OVERVIEW

MANAGEMENT

PERFORMANCE

POSSIBILITIES

CAPITALS

ACTIVITIES

ACTORS

BURGESS

|

US ECONOMY

INFLATION Umair Haque: Welcome to the Extinction Depression ... How Much Worse Is the Economy Going to Get? You Don’t Want to Know

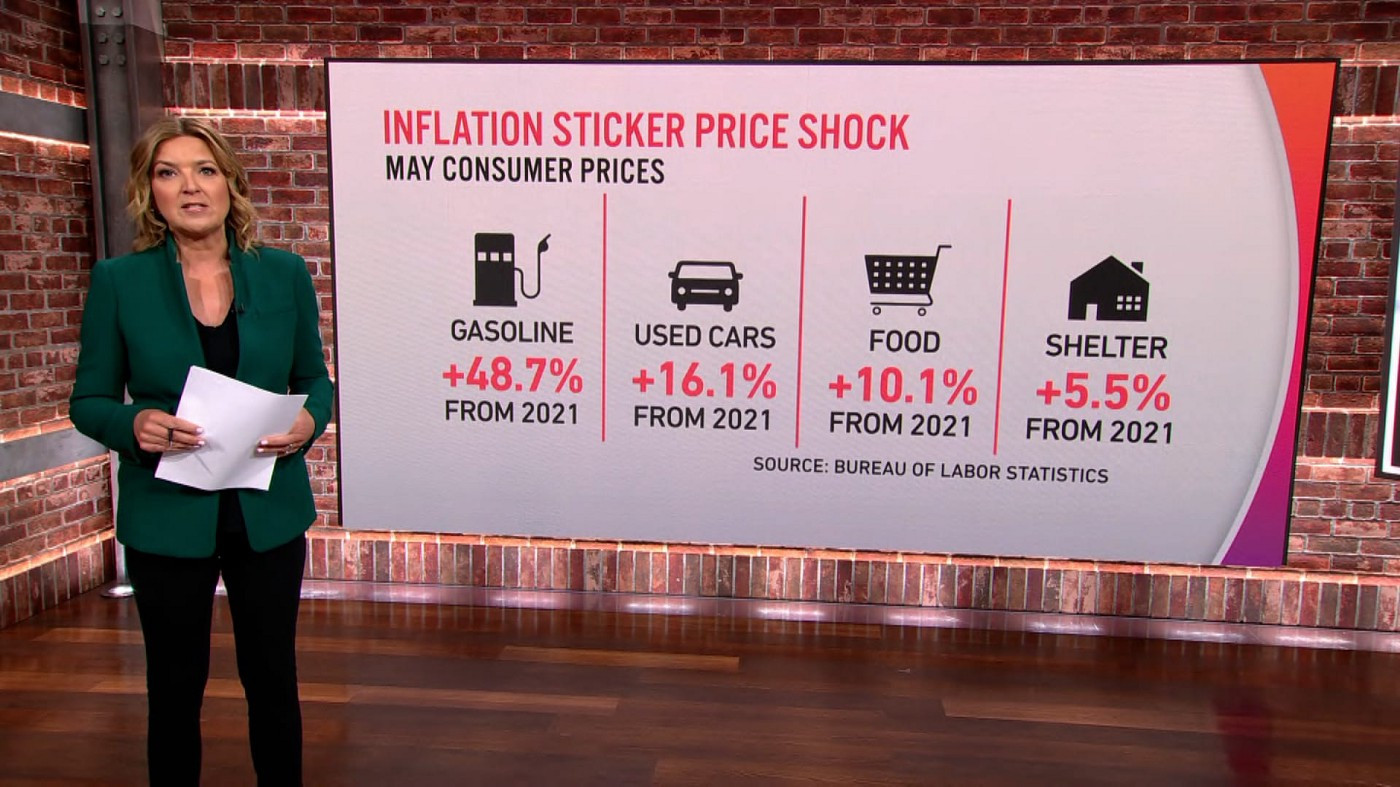

Image Credit: CNN Screenshot Original article: https://eand.co/welcome-to-the-extinction-depression-fe29c4bc066d Peter Burgess COMMENTARY I usually like reading Umair Haque's missives, and this is pretty good. Sadly, not much of the media has this level of economic understanding! There are some serious problems in the modern world. They are likely to get worse, but this is going to be because the wrong policies are implemented driven, in large part, by sloppy and to some extent incompetent analysis. I don't know how much policy formulation is driven by public sentiment that is largely driven by the media ... mainstream and social. I worry that there is a dangerous amount of feedback from the thoughts of focus groups back into the media and then into policy formulation. This will most likely be catastrophically unstable. Back in March 2020, the Federal Reserve and other Central Banks acted aggressively to help alleviate a massive global economic downturn that was looming as the Covid pandemic forced the major industrial economies into 'lockdown'. Without that action, it is likely that there would have been a cascade of massive business bankrupties. An economic catastrophe was averted, for which we should all be happy. Not unsurprisingly, some businesses took advantage of the various economic emergency measures from Central Banks and Governments to enrich themselves which is obscene but also somewhat to be expected. Broadly speaking, there is not much 'moral compass' at the Board level in many if not most big companies. In the USA, the Biden administration has made a lot of progress ... though not as much as they would have wished. Early in their administration, they passed a substantial Covid relief stimulus package similar to one passed some months before by the Trump administration. This complemented in many ways, the initiative of the Federal Reserve in March 2020. It is often remarked that the Covid pandemic got people to think about their social priorities, and especially the role that their work played in their lives. As a result, there are changes going on in the workplace that are going to result in a new normal. But at the same time in the business sector, there have also been important issues that have emerged. One of the most important is that the high productivity and profit performance of the business sector has been achieved in large part by sacrificing resilience, expecially in the supply chain. I think everyone was shocked by the inability of the many actors in the product supply chains to adjust to the many changes brought on by the pandemic. In many ways, business performance with regard to the supply chain was an abject failure ... but totally to be expected after decades of profit optimization that included less and less provision for contingencies and less and less resilence overall. I think it is fair to say that because the business and investment community has a singular focus on profit as the measure of success, all of this is to be expected, and overall the fact that the stock markets remained at near record levels suggests that the management of the global economy has been a success. I won't agree to that, but it is true that the global economy could have been in a catastrophic situation without the many important policy choices that were made ... and implemented in record time ... over the past two years. The big question now is 'What next?' First of all, the Biden Infrastructure Program is now going forward. It is one of the biggest US Government investment initiatives since the Eisenhower administration in the 1950s which set the stage for the US Interstate Highway System. This infrastructure program will not be quite so transformational because much of the money will have to be spent on 'catch up' to fix the decades of underinvestment in American infrastructure that has become a national disgrace, but it is nevertheless a major step in the right direction. The legislation got some support from Republicans but by no means unanimous. Another major Biden initiative ... the Build Back Better legislation ... has not gone forward because of the razer thin majorities that the Democrats have in Congress. Even though many of the provisions of this legislation have strong support among voters in general, there is no support at all from any of the Republicans elected to Congress. Constructive legislation in Washington is made more difficult by the month by month trends of the top line economic statistics which are repeated over and over by the media ... mainstream and social ... with minimal meaningful commentary. In fact, much of the media commentary seems designed to misinform the public in an unhelpful way. There are a number of headline data points that need to be addressed including: (1) rapid broad inflation (2) affordable housing, and (3) living wages. A starting point for this has to be a much clearer understanding of the way the complete socio-enviro-economic system works, something that seems to be sadly lacking among many policy experts. Peter Burgess | ||

|

Welcome to the Extinction Depression

How Much Worse Is the Economy Going to Get? You Don’t Want to Know Written by Umair Haque July 8th, 2022 One of the questions I get most often these days is: “is there going to be a recession?” The answer is: yes, and. It goes like this. There’s the friend who just had her rent raised by 30% — a devastating blow for her. Will she, she wonders, end up getting evicted? There’s the couple of highly educated professionals — a professor and a doctor — who can’t make ends meet, and thought about moving to a Red State…until the end of Roe. Now what? There’s the elderly parent of a friend who’s struggling, on her fixed pension income, to keep pace with the skyrocketing prices of everything. Everyone I know — every single person I know, apart from a handful of ultra rich ultra lucky winners of life’s lottery — is struggling. And afraid. Hence, everyone asks me the question: “is there going to be a recession?” That’s not really what they mean, though. They’re not economists, or even the kinds of dorky wannabe financial dudes who watch Bloomberg TV. They’re just…people. What they really mean: “Things are rough out there. It’s never been like this before. I’m getting poorer, fast. How much worse is it going to get? Is it going to stop?” We’re heading, unfortunately, for the economic equivalent of a superstorm. A megafire. An immense glacial melt. Choose your metaphor. What I mean is: an extreme, and an extremely rare, event, which is rarely seen in the annals of economics. Here’s another metaphor: the earth starts turning in reverse. We are now entering a period of inflationary recession — and maybe, probably, even inflationary depression. Let me put that in two kinds of context, practical and theoretical, so you really understand why it’s a) alarming b) freakish and c) special. Theoretically, recessions — and especially depressions — aren’t inflationary. They’re deflationary. Bear with me for a second, it’s boring but it matters. Deflationary just means that a vicious cycle sets in: unemployment leads to people losing their incomes leads to them spending less leads to more unemployment, and the net effect of all this is falling prices. Repeat that cycle long enough, and you get the classical story economics tells about recessions and depressions: demand-side slowdowns. But that’s not what’s happening here. The economy is going haywire, but not because of deflation. Everything’s crashing and burning — but because of inflation. That’s different, special, and rarely seen in economic history. Economics doesn’t usually tell the story of inflationary recessions and depressions because in a sense they’re harder — technically — to understand. But not practically. Just think about your own life. What’s happening in it? Well, you’re paying — suddenly — huge, huge amounts more for exactly the same stuff. Butter, bread, energy, gas, clothes — everything. Inflation rates are at their highest in decades. But wages aren’t keeping pace — as anyone who’s not a billionaire knows. As a result, you have less real income. The money you do earn — even if you got a raise in the last year, or switched to a higher paying job, or whatever — doesn’t go as far as it did not so long ago. You’re getting poorer in real terms. And the net effect of all that, ultimately, is recession. And then depression. The very same vicious cycle kicks off. Unemployment, businesses closing their doors, etcetera — and the economy grinds to a halt. That’s because you have less money to spend on, I don’t know, toys or electronics or clothes, because you’re spending so much more on the basics right now. So. We’re entering the economic equivalent of what used to be called “freak weather” (except now, we just call it climate change). Inflationary recession, and most likely, depression. What’s it really about? Why are you getting poorer in real terms, as the price of everything skyrockets way, way faster than your salary or wages or even investments? Classical depressions and recessions, remember, are about demand. But the problem we now face is not just about demand. It’s becoming about demand, as people get poorer in real terms. But the underlying problem is about supply. Supply as in: our civilization is now beginning to struggle to supply the basics. From wheat to metals to water and energy, and all the things derived from them. Our problem is that the planet is dying, and it can’t supply our civilization with the endless abundance of artificially cheap stuff we — we in the West, anyways — are used to taking so much for granted that until the last year or so, most of us never thought twice about where all our basics even came from. Compounding that problem is the fact that dictators like Putin are already trying to seize what’s left of a dying planet’s dwindling resources. And the fact that corporations and “hedge funds” and whatnot are profiteering from the death of the planet. Extinction. Inflationary depression. These two things are linked in lover’s embrace like death and time. Take a few simple examples. The American West is running out of water. There’s no real plan to keep the taps on. Meanwhile, across the nation energy grids are stressed. But Europe, too faces a situation of prolonged drought. Meanwhile, in the world’s breadbaskets, harvests are in decline, from coffee to sugar and beyond. What happens when California’s thirsty agriculture can’t supply America with food anymore? When the choice is water to drink, or food to eat? We’re already there. The effect is that prices begin to skyrocket. The eye-watering inflation we’re seeing now is usually ascribed to Covid — by second and third rate economists. But in fact it predated Covid. Food and energy prices began to rise before the pandemic. What Covid did was increase the pressure on our civilizational economy — and yet Covid itself is a “climate change” effect — an Extinction Effect. How so? Well, pandemics begin to accelerate when “zoonotic flow” increases — when habitable land begins to run out, and humans and animals rub shoulders. It’s the first dot in a trend, and many, many more will follow it now. Imagine what happens when humans and animals both flee Fire Belts in search of highlands, or both drink from the few remaining water sources as most run dry. Covid exposed how fragile our civilizational economy really is. We in the West take it for granted that goods will simply flow from one corner of the globe to the other, in an endless conveyor belt. But it’s not that simple. Getting all that stuff from East to West is hard — and it’s costly. The system can be broken by the slightest disruption. Think of how back-ordered Apple’s new computers are — or most kinds of electronics are. Our economies are now peering into the next chapter of human history: Extinction. What does an Extinction Economy look like? A lot like this, only getting worse by the day, week, month, year. Recently, Americans couldn’t get baby formula and tampons. Good luck getting a computer. For the things you can get, prices just perpetually increase. That’s the Extinction Economy: skyrocketing inflation, for what you can get, and chronic shortages, of what you can’t. This is what happens when a planet’s resources run out. Getting raw materials is becoming increasingly difficult and costly — and then there’s the challenge of manufacturing them, and shipping them halfway around the globe. Reflecting all that, financing all that is becoming harder and harder too. The Extinction Economy is the polar opposite of what we in the rich West, at least, grew up in — and most of us, I think, expected to go on forever: the Industrial Economy. The story of the Industrial Economy is very, very simple. Big Western corporations, many of which are descendants of the original “companies” used to colonize the planet, go forth, extract resources — minerals, metals, wheat, water, whatever — manufacture it into finished goods, using cheap labour, mostly in China, and then send it via supertanker to us in the West. We consume 80% of it or so — the rest of the planet barely joins in this veritable smorgasbord of hyper consumption. Financing all that? Well, it happened this way. The jobs were shipped off the China, too — the ones which used to make up stable, healthy Western working classes — at least many of them. So Westerners increasingly went into debt to make ends meet, and un(der)employment rose to a new fixed, or what economists call “natural,” level. The toxic consequence of all that was the rise of populist demagogues, in nation after nation, from America to Britain to France and beyond, who scapegoated vulnerable groups for the working class’s woes. Debt. It usually comes with fascism attached. Let me now connect all those dots for you. When in history have we seen these rare periods of inflationary recession — or even depression? It’s when societies face huge, sudden supply shocks that such crises happen. Think of the Weimar Republic. People associate it with hyperinflation. That hyperinflation, though, reflected the fact that everything was in real shortage. Jobs. Electricity. Clothes. Bread. Beginning to sound familiar? Another time in history when we’ve seen bouts of inflationary recession and depression is in nations which have had sudden debt crises. Latin America, for example, experienced these over and over again — can anyone tell my why poor countries even “owe” money in the first place? There’s no good answer to that question, but I digress, even though it reveals what a fiction our global economy really is. When such nations default on their debts, their currencies implode — and suddenly, everything goes into shortage, because now, imports become ruinously expensive. Just getting the basics becomes next to impossible — bread, clothes, fuel. Hyperinflation results. Are you beginning to see the link? Inflationary recessions and depressions result from supply side shocks. Big ones. So. Which are we in for? Inflationary recession — or depression? Well, if you read me regularly, you’ll already know, even though you might not want to at this point. We now face the greatest supply side shock in human history. What shock is that? Extinction. Like it or not, our civilization’s basics all come from life on this planet. All of them. Clean water comes from rivers which are becoming stagnant, toxic pools with no life in them. Fresh, clean air comes from…trees. Food? Medicine? Come on now. You know the answer to those questions, and if you don’t, you should. They come from plants and animals. But as a consequence of making the planet heat up faster than it has for 65 million years — even though human beings have only been around for 300,000 — we have now caused the 6th mass extinction in deep history. In the last one? The Permian extinction? 90% of life on this planet died off. Are you beginning to see what I mean by “greatest supply side shock in human history”? There are things that you think aren’t made from life on this planet. But, well, you’re wrong. No, your iPhone isn’t made from plants and animals. Or is it? How does the aluminum in it get mined and milled? How is it transported across the globe to you? What’s the factory it’s made in powered by and made of? That’s right, fossil fuels. Those are the remains of living things, by the way. All the stuff we consume is made from life on this planet, in that broad sense. And even then, just transporting inert objects to you — iPhones, TVs, what have you — is going to become that much more difficult when there’s a continent on fire or a megastorm or three in the way. There are civilizations which have faced such supply shocks — let’s call them twin ecoshocks, for ecological and economic — before. Various civilizations in the Americas, for examples, had their water run out, as the temperature rose in their local climate by a degree, or half. History is littered with such examples. And in almost all of them, such civilizations perished. They couldn’t survive the shock. For a generation or two or three, people tried to hang on. They moved to the nearest place with more abundant resources. OR wars broke out, and conflicts arose, or virgins were bloodily sacrificed as they tried to appease the Gods. Hello, America’s Supreme Court. I’m not saying our civlization is doomed. But I am saying: it’s not looking good. Because we aren’t even thinking about what we face correctly yet. How are governments responding to the economic megastorm we’re now heading into? They’re — LOL — raising interest rates. I laugh, because in a supply side shock, that’s exactly the wrong thing to do. Remember my friend who went into paralytic shock and despair because she had her rent jacked up unaffordably — like plenty of people? That’s what raising interest rates does — the landlord has a more expensive mortgage to pay, and passes on the costs. There’s a broader lesson there. Raising interest rates is a way to tamp down demand-side pressures. It’s a tool to use when people have too much money. See anyone — apart from Bill Gates and Jeff Bezos — with too much money? Hello, anyone? Of course not. Everyone who’s just a normal person is struggling mightily because their real incomes are falling, not rising. Raising interest rates makes less than zero sense — it’s exactly the wrong thing to do. I know that every crackpot dude who’s read some dumb article on the Internet and thinks they’re Friedrich Von Hayek will scream like a man-child throwing a baby tantrum over their pacifier over that, but hey — they’re clueless. What we should be doing is exactly what anyone sane thinks we should be doing. We need the greatest wave of investment in human history. In…all the goddamned painfully obvious things which can help cushion the possibly civilization-killing blow of Extinction. Clean energy, basic raw materials like cement, fertilizer, glass, steel, that aren’t made from fossil fuels, whole careers and industries which save the planet’s dying ecologies and lifeforms, a shift to an economy which guards and affirms and save life, not just destroys it without replenishing it. Even my Republican father in law, the former farmer, understands that much. We all know it. But we have to start acting like it. Until we begin to demand something better than the Extinction Economy, we’re all going to live in it. That means getting poorer right into the end of civilization as we know it. It means higher prices, for basics, forever, while shortages grow and increase to encompass everything more or less, and war and conflicts break out over what’s left, because, well, that’s what happens on a dying planet. If you don’t want to get poorer forever, then, you, my friend, have to begin to care about the fate of all of us, in the broadest sense, now, because we are in all in this together. Life — and Extinction. Umair July 2022

| The text being discussed is available at | https://eand.co/welcome-to-the-extinction-depression-fe29c4bc066d and |