OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

STOCKMARKETS

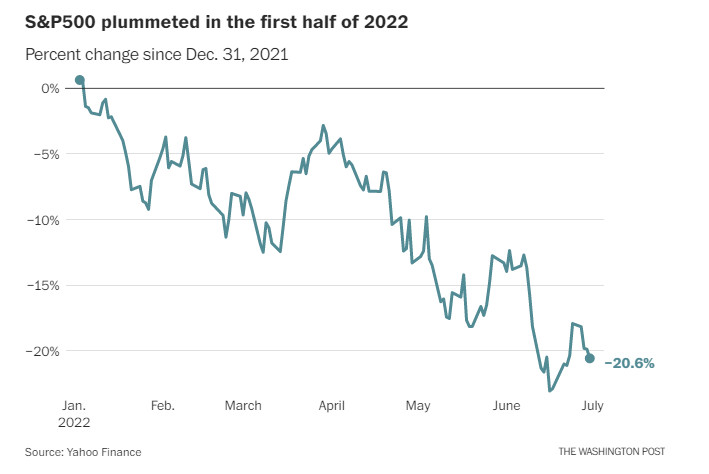

FIRST HALF 2022 NYSE Stocks slide, with Wall Street closing out its worst first half since 1970

Original article: https://www.washingtonpost.com/business/2022/06/30/stock-market-today-recession-inflation/ Peter Burgess COMMENTARY The decline in the US stock market during the first half of 2022 has come as a shock to a lot of Wall Street stock traders. I am perhaps a lot less surprised, and in fact quite relieved. I have been concerned about the 'financialization' of the modern world economy for a long time. I think I understand why 'financialization' emerged as the dominant aoperational playbook in the Western world ... and that means that I also worry about what this focus actually means over time for society (people) and the environment (nature). A 20% decline in most of the major indeces of the New Yor stock exchange over a period of 6 months in the first half of 2022 has a lot of investors more on edge than they have been in a long time, and they will be looking to the Fed to ease their pain. It is quite likely that the Fed will oblige ... but in the process simply put off the day of reckoning by some months or perhaps even a couple of years. At some point, however, the interest of people as a whole (society) has to be balanced against the interest of a few people (investors) and the need to address environmental sustainability in a meaningful way. A simplistic policy response by the Fed is likely to aggravate rather than solve the stock malaise of the first half o 2022. Several major sectors have been earning record profits ... energy stocks, banking and finance, health sector / pharmaceuticsl, social media / big tech ... but all of these industries are marketing products that people are having difficulty affording or using responsibly. I would not be surprised to see big changes over the next two quarters. Peter Burgess | ||

|

Stocks slide, with Wall Street closing out its worst first half since 1970

The slump follows a record-shattering performance in 2021, By Hamza Shaban and Aaron Gregg ...Steven Zeitchik contributed to this report. Hamza Shaban is a business reporter covering national and breaking news. He joined The Washington Post in 2017 as a technology reporter. Previously, he covered tech policy for BuzzFeed News. Aaron Gregg is a general assignment reporter for the Washington Post. His coverage focuses on the labor market, corporate accountability, and economic issues of all sorts. Updated June 30, 2022 at 4:38 p.m. EDT|Published June 30, 2022 at 9:33 a.m. EDT The stock market closed out its worst six-month stretch to start a year since 1970, as inflation-driven upheaval has spread across nearly every part of the economy. The S&P 500 index edged 0.9 percent lower Thursday to bring its 2022 losses to 20.6 percent. The tech-heavy Nasdaq, which fell 1.3 percent, has tumbled nearly 30 percent this year, while the Dow Jones industrial average’s 0.8 percent drop put its year-to-date decline near 15 percent. Even the mighty tech giants, which enriched investors during the early phase of the pandemic with soaring share prices, have been brought low, performing worse than the market overall this year. Apple, Microsoft and Alphabet have shed close to a quarter of their values this year. Amazon lost more than 30 percent. Meta has tumbled by more than half. The slump follows a record-shattering performance in 2021, and all the major indexes remain above their levels before the pandemic began in 2020. Still, inflation has pulled on the stock market like an anvil, depressing consumer and business sentiment and forcing political leaders to scramble, while a compounding array of geopolitical uncertainty added to the volatility. “Investor sentiment has been rattled this year, dominated by concerns around persistently high inflation, slowing economic momentum and an aggressive Fed,” said Nicole Tanenbaum, partner and chief investment strategist at Chequers Financial Management. There are growing signs that a softer stock market, the rising price of food, fuel and other essentials, as well as higher borrowing costs, have given many consumers pause after frenetic levels of spending in the past year. On Thursday, new data showed that growth in consumer spending had slowed but had not declined. Similarly, other data revealed that weekly jobless claims remained very low, a positive sign as economists monitor the pace of layoffs. But the sharp pullback in stock portfolios underscores a souring mood on Wall Street and may serve as a preview of flailing corporate earnings: More than $8 trillion has been wiped out of the stock market this year. And just a few weeks ago the state of the markets looked even more grim. Although stocks have seesawed upward, as some investors went bargain hunting. “Until investors start to see evidence that inflation is abating and the Federal Reserve begins to signal a shift in policy, we expect the markets to continue down this choppy path,” Tanenbaum said. The central bank has raised its benchmark interest rate three times this year and signaled that four more hikes are on deck. The most recent, in mid-June, came in at three-quarters of a percentage point, the central bank’s largest since 1994. Raising interest rates make mortgages, auto loans and all manner of business investment more expensive; but it also serves to cool an overheated economy by dampening consumer spending, thus cutting demand for goods and services to help bring prices down. However, investors and some businesses worry that the Fed’s action may slow the economy too much, triggering recession and a wave of layoffs. A recent Bankrate survey of 17 economists put the odds of a recession in the next 18 months at 50-50, said Mark Hamrick, a senior economic analyst for the consumer financial services company. Each rate increase has been quickly followed by sharp stock market sell-offs, contributing to a broader rout that has pushed the S&P 500 into a bear market — defined as a 20 percent drop from a recent high. Now the broad-based index has post its worst first-half of the year since 1970′s 21 percent decline, says Sam Stovall, chief market strategist at CFRA research. What’s more, geopolitical conflicts and supply chain disruptions that are beyond the control of central bankers are compounding Wall Street’s problems and those of everyday consumers who are getting clobbered at the gas pump and the grocery store. In sharp contrast to the first year of the pandemic, when the Fed and Congress moved with blazing speed to shore up the American economy, monetary policy this year was designed to clamp down on an economy running too hot. Then the Fed’s rhetoric around fighting inflation grew far more aggressive. Exacerbated by Russia’s invasion of Ukraine and the sprawling international sanctions, energy and commodity prices shot up. “That exerted downward pressure on economic growth and upward pressure on inflation, and real incomes fell,” said Kristina Hooper, the chief global market strategist at Invesco. “In many respects, this was a ‘perfect storm,'” she said. Even consumer spending, the main engine of the U.S. economy, which had adapted to the quirks and roadblocks of life during the pandemic, is showing signs of slowing again. Higher interest rates and a slowing savings rate are putting a damper on families’ budgets. And some retailers have been caught off guard in recent months, as consumers have turned away from the shopping patterns of the early pandemic-era, leaving a glut of appliances and televisions on store shelves and warehouses. Overall consumer spending rose by 0.2 percent in May, down from 0.9 percent growth a month earlier, according to data released Thursday by the Bureau of Economic Analysis. The BEA’s measure of inflation remained steady at 6.3 percent. On Thursday, the core personal consumption expenditures index, the Fed’s preferred gauge of inflation, rose 4.7 percent. That’s 0.2 percentage points less than the month before, but still close to a four-decade high. Economists had expected the index to come in at 4.8 percent, according to CNBC. “People are eager to call the moment of peak inflation, but we’re still waiting to see that,” Hamrick said, adding: “For many people the current experience of inflation is unlike anything they’ve experienced in their lifetimes.” Others are more optimistic. LPL Financial Chief Economist Jeffrey Roach points out that the rate of inflation for goods, as opposed to services, appears to be slowing. “This is a net positive for investors as the core year over year growth rate has consistently fallen since February,” Roach said in an email. The all-important job market will offer a crucial sign whether the actions of the Fed might lead to a contraction. Weekly jobless claims, a proxy for layoffs, have drifted higher in recent weeks, a sign that the labor market could be softening. Initial claims reported by the Labor Department on Thursday decreased by 2,000 to 231,000, but the four-week moving average jumped 7,250 from the previous week’s revised average. Meanwhile, cryptocurrencies suffered some of their worst losses in several years during the latest quarter as both retail and institutional investors took a hit on a number of their biggest bets. The ambitious South Korean crypto project Terra — with both a token and a so-called “algorithmic stablecoin” — saw much of its value wiped out over a few calamitous days in May. (The stablecoin lost two-thirds of its value, while the token Luna fell more than 95 percent.) That triggered losses throughout the market, including to crypto-bank Celsius, which would go on to freeze assets, and hedge fund Three Arrows Capital, which would fall into liquidation this week. Among the biggest bellwethers of the crash has been bitcoin, the widely held and, in the view of many investment experts, most important cryptocurrency. Thanks to crypto-company unravellings and larger economic factors like the interest-rate hike, bitcoin dropped more than 55 percent since April 1 to land at barely $19,000 by the end of the first half of the year. Depending on where the price finds itself at midnight, the quarterly plunge may prove to be the biggest in more than a decade. Steven Zeitchik contributed to this report. By Hamza Shaban Hamza Shaban is a business reporter covering national and breaking news. He joined The Washington Post in 2017 as a technology reporter. Previously, he covered tech policy for BuzzFeed News. Twitter By Aaron Gregg Aaron Gregg is a general assignment reporter for the Washington Post. His coverage focuses on the labor market, corporate accountability, and economic issues of all sorts. Twitter

| The text being discussed is available at | https://www.washingtonpost.com/business/2022/06/30/stock-market-today-recession-inflation/ and |