneer

- after seeing all the moves China has been making a lot of military experts have pointed out that the Belton Road is

- not just a geo-economic plan it also has a military strategic advantage

- the ports have increasingly come to play a potentially more menacing role as dual use ports that can give the strengthened

- Chinese Navy a global reach it lacked entirely just a few years ago

- these strategic Investments are nicknamed The String of Pearls as the goal is to encircle India and put

- pressure on New Delhi India was aware of this already but the war in Ukraine showed every country in

- the world how important it is to secure your economic interest in the modern world wars can be won and lost before

- even stepping foot on the battlefield Thea realized that in the case of a war China's String of Pearls can be used as

- a way to choke off India's access to the World on top of safeguarding Chinese interests

- adding to this countries that received Chinese money were slow to criticize China whenever it would start skirmishes

- on the disputed border with India like it did in 2017 and 2020. there's also a

- rumor that China plans to start setting up military bases in countries that received Chinese loans and of course

- this was undoubtedly stressful for New Delhi as it didn't want to be surrounded

- by the Chinese military so India started laying out its own plan to safeguard its economic interests but

- it didn't just stop there later in the video we'll go over how India is taking advantage of China's trade war with the

- USA to hurt China where it's the strongest its manufacturing prowess but first let's go over how India is

- countering China's military to counter The String of Pearls India started its own Alliance to encircle

- China nicknamed the necklace of diamonds India is expanding its Naval bases and

- is also improving relations with strategically placed countries to counter China's strategies in 2018 India

- partnered with Singapore and Indonesia to get access to their Naval bases of Changi and sabang this increased India's

- influence and access to the Strait of Malacca one of the most important choke points for China and the rest of the

- world in terms of trade that same year India also got military access to the port of dukem in Oman this port

- facilitates India's crude imports from the Persian Gulf in addition to this the Indian facility is located right between

- two important Chinese pearls Djibouti in Africa and guadar in Pakistan

- India has also signed an agreement with Seychelles for a naval base in the region which will increase India's

- presence near the African continent while doing this India has also extended credit lines to Iran and agreed to build

- a port in the country to extend access to trade routes in Central Asia additionally India has extended credit

- lines in Central Asia to countries like Mongolia where Modi has agreed to develop a bilateral air corridor New

- Delhi has invested a lot in policies to improve relations with Japan and Vietnam

- these relations have helped increase Indian trade and consequently India's influence on countries around China but

- India realized this alone isn't enough it has also taken big steps towards

- speeding up its economic growth while taking business away from China you see the china-u.s trade war and

- covid provided countries like India with a unique opportunity because of economic

- growth in the past couple of decades living standards and wages in China have gone up dramatically this has become an

- 20:02

- issue for companies that moved to China for their low labor costs furthermore terrorists from the trade War have added

- even more costs and the headache of operating in China increased multiple fold because of xi's covet clampdown

- this is where companies started looking outwards for their manufacturing needs

- for many countries India provided a perfect solution India's population is

- fast growing and according to the UN it's officially now the biggest nation

- in the world overtaking China this year furthermore the Indian population is a

- lot younger when compared to China's aging demographic the median age in India is 28. a lot younger when compared

- to China's 38. a big portion of Indian workers speak English in fact India has

- the second largest English-speaking population only behind the USA

- this definitely makes things a lot easier for companies looking to set up shop in India certain companies have

- already noticed these benefits and taken advantage of them one example of this is Apple which has already moved some of

- its iPhone production to the Indian states of Tamil Nadu and Karnataka and

- is exploring moving its iPad manufacturing to the South Asian Nation JPMorgan analysts even made calculations

- and their projections show that one in four iPhones would be made in India by

- 2025. India is simply capitalizing on the vulnerabilities that covet exposed

- in China the need for Apple to reduce its dependence on China as a manufacturing center has been clear for

- many years but the impact of the pandemic at the world's biggest iPhone assembly plant really underlined the

- problem the covid-19 related disruption was estimated to cost the company a billion

- dollars weekly it makes sense that Apple wants to avoid this kind of mess again

- the Indian government is welcome to Deals as Indian Prime Minister Modi has been working on attracting foreign

- direct Investments since he took office in 2014 sending FDI to a record 83.6

- billion dollars in the past fiscal year with low-cost labor available low cost

- of production and a willing government it's not hard to see why a good portion

- of business is leaving China for India at the current rate India stands to take a lot of China's business because of all

- this the U.N predicts that India's economy is expected to grow at 6.7 percent in 2024 compared to the measly

- five percent expected by China's economy and it's not just next year many

- organizations forecast that India's economy is expected to grow at a much faster rate for years to come compared

- to China's economy India has already started putting this growth to good use it's now lending money to Neighbors in

- order to avoid having them in indebted to Chinese loans it has given 8 billion

- dollars to Bangladesh 2.1 billion dollars to bail out Sri Lanka after a recent collapse 1.7 billion dollars to

- Nepal 13 billion to the Maldives and a few more while India lags far behind

- China in its overseas lending New Delhi has stepped up its efforts in recent years providing tens of billions of

- dollars in credit to neighboring countries including financially distressed Bri recipients like Sri Lanka

- Indian companies have also expanded rapidly in the region providing a counterweight to Chinese commercial

- activity Indian policymakers see countering Bri as vital to avoid being surrounded by

- pro-chinese governments and infrastructure they speculate could one day serve beijing's military interests

- India has definitely stepped up its efforts in containing China India publicly downplays the competition

- with China but its actions show India doesn't want to be held hostage to

- China's economic or military might recently the first bloody clashes in 45

- years took place at the india-china border but you might not have seen this news because a lot of traditional news

- organizations are not good at properly covering important geopolitical news that's why I launched Global Recaps a

- geopolitical newsletter that covers important geopolitical news in a simplified manner every evening I send

- out an email directly to your inbox covering important stories that you can read in just a few minutes best of all

- this is completely free and you can sign up right now by clicking on the link in the description Mexico's economy is on

- the rise an increasing number of foreign businesses like to do business in Mexico and it looks like this will only

- increase in the future right now Mexico sits in The Perfect Storm preparing it for an economic boom this is due to

- multiple factors both inside of Mexico and also outside in the changing International landscape Mexico has

- relatively low labor costs which attracts manufacturers looking to Outsource their operations Additionally

- the country's population can provide a lot of skilled labor which makes doing business in Mexico even more attractive

- and something that separates Mexico from all the other low-cost manufacturing countries is one simple Geographic

- reality Mexico is located right next to the largest economy in the world the

- United States of America it's not hard to figure out why businesses like this fact when you

- manufacture your products in Mexico you can easily and cheaply export your products to the huge Market in the

- United States so Mexico is a huge opportunity for manufacturing which can attract businesses and Spark economic

- growth and the changing global economic environment is turning this opportunity into a reality right now the United

- States outsources a lot of its manufacturing to China but due to a variety of reasons this trend seems to

- be shifting it's only a matter of time before China's position as the manufacturing Behemoth will crumble

- China's downfall will inevitably cause Mexico's economic rise because Chinese

- manufacturing will have to move somewhere else but in a weird way Beijing is actually trying to benefit from Mexico's Rise by

- gaining an economic footprint in the country in this episode we'll go over how these complex geopolitical and

- economic changes are causing an economic boom in Mexico what's happening in Mexico is very interesting because it

- doesn't only affect One Nation but really the entire world and just a side note if you enjoy my

- videos be sure to hit that like button down below without your help this video won't get very far in the algorithm it

- took a lot of work to cover this topic so your support is really greatly appreciated thank you so much a tectonic

- shift is underway in the North American economy we are seeing a lot of investment for Chinese companies and

- Mexico is more motivated to attract that the latest example of Chinese business expansion is the 850 hectare hafu San

- Industrial Park it's the potential for creating as many as 7 000 jobs over the

- next five years and bringing their products closer to the world's largest market the United States

- multiple Chinese companies are now moving their manufacturing to Mexico they've already invested billions of

- dollars in the country building up factories and Supply chains this is a fascinating development because it tells

- us two important things Mexico is now a very attractive place to do business and

- China is well not that attractive anymore after all why are Chinese companies

- moving out of China if things are going well at home the truth is it's not going well for the country since the coveted

- pandemic hit in 2020 things are going downhill in China the first thing we should look at are

- the supply chain weaknesses that were exposed during the recent years this isn't the first time you'll hear

- about globalization and Outsourcing manufacturing as these Concepts have shaped our modern economy basically

- companies from Western countries have moved their manufacturing to other cheaper countries

- for decades globalization has been a trend that countries like China benefited from enormously because other

- countries started to Outsource their manufacturing China became a manufacturing Giant

- China had an abundance of cheap labor which made it the best place for manufacturing businesses but this

- globalization had one huge disadvantage it makes countries reliant on other

- countries China is the world's top manufacturer producing 28.7 percent of

- the world's manufacturing output because of this huge market share Global Supply chains are largely reliant on the

- Chinese economy and when the covid-19 pandemic happened this over-dependence on the Chinese economy clearly showed

- the long and ruthless lockdowns in China caused economic unrest and supply chain

- weaknesses all over the world a lot of governments came to the same conclusion it's not smart to have all your

- Manufacturing in one country diversifying your manufacturing by Outsourcing it to different countries is

- a lot safer even though it comes with a heavier price tag due to more Investments for example apple is now

- diversifying its manufacturing by adding Indian companies to its supply chain the Chinese companies moving to Mexico might

- be doing the same thing diversifying their Manufacturing if something unfortunate were to happen in China

- these companies would still have their manufacturing plants in Mexico up and running but supply chain safety isn't the only

- motivator driving these companies in Mexico cheap labor certainly has a huge role to it the quoted monthly earnings

- in Mexico are 874 dollars which is significantly lower than China's quoted

- earnings of one thousand three hundred and thirty six dollars per month Chinese manufacturers want to make money and by

- moving to Mexico this gets easier due to the lower labor costs and the costs of

- 30:01

- Labor aren't the only explanation in China many manufacturing companies are facing acute labor shortages the new

- Chinese generation is smaller than the older ones and many young Chinese people aren't willing to work factory jobs the

- reason for this is that the new generation has a higher education than the previous one making them well

- overqualified for manual work basically there are less people in China and even less of them considering low paying jobs

- this has led to more than 80 percent of Chinese manufacturers facing labor shortages from 10 percent of up to 30

- percent if these manufacturers don't have the people at home they're forced to move abroad and Chinese companies

- moving to Mexico fit perfectly in this trend but the reasons for things going

- downhill in China aren't only economic they're also heavily political the turmoil that began with the U.S China

- trade War has caused significant damage to Chinese Manufacturing in 2018 U.S

- president Donald Trump began to impose High tariffs on imports from China which

- hurt Chinese businesses wanting to export to the huge U.S market in one single move he increased the taxes on

- 200 billion dollars worth of goods and President Biden well he didn't make the

- situation a whole lot better for these Chinese companies his administration maintained the tariffs Trump imposed

- which didn't help with stopping the trade War he even went as far as to add new restrictions on the Chinese economy

- most notably on the chip industry that is so crucial to the country and deals with other countries like

- Japan or the Netherlands Biden effectively destroyed the supply chains of Chinese chip manufacturers for

- Chinese companies exporting to the United States this ongoing trade war is very bad for business

- this is yet another reason for Chinese manufacturing companies to now move to Mexico

- is located right next to the U.S market and it doesn't have the same restrictions placed on itself as China

- has adding on to this diversifying your manufacturing to other countries is a smart move due to the same political

- reasons with the situation around Taiwan getting very tense a conflict between the United States and China is not

- completely out of the picture an American four-star general predicts that the two will be at War by 2025.

- now this is a topic for a whole nother video but these speculations do concern companies about potential geopolitical

- risks of doing business in China maybe it's safer if you have some of your manufacturing elsewhere because a

- war will be pretty devastating for everyone involved and in the terrible scenario that comes with a war there's a

- good chance Mexico won't be involved in short there are a lot of Economic and political reasons for Chinese companies

- now moving over to Mexico and it isn't just Chinese companies that are moving out of their own country for

- Mexico other companies are seeing the benefits of Mexico too American businesses that were formally

- Outsourcing their manufacturing to China are now considering moving to their neighboring country for example the car

- manufacturers Tesla General Motors and Ford are all building manufacturing plans in Mexico and companies from

- Europe and other Asian countries are doing the same especially when the United States is their primary export

- Market it's safe to say that the trend in global manufacturing is Shifting China's downfall in manufacturing is

- turning out to be Mexico's rise as with every Trend there are push and pull factors the push factors are that

- China isn't that attractive anymore for manufacturing we've already discussed the reasons for this which are both

- economic and political so let's go over the poll factors and uncover why Mexico has great potential to be a

- manufacturing economy Mexico has surpassed China as America's top trading partner signaling a changing Dynamic

- within the global economy Mexico hosted the North American Summit with the leaders of the United States and Canada

- the North American leader Summit is expected to focus on economic issues and climate change but also the situation on

- the U.S Mexican border perhaps one of the greatest poll factors driving manufacturers to Mexico is the end of

- globalism many experts are speculating that globalism is reaching its final days this major shift has to do with the

- increasing International tensions in the world one of the preconditions for globalism has always been International

- Peace and Order connecting each individual economy with each other to form a global economy isn't an easy task

- you need to have everyone on the same page and you must provide every country with safety and assurances after the

- second world war the United States was so strong that it could enforce this the US LED World Order provided relative

- stability which led to an increasingly globalized economy as International Trade flourished but now this global

- economy appears to be crumbling the Russian invasion of Ukraine is a very good example of this Russia challenged

- the Western influence in Ukraine by starting an illegal Invasion as a result the world became a lot less stable and

- the global economy suffered with China's increasingly aggressive stance regarding Taiwan the U.S led World Order is also

- being challenged Chinese and American interests regarding Taiwan are completely opposite and China is showing

- no signs of backing off in the scenario that this situation escalates boy oh boy

- we will definitely see the globalized economy crumble right now the world is dependent on Taiwanese chips which could

- turn out to be disastrous and it's not only us enemies that make globalism difficult to execute its allies are also

- giving it a hard time for example the European Union is not blindly following U.S policy anymore macron has repeatedly

- said that he doesn't want to be a vassal for the U.S and that he rather wants the EU to form an independent strategic

- block even U.S allies don't accept an american-led World Order anymore from all of these geopolitical developments

- we can conclude that the United States dominance is being challenged for multiple sides so what on Earth does

- this have to do with Mexico well a lot actually with the US no longer leading

- the world order the old version of globalism isn't viable anymore consider this American ship manufacturers used to

- move their factories to other countries now Biden is paying billions of dollars for them to come back nowadays world

- leaders prefer to have a secure and robust economy at home home above all the benefits globalization can offer

- this is because globalism can be safeguarded by a dominant power like the United States anymore as a result of the

- crumbling World Order international relations aren't as stable as they used to be think about Russia or China for

- example because of these significant changes countries want to reduce their dependency on each other by moving chip

- manufacturing to the US Biden effectively reduces the dependency on Taiwan and China

- if this trend continues globalism is over but Mexico might be the rare

- exemption to this the United States doesn't mind being dependent on Mexico because the two are neighbors

- while the globalized economy is in Decay stronger Regional economies might be the solution Regional economies are

- basically a watered-down version of globalism regional economies can have greater security and stability but they

- still have some of the benefits globalism can offer this includes things like bilateral trade with other nations

- and economies of scale therefore an improved relationship between the US and Mexico can be vital for the future

- because it can create a strong Regional economy as globalism appears to be ending countries will need to focus on

- their Regional economies especially North America a stronger Regional economy will provide a lot of

- opportunities in and of itself you could even argue that this Regional economy can outperform the former

- globalized economy in a lot of ways getting goods from Mexico to the US is

- simply a lot faster and a lot cheaper than importing it from China from Mexico to the US you can transport goods via

- trucks trains or ships within a few days when you're importing from China to the US however it can take multiple weeks if

- you have bad luck as we've already discussed Mexico simply has a cheaper labor force which makes for a greater

- manufacturing opportunity on top of that Mexico doesn't face the same labor shortages as its Chinese

- counterpart the tariffs for trade between Mexico and the US are also significantly lower for trade coming

- from most countries the United States asks tariffs as a form of Taxation on Imports but due to the usmca agreement

- and Port tariffs between the U.S Canada and Mexico are minimal or even non-existent

- for a lot of products you don't have to pay an import tax when you're trading between these three countries this is

- yet another benefit of a stronger Regional economy Mexico can become a powerful manufacturing hub for the

- United States and the opportunities don't only stay at manufacturing Mexico also has a highly educated Workforce fun

- fact Mexico graduates more Engineers annually than the United States this

- means that not only manufacturing companies but also technology firms can grab the opportunity to Outsource to

- Mexico this is great news for Mexico but also for the United States right now the

- US is facing a critical shortage of Engineers ranging in the millions of job offers when you look at their respective

- economies Mexico and the United States complement each other pretty perfectly the United States needs both cheap and

- skilled labor and a reliable trading partner and Mexico needs jobs and companies to boost their economy all the

- more reason to start a strong wrong Regional economy conventional wisdom would say that a good neighbor is better

- than a far-flung friend which definitely applies to the US and Mexico sadly enough the political reality isn't as

- promising the United States and Mexico have had their issues so to say illegal immigration coming from Mexico is one of

- the biggest political issues in America with more than two million border Encounters in the fiscal year of 2022

- 40:00

- alone most of the migrants don't come from Mexico however but from other Latin American countries like Honduras and El

- Salvador the reason for this Mass migration is poverty and crime that many

- of the failed States in Latin America have failed to solve many Latin Americans think that they'll have a

- better chance in the United States being the more stable and prosperous country in the continent but a lot of Americans

- fear that mass immigration will cause problems at home especially the Republican side of the debate that's why

- Donald Trump tried to build a wall on the border to prevent migrants from illegally coming into the country The

- Unwanted side effect of this policy was a strained political relationship between the United States and Mexico

- there was a lot of political back and forth on the necessity and The Unwanted effects of the wall Donald Trump blamed

- the Mexican Government for not doing enough about the illegal migration issue in turn the Mexican Government blamed

- him for worsening their Mutual relation with the wall building a wall isn't good for bilateral

- trade as it slows down imports and exports coming from both sides the strained relationship isn't only to be

- blamed on the illegal migration though the high crime rate in Mexico along with its Infamous cartel violence also causes

- political concern the Mexican Government doesn't have full control over its own country because

- organized crime groups have become way too powerful the most powerful cartels in Mexico have military-grade weapons

- and equipment and through corruption they also have a large political say in the country the United States doesn't

- like this because these cartels bring illegal drugs into the country with the risk of spreading violence

- the ongoing fentanyl crisis has caused thousands of American deaths and it's directly related to the cartels in

- Mexico who import contaminated drugs some politicians call for the US military to intervene in Mexico to

- address the issue of the cartels the Mexican president Lopez obrador doesn't like this he wants to solve the

- organized crime issue on his own and preserve his country's sovereignty he even made the false claim that none of

- the fentanyl was being produced in Mexico and that was all America's own problem right now the drug war cooperation

- between the United States and Mexico is at its lowest point in decades law enforcement from both sides are barely

- cooperating to solve their Mutual problem so the issue of organized crime is also

- something separating the United States and Mexico but increasing economic ties might be the way out one of the reasons

- for illegal migration and organized crime is poverty which is related to economic underdevelopment

- therefore when Mexico gets more Prosperity it will theoretically have lower crime rates and less migration the

- Mexican Government will also have more money to fight issues like organized crime and illegal migration when

- bilateral trade grows Mexico's economy will be on the rise and these issues can

- be resolved that's why building a strong Regional economy is one of the best ways

- to improve the strained relationship between the US and Mexico the political relations are difficult

- but they can be resolved once the two countries just start cooperating we should also look at the politics inside

- of Mexico government policies have a lot of effect on the economic success of a country and looking in the past decades

- the economic growth it hasn't been great this chart shows that the Mexican economy hasn't experienced outstanding

- growth over this time period the GDP growth rate has been irregular with ups

- and downs and they haven't been fantastic in general in fact when we compare Mexico's GDP growth with that of

- the United States it appears like there has been no economic growth at all the opportunities for economic growth were

- certainly there but the Mexican government has struggled to turn them into reality Mexico could have been the

- most successful country in Latin America because it has a great opportunity for manufacturing as it shares a border with

- the US but Mexico's economy hasn't outperformed other countries in Latin America in any

- way that's because economic success has a lot of preconditions like large

- amounts of foreign direct investment and an improved business environment first of all Mexico lacks infrastructure

- and sufficient Public Utilities to achieve economic success the root cause of this problem is the lack of

- government taxes to fund public infrastructure projects the government only invests 1.3 percent of its GDP into

- these projects which is a very small amount compared to many other countries now this problem could be relatively

- easily solved by attracting foreign direct investment the private sector would love to invest

- in Mexico because of the growth opportunity ahead with increased foreign investments the infrastructure problem

- could be solved however Mexico doesn't attract that much Capital foreign direct investment inflows account for only 2.6

- percent of its GDP which isn't a crazy high number this is definitely not enough to solve the infrastructure

- problem that Mexico is currently facing however with more and more companies moving to Mexico for manufacturing this

- foreign investment inflow will surely increase but even with the odds in its favor the government in Mexico is still

- struggling to get more companies to invest in the country some of the government policies are causing this

- deficiency for example in 2022 the Mexican president tried to let the government take over the energy sector

- which was defeated in Congress this move has scared multiple private energy companies which could have

- invested in Mexico's underdeveloped energy infrastructure this is just one of the many examples of government

- policies that scare away foreign investments coming from the private sector president Lopez obrador focuses

- on state-led growth which decreases the impact companies can have in Mexico this

- isn't helpful with achieving economic growth because the huge opportunities for Mexican growth lie in the private

- sector the business environment is also a reason for the lack of economic success the Mexican Government tries to

- give businesses all kinds of incentives in order to spark economic growth this is the case with the makila Factories

- near the U.S Mexico border which have received multiple benefits from the government these factories manufacture

- goods for American companies just South of the Border and they don't have to pay taxes or import duties to the Mexican

- Government The Mexican government has also created various special economic zones to improve the business

- environment they provide various benefits to the company's in the economic zones such as having to pay no

- income tax for 10 years and no import taxes in a lot of ways the business environment is great for large

- corporations but the problem is that the rest of the economy just lacks behind nearly 30 percent of Mexico's economy is

- informal meaning that it's not registered nor taxed by the government in fact nearly 60 percent of Mexicans

- are employed in this informal sector this has a huge negative impact because the government can't collect taxes on

- this informal economy and 60 of Mexicans don't enjoy Social Security one of the

- reasons for the informal economy is the excessive regulations that make doing business in the formal economy very hard

- paying taxes alone takes Mexican firms 241 hours each year on average something

- that small businesses can't afford to do the huge informal economy is directly

- one of the reasons for Mexico's sluggish economic growth countries with large informal economies generally suffer from

- low productivity poor governance and high inequality these are things that have dragged Mexico's economy down and

- have historically caused low growth rates Mexico might attract a lot of large corporations but it also has to

- solve the informal economy in order to grow adding on to the complexity of the issues is that the situation varies

- dramatically per state in Mexico looking at the GDP per capita for every state

- you can see that there is a huge difference in some states the GDP per capita is about ten thousand dollars

- while in other states it's forty thousand dollars per capita or even higher that's four times the difference

- just on a regional scale this can be attributed to poor government policies that aren't organizing things well but

- it can also be blamed on different policies on a state level some states like Mexico City Nuevo Leon or Baja

- California have received relatively high amounts of foreign direct investment as compared to others this is because some

- states are just better at attracting businesses than others these states also have better legislation solving the

- problems of the informal economy more efficiently but to truly achieve economic success in Mexico every state

- needs to grow and the other states shouldn't get left behind this is something that the country lacks right

- now however all these political issues can be solved eventually when the country takes an example from successful

- States like Nuevo Leon Mexico could work out a solution to the problems if the

- entirety of Mexico manages to attract businesses and to grow its formal economy an economic boom is inevitable

- at least that's what the governor of Nuevo Leon predicts many problems can be solved when this

- economic boom happens for Mexico it could reduce poverty and the issues related to it in general the quality of

- life will improve and Mexicans will get more prosperous for the United States Mexico could turn out to be an

- invaluable partner with all the benefits the bilateral trade can offer such as proximity and Reliance these stronger

- Regional economy in North America will be a serious competitor to China's economy which has a huge impact on

- global geopolitics talking about China the CCP is decided between two strategies when it comes to

- this change in Mexico it can either try to compete with Mexico and fight for its own manufacturing

- industry or it can cooperate with Mexico and gain influence within the country at

- first glance Beijing trying to compete with Mexico is a viable option after all

- 50:01

- China's economy is more than 10 times bigger than that of Mexico China's population is also more than 10 times

- bigger than Mexico's population and I know that economic and demographic figures coming from China aren't that

- reliable but China certainly has an advantage in size Mexico won't be able

- to take over China's manufacturing completely so China will try to remain competitive on a global level but when

- it comes to the U.S market well the story is a little bit different in the U.S market the competition between China

- and Mexico isn't a story of David and Goliath in 2021 China exported about 600

- billion dollars to the US in the same year Mexico exported about 400 billion

- dollars to its northern neighbor in the U.S market Mexico is a serious competitor to China because of the

- shifting Trend in North America with a stronger Regional economy China stands to lose some serious market share

- in this market it'll be harder for China to compete that's why the CCP is adopting a different policy cooperation

- with Mexico the CCP doesn't want to lose control over the U.S export Market because this is one of its biggest

- strategic advantages with Mexico increasing its market share the only way for the CCP to retain this Advantage is

- through getting influence in Mexico one of the ways to do this is by building infrastructure projects which

- the CCP is trying to do in the country for example Chinese companies have signed multi-billion dollar railroad

- contracts with the Mexican Government this policy of gaining influence through infrastructure projects isn't new for

- the CCP however this traditional way for China to gain influence isn't going to

- cut it Mexico is one of the few emerging markets that isn't part of the Chinese belt and Road initiative this is

- partially because Mexico doesn't want to have too much Chinese investment within its borders if Mexico would take tons of

- loans from China it could upset the United States their biggest trading partner but luckily for the CCP there's

- another way of getting influence in Mexico and that's taking over a part of the Mexican economy itself as of 2022

- there were 1289 Chinese companies investing in Mexico this includes Chinese car

- manufacturers like byd chungan Motors or mg Motors of course these are private

- Investments but in China companies aren't that independent from the CCP as they have to follow State policies set

- by Xi Jinping himself through these private Investments the Chinese government is gaining a foothold

- in the Mexican economy this could be beijing's master plan to counter an independent American economy after all

- importing from Chinese companies in Mexico isn't much different than importing out of China itself and this

- is bad news for the United States because it desperately wants to be independent from China but it's clear

- that the CCP has a different agenda to wrap it all up an economic boom in

- Mexico seems more than logical Mexico and the United States could grow their bilateral trade in a move to strengthen

- the regional economy cheap and reliable labor just South of the Border is all the US can wish for when it comes to

- manufacturing and Mexico which is still struggling to grow its economy would love to expand its exports to the

- biggest economy in the world because their interests are aligned the political differences between Mexico and

- the United States can be solved the political situation within Mexico could also improve with States like Nuevo Leon

- leading the way the question now becomes will this new alliance make the United States independent from China the United

- States hopes to replace Chinese manufacturing with manufacturing coming from Mexico for economic and political

- reasons but the CCP isn't letting this happen as it's moving hundreds of Chinese

- companies to the country one thing is certain though Mexico is the perfect storm for an economic boom with all

- these developments Mexico could become a manufacturer's Paradise China has been eyeing Africa for decades

- now as growth in China slowed down the CCP realized that taking over Africa was

- the solution that's because Africa is expected to become a Powerhouse in the

- coming decades when you think about global superpowers countries in Africa aren't the first ones that come to mind

- as a superpower you need to have a huge economy a powerful military and a lot of

- international influence not a lot of African countries have these things yet

- but a few decades from now this is going to be very different in 2030 42 of the

- world's young people will be living in Africa by 2050 the prediction is that

- more than a quarter of the entire world's population will be African countries like Nigeria Ethiopia Egypt or

- Congo will have one big advantage over the coming years their huge populations

- while the rest of the world is struggling with low birth rates and Rapid aging African countries will

- experience exactly the opposite their populations will be extremely young and

- it will be growing rapidly just think about it Italy only has 1.24

- births per women while Nigeria's birth rate sits at a whopping 5.31

- these demographics will shape the 21st century in this video we'll talk about the

- dramatic effect of Africa's demographics you may have guessed this already but this population growth is creating a

- huge Economic Opportunity in fact it is so important that today's superpowers are fighting for influence

- in the continent and talking about influence you guys can influence the channel by hitting the like button down

- below sometimes the algorithm decides to throttle some of my videos your support is greatly appreciated because it allows

- me to make more videos like this thank you very much 70 percent of Africans are under the age

- of 13. this is happening while the developed nations are experienced in a rapid aging population a country the

- size of Rwanda can sustain this kind of population growth it's so crowded here they teach in shifts four billion the

- population of Africa at the end of this Century basically going to be half the

- planner looking at facts such as birth rates and median age it becomes obvious that Africa has some very powerful

- demographics and as we've seen in China during the last 40 years or so these

- powerful demographics are a very valuable asset to illustrate just how much of an advantage your demographics can have

- these days let's look at China's example in more detail in the modern globalized world where Goods can be traded across

- the entire Globe population numbers give a country an economic advantage China's economic boom has proven this

- when China opened up its Market to the rest of the world in 1978 its huge

- population was one of the drivers causing spectacular GDP growth the reason for this is simple there was

- a lot of demand for labor and especially cheap labor when you have a huge and

- cheap labor force it becomes easier to start an export economy companies across

- the entire world look for places with an abundance of cheap labor so that they can produce their products as cheaply as

- possible and make as much profit as possible in 1978 China was that place

- all over the world companies started Outsourcing their manufacturing to China because producing there was just pennies

- on the dollar nowadays the result of this process is visible on most of the products you buy you know the all too familiar made in

- China logo on the back of most Goods but wages in China have risen significantly over the last few years as a direct

- result of their economic growth this chart makes it clear that Chinese labor isn't nearly as cheap as it was in

- 1978. so is China still the go-to destination for manufacturing not really and

- population wise China is also going through some trouble the country has a rapidly aging population just like many

- Western countries China's median age is already nearing 40 years old and this is expected to rise

- to 50 within a few decades there will simply be a smaller percentage of people who are able to work so for companies

- seeking an abundance of cheap labor China just isn't it companies will have to search for different places to find

- their low-cost labor and Africa might be where they'll go right now 60 percent of

- Africa's population is under 25 years old yeah that's an absolutely crazy

- statistic and Africa's total fertility rate sets at just above four meaning that every woman has four children on

- average with most Western countries having birth rates below two this gives Africa some clear advantages because of

- such strong demographics Africa will have a huge Workforce in the future and a cheap one too according to a United

- Nations report most of Africa isn't yet industrialized The Only Exception being

- South Africa this is of course not particularly shocking but it has a huge impact seventy percent of Africans rely

- on the agricultural sector to make a living which shows that many economies in Africa aren't yet Advanced

- underdeveloped countries that aren't industrialized also tend to have a weaker currency meaning that one dollar

- has a lot more purchasing power there relative to other countries this means that wages are very low

- compared to other countries who've already fully industrialized when you look at this map showing the median

- income per country it becomes clear that the continent of Africa has the lowest wages in the entire world in the long

- term this will be a huge opportunity for businesses seeking to cut their expenses after all an abundance of cheap labor is

- an offer many companies can't refuse it's a pretty good bet that many companies will move to Africa in the

- long term and this isn't bad news at all for most Africans when businesses move to the continent African nations will

- experience an economic phenomenon similar to China industrialization companies moving to Africa due to low

- 1:00:10

- labor costs could cause the entire continent to have an economic boom the companies that move to the area will

- attract other businesses which will then attract even more businesses and so on and so on I'll give an example to

- further illustrate this let's say some manufacturing companies move to a certain country these new companies will

- attract a variety of other businesses construction companies logistics companies producers of raw Goods energy

- suppliers you get the point before you know it you can have entire new Industries this ripple effect which is

- called industrialization may happen to Africa at some point in the future as we've talked about earlier Africa is

- a huge business opportunity due to its large and cheap labor force so businesses moving there and sparking

- industrialization is not entirely out of the picture and this will be a huge economic event the industrialization of

- Africa will open up thousands of markets with billions of consumers it will create Market opportunities for

- existing businesses and it will also give rise to many new business opportunities in other words this is a

- multi-trillion dollar Enterprise now I won't claim that this industrialization could happen as soon as a few years from

- now I mean in the short term the economic success of African countries relies mostly on individual government policies and to be honest it doesn't

- look too exciting for the short term it's important to understand why Africa failed to attract businesses thus far

- and the reasons why it's lagging behind the rest of the world right now corruption is a major reason

- for why Africa is still underdeveloped and why it failed to achieve economic success on the corruption perceptions

- index which ranks how corrupt different countries are African countries scored 33 points on average so to provide

- context a hundred points means zero corruption and zero points means a totally corrupt regime

- so 33 points on average is a very bad statistic having a corrupt government doesn't help with a country's economy

- because a lot of the money goes straight into the politicians pockets and corrupt politicians don't exactly have their own

- populations as their number one priority which leads to bad policies worsening

- the economy another reason for Africa still being underdeveloped are the potential risks of doing business there

- due to political instability social unrest and a bad reputation in general many African economies have failed to

- attract businesses many countries in the continent are labeled as risky and

- companies that want to move their manufacturing don't prefer to invest in these risky countries I should also

- mention the lack of proper education 98 million children in Africa are not going

- to school although this doesn't matter for unskilled labor it's still a huge factor in keeping Africa's economic

- growth and development down but perhaps one of the biggest reasons is this a

- lack of infrastructure when there aren't roads Railways and ports in a certain country well good luck doing any

- business there many African countries are suffering from this problem a severe lack of infrastructure which is keeping

- businesses away according to a McKinsey report Africa lacks behind the rest of the world when it comes to roads

- railroads and in energy infrastructure to address this issue African countries need more than a hundred billion dollars

- every year when you don't have the infrastructure put in place economic growth becomes

- impossible all of these reasons make it very hard for African countries to industrialize within this decade

- corruption political instability and a lack of education and the infrastructure Gap they're all huge problems

- but within 50 years who knows how the situation might change African

- governments will get new leaders which are hopefully less corrupt new government policies could also decrease

- the risk of doing business and improve the education system there are a lot of factors holding back

- Africa's economic development but that doesn't mean Africa stands no chance in the long run

- the economic problems are hard to solve but Africa's demographics will definitely help in finding the solution

- if African countries manage to follow the same path as China did they can surely profit from their young and

- growing populations and the infrastructure Gap that problem may be solved sooner than you think because

- other countries are eager to help out there's no doubt that leaders and governments from all over the world are

- looking at the situation in Africa very closely after African countries industrialize they will grow into

- sizable economies to get a better position in the future loads of countries would like to strengthen their

- ties with African countries after African nations grow their economies they will have a stronger military and

- more International influence in general for other countries this provides opportunities for cooperation both

- economically and politically all the more reason for global leaders to look at Africa right and that's exactly what

- leaders all over the world are doing they're trying to gain influence in Africa before this industrialization

- will take place because when it happens the industrialization of Africa could be one

- of the most important events of the 21st Century as you can imagine today's superpowers

- have a lot of geopolitical interests and objectives in this whole development having influence in Africa is a

- strategic objective for countries like China the United States or the countries of the EU unsurprisingly these countries are

- sending billions and billions of dollars to the continent in the hopes to secure a good position for the future

- in fact the major international players of today are fighting each other to get their own piece of the pie so let's look

- at how this race for influence in Africa is reshaping the World of Tomorrow

- thank you

- China's belt and Road initiative Europe's global gateway and the United States build back better world all have

- one thing in common the programs are pouring billions of dollars into Africa in the form of Investments and they

- aren't just doing this to be nice for once and to help Africa develop itself of course there are strategic objectives

- involved in these massive undertakings the first one is securing an economic footprint in Africa when African

- countries industrialize China the US and the EU want to secure trading relations

- with these countries it would be great news for their economies and they sure don't want to miss out on any massive

- opportunities so securing trade relations for both imports and exports is a must investing in African countries

- will help with these trade relations the economies of the recipient countries will grow as a result which provides

- trading opportunities and most of these foreign investments come in the form of loans which have conditions to

- strengthen trade relations with the lender when China gives out money to build a port it can make arrangements to allow

- Chinese companies Priority Access so these loans can help to build solid trading relations another objective for

- investing in Africa is to make political allies for the future there are 54 countries in Africa so it's very useful

- to have at least some of them on your side politically African countries will grow in importance because of their huge

- populations so securing good political relations with these countries is a must

- for countries like China or the us one of the best ways to befriend these African countries is to help them

- financially in huge parts of Africa crucial infrastructure like Railways

- ports or adequate Road networks have yet to be built because many African nations

- aren't in the best shape money-wise most governments turn to loans to finance

- massive infrastructure projects and other countries are happy to provide them with these loans after all everyone

- wants to be friends with Africa in the future multiple countries are eager to

- lend out billions of dollars to African countries these investments in infrastructure will spark Africa's

- economy to grow which makes Africa's industrialization a self-fulfilling prophecy once the roads and the bridges

- are built Africa can start participating in the global economy one country understood this very well and that is

- China it is estimated that China has invested around 300 billion dollars in

- Africa which includes many infrastructure projects that Africa needs so desperately these huge

- Investments fall under China's belt and Road initiative beijing's International infrastructure program

- in Africa alone China has built more than 13 000 kilometers of Railways nearly a

- hundred thousand kilometers of Highways about a thousand Bridges and nearly 100 ports and 80 large-scale power

- facilities and keep in mind that China is already the biggest bilateral trade partner of

- the African continent meaning that economic ties between the two sides are already pretty strong

- there are currently around 10 000 Chinese firms in the continent giving China a strong presence and the huge

- amount of investment that Beijing is sending into Africa will only increase this Chinese presence and remember all

- the roads and bridges made with Chinese loans are obviously being built by Chinese firms in a weird way sending

- money to Africa actually helps Chinese businesses which gets China an even bigger footprint now we all know why

- China wants this influence in Africa so desperately Africa is a huge Economic Opportunity for the future for China

- Africa can be both a sales market and a crucial importer of goods the fact that

- Chinese firms could sell their products in Africa shouldn't be overlooked with a forecasted 2.5 billion people living in

- Africa by 2050. Africa could be a huge sales market for China

- especially after the continent industrializes and starts importing more and more products no wonder that the CCP

- 1:10:10

- is interested in growing Chinese companies in Africa ultimately it makes the CCP more

- powerful internationally because it gives them an economic boost apart from exporting Chinese products

- and companies Imports coming from Africa are just as important for Beijing

- China needs natural resources for domestic consumption in Industries like car manufacturing and a lot of African

- countries have an abundance of these resources they have huge reserves of things like Cobalt copper and platinum

- Chinese state-owned companies strategically invest and take control over mines in Africa to secure the

- supplies of these essential minerals and metals for example they've taken control over Cobalt deposits in the Democratic

- Republic of the Congo apart from these resources cheap labor is also a driver for Beijing China now has a declining

- Workforce and increasingly higher wages which makes manufacturing less and less attractive to do at home the Chinese

- economy needs to transition away from a manufacturing economy at some point which can be a whole video on its own by

- the way sooner or later we could see Chinese companies moving their manufacturing to other countries and

- Africa is a great place to move it when it comes to cheap labor it's clear that investing in Africa has been any

- advantages for China and since a decade or so Beijing has had the money to do so when China's export economy grew to its

- current level a lot of money was flowing into the country China was exporting more than it was importing and Beijing

- had a beautiful problem it had a surplus of capital you can see in this chart that China has

- a trade surplus worth hundreds of billions of dollars at this point china

- has a lot of capital sitting at home Capital that it can invest into African countries that's why we're now seeing

- China giving out tons of loans for example in the Belton Road initiative this has raised concerns in some

- countries because they fear that China is using these loans to gain power and influence one theory is that China has

- so-called debt trap diplomacy China could overload economically unstable

- countries with debt until they eventually go bankrupt after this happens China could take over all the

- infrastructure the debt was used for and take control over crucial locations in some countries like Sri Lanka the

- debt trap diplomacy has already worked when Sri Lanka couldn't pay off its Chinese debts it resulted in China

- taking ownership of a port in Sri Lanka for 99 years