OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

SUSTAINABILITY

KPMG (US) IMPACT INITIATIVE INSIGHT 2022 ... How to move from decarbonization ambition to action

Cover art: Charting a course to net zero Download PDF https://www.kpmg.us/insights/2022/move-from-decarbonization-ambition-action.html Download PDF (TVM) Download PDF (KPMG) Peter Burgess COMMENTARY Peter Burgess | ||

|

KPMG LLP ...KPMG Advisory

US › Insights › How to move from decarbonization ambition to action Goals and good intentions aren’t enough: Companies must begin making changes now to reach 2030 and 2050 emissions goals. The race to a greener future has begun. Organizations around the world have invested half a trillion dollars in decarbonization, and more than a thousand large companies have committed to setting science-based emissions targets to limit warming to 1.5°C, the goal established by the Paris Agreement at the Conference of the Parties, COP 21, in December 2015.1 While these commitments represent progress, tangible results remain elusive. For example, only 110 of the world’s 2,000 largest companies meet the United Nations’ “starting line” criteria to “pledge, plan, proceed and publish,” and only 25 percent of those that have made commitments to ESG goals are on track to reach Paris Agreement goals.2 Treating net-zero targets merely as aspirations, or worse, as part of branding or marketing, can pose serious risks. Not living up to commitments can have a reputational impact and can provoke a backlash from investors, lenders, customers, employees, and local communities. And, of course, failure to act means falling short in meeting the climate challenge. To reach goals of any kind, organizations need roadmaps, including near-term milestones and actions to drive a sense of urgency. In this short report, we explain how organizations of all kinds can develop the strategies and roadmaps they need to start their journeys to decarbonization. Only 25% of organizations that have made ESG commitments are on track to meet Paris Agreement goals. Devising a meaningful decarbonization strategy Net-zero targets resemble New Year’s resolutions in that they’re easy to set but require changes in specific behaviors and practices, consistent effort over time, and a clear plan. In any organization, the actions required to decarbonize are numerous and demand changes in all sorts of processes and business units. Decarbonization therefore cannot succeed as a stand-alone effort—it must be woven into an organization’s operations and align with and enable the enterprise strategy. A tailored decarbonization strategy can be developed in just a few months. Our approach includes five main steps (Exhibit 1). Exhibit 1. Five steps to developing a decarbonization strategy and roadmap The first step is building a detailed picture of the organization’s carbon footprint at the individual asset level (e.g., buildings, vehicles, equipment), assessing the impact of climate risk on these assets, and identifying gaps between the current state and a future decarbonization vision. Based on these analyses, leaders can set realistic targets and draft a defensible roadmap to reach net-zero goals using an array of decarbonization levers. Using our decarbonization pathways methodology, we help clients establish emission baselines, model scenarios, and develop a roadmap that aligns with the organization’s capital program strategy. Based on the roadmap, the company defines a target operating model that specifies the changes needed to adjust processes, policies, and behaviors to reach net-zero goals. Baseline and GHG inventory assessment

While many organizations can measure their carbon footprints and set emission targets, we find that they often run into difficulties in defining needed operational changes and determining the size and timing of required investments. To translate targets into a roadmap, an organization should gather and analyze critical issues:

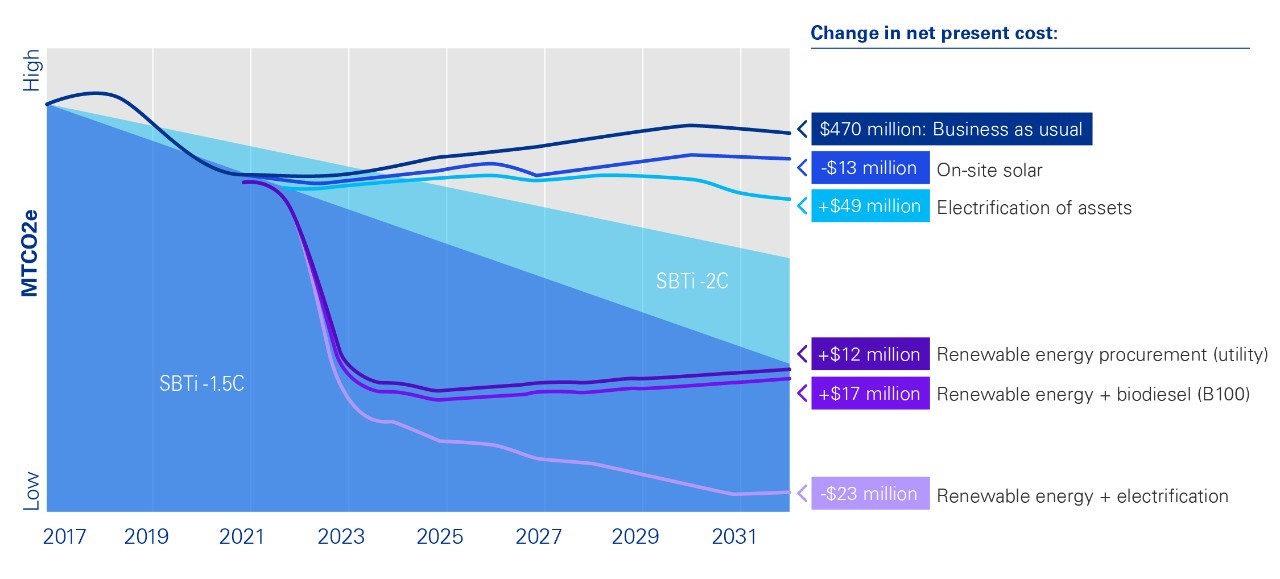

A U.S. port authority had bold ambitions for its decarbonization plan. It wanted to keep pace with the net-zero goals of its large customers, boost efficiency, get ahead of future regulations that might require deep emission reductions, and become an industry leader by contributing to UN Sustainable Development Goals. The first step was gauging current fossil fuel use. This was complicated by the inability to track the fuel consumption and idle time of decades-old vehicles. Using fuel consumption estimates, additional data, analytics, and our decarbonization pathways capability, we helped the port calculate its carbon footprint at the asset level and make decisions about how to achieve its climate ambitions. Its options fell into two categories: which assets to electrify (and when), and where to get the electricity to power the new equipment. Local providers offered renewable choices at low cost. We considered total cost of ownership and a range of options, such as switching to electric fleets in phases. Our analysis concluded that tapping renewable energy and electrifying some of the port’s equipment could reduce overall scope 1 and 2 emissions3 over time by more than 90 percent, while cutting costs by more than $20 million annually (see Exhibit 2). Using these analyses, senior leaders could then agree on a future state where the port would switch to 100 percent renewable energy, reduce greenhouse gas emissions by two- thirds by 2032, and achieve net-zero carbon emissions by 2040. As the company launches projects based on its new roadmap, it is tracking progress toward targets and providing employees, customers, and local communities with clear performance metrics. It has already announced 14 percent reductions in CO2e emissions since its baseline year of 2017, and a 44 percent decline in scope 1 emissions as it transitions to hybrid and electric straddle carriers. Decarbonization is a bottom-line imperative Significant decarbonization requires investment. But there are returns, too: in lower energy costs and gains in reputation, brand, and employee retention. Companies that act now also can reduce transition risks and will be prepared if carbon taxes are implemented in the U.S. Exhibit 2 shows a typical decarbonization pathway, such as the one adopted by the port described above. This is the moment to craft a decarbonization strategy and an actionable plan to achieve it. The costs of delay will only continue to rise. Exhibit 2. Greenhouse gas reduction scenario modelings Sample carbon reduction scenario for scope 1 and 2 emissions that measure total emissions and approximate costs.

Greenhouse gas reduction scenario

For more on these, visit the KPMG IMPACT website. Contact us Improving business performance, turning risk and compliance into opportunities, developing strategies and enhancing value are at the core of what we do for leading organizations. Katherine Blue IMPACT ESG Advisory Leader, KPMG US +1 404-222-7606 David T Ross Director, Advisory - Infrastructure & Projects Adv, KPMG US +1 213-955-8842 Some or all of the services described herein may not be permissible for KPMG audit clients and their affiliates or related entities. KPMG LLP Request for Proposal Related content INSIGHT Climate change, decarbonization, renewables Managing climate risks and opportunities, implementing long-term sustainability strategy, attracting investors, and improving performance INSIGHT The SEC climate-related proposal: What it means to your business Go beyond compliance to tell your ESG story with data-driven insights and create value for your organization. INSIGHT Time to address real estate climate risk Organizations should assess climate risk across their entire portfolio then design a strategy that integrates risk calculations into long-term portfoli... INSIGHT Big questions for a sustainable future Economist Impact and KPMG explore big sustainable questions facing companies today The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. KPMG does not provide legal advice. © 2022 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. For more detail about the structure of the KPMG global organization please visit

| The text being discussed is available at | and |