OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

FINANCIAL SECTOR

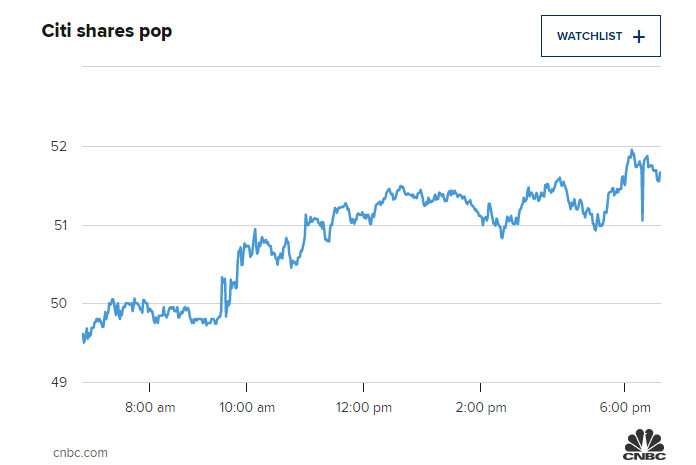

WARREN BUFFETT Citigroup shares got a boost from Warren Buffett who just disclosed a big stake in the struggling bank.

Berkshire Hathaway Chairman and CEO Warren Buffett. ... Andrew Harnik | AP Original article: https://www.cnbc.com/2022/05/17/citigroup-shares-jump-5percent-after-warren-buffett-reveals-a-near-3-billion-stake-in-the-struggling-bank.html? Burgess COMMENTARY Mostly, I think of plutocrats in a very negative light. My main exception to this is Warren Buffett who has been a solid reasonable investor for all of his very long adult life. While he has been financially very successful, his basic operating philosophy and investment stratgey has been to invest in well managed important businesses. Doing this for many decades has been a very successful investment formula. Warren Buffett has been very different from a lot of the other big name successful investors. For example, Senator Mitt Romney and former Governor of Massachusetts and executive at Bain Capital was more of an opportunist than Warren Buffett and made his money by stressing everything that could be stressed. The Bain Capital business made money but left a trail of losers wherever Bain Capital touched down. Most of the top folk with wealth have been ruthless in what they have done to get to be financially successful ... few of them are like Warren Buffet. Peter Burgess | ||

Citigroup shares jump 7% after Warren Buffett reveals a near $3 billion stake in the struggling bank

PUBLISHED TUE, MAY 17 2022 8:00 AM EDT ... UPDATED TUE, MAY 17 2022 4:00 PM EDT

Witten by Yun Li @YUNLI626

In this article

The 91-year-old “Oracle of Omaha” scooped up Citi shares while they have been underperforming the rest of the financial sector in the past 12 months. The stock is down nearly 40% while the Financial Select Sector SPDR Fund is off by 12% over the same period. Citi welcomed Jane Fraser as its new CEO a year ago, the first female chief of a major U.S. bank. She has set a medium-term target of 11% to 12% for return on tangible common equity, aiming to overhaul a company that has deeply underperformed U.S. rivals for years. Fraser has opted to exit less-profitable parts of the firm’s global empire, including leaving 13 retail markets across Asia and Europe. Citi now joins some of those rivals in Buffett’s portfolio. Berkshire owned $41.6 billion of Bank of America at the end of March, marking its second biggest holding next to Apple. Berkshire has owned Bank of American since 2017. Berkshire built a $390 million new stake in Ally Financial. The stock jumped 4% in premarket trading Tuesday after the disclosure. The conglomerate also held shares in Bank of NY Mellon, U.S. Bancorp, Mastercard and Visa. The conglomerate exited its position in Wells Fargo in the first quarter.

| The text being discussed is available at | https://www.cnbc.com/2022/05/17/citigroup-shares-jump-5percent-after-warren-buffett-reveals-a-near-3-billion-stake-in-the-struggling-bank.html? and |